A typical set up is using calls and placing the spread at-the-money, but traders can also do directional calendars, and I’ll share a recent MSFT example below.

One nice feature of calendar spreads is that the maximum loss is always known in advance. The trade can never lose more than the cost of entry or the debit paid.

The maximum profit however, can be a little tricky and the best we can do is estimate it because we don’t know in advance how the back month option will be impacted by changes in implied volatility.

When trading delta neutral calendars, you want to look for a stock with low implied volatility that you think will remain stable over the course of the trade.

If I’m trading an at-the-money calendar, I set adjustment points around the breakeven lines. If the stock reaches either of these level, but hasn’t hit a stop loss, I will either reposition the calendar or turn it into a double calendar.

Let’s take a look at a recent bullish calendar trade on Microsoft.

On June 8th, the stock was trading around 188 and showing nice accumulation on the chart. My thesis was that it was likely to break above resistance at 190 and head up to around 195.

As such, I entered a bullish call calendar at the 195 strike with 11 days to expiry. The total cost for the trade was $514 plus commissions and I set a profit target of 30% and a stop loss of 20%.

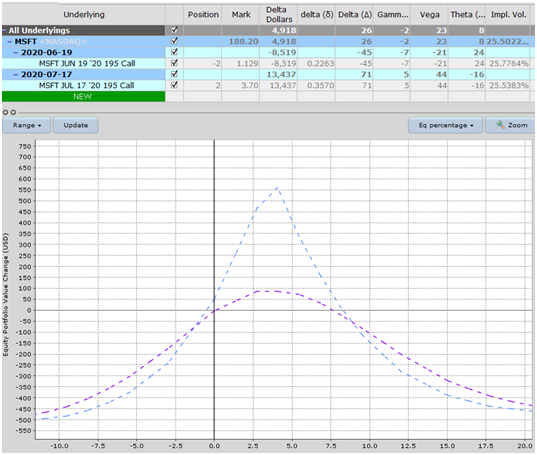

Here are the details:

Date: June 8, 2020

Stock Price: $188.20

Trade Set Up:

- Sell 2 MSFT June 19th, 195 calls @ $1.13

- Buy 2 MSFT July 17th, 195 calls @ $3.70

Premium: $514 Net Debit

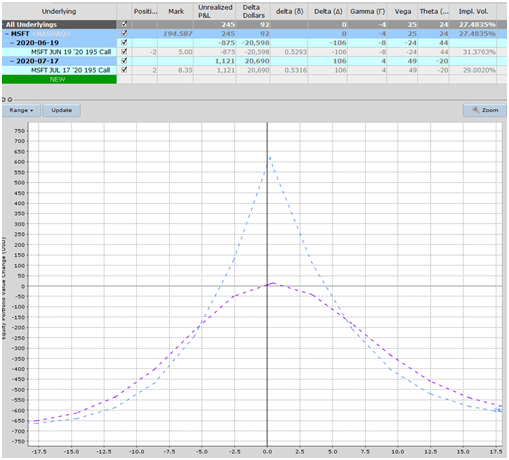

Two days later, MSFT had rallied to 194.58 and the trade was up $245 or 47.67%. They don’t always work out this well, but this was a nice return on a small amount of capital at risk.

One nice thing that happened with this trade is that the volatility in the back month rose from 25.5% to 29% which gave the trade a nice little boost.

I recently put together detailed guides on calendars and double calendars if you want to learn more about these trading strategies.

This was a short-term trade but some traders will also do what’s called a campaign calendar where they buy a six month call and sell multiple months’ worth of calls against it.

Bearish put calendars are also a nice trade if you think a stock is going to drop or you want some general protection against a falling market. The beauty with put calendars is you gain due to the delta, but you also gain due to the rise in volatility. Of course, this could also go the other way if the stocks rises.

A few quick tips if you’re thinking about getting started with calendar spreads:

-

Stick with highly liquid underlying stocks and ETF’s. Stocks that have a tight bid-ask spread will be much better in the long run because you will be able to get better fill prices.

- Start with small trades and never risk more than you can afford to on any one trade. Position sizing should be no more than 2-5% of your account size.

Happy trading and feel free to reach out if you have any questions.

Gavin McMaster has a Masters in Applied Finance and Investment. He specializes in income trading using options, is very conservative in his style and believes patience in waiting for the best setups is the key to successful trading. He likes to focus on short volatility strategies. Gavin has written 5 books on options trading, 3 of which were bestsellers. He launched Options Trading IQ in 2010 to teach people how to trade options and eliminate all the Bullsh*t that’s out there. You can follow Gavin on Twitter.

Related articles

- How We Trade Calendar Spreads

- How We Lost 60% On SPX Calendar

- Why We Sell Our Calendars Before Earnings

- TSLA, LNKD, NFLX, GOOG: Thank You, See You Next Cycle

- Should You Add to A Losing Trade?

- SPX Calendar Spreads: Historical P&L Levels

- Using OTM Directional Calendar Spreads

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.