Study Methodology

Here are the specifics of the test:

Time Period: January 2007 to Present

Trade Setup: On each trading day, locate the standard expiration cycle with 30-45 days to expiration. If the front-month standard expiration cycle did not fall within that time frame, we simply did nothing and proceeded to the next trading day.

When the front-month expiration cycle fell between 30-45 days to expiration, we “sold” the at-the-money put in that cycle. In the following standard expiration cycle, we purchased the put at the same strike price to complete the calendar spread.

Position Tracking: Each position’s profit/loss as a percentage of the debit paid was tracked on each trading day until the day before settlement. We did this to avoid any unwanted outcomes as a result of the SPX settlement process.

Overall, 1,200 SPX calendars were tracked.

Once all of the profit/loss metrics were gathered, we filtered the trades into four buckets based on the VIX Index level at the time of entering the trade:

- VIX Below 15

- VIX Between 15 to 20

- VIX Between 20 and 25

- VIX Above 25

Each bucket had a similar number of occurrences.

The Results: Profit/Loss Frequencies for 30-45 DTE SPX Calendar Spreads

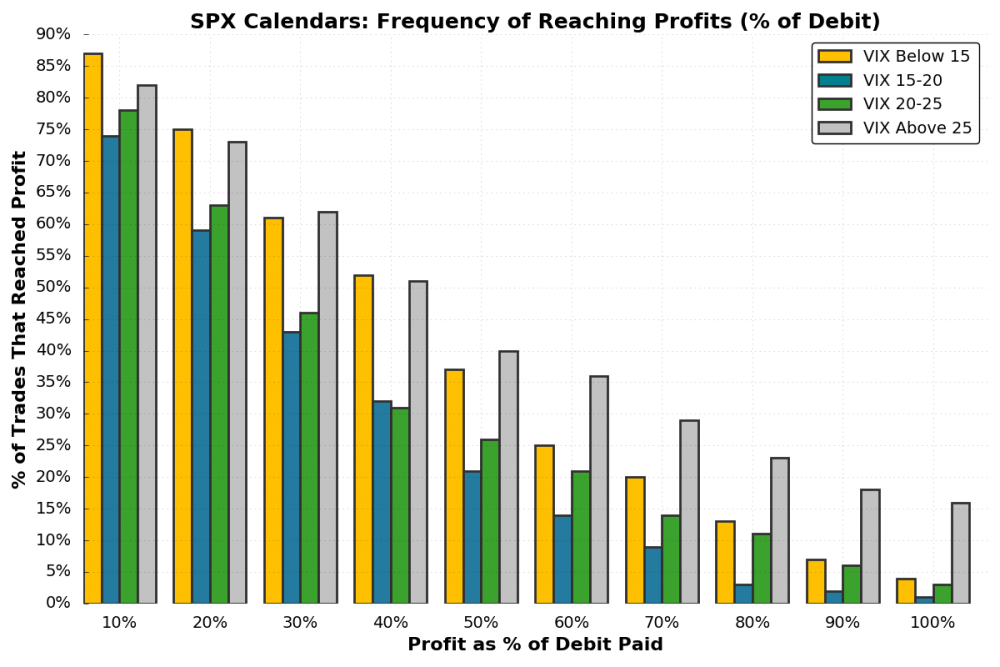

Let’s take a look at the data! We’ll start with the percentage of calendar spreads that reached profit levels between 10-100% of the initial debit paid:

There are some key findings from these results:

- Over 50% of the trades reached returns of 40% or more on the initial debit paid, with 75% of the positions reaching 10-20% returns on the debit paid.

- The low IV (VIX below 15) and high IV (VIX above 25) had the highest percentage of trades that reached each profit level.

High IV calendar spreads in second place? How can that be?

In super high IV environments, the VIX term structure (SPX volatility) goes into backwardation. As a result, the near-term expiration cycles trade with significantly higher implied volatility than longer-term expiration cycles. When volatility comes back down, the front-month implied volatility will fall with greater magnitude than the back-month implied volatility, which can lead to quick profits on a calendar spread if the underlying hasn’t moved too much. The only problem is that in high implied volatility environments, realized volatility tends to be high, which is not ideal for delta-neutral calendar spreads.

So, in high IV, long calendar spreads become more of a term structure reversion trade, and less of a time decay trade.

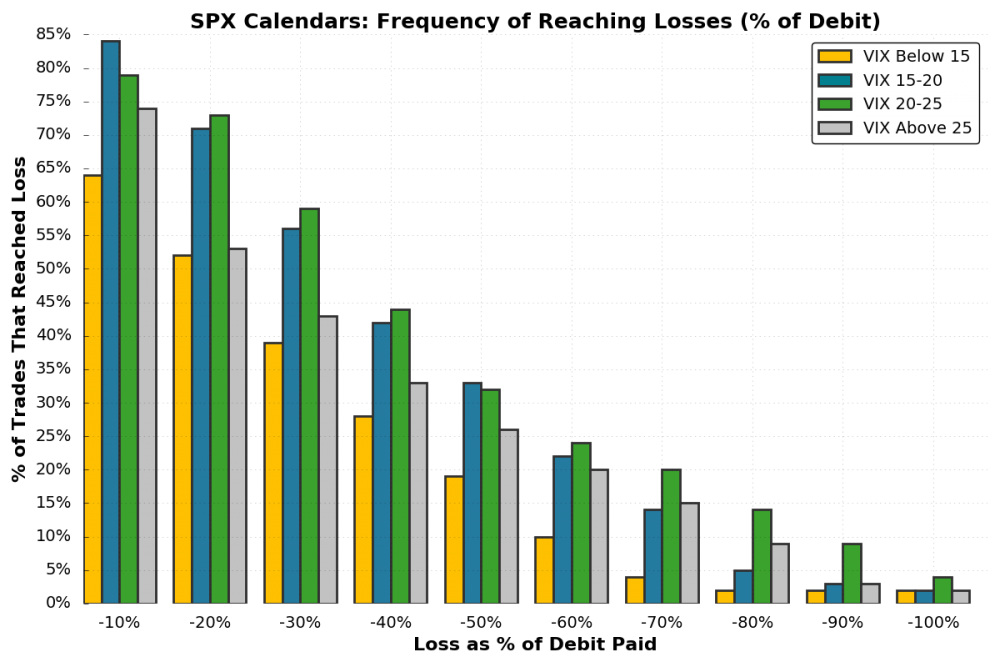

Let’s move on to the loss frequencies:

In low IV environments, the SPX calendar spreads reached each loss level less frequently than in higher IV environments. Again, this is most likely due to the fact that realized volatility tends to be more significant in times of high implied volatility.

When you compare the calendar spread profit frequencies to the loss frequencies, we can see that the biggest gap (profit frequency – loss frequency) is typically in the low IV (VIX below 15) trades. For example, in the low IV bucket, over 85% of positions reached a 10% profit, while 65% reached a 10% loss.

In the 15-20 VIX trades, 75% of trades reached a 10% profit, while 85% reached a 10% loss.

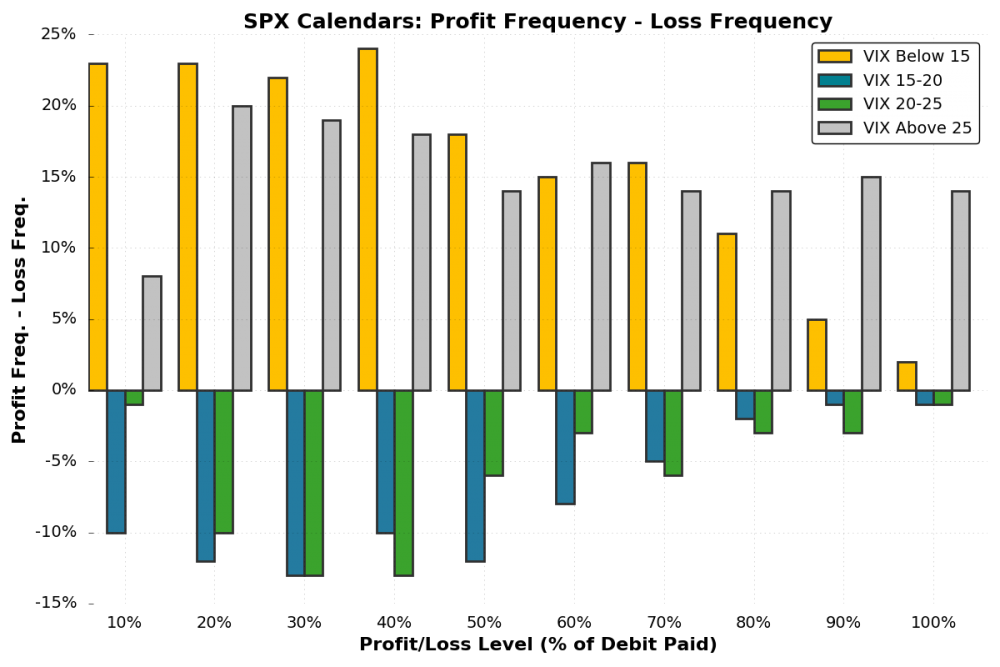

Of course, you’d like to see a large gap between the percentage of trades that hit each profit and loss level (more trades reach the profit level as opposed to the loss level).

To visualize this, we simply subtracted the loss frequency from the profit frequency at each level:

As we can see, the calendars entered when the VIX was between 15 and 25 reached the loss levels more frequently than the same profit level (resulting in a negative value).

In the low (VIX below 15) and high (VIX above 25) volatility environments, the SPX calendar spreads reached the profit levels more often than the same loss level.

Summary

What can we learn from this calendar spread profit and loss data? First and foremost, calendar spreads typically perform very well in extremely low implied volatility environments, but they also have potential when front-month IV is inflated at a significant premium to the back-month IV. However, there are strategies that may be more suitable for time when implied volatility is high.

Second, based on a positive spread between profit and loss frequencies, calendar spreads have historically had positive expectancy at each profit/loss level, as profits have occurred more often than losses of the same magnitude.

On a final note, it’s important to keep in mind that this is a backtest based on closing values. As a result, it’s likely that there were trades that hit profit or loss levels intraday, but ended the day less than those levels.

Additionally, these positions were not managed, which is the key to success when trading calendar spreads. At the very least, the data discussed in this post can help to guide management levels, and expectations for achieving certain profit/loss levels when trading SPX calendars.

About the Author

Chris Butler is the founder of projectoption, an options trading education and research website. Chris primarily trades non-directional options strategies in equity indices (SPX, RUT, /ES Options), but is also active in volatility-related ETNs (VIX Options, VXX, XIV).

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now