A quick step back before we thrust forward. The VIX that we see on CNBC or various websites is actually called the 'Spot VIX' and it is not a tradeable asset -- which is to say, you cannot buy or sell the VIX spot.

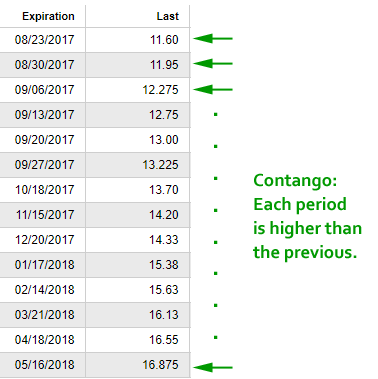

The VIX spot is derived from the implied volatility of SPX options. But the tradeable VIX is actually in the futures market. Here is how VIX futures look as of 8-22-2017, pay special attention to the price for each expiry, and how it rises with each successive date.

We can see a futures expiration every week through 9-27-2017, and then it goes monthly. But that's not the key, here.

Notice that for every time period further out in the future, the price of the VIX future is higher than the last. This pattern, when the future price is higher than the price behind it, is called "contango." The opposite, for those curious, is called "backwardation."

BACK TO THE VXX OPTIONS

Jill Malandrino, formerly of TheStreet.com writes it beautifully when she notes:

Quote

This has a negative impact on VXX as the strategy VXX was created to follow will consistently sell front-month futures and buy second-month futures.

This buying and selling of futures contracts is done to maintain a 30-day weighting between the two. Often this means that cheaper futures are being sold and more expensive futures being purchased. Eventually the second month future becomes the front month and the strategy will sell those contracts and begin purchasing the farther month.

Often when selling commences the price of the future is lower than when it was purchased and the vast majority of the time the front month is being sold for less premium than is being paid for second month.

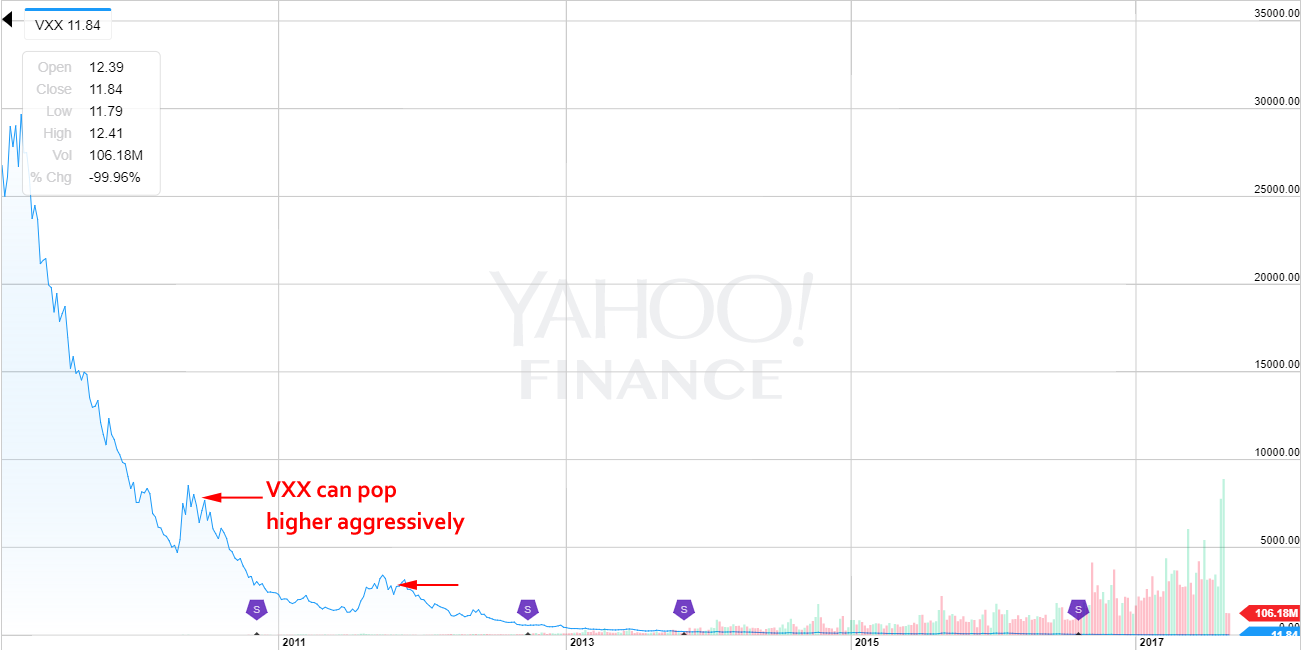

To see how often VIX futures are in contango, or more precisely, how often VXX falls, here is an all-time price chart for trading VXX options:

Yep, the VXX is down 99.96% since inception. The reason is simply that VIX is almost always in contango. For the times that VIX falls out of contango, we can see abrupt pops in the VXX which we have highlighted in the image above.

Note that the VXX does a reverse split quite often and that's why it isn't trading at $0.01. It splits into fewer shares which raises the stock price -- obviously having no affect on the actual option trade. The most recent split is 8-23-2017.

OK - TALK TO ME ABOUT THE TRADE

For those that want more information on the trading VXX options and VIX futures and options the CBOE is a treasure trove of information as is Jill's article 5 Misperceptions About VXX.

With the price of VXX trending down most of the time, except for rare instances where there are large price spikes, a simple option strategy should work.

TRADING VXX OPTIONS

We tested buying a put option spread in the VXX using the 90 day options over the last five-years. Here are the results of this VXX options trading strategy:

We see a 615% return, testing this over the last 5-years. Since we tested the 90 day options, that was 21 trades, in which 17 were winners and 4 were losers.

We can see that this VXX trading strategy hasn't been a winner all the time, but it has won a lot.

Setting Expectations

While this strategy has an overall return of 615%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 28.9% (in 90 days).

➡ The average percent return per winning trade was 52.7% (in 90 days).

➡ The average percent return per losing trade was -72.4% (in 90 days).

We note that when the VIX goes into backwardation, the VXX does pop aggressively higher and we see that in the average loss, which is actually larger than the average win.

Option Trading in the Last Year

We can also look at the last year of trading in the VXX options:

The results are staggeringly similar to the five-year results with a 80% win-rate versus the 81% win-rate over 5-years.

➡ Over just the last year, the average percent return per trade was 50.3% (in 90 days).

➡ The average percent return per winning trade was 63.4% (in 90 days).

➡ The percent return for the one losing trade was -1.9% (in 90 days).

The key to this trade has been risk control so the losses aren't harmful and didn't discourage trading the next cycle.

WHAT HAPPENED

Successful option trading is about preparation -- it's methodical -- it's scientific. This is it -- this is how people profit from the option market, and this can be done with any stock, ETF, ETN or index.

To see how to become a scientific option trader and take the guess work out, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Please note that while the trade wins 80% of the time, when it loses, it can lose big time. This is why position sizing is the key.

SteadyOptions launched Creating Alpha strategy that uses a different strategy, limiting the loss significantly. This strategy still wins 80% of the time, but the loss is typically limited to ~5%. The winners are obviously much smaller as well.

The Incredible Winning Trade In SVXY article describes how this strategy performed in February 2018. The trade is now being implemented using VXX options instead of SVXY options.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.