Some option combinations are easier, or less costly to trade than others. Which means less slippage and less commissions.

Here are few examples of synthetic options positions.

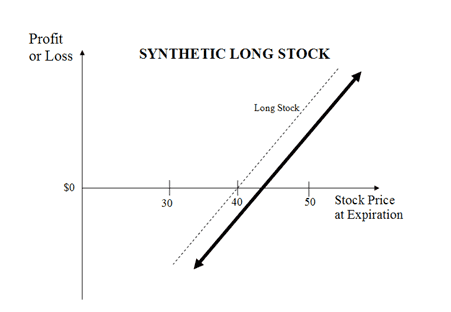

Synthetic Long Stock

Among the many options strategies, one of the most interesting is synthetic long stock. This combines a long call and a short put opened at the same strike and expiration. The name “synthetic” is derived from the fact that the two positions change in value dollar for dollar with changes in 100 shares of stock.

| Synthetic Long Stock Construction |

|

This is an unlimited profit, limited risk options trading strategy that is taken when the options trader is bullish on the underlying security but seeks a low cost alternative to purchasing the stock outright.

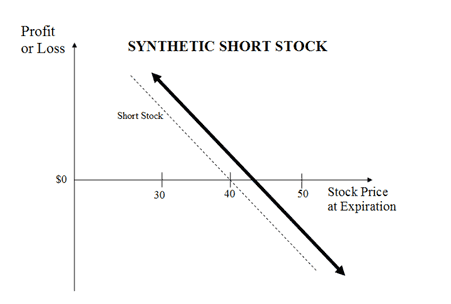

Synthetic Short Stock

The synthetic long stock is a low-risk, highly leverage strategy. But for synthetic short stock, the risk profile is completely different. For the synthetic long, the combination consists of a long call and a short put, at the same strike, and at the same expiration.Reversing the positions to short call and long put creates a synthetic short stock, and completely changes the risk.

| Synthetic Short Stock Construction |

|

This is a limited profit, unlimited risk options trading strategy that is taken when the options trader is bearish on the underlying security but seeks an alternative to short selling the stock.

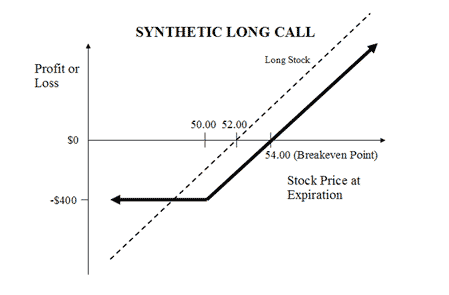

Synthetic Long Call

A synthetic call, or synthetic long call, is an options strategy in which an investor, holding a long position in a stock, purchases an at-the-money put option on the same stock to protect against depreciation in the stock's price. It is similar to an insurance policy.

| Synthetic Long Call Construction |

|

This is an unlimited profit, limited risk options trading strategy. A synthetic call is also known as a married put or protective put. The synthetic call is a bullish strategy used when the investor is concerned about potential near-term uncertainties in the stock. By owning the stock with a protective put option, the investor still receives the benefits of stock ownership, such as receiving dividends and holding the right to vote. In contrast, just owning a call option, while equally as bullish as owning the stock, does not bestow the same benefits of stock ownership.

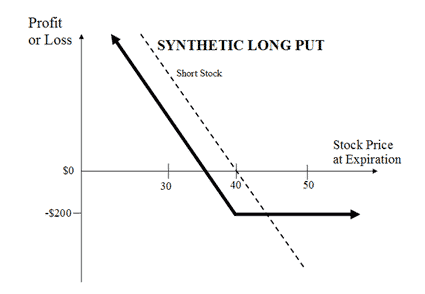

Synthetic Long Put

By combining a long call option and a short stock position, the investor simulates a long put position. A synthetic put is also known as a married call or protective call.

| Synthetic Long Put Construction |

|

This is a limited profit, limited risk options trading strategy. The synthetic put is a strategy, used when the investor has a bearish bet and is concerned about potential near-term strength in the underlying stock. It is similar to an insurance policy except that the investor wants the price of the underlying stock to fall, not rise. The strategy combines the short sale of a security with a long-call position on the same security.

Other Equivalent Positions

The basic equation that describes an underlying and its options is: Owning one call option and selling one put option (with the same strike price and expiration date) is equivalent to owning 100 shares of stock. Thus,

S = C – P; where S = stock; C = call; P = put

There are some other options positions that can be considered equivalent. For example, take a look at a covered call position (long stock and short one call), or S-C.

From the equation above, S –C = -P. In other words, if you own stock and sell one call option (covered call writing) then your position is equivalent to being short one put option with the same strike and expiration. That position is naked short the put. Amazingly some brokers don’t allow all clients to sell naked puts, but they allow all to write covered calls. But as we can see, writing a covered call is equivalent to selling a naked put.

Summary

Synthetic positions can be used to change one position into another when your outlook changes. Options offer enormous flexibility in positioning. Synthetics can offer an alternative plan B, require less capital, eliminate the need to borrow the stock if selling it short etc. It is essential to understand synthetic options in order to fully utilize the flexibility of options.

If you want to learn more how to use our profitable strategies and increase your odds:

Start Your Free Trial

Related articles

- Synthetic Long Stock For Extreme Leverage

- Synthetic Short Stock – Higher Risk

- Options Equivalent Positions

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now