Please note that those results are based on real fills, not hypothetical performance.

Performance dissected

It is important to mention that those numbers are pre-commissions, so your actual results will be lower. As with every trading system which uses multi leg trades, commissions will have a significant impact on performance, so it is very important to use a cheap broker. We have extensive discussions about brokers and commissions on the Forum (like this one) and help members to select the best broker. Commissions reduce the monthly returns by approximately 2-3% per month, depending on the broker. Please refer to Performance Dissected topic for more details.

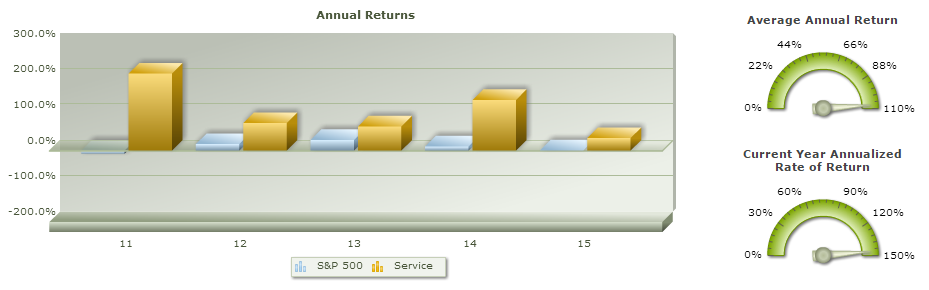

The following is a snapshot of our performance, taken from Pro-Trading-profits.com:

According to PTP, our Average Annual Return since inception is a remarkable 107.7%, including commissions. Current Year Annualized Rate of Return is 146.3%.

SteadyOptions strategies

SteadyOptions uses a mix of non-directional strategies: earnings plays, Iron Condors, Calendar spreads etc. The pre-earnings strategy is based on my Seeking Alpha articles ‘Exploiting Earnings Associated Rising Volatility’ and ‘How To Rent Your Options For Free’. This strategy aims for consistent and steady gains with holding period of 2-7 days.

SO model portfolio is not designed for speculative trades although we might do some in the speculative forum. SO is not a get-rich-quick-without-efforts kind of newsletter. I'm a big fan of the "slow and steady" approach. I aim for many singles instead of few homeruns. My first goal is capital preservation instead of doubling your account. Think about the risk first. If you take care of the risk, the profits will come.

What makes SO different?

First, we use a total portfolio approach for performance reporting. This approach reflects the growth of the entire account, not just what was at risk. We balance the portfolio in terms of options Greeks. SteadyOptions provides a complete portfolio solution. We trade a variety of non-directional strategies balancing each other, including but not limited to straddles, calendars, butterflies etc.. You can allocate 60-70% of your options account to our strategies and still sleep well at night.

Second, our performance is based on real fills. Each trade alert comes with screenshot of my broker fills. Many services base their performance on the "maximum profit potential" which is very misleading. Nobody can sell at the top and do it consistently. We put our money where our mouth is.

Our performance reporting is completely transparent. All trades are listed on the performance page, with the exact entry/exit dates and P/L percentage.

It is not a coincidence that SteadyOptions is ranked #1 out of 704 Newsletters on Investimonials, a financial product review site. Read all our reviews here. The reviewers especially mention our honesty and transparency.

Other services

In addition to SteadyOptions, we offer the following services:

- Anchor Trades - Stocks/ETFs hedged with options for conservative long term investors. The strategy delivered 0.3% return in Q1 2015, basically tracking the S&P 500, while staying completely hedged all the time.

- Steady Condors - Hedged monthly income trades managed by the Greeks. The strategy delivered 10.8% return in Q1 2015. Including April portfolio which was closed recently, the YTD return is 17%, which brings Steady Condors back to new equity highs.

- LC Diversified Portfolio - broadly diversified, absolute return, multi-strategy portfolio. The strategy delivered 3.1% return in Q1 2015.

The LCD is our most diversified, comprehensive and scalable portfolio. I highly recommend that members check it out. It is offered as an added bonus of all subscription plans. You can also read a comprehensive overview of the strategy here.

We also offer Managed Accounts for Anchor Trades and LCD.

Subscription is now open to new members for a limited time. We invite you to join one of the most successful options newsletters.When you join SteadyOptions, we will share with you all we know about options. We will never try to sell you any additional "proprietary systems", training, webinars etc. All our "secrets" are included in your monthly fee.

Happy Trading from SO!

Related articles:

SteadyOptions 2014 - Year In Review

SteadyOptions 2014 Half Year Report: 95.3% ROI

Steady Options 2013 - Year In Review

How to Calculate ROI in Options Trading

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now