.thumb.jpg.aebab51206ddcb531766328d2f5d5ef5.jpg)

- Unhedged exposure to SPY.

- Fully hedged exposure with at the money puts.

- Partially hedged exposure without of the money puts.

-

And a more simple approach of reduced allocation to SPY with the proceeds allocated to an intermediate term US Treasury ETF (IEI).

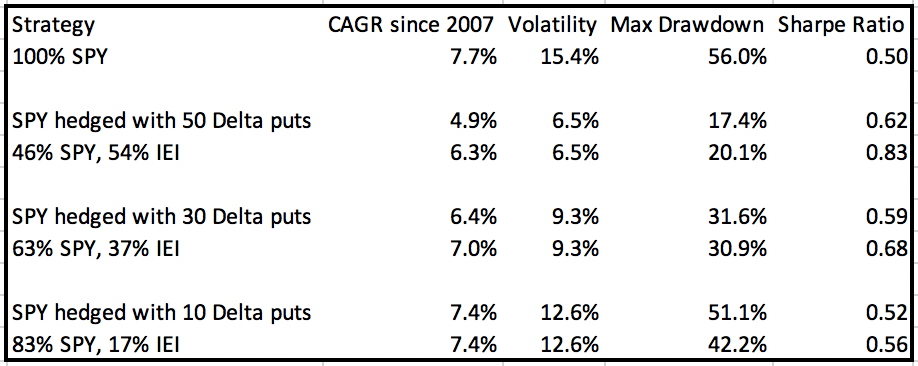

In the following data, I’m showing the hedged portfolios compared to the stock/bond portfolios scaled to have similar volatility. The option hedge parameters entered into the ORATS backtester targets the contract closest to one year from expiration and rolls the contracts at 45 days from expiration. The idea of going further out in time and rolling prior to expiration is to reduce the impact of negative theta (time decay) that you experience with long puts. I did not attempt to optimize the parameters that would result in the best hedging results. With the stock/bond portfolios, rebalancing is assumed to occur based on 5/25 rebalancing bands that can be replicated using Portfolio Visualizer and all results include the reinvestment of dividends. Past performance doesn’t guarantee future results. Now to the data.

What we see is not surprising based on published research I’ve reviewed from multiple sources. Hedging with puts has been documented to be inefficient due to the volatility risk premium (VRP) built into option prices, making it more effective to simply lower equity allocation and use the proceeds to buy safe bonds (IEI). A stock/bond ETF or mutual fund portfolio is also much easier and less costly to manage. If buying puts produces poor long-term risk-adjusted results, it then means that selling them may produce attractive long-term risk-adjusted returns. That is the strategy we attempt to capitalize on in the Steady Momentum PutWrite service.

In the AQR podcast episode “diversify or hedge?”, the hosts discuss how a portfolio of equities and cash (or safe bonds, as in my example) produces better long-term results than hedging with puts. AQR also has a research paper titled, “Pathetic Protection: The Elusive Benefits of Protective Puts” which concludes that “because of path dependent outcomes and option expensiveness, put options may do more harm than good.

An alternative approach to protection that investors can take is increasing diversification. ”Hedging with puts" can still be a rational decision if an investor wants to protect from a near or complete loss of value in the stock market (and is willing to pay for it), at which point the outcomes would favor the hedging approach as opposed to the stock/bond approach. The goal of this article is to simply make investors more aware of the different choices they can make with regard to risk management and the expected outcomes related to those choices.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse manages the Steady Momentum service, and regularly incorporates options into client portfolios.

Related articles

- Are Bonds Still A Good Hedge?

- The benefits of diversification

- How to Analyze an Investment Strategy

- Equity Index Put Writing For The Long Run

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now