Facebook Inc (NASDAQ:FB) Earnings

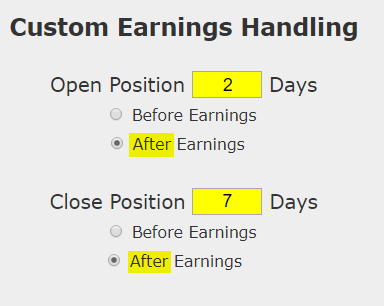

We can test this approach without directional bias with a custom option back-test. Here is our earnings set-up:

Rules

* Open an iron condor two calendar days after earnings

* Close the iron condor 7 calendar days after earnings

* Use the options closest to 7 days from expiration (but at least 7-days).

And a note before we see the results: This is a straight down the middle volatility bet -- this trade wins if the stock doesn't move much during the week following earnings and it will stand to lose if the stock is volatile.

RESULTS

If we sold this 40/20 delta iron condor in Facebook Inc (NASDAQ:FB) over the last three-years but only held it after earnings we get these results:

|

FB: Short 40 Delta / 20 Delta Iron Condor |

|||

| % Wins: | 67% | ||

| Wins: 8 | Losses: 4 | ||

| % Return: | 49.5% | ||

We see a 49.5% return, testing this over the last 12 earnings dates in Facebook Inc. That's a total of just 60 days (5 days for each earnings date, over 12 earnings dates).

We can also see that this strategy hasn't been a winner all the time, rather it has won 8 times and lost 4 times, for a 67% win-rate.

Setting Expectations

While this strategy had an overall return of 49.5%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 7.78% over 5-days.

WHAT HAPPENED

This is how people profit from the option market -- it's not about guessing.

We hope, if nothing else, you have learned the intelligence and methodology of trading Facebook options and this idea of equilibrium right after earnings.

To see how to find the best strategy for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

We incorporated this strategy into our SteadyOptions model portfolio with good results so far. This is how SteadyOptions members take advantage of the CMLviz Trade Machine.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.