By

Kim

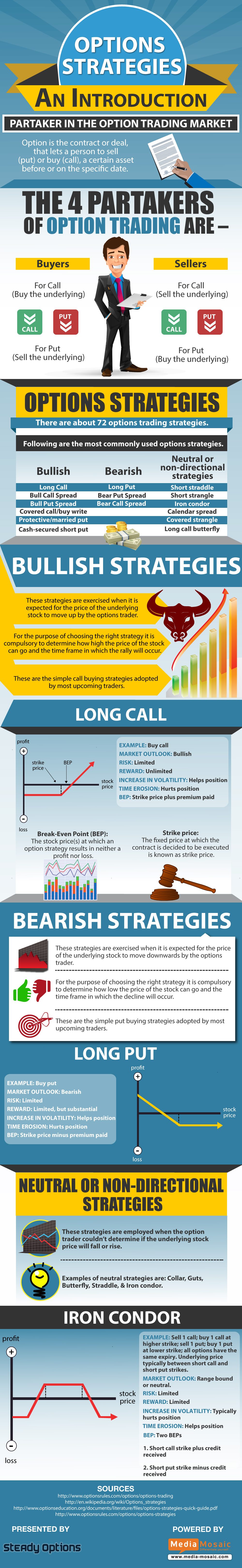

Option is the contract or deal, that lets a person to sell (put) or buy (call), a certain asset before or on the specific date. There are about 72 options trading strategies. There three most commonly used options strategies: bullish, bearish and neutral or non-directional. The following infographic describes few basic options strategies.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now