The long and short straddle are normally understood only in terms of how money flows. In a long straddle, the trader pays, and risk is mainly one of time versus price movement. In a short straddle, the trader is paid, and risk involves time decay and time to expiration. But does this really explain how these two strategies work?

In both forms of the straddle, the key to risk and profit potential is volatility. But the significance is opposite. A long trader tends to realize the greatest possibility of profits when underlying volatility is high; a short trader relies on declining time value and will reduce exercise risks when volatility is low.

Long profits

The formula for maximum profit in a long straddle is twofold, as maximum profit will be found at the upper price or the lower price:

U – S – ( P + F ) = Pu

S – U – ( P + F ) = Pl

When U = underlying price

S = strike

P = premium paid

F = trading fees

Pu = upper profit

Pl = lower profit

Breakeven point also is found at two price points:

S + P + F = Bu

S – P + F = Bl

When S = strike

P = premium paid

F = trading fees

Bu = upper breakeven

Bl = lower breakeven

Finally, maximum loss occurs when the underlying price is at strike at expiration. Both sides expire worthless and loss is equal to premium paid:

P + F = M

When P = premium paid

F = fees paid

M = maximum loss

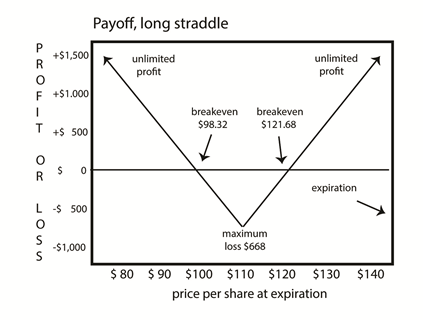

For example, a long straddle consists of the following positions:

Buy one 105 call, ask 3.40 plus trading fees = $349

Buy one 105 put, ask 3.10 plus trading fees = $319

Total debit $668

Possible outcomes, assuming a movement in the underlying of 8 points:

Upper profit: 113 – 105 – 6.68 = $132

Lower profit: 105 – 90 – 6.68 = $832

Upper breakeven: 105 + 6.68 = $121.68

Lower breakeven: 105 – 6.68 = $98.32

Maximum loss: 6.50 + 0.18 = $668

These outcomes are diagrammed in the following payoff chart.

Short profits

The opposite occurs for a short straddle. Traders want underlying prices to remain as close as possible to the strike so profits will result from declining time value and, ultimately, worthless expiration.

Although short straddle profits are limited to the net premiums received, the strategy is appealing to those willing to be exposed to the risk. Maximum profit is:

P – F = M

When P = premium received

F = trading fees

M = maximum profit

Breakeven occurs at two points, upper and lower:

S + ( P – F ) = Bu

S – ( P – F ) = Bl

When S = strike

P = premium received

Bu = upper breakeven

Bl = lower breakeven

Maximum loss is unlimited and depends on how far the underlying price moves. It occurs at two points:

U > S – ( P – F )

U < S – ( P – F )

When U = underlying price

S = strike

P = premium received

F = trading fees

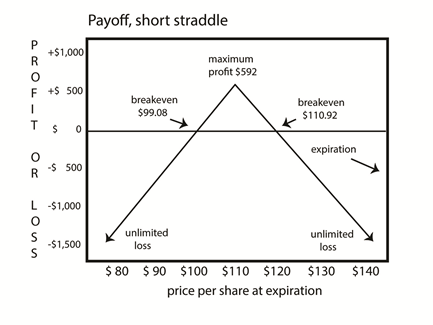

For example, a short straddle is constructed with the following positions:

Sell one 105 call, bid 3.20, less trading fees = $311

Sell one 105 put, bid 2.90, less trading fees = $281

Net credit = $592

Outcomes for this trade, assuming a 215-point movement ibn the underlying, are:

Maximum profit: $610 - $18 = $592

Upper breakeven: 105 + 5.92 = $110.92

Lower breakeven: 105 – 5.92 = $99.08

Upper loss: 112 – 5 – 5.92 = $108

Lower loss: 105 – 97 – 5.92 = $208

These outcomes are also summarized in the diagram.

The complexity of the long and short straddle is clarified by the realization that they operate in opposite directions – limited profit versus unlimited profit, and limited risk versus unlimited risk.

The nature of the short straddle must be further modified by the realization that collateral is required. For two positions, a total equal to potential exercise requires deposit of a significant sum. As a result, capital is tied up between position entry and expiration date. A completely accurate analysis should include calculation of the internal rate of return, given the requirement for depositing capital in the margin account. This is a significant variable; the longer the time to expiration, the more expensive it is to open a short straddle.

Michael C. Thomsett is a widely published author with over 80 business and investing books, including the best-selling Getting Started in Options, coming out in its 10th edition later this year. He also wrote the recently released The Mathematics of Options. Thomsett is a frequent speaker at trade shows and blogs on his websiteat Thomsett Guide as well as on Seeking Alpha, LinkedIn, Twitter and Facebook.

Related articles:

- How We Trade Straddle Option Strategy

- Buying Premium Prior To Earnings - Does It Work?

- Can We Profit From Volatility Expansion Into Earnings?

- Long Straddle: A Guaranteed Win?

- Selling Strangles Prior To Earnings

- Straddle Option Overview

- Long Straddle Through Earnings Backtest

-

Straddles - Risks Determine When They Are Best Used

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now