According to Bruce Bittles, chief investment strategist at RW Baird & Co., “Markets just don’t go into a V-shaped recovery after such violent and drastic drawdowns,”, referring to a 12% drop in the S&P 500 from its May 21 peak.

Honestly, I have no idea. If anyone tells you he "knows" what the markets will do in the next day/week/month, please don't believe it.

Question: Can equity market experts, whether self-proclaimed or endorsed by others (such as publications), reliably provide stock market timing guidance? Do some experts clearly show better market timing intuition than others?

Answer: Terminal accuracy is 46.9%, an aggregate value very steady since the end of 2006. The average accuracy of the investment gurus is worse than a coin toss!!!

You can read more here.

At SteadyOptions, we are not trying to predict what the markets will do. We will not brag to you that "we trade on the right side on the market". We are not trying to guess the direction of the markets, gold, oil, interest rates, or trade Fibonacci/Shmibonacci, RSI, SMA and other fancy indicators. I found out that 90% of the "experts" are just guessing. They have no idea.

Instead, we are just following our plan to trade non-directionally, and to find the best trading opportunities, no matter what the market does.

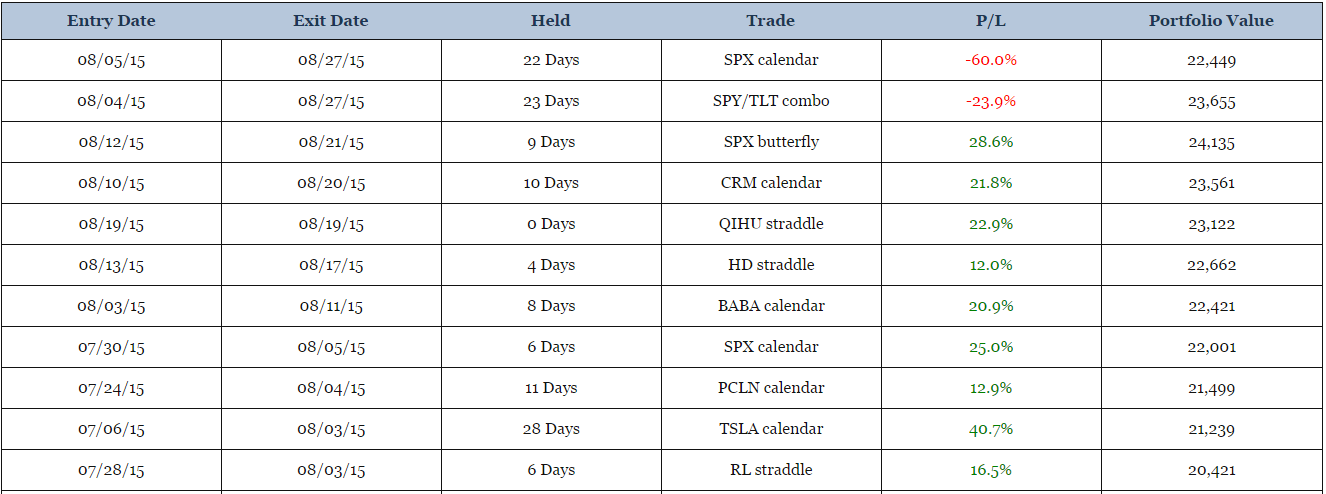

How did it work for us in August? Take a look for yourself. Those are all trades we closed in August:

We closed 9 winners and 2 losers, for a total ROI of 19.6% (11.7% gain on the whole account based on 10% allocation). You can see the full performance here.

We did it by being conservative, selective and patient. Our patience is always rewarded. Protecting capital is rule #1, growing capital is rule #2.

This is what our members posted on the forums:

- "Kim, you've done a phenomenal job navigating these treacherous waters for us. Thank you so much for these value-added trade ideas."

- "Yes, even with the big loss, August is going to be my second most profitable month this year."

- "You guys are doing a terrific job designing risk and managing it during a flash crash!"

- "I was very pleased how you navigated the recent shock in the market"

We hope to see you join us and learn to trade with confidence, no matter what the market throws at you!

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.