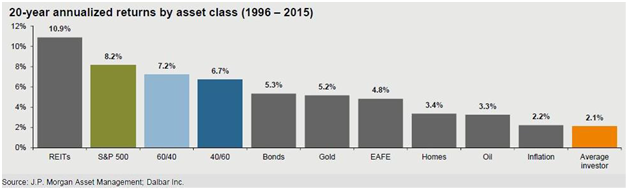

Think on that for a moment…the average investor in the world underperformed every single major asset class out there. That is both incredible and sad at the same time and takes WORK at making that many bad decisions.

This has been confirmed over and over in various market studies. Fidelity Investments conducted a study on their Magellan Fund from 1997-1990 during Peter Lynch’s tenure. His average annual return during this period was an incredible 29%. This is a remarkable return over a thirteen year period. Given all of that, you would expect that the investors in his fund made substantial returns over that period. However, what Fidelity Investments found in their study was shocking. The average investor in the fund lost money.

For those of us that trade options, particularly options under a defined strategy, this should be a stark reminder to stick to a plan, don’t go off plan, and certainly remain patient when patience is called for. While this may be easy to say though, in practicality what does this mean? For me, there are four points I try to keep in mind:

1. When you enter a trade, know your exit points before entering

This seems simple, but in actuality can be quite difficult to stick to. For instance, we might say our target gain in an earnings straddle trade is fifteen percent. Two days in though we’re at an 11% gain and the price has moved 8% from our strike. Do we take and roll? Let it ride to get closer to 15% and risk retracement? Do we exit and move to the next trade? Does this change if we’re 8 days from expiration as opposed to 2? How does it change if overall market volatility has dropped or increased dramatically? And what is the 15% target even based on? Has it been back tested, is it based on “experience,’ or does it just seem like “a good target?”

A lot of options traders will say it just depends on a lot of factors, the current market, and that they have developed a good “sense” for when to make these decisions. And while it is indisputable that there certainly are better traders than others that have a better “sense” of doing things, anyone who falls into this trap is certainly both (a) deluding themselves and (b) costing themselves profits.

Psychology studies on humans on this topic are fascinating. We have an incredible ability to deceive ourselves into thinking we’re better at things than we are, that we are making decisions based off of empirical and factual evidence when we are not, and that we always will make the same decisions in the same situations. In reality, what you had for breakfast will impact your decisions. How much you are up or down will impact your decisions – and this is true EVEN IF you consciously realize that you being up or down might impact your decision.

There are several great books that speak to how our minds work and are impacted by things we don’t even realize:

- Impossible to Ignore, by Dr. Carmen Simon

- Thinking Fast and Slow, by Daniel Kahneman

- Influence, by Robert B. Cialdini

- The Power of Habit: Why We Do What We Do in Life and Business, by Charles Duhigg

as well as others. What they all have in common is noting that basically we are all morons that have deluded ourselves into thinking we have more control over our thought processes than we really do.

The only way to reliably combat this is by having a robust trading plan, which has been back tested and verified through continual updating and monitoring, that you stick to in all conditions. Changes to the trading plan should NOT occur on the fly but rather over time, when you are away from the trading monitors. If, for some reason, you feel like deviating from it, write down why and either incorporate that into your plan moving forward or don’t do it again.

Your trading results will improve.

2. Prior to entering an order, know the highest price you are willing to pay

Slippage cuts on both sides of the trade.

This point is a close corollary to the first, and may seem obvious, but I cannot count the number of times prices are chased, often simply because we feel a need to be trading or “doing something.” It’s often not until the trade is over that we realize we completely shot ourselves in the foot.

Perhaps the most common mistake I see with this is not sticking to a cap in entering a trade, but rather failing to consider that same slippage on the cost of exiting and calculating that at the start.

For instance, let us assume the current midpoint on a straddle we plan on buying is $1.00 and we have a 10% profit target. We enter our order and are not getting a fill and think to ourselves that we would enter this trade, with an acceptable risk profile, as long as we still have an expected return of 7%. So we bump our order to $1.01 and still don’t get a fill. Then we bump to $1.02 and do get filled and think we reduced our expected gain from 10% to 8% and feel good about being in the trade. Only our expected gain is not 8% it is 6%. If this trade fills at $0.02 off the midpoint then there is no reason to simply assume that it will magically fill at the midpoint when selling. It is much more likely that it will take a price $0.02 or more to get a fill then too. In fact, slippage off the mid is more common when exiting a trade then entering, particularly in the last hours before earnings or expiration when the trade is more sensitive to gamma moves. In this case, we’ve now entered a trade with too low of a risk/reward profile that we should not have entered.

This applies also to trade alerts, not just your own trades. If you are consistently getting fills $0.05 off of an “official” trade alert, don’t assume that you will only find that inefficiency on the trade entering side. You most likely will encounter it exiting too and need to account accordingly.

3. Be willing to stay in cash

To me, this is by far the hardest discipline, particularly after a series of losses. If we are looking at trade that has profited when relative value was below 4% and loses when above 5% then WAIT until it gets below 4% to enter. It is tempting to say “well I’m below that 5% loss point, we don’t have any trades on, we can’t make money if we’re not trading, so let’s go ahead and enter.” Unfortunately this has simply reduced a strategy to gambling. Sure, we may win sometime and lose others, but we are not here to gamble. We are here to make money, and that means sticking to what we know works.

This can be incredibly frustrating. I can go through sixty different charts and not find a single setup, then catch myself going back through the list looking for the “best of the worst.” If a trade is not setup right, don’t do the trade. There will be more trades come along and having your powder (cash) dry and ready to invest when the good trades come along is infinitely better than being in a series of bad trades. I have actually missed really good setups because I was impatient wanting to just “trade” so entered other trades that I should not have. This ends up being a double whammy as you lose on the bad trade you shouldn’t have entered AND miss the good trade and its gains because your capital was otherwise committed.

If you ever feel the urge to enter a trade, you know is questionable, step away, talk to someone, do something to get away from your trading screen.

4. Be able to move on from losses AND gains

This is the hallmark of a good trader. Anyone who watches poker regularly has seen a player go on tilt. Going on tilt simply means a player is on a “streak” and stops doing what they are supposed to be doing and goes on feel, increases leverage, or generally starts acting stupid. What’s amazing is that poker players, even very good ones, go on tilt just as often on a winning streak as they do on a losing streak.

When losing in trading it is tempting to want to up your allocation size so you can “make up” for those past losses, or from point three above, just to trade more maybe when you shouldn’t. When winning it’s tempting to keep jumping back in, or worse, letting gains “ride” that you should have closed out from (point 1).

No matter how well we execute our trades, there will be losing trades because we are playing a probability game. Trading, particularly in options, is a business based on probability. And probability means that sometimes we get what we want and sometimes we don’t. That’s the nature of this business. Then sooner we accept that, the better we can operate as a business.

One of the hardest things to do is to ignore your gains and losses on a day to day basis. I’m not advocating not watching your portfolio because if you lose 5% a month, following the same strategy, for a full year then something is wrong (maybe – could still be a viable strategy with a horrible streak, but you need to definitely dig into it some). But to be able to stick to your trading plan one must be able to largely ignore a 50% gain on one trade or a 90% loss on another.

The simplest way to do this is to follow the previous three points. If you know when to get in a trade and how not to over pay, know when you are supposed to go out, and are not over trading just to trade, then you can look at your gains and losses and say “I did everything right” and accept the results. I find that I get mired in results the most when I deviated from the plan and have to say “I messed up.”

Concluding Remarks

Vanguard commissioned a study to look at investment advisors, the fees they charge, and the services they provide. Surprisingly, they concluded that the single most valuable service an advisor provides to clients relates to investor psychology and staying on track. Not picking “winning” investments, not developing a proper tax plan, not financial planning – but rather preventing your average investor from underperforming every asset class out there because the investor won’t stick to a plan that was developed.

If you would like to talk to an investment advisor or Certified Financial Planner™ Professional feel free to contact me (cwelsh@lorintinecapital.com) or my partner Jesse Blom (jblom@lorintiencapital.com) at anytime.

If you have any questions you would like answered and do not want to reach out to us directly, feel free to make a posting on SteadyOptions. We also answer questions on Quora and any of us here would be happy to answer your questions through that forum. Feel free to follow us:

Related articles:

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.