This is a highly respected publication managed by highly dedicated editor, Charles E. Kirk. It is my pleasure to share some insights from Charles. I took the liberty to add some of my own thoughts.

Trading IS Hard Work

Learning how to trade and invest successfully requires a lifetime of work, dedication, and focus. Not only is there a long and difficult stock options learning curve just to learn the basic fundamentals, but you'll soon discover that being a student of the markets never ends.

One of the tremendous challenges in SteadyOptions is to provide material that is both useful and helpful for members who've been with me for many years while still making the site readable and useful for new members and those who may have limited skills, knowledge, and experience. As you might imagine, this is not an easy balance to maintain.

So, if you are a new trader and investor in addition to being a new member of SteadyOptions, please understand there is going to be a learning curve ahead.

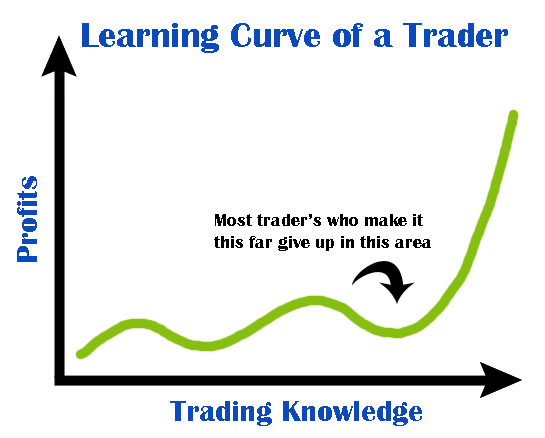

In the past I have had members tell me that for the first year they only understood a little of what I shared with members, the second year they started to comprehend even more and to apply what they learned and by the third year they finally "got it." This is not all that unusual. Any skilled endeavor requires both time and an inordinate amount of dedication to achieve success.

While members range from complete newbies to professionals who manage and trade millions daily, all members will have their own unique challenges to face. But, in the end, it will be well worth it if you are motivated to do the work and utilize the site as it is designed.

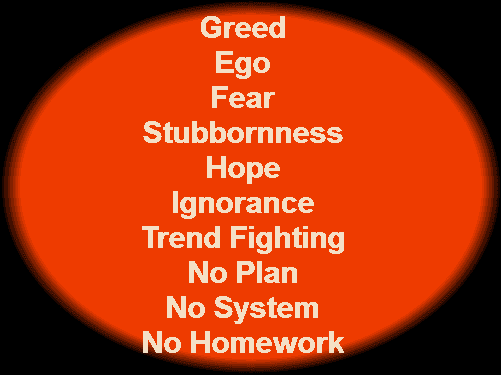

Unfortunately, it is not unusual for me to see new members who sign up for all the wrong reasons. Many people have heard of SteadyOptions and our track record, and it isn't unusual at all for them to become a member in the hope that I will do their work for them, enabling them to make millions without doing any work. In other words, these members are seeking shortcuts and quick answers.

Unlike the vast majority of people who work in this industry, I will never tell you what to do in the markets. My goal here is to help you think for yourself and share knowledge and skills I've developed along the way to help you do that on your own and, more importantly, in your own way.

The key to finding AND maintaining a high level of success in the markets is to trade and invest according to your own risk tolerance, time horizon, investment goals, and personality. This is very important. Your #1 goal should be to develop your own approach that takes all of these things into account.

Please understand that SteadyOptions is not an investment advisory. I am not in the business of providing trading tips or personalized trading or investment advice. This is not just a disclaimer, but an important point to understand. I view myself as an educator and mentor, not your guru or personal adviser.

If you happen to be one of those people who signed up for the wrong reasons with the expectations that you could earn lots of money in the market without any work, that's ok. For what it is worth, I too once thought like many that the path to my future success was having someone else tell me what to do in the markets. While I eventually learned that was not the right path and NEVER is for anyone, I had to discover that for myself in my own way.

Why Most Traders Lose?

90% of retail traders lose money in the stock market. You know why? Because they give up too quickly. Success in trading requires long term commitment, determination and discipline. Unfortunately, many people concentrate on short term performance instead of investing in their education and build long term goals. New traders expect to make money with a new strategy after few months which is usually not realistic.

Over the years, I developed some simple rules that helped me to become a successful trader:

- Set your performance goals in years, not months or weeks.

- Try to look beyond the last 5 trades.

- When starting trading new strategy, paper trade for at least one month, then start small and gradually increase the allocation.

- When following someone, try to understand what he is doing. If you don't understand the rationale and the risks of the trade, don't take it.

- Position sizing is the key. With proper position sizing, even 5-7 losers will have little impact on your account.

Bottom line - I can be of tremendous help to you, but you are going to have to work hard, be focused, and be dedicated to achieve the results you desire. I can only be part of the solution, not the entire solution. I am excited and happy to do my part and I hope you are willing to do the same.

I would like to finish with a quote from one of my oldest members:

"The last year was a huge learning experience for me as trader/investor. I have realized how much I did NOT know, after a BA and MBA in finance. I remember joining this site, and reading terms like volatility, negative theta, and trying to make sense of them. I think, one of the best moments, is when you(trader) stop blindly following and actually start making some of your own decisions on the trades.

Kim always, says: "set your own entry and exit points". I try to do that. But I feel really great, when I make a trade before Kim's alert and happen to be within 2 to 3 cents of his number......"

If you are ready to start your journey AND ready to make a long term commitment to be a student of the markets:

Related Articles:

Why Retail Investors Lose Money In The Stock Market

Can you double your account every six months?

How to Calculate ROI in Options Trading

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now