On the surface these products appear to be risk-free but multi-year interest penalties and surrender charges mean investors could lose money if they need to liquidate capital quickly. Investors have more options than they might realize when constructing low risk investment portfolios that could easily be established with certain mutual funds and ETF’s.

First, when investing it’s important to consider the impact of taxes on assets held outside of retirement accounts. Ordinary interest income generated from bank products like CD’s and savings accounts is taxed as ordinary income in the year earned (no tax deferral). Annuity products are allowed tax deferral of interest until withdrawn, but again at the higher ordinary income tax rates. Also, withdrawals from annuities when under the age of 59.5 may experience 10% penalties on any earnings in addition to ordinary income taxes.

Mutual funds and ETF’s can be more tax-efficient and provide better liquidity than bank and insurance products. For example, dividend income on municipal bond funds can be both state and federal income tax free, and at minimum, they are federal income tax free. Dividend income on US Treasury funds is state income tax free. Equities can be even more tax-advantageous.With tax-managed mutual funds from companies like Dimensional Fund Advisors (DFA), techniques are usedto produce mostly or entirely qualified dividends (taxed at more favorable capital gains rates)andtax-loss harvesting to minimize short term capital gains. Then there is simply the ability to defer capital gains on shares until sold that makes equities good options. This tax-deferral on capital gains is the primary benefit of the ETF structure for equity ETF’s.

In my article “The magic of compounding, and the tyranny of taxes,” I showed how important taxes are in evaluating investment products with a simple, hypothetical example. I recommend all investors read the article. Ignore taxes at your own peril!

Since 1931 the term premium of 5-year US Treasury Notes (5YT) in excess of 1-month US Treasury Bills (BIL) has been 1.8% per year (5.1% annualized return for 5YT vs. 3.3%for BIL). A conservative investor could easily roll over 5YT’s as they come due every 5 years, and ladder them annually to create liquidity events. This is not much different than a CD but with better tax treatment for those with a state income tax. Alternatively, many different low-cost ETF and mutual fund products exist with these types of holdings.

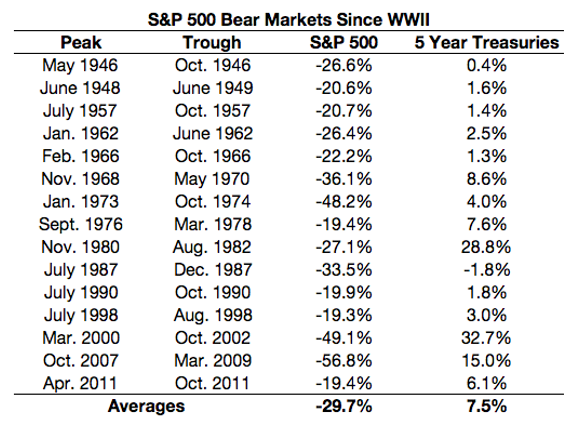

5YT’s historically have very low correlations to equities and often experience above-average returns during periods of equity market stress/crisis. For example:

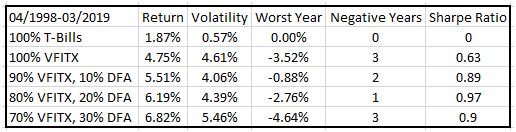

With this knowledge in mind, investors are able to diversify our 5YT’s with small allocations to equities with minimal or no increase in risk. To represent “equities,” we’ll focus on the highest expected return equity asset class,Small Cap Value. We’ll use DFA mutual funds to represent US Small Cap Value (DFSVX), International Small Cap Value (DISVX) and Emerging Markets Value (DFEVX), as well as the Vanguard Intermediate Term Treasury mutual fund (VFITX) as a proxy for 5YT’s. The analysis period will be from April 1998 – March 2019 (April 1998 represents the earliest common inception date for these funds).

During this period, BIL produced annualized returns of just 1.87%. This is below the very long-term average due to the Federal Reserve Bank reduction of short-term interest rates to zero for several years after the 2008 financial crisis. 5YT’s earned 4.75% per year, in the form of the Vanguard mutual fund. Interestingly, adding a 10% and 20% allocation to equities actually lowered risk while also increasing returns. This is the power of diversification at work! Risk begins to increase with a 30% allocation to equities. Let’s also remember that this period includes 2 of the largest bear market periods for stocks that the market has everseen If including any equity allocation would increase risk for investors, we’d expect it to be during this period. On an after-tax basis, the portfolios that include equities look even better compared to alternatives that generate regular taxable ordinary income.

Of course, these portfolios are not examples of “free lunches,” as we can see that there were still some occasional temporary declines. I come across investors all of the time who have excessive amounts of cash on hand often not even earning competitive savings account rates. These investors repeatedly look to banks and insurance companies for investment products. If investors have expected time horizons for accessing their money of 24 months or more, a conservative portfolio of tax-efficient mutual funds and/or ETF’s should be considered.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse manages the Steady Momentum service, and regularly incorporates options into client portfolios.

Related articles

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.