The same diversification benefits that would apply to owning the equities outright via ETF's should transfer over to put writing, and all of these products have a highly liquid options market.

In this post, we'll look at a simple backtest that includes SPY, IWM, EFA, and EEM from 2007-2018. The weights and parameters will be as follows:

SPY: 30%

IWM: 20%

EFA: 37.5%

EEM: 12.5%

This roughly correlates with current global cap weighting, with an overweight to small cap in the US. The put selling parameters are simple as well: 30 DTE entry, held until expiration, selling the strike closest to 50 delta (roughly at the money). Results are net of transaction cost assumptions for both commissions and slippage, and options are assumed to be fully collateralized with 1 Month US T-Bills. Option backtests were done with the ORATS Wheel, which comes with a free trial. It's a great tool that I highly recommend for those interested in backtesting option strategies, which otherwise can be quite a challenge. I then uploaded the data to Portfolio Visualizer to be able to simulate a portfolio inclusive of T-bill collateral yield.

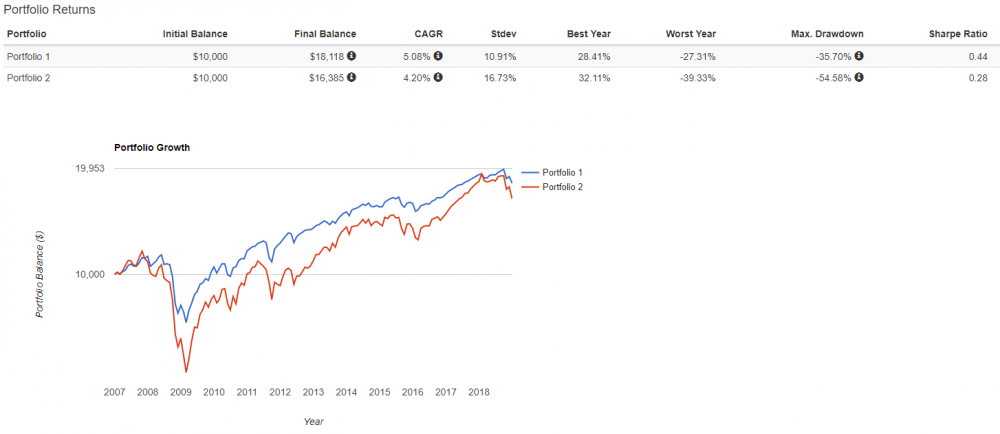

Hypothetical Results: (Portfolio 1 represents our put write portfolio. Portfolio 2 represents holding the ETF's directly in the same weights, with monthly rebalancing):

Results are hypothetical, and do not represent performance that any investor actually attained. Past performance doesn't guarantee future results.

During this 12 year period we see a nice improvement in risk-adjusted returns with our put write portfolio relative to owning the ETF's directly. A shallower drawdown during the 2007-2009 GFC, roughly 35% less portfolio volatility, and even a slight overall improvement in total return. During a tough 2018, the put write portfolio would have been down about half as much as the ETF portfolio (-5.5% vs. -10.6%). This outcome is similar to what can generally be seen when studying CBOE's PUT (S&P 500 put write) and PUTR (Russell 2000 put write) historical index data which extends back much further. For example, PUT historical data starts in 1986, allowing investors to analyze over 3 decades of hypothetical put writing performance.

Conclusion

Options are an incredibly versatile asset that can be used to strengthen an overall portfolio in many ways. The volatility risk premium, which largely explains the positive performance of put writing, is not something we should expect to go away for the same reasons we don't expect the equity risk premium to go away. Both can be thought of as having an intuitive risk-based explanation. Retail and professional traders could likely improve their long term equity allocations by incorporating put writing into their investment process.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse manages the Steady Momentum service, and regularly incorporates options into client portfolios.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now