.thumb.jpg.9dba620408d62ab9231ddf4bb7249751.jpg)

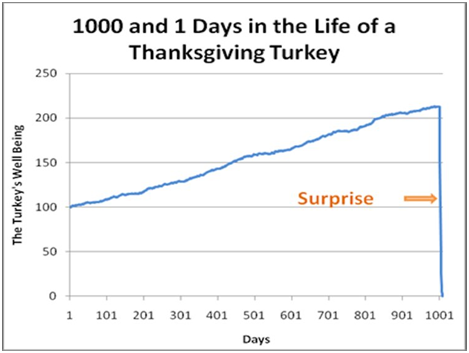

On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief."

Source: Business Insider

So what’s a Thanksgiving turkey investment, and how can we avoid them? From my experience, investments that blow up have several things in common.

-

Excessive leverage. There’s no strategy so good that an excessive amount of leverage can’t make it bad. This is the number 1 mistake I see, by far.

-

Exotic, highly complex, strategies. Don’t assume that it’s ok if you don’t understand it because you’re sure the manager does. This isn’t always the case...trust, but verify.

-

Discretionary Management. The problem with a strategy that relies on the discretion of the manager to determine when to buy, when to sell, and how much to buy and sell is that you can’t backtest it. More on this next.

-

No long-term track record or backtest. A track record or backtest isn’t bulletproof, but it can at least give investors an idea of what the past would have looked like. The good, the bad, and the ugly. If a strategy doesn’t have a track record, at least require it to have a long backtest through a variety of market conditions. If excessive leverage was being used, the backtest would likely show how the strategy would have failed during a bad period for the strategy.

-

No quantitative measurements. This ties in with number 4. As an experienced quantitative investor who has looked at and performed thousands of backtests, I can usually tell within seconds if something doesn’t pass the smell test. Statistics like CAGR, Standard Deviation, and Sharpe Ratio can quickly tell you if things look right or not. As Cliff Asness of AQR says, “beware of the 3 Sharpe strategies.”

-

Basic intuition. Everything I’ve said about quantitative data is important, but so is basic qualitative intuition. Does the strategy make intuitive sense? Since there’s always someone on the opposite side of a trade, what risk are you being compensated to bear? If the strategy can’t be explained as a logical risk premium, it’s more prone to be a data-mining artifact that either won’t work at all going forward in time or will eventually stop working due to the curse of popularity.

- A Hedge Fund or newsletter. This is anecdotal, but it just seems that the media headlines of a blowup usually come from hedge funds and newsletters where regulations are low or non-existent. But this isn’t always the case, and I’m involved with both hedge funds and newsletters myself so it obviously doesn’t mean avoid both at all costs. Just be careful and use common sense.

It’s been said that if you can’t spot the sucker at the poker table after 30 minutes, it’s probably you. When it comes to making financial decisions with your hard-earned money, it’s best to maintain a healthy dose of skepticism. Hopefully the 7 points from this article can help avoid your money having the same fate as your next Thanksgiving turkey.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University.

Related articles

- Karen The Supertrader: Myth Or Reality?

- Karen Supertrader: Too Good To Be True?

- How Victor Niederhoffer Blew Up - Twice

- The Spectacular Fall Of LJM Preservation And Growth

- James Cordier: Another Options Selling Firm Goes Bust

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.