Lately we experienced a 7% down move in the S&P 500.

We have also seen an explosion in the VIX.

All in all a pretty shitty situation if you have a delta neutral short premium portfolio.

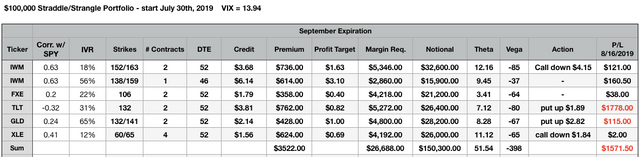

So let's have a look how a portfolio consisting of 30 delta short strangles and/or atm short straddles in IWM, FXE, TLT, GLD, XLE, which was started before this wild ride in the markets happened, would have performed.

Set up

As shown in my books, IWM, FXE, TLT, GLD, XLE are the most uncorrelated ETFs. With these underlyings you have exposure to the Russell 2000, the Euro Currency, Bonds, Gold and the Oil Sector.

Rules

- $100k portfolio

- capital allocation based on the VIX (20-25% allocation in very low VIX environment, 40-50% in a high VIX environment)

- equal buying power in all underlyings

- never go above 3x leverage in notional value

- 30 delta short strangles or atm straddles

- about 45 DTE

- profit target = 16 delta strangle credit at trade entry

- close all positions at 21 DTE if profit target is not hit before

- if short strike in strangles gets hit, roll untested side into a short straddle (original profit target doesn't change)

- if break even in a short straddle gets hit, roll untested side to the new atm strike (going inverted)

-

if IVR in IWM goes above 50% and/or VIX makes a big up move, add aggressive short delta strangle to balance deltas

Portfolio Performance

As a starting date I picked July 30th 2019, probably the worst day in this expiration cycle to start this kind of portfolio. Since the VIX and IVR was pretty low at this moment, I committed only a little bit above 25% of my net liq.

IWM

FXE

TLT

GLD

XLE

Portfolio

So far in dollar terms a $1,571.50 loss or 1.571% loss on the whole portfolio.

Not too bad considering the IV explosion and the big moves, especially in TLT.

As you can see, even in a tough market with big outside the expected moves and IV explosion, short strangles/straddles are not a recipe for disaster.

The key is to trade small when IV is low and mechanically adjust your positions/deltas.

Of course the expiration cycle is not over yet and we can still have more big moves and much higher implied volatility in the coming days, but you should have seen now, when you have the right set of rules and religiously stick to these rules and when you trade small enough when IV is low, you are not going to blow up your portfolio.

Stephan Haller is an author, teacher, options trader and public speaker with over 20 years of experience in the financial markets. Check out his trilogy on options trading here. This article is used here with permission and originally appeared here.

Related articles

- Selling Naked Strangles: The Math

- Selling Short Strangles And Straddles - Does It Work?

- James Cordier: Another Options Selling Firm Goes Bust

- How Victor Niederhoffer Blew Up - Twice

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.