And the same is true with determining which strikes to use when selling puts. As it turns out, over a relatively long period of time risk and reward are related, as we would expect.

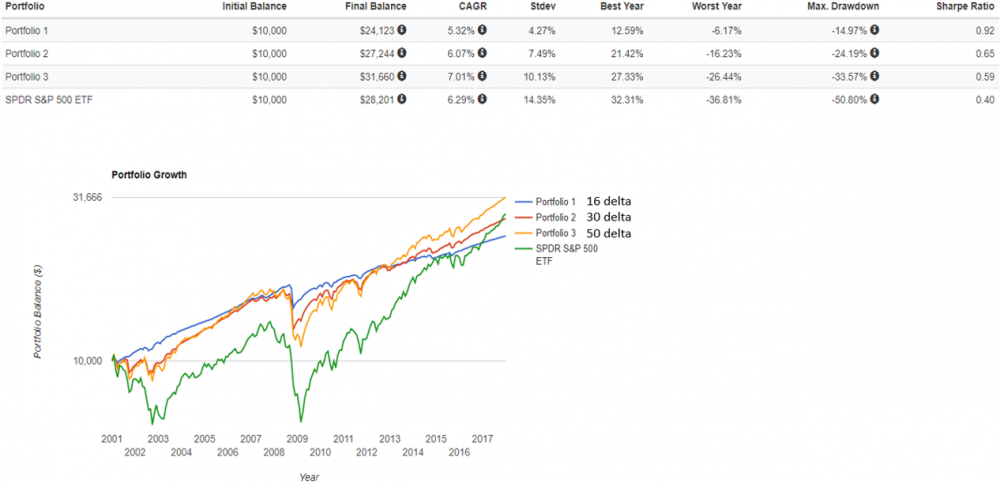

Below are the results of three backtests simulating the monthly sale of SPX put options from 2001-2017 at various delta levels (16, 30, and 50). Each test assumes you enter approximately one month from expiration and exit approximately 3 days prior to expiration (results have minimal variation if entries and exits are slightly modified). No active trade management is involved.

My tests also assume no leverage is being used, with cash fully secured by 1 month T-bills. In other words, the returns of put selling can be thought of as the yield on cash plus the net results of the option trades. No commissions, slippage, or taxes are included, so real results would be slightly lower. Given the size of the SPX contract and its liquidity, this isn't a serious issue. The strategy passes the test of real world investability.

Click on the image for greater clarity

Several interesting observations can be seen:

1. All strikes deliver returns similar to the underlying asset (using SPY as a proxy). The at the money strike (50 delta) even slightly outperformed SPY. It should be noted that every backtest is sensitive to the start and end point, and if we started our test in 2009 SPY would substantially outperform. This is what we would expect given the limited profit potential of put selling. CBOE has data going back to 1986 showing that at the money put writing has delivered returns comparable to owning the underlying.

2. All strikes delivered less risk than the underlying asset, measured with standard deviation and max drawdown. This results in higher Sharpe Ratios. The Sharpe Ratio is one way to measure how well we are being compensated for the risk taken, and a higher number is better. Put selling having lower risk than owning the underlying asset is something that we can expect to persist in the future. This is often counter to the perception that many have about selling options being "risky". Leverage is what creates risk, not product/strategy.

3. The farther out of the money strikes deliver higher Sharpe Ratio's, with 16 delta options producing an extremely high 0.92 Sharpe. This could be noise in the data that may not be likely to continue out of sample, but many other researchers have found similar results on additional data and underlying assets leading us to believe it's not random. Those who believed this will continue to persist may choose to modestly lever their notional exposure to produce higher returns instead of selling strikes that are closer to the money.

4. If you look closely at the chart, you can see that put selling can make money even in a declining market (especially with further out of the money options, of course). For example, during the 2001-2002 bear market, 16 delta put selling was continuing to put in new equity highs. This was also the case during the first several months of 2008 where the market was declining, but not too far/too fast. When the crisis hit in the fourth quarter, the speed and magnitude of stock market losses was too great for any of the strikes to endure. No surprise there, as insurance must pay off from time to time to attract buyers.

5. After a crisis period like 2008, put selling recovered quickly as option premiums were substantial. SPY didn't reach a new high until 2013, while put selling recovered it's drawdowns in 2010. This is important given the nature of our human discomfort with losses and our ability to stick with a strategy.

You may even draw additional conclusions of your own from this data. So with all this being said, which strike should you sell? I don't think a binary decision needs to be made here anymore than a binary decision on if you should sell puts or just buy the ETF directly. There are advantages and disadvantages of both, but hopefully this has made it clear that put selling is worthy of at least a partial allocation for a particular asset class like US large cap equity.

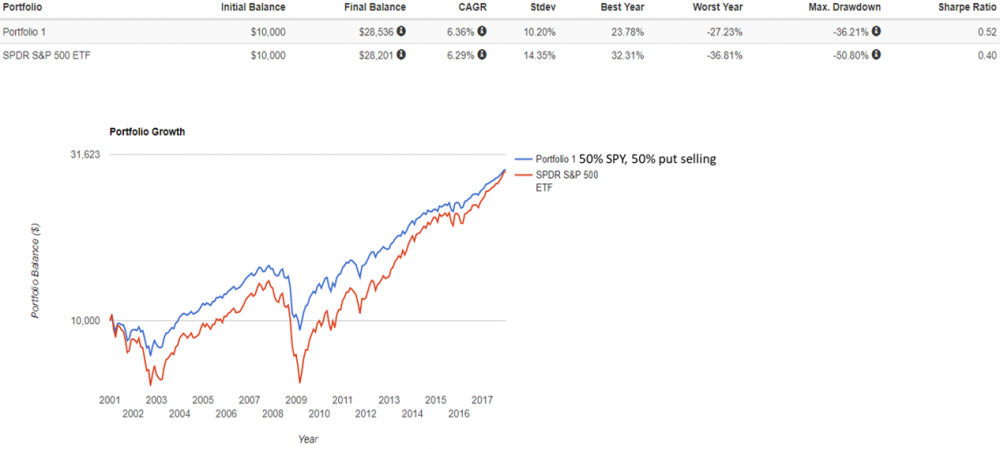

Below I'll present one additional chart that is 50% SPY, and 50% put selling with equal allocation to our three strike levels (in other words, about 16.66% each), rebalanced monthly. Given the certainty of our uncertainty about which method will be best in the future, as well as the simplicity and tax efficiency of a traditional ETF allocation, this approach could be ideal for many sophisticated investors.

Click on the image for greater clarity

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse oversees the LC Diversified forum and contributes to the Steady Condors newsletter.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.