"The CBOE S&P 500® PutWrite Index (ticker symbol “PUT”) tracks the value of a passive investment strategy (“CBOE S&P 500 Collateralized Put Strategy”) which consists of overlaying S&P 500 (SPM) short put options over a money market account invested in one- and three-months Treasury bills. The SPX puts are struck at-the-money and are sold on a monthly basis, usually on the 3rd Friday of the month. This is called the “roll date” and it matches the date of S&P 500 option expirations."

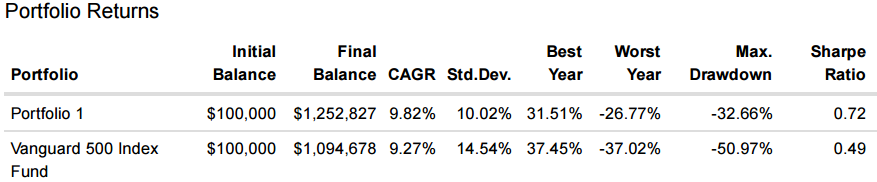

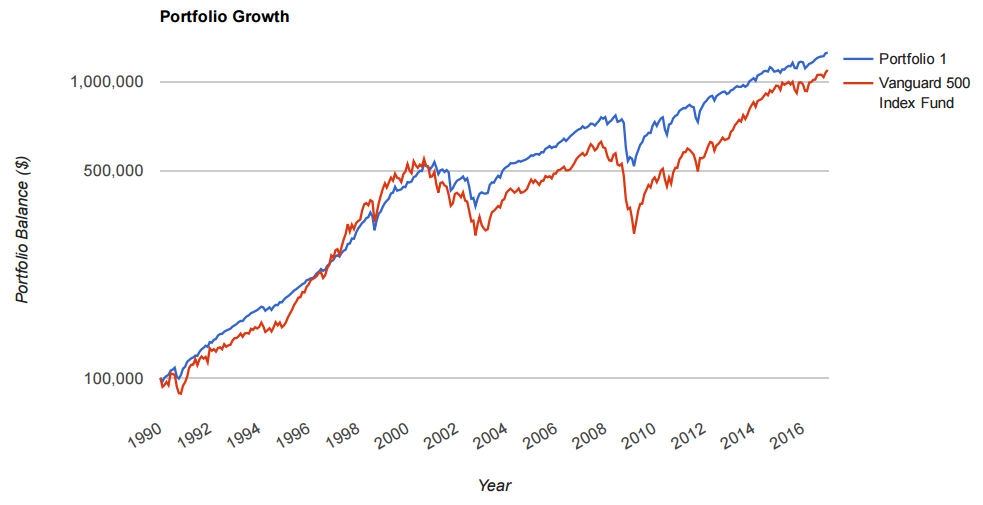

Here is the performance of PUT (Portfolio 1) vs. VFINX (Vanguard S&P 500 Index Fund) from 1990-2016:

The most attractive part of PUT vs. VFINX is the improvement in risk-adjusted returns. Both volatility and maximum drawdown were cut by about a third, resulting in a nice increase in Sharpe Ratio. Even the most passive investors could benefit from this approach as the PUT selling strategy is now available in an ETF structure from Wisdom Tree. More active investors that follow our Steady Options content may be interested in replicating the PUT selling strategy themselves, saving themselves the 0.38% management fee. In addition to saving on management fees, an active investor with a creative mind can potentially further increase potential returns by keeping collateral in something other than T-bills.

Momentum

What if we add a trend-following, or "time-series momentum" overlay to PUT? We already know that it has been peer reviewed and validated out of sample on multiple underlyings, so why would PUT be any different? Answer: It's not.

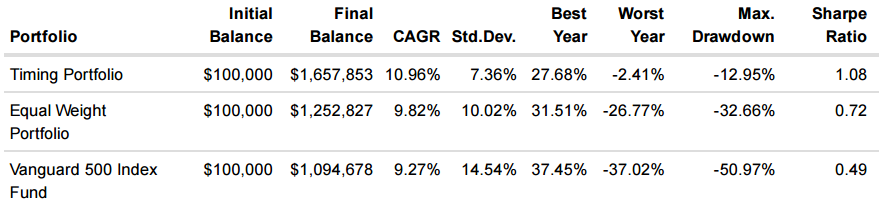

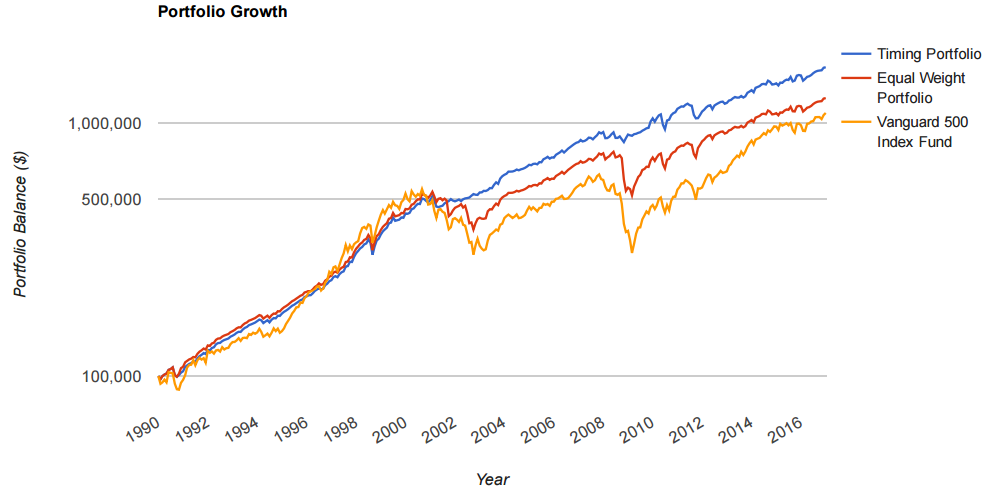

Below is the performance of all three: VFINX, PUT (Equal Weight Portfolio), and PUT with a 12 month time series momentum filter where we are invested in PUT when its rolling 12 month excess return is positive, otherwise VBMFX (Timing Portfolio). The timing portfolio reallocation period is monthly.

All charts and statistics were custom generated at www.portfoliovisualizer.com.

As expected, adding time-series momentum cuts off a substantial part of the left-tail of returns. This benefit can't be emphasized enough in the real world of human emotion. Sophisticated traders and investors like those following all of our content at Steady Options could benefit from this approach as part of their long-term portfolio. In our firm, we already utilize a variation of this strategy for our clients.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now