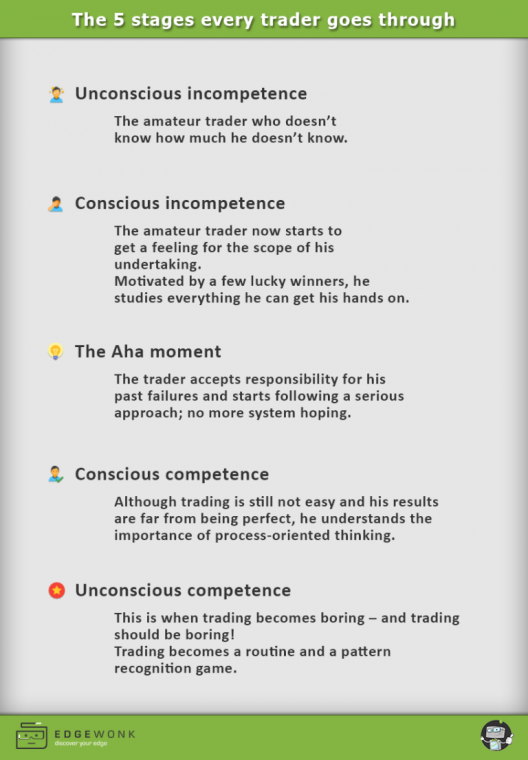

Unconscious incompetence

This is the initial phase of a new trader when he is just getting his feet wet in the markets and looks at his trading platform for the first time. At that stage, a trader doesn’t know how much he doesn’t know, which can often be a liberating, but dangerous place to be in.

His trading decisions are pretty much still a gamble and not backed by a sophisticated decision-making process; although the unconscious incompetent trader will never admit that – he doesn’t know any better yet.

A few characteristics of the unconscious incompetent trader:

- He randomly opens and exits trades without a defined trading system

- He changes his “approach” on a trade to trade basis

- He does not apply risk management or position sizing principles

- He often changes his trade direction on the spot and chases price

- He gets motivated by winning trades and does not care much about losses

- Beginners luck is what keeps him going

- One loss often wipes out all previous wins

At this stage, the traders with beginners luck are more likely to keep going and make it to the next stage. Often, however, traders lose money, get easily discouraged and acknowledge that trading isn’t as easy as clicking a mouse.

Conscious incompetence

Now it dawns on the trader how little he knows and he starts to understand that he has to put in the work and study more. Motivated by a few lucky winners, he studies everything he can get his hands on.

A trader who still loses money consistently, even after spending a lot of time learning about trading, will often start blaming his tools, the wrong indicators, missing information or unfair markets; he is looking for external excuses.

This stage of conscious incompetence is the one that lasts the longest. Some traders will never leave this stage, even after years of being involved in the markets. A few principles and questions can make you aware of potential problems in your trading mindset and general approach:

- Have I changed my trading system more than once in the last 6 months without really putting in the work?

- Am I actively reviewing my trades to find out what is going wrong?

- Am I still making impulsive trading mistakes that cost a lot of money?

- Do I repeat the same trading mistakes over and over again?

Sit down and try to answer these questions. Be honest with yourself even if the truth hurts. Lying to yourself will keep you trapped in your current state and you won’t be able to improve and evolve as a trader.

The Aha moment

It sounds cliché but this is the time when the trader accepts responsibility for his actions. He understands that all his past mistakes and false behavior will not get him anywhere. If a trader is really serious about making this work, there is typically only one way and the following principles describe the “new” mindset:

- He stops changing systems and focuses on making the one he has work

- He starts monitoring his behavior to find negative behavioral patterns

- He follows a daily trading routine, starts keeping a trading plan and a trading journal

- He understands that entries are just one part of his system and that, in order to become profitable, he has to work on all components of his system

Conscious competence

The trader now starts to realize what trading is all about. Although trading is still not easy and his results are far from being perfect, he understands the importance of process-oriented thinking. He stops focusing on only the outcome of his trades.

Traders at this stage are typically break-even traders and slowly start to turn their equity graph up. Discipline, emotions and adequate risk management are of utmost importance at this stage and a long-term approach will keep the trader from falling back into old habits.

The trading journal becomes his most important companion at this stage because it provides an objective look at his performance and behavior. Traders at this stage are very likely to make it to the next and final stage. They can see that their work is starting to pay off, they stop system hopping and focus on their process-oiented approach.

Unconscious competence

This is when trading becomes boring – and trading should be boring! At this stage, the trader has spent years of looking at screens and taking the same setups hundreds or even thousands of times. He knows exactly how his preferred setup looks like and trading becomes a waiting game.

At this stage, the trader has fully internalized that he can’t win every trade and, more importantly, he does not really care about losses as long as he has followed his rules. Trading is now an activity of pattern recognition, risk management and constant self-improvement.

The unconscious competent trader has a thirst for self-improvement and constantly studies the markets. He evaluates the effectiveness of his method and he is driven by the success and his improvements so far.

Which stage are you at right now?

Being a trader is a life-long journey of self-improvement and self-discovery. The markets teach you something about yourself every day. In fact, a trading plan that makes money for a trader is simply the extension of his own personality with all its qualities and imperfections.

Your task right now – if you are not a consistently profitable trader yet – is to sit down and take a deep look at yourself. Then try to answer the following question: which stage are you at right now?

Try to answer this question as best and honest as you can. The moment you answer this question, and draw the consequences from it, you will be on your path to improving your trading bit by bit until one day you will finally reach controlled profitability.

This article has been published originally on Edgewonk.com – Tradeciety’s partner site: original article here.

Related articles

- How To Become A More Profitable Trader

- Can you double your account every six months?

- Why Retail Investors Lose Money In The Stock Market

- Top 10 Mistakes New Option Traders Make

- Are You Ready For The Learning Curve?

If you are ready to start your journey AND make a long term commitment to be a student of the markets:

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.