I’ll explain all three in this article, along with examples. The best part is none of this is overly complicated and can largely be automated with recurring ACH transfers, systematic fund purchases, and rebalancing software. I recommend financial plan automation to the maximum extent possible, as this minimizes the chances we'll overthink our purchase decisions by trying to time the market.

Asset allocation

Asset allocation is your portfolio mixture of stocks, bonds, and cash. In order of lowest expected risk and return to highest is cash, bonds, and stocks. Your allocation to cash should be based on your short term liquidity needs. Keeping a month or two of living expenses in your checking account, and another three to six months in a high yield savings account or money market mutual fund should round out the majority of your cash position most of the time. Cash is also sensible for any lump sum expenses coming up in the next year (large tuition payment, car purchase, etc.). Expenses coming up in the next 2-5 years can be held in FDIC insured CD’s or bond funds of similar maturity as this appropriately reflects the time horizon of the money. I recommend only investment grade bond mutual funds or ETF’s.

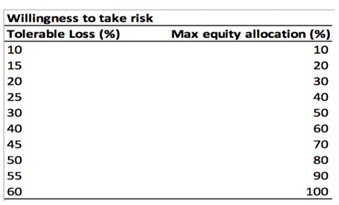

Beyond 5 years, your decision to include fixed income in your portfolio (CD’s or bond funds) becomes more of a risk tolerance decision than a financial planning decision. It would be reasonable to consider keeping all dollars with an expected time horizon of greater than 5 years in diversified equity funds, but not everyone has the stomach for the associated volatility even when they know they don’t need the money for several years. For this reason I recommend using the following table to guide that decision, where your maximum tolerable loss helps determine your equity allocation, with the difference going into fixed income funds.

Source: “Your Complete Guide to a Successful and Secure Retirement” by Larry Swedroe and Kevin Grogan.

Diversification

Diversification is your allocation across all publicly available stocks and bonds. Instead of just buying a handful of your favorite stocks, or even buying just the S&P 500 which represents US large cap stocks, practice smart diversification by investing globally. For US investors, a good mix is around 65% US, and 35% World Ex-US stocks. Do this with low cost index funds that capture the total market return. Within stocks, an advanced concept is to add additional weight to stocks with higher expected returns, such as small cap and value stocks. For example, from 1930-2019 the Dimensional US Small Cap Value Index outperformed the Fama/French Total US Market Research Index by 3.98% per year.

For those who are skeptical about this datapoint, consider the frequency at which the small cap value index outperformed the market index over all rolling 10-year periods (90%) was higher than the frequency of the total market index outperforming risk free one-month US treasury bills (87%). Both the total market premium over T-bills and the small value premium over the market can be explained as rational compensation for taking more risk. Academic research has concluded that small cap and value stocks have unique and independent risks from the market, and these risks result in these types of stocks having higher expected returns. On the bond side, global diversification is also beneficial, and fund companies like Vanguard offer global bond mutual funds and ETF’s worth considering as a simple one fund solution. My firm uses funds from Dimensional Fund Advisors, but these funds are only available through financial advisors. There’s usually no reason your total portfolio needs to consist of more than about 5-7 funds. Arguments for a few more or a few less can be made, but portfolios of a dozen or more funds are probably overly complex.

Rebalancing

This is the last core principle to long-term success. Rebalancing is the act of bringing your portfolio back to your targeted allocations on a periodic basis. This can be done systematically based on the calendar (such as annually) or based on tolerance bands where you assign a minimum and maximum allowable percentage range for each fund in your portfolio to drift, which you review monthly or quarterly. For example, if you had an equal 50/50 allocation to two different funds, differing performance between the funds will cause the allocation to drift over time to where you’ll need to sell some of the fund(s) that has become overweight relative to your target and use the proceeds to buy some of the fund(s) that has become underweight. If your portfolio has a mixture of stock and bond funds in it, this will keep the volatility of your portfolio in line with your objectives outlined in the asset allocation section. For taxable accounts, it makes sense to rebalance with cash flows when available in order to minimize taxable events. If you’re regularly contributing new money to your account, you can apply it to funds that are underweight. Additionally, you can apply dividends paid in cash towards funds that have become underweight. For employer retirement accounts, check to see if automated rebalancing is a feature available within your plan.

Conclusion

Good financial planning and portfolio management is not particularly difficult, and there has never been a better time to be an investor from the standpoint of having access to funds that cover stocks and bonds all over the world. But the process does require a lot of upfront knowledge and discipline, especially during extreme markets like we’ve seen so far in 2020. As the cartoon character Pogo said, “we have met the enemy, and he is us.” If the entire process still seems more complicated than you’d prefer, or if you’d simply like a second opinion from time to time, contact an independent fee based financial advisor that can help you construct a well thought out plan in line with these principles for either an hourly fee or based on assets under management. My firm can provide both service models to individuals, and we offer a complimentary 15-minute phone call to determine if we might be a good fit for your needs.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse manages the Steady Momentum service, and regularly incorporates options into client portfolios.

Related articles

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.