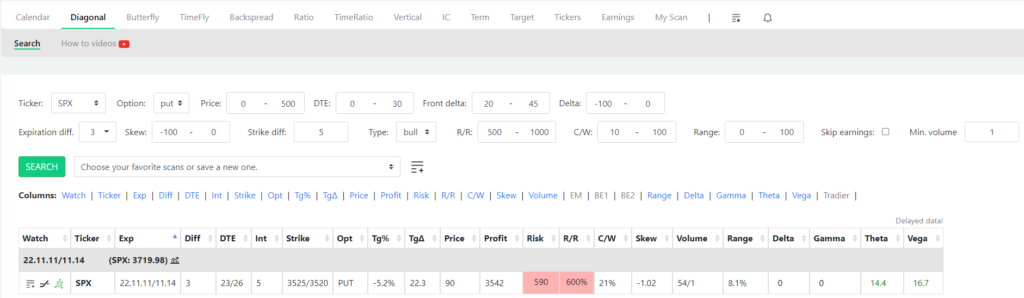

I always wanted to have a mechanism that scans the market for specific SPX diagonals and alerts me whenever find it. That is why I have developed an alert algorithm in the scanner so that I do not have to manually scan for interesting setups all day, but it will alert me.

Let’s see what type of diagonals I like for SPX.

-

Ticker: “SPX” because I am looking for SPX diagonals;).

-

Option: “put” means I am looking only for put diagonal spreads.

-

Price: “0 – 500” means I am only interested in spreads that have a debit between 0 and 500 dollars. I am only looking for debit diagonals because credit ones would have different directional bets.

-

DTE: “0 – 30”, I am looking for the ones with max 30 days to expiration.

-

Front delta: “20 – 45” defines the delta distance for the front leg of the spread. This makes it close to the money, but not ATM where the net delta would be positive and I am looking for negative delta.

-

Delta: “-100 – 0” is the net delta of the position. In this scan, I am only looking for a negative net delta configuration because then if the market starts to fall, I am immediately making money on the spread. This diagonal is accumulating net negative delta as days go by through the effect of charm Greek.

-

Expiration diff: “3”, means I am looking for diagonals where there are 3 days in between the expiration dates. This is typically Friday/Monday expiration. You can also search for various expiration differences.

-

Skew: “-100 – 0”, this is the most crucial part of this setup, the horizontal IV skew. This setting states that I am looking for negative skew, which means the front leg has a higher IV than the back leg.

-

Strike diff: “5” is the interval between the long and short strikes of the diagonal. If I want to have the scanner look for all the variations, I would set it to 0. But for this setup, 5 is the best strike difference.

-

Type: “bull”, there are two types of diagonals for puts and calls. Bull diagonals and bear diagonals. In this setup this is a bull put diagonal which means that the long put has a higher strike than the short put, hence it is more of a range trading setup.

-

R/R: “500 – 1000” means I am looking for diagonals that have a reward-to-risk ratio of at least 500%. The R/R is based on the max potential loss vs. the max potential profit of the diagonal.

-

C/W: “10 – 100”, stands for the percentage of credit/width I get for shorting the embedded vertical that is found in the diagonal spread. Every diagonal has an embedded vertical spread and with this setting, I am making sure that it’s worth selling that embedded vertical. So if I am looking for a min. of 10% C/W that means when I short the vertical I get at least 10% of the width of the vertical in credit.

-

Range: “0 – 100” defines how wide the breakeven range in percentage should be in a calendar spread. I left it on default.

-

Min. volume: “1” is looking for legs that have at least a volume of 1 on the current day. With this, you can filter out those that have very low volume, hence wider bid/ask spreads.

As you can see in the image above, I have only found one SPX put diagonal which had 600% R/R potential and a pretty flat configuration. Let’s go through what the columns mean.

-

Watch: with these icons you can add a spread to your watchlist, analyze the risk graph or copy the trade to thinkorswim format.

-

Ticker: nothing to explain here:)

-

Exp: the front and back month expiration of the diagonal spread.

-

Diff: the day difference between the legs’ expiration dates.

-

DTE: how many days are until expiration in the front / back leg.

-

Int: the strike difference between the legs.

-

Strike: the found strikes of the diagonal spread.

-

Opt: option is either call or put.

-

Tg%: target %, how far the strike is in percentage move from the current stock price.

-

TgΔ: the target delta of the spread which is the front delta in this case.

-

Price: debit of the spread.

-

Profit: the theoretical max. profit you can make on the specific calendar spread.

-

Risk: the risk of the trade, in this case, the debit paid.

-

R/R: reward to risk in percentage.

-

C/W: percentage credit/width of the embedded vertical.

-

Skew: the horizontal IV skew of the legs. Negative means it is backwardated that is the front leg has a higher IV than the back month.

-

Range: what is the price range in percentage between the breakeven points of the spread (how wide is).

-

Delta: net delta of the spread.

-

Gamma: net gamma of the spread. Theta: net theta of the spread.

-

Vega: net Vega of the spread.

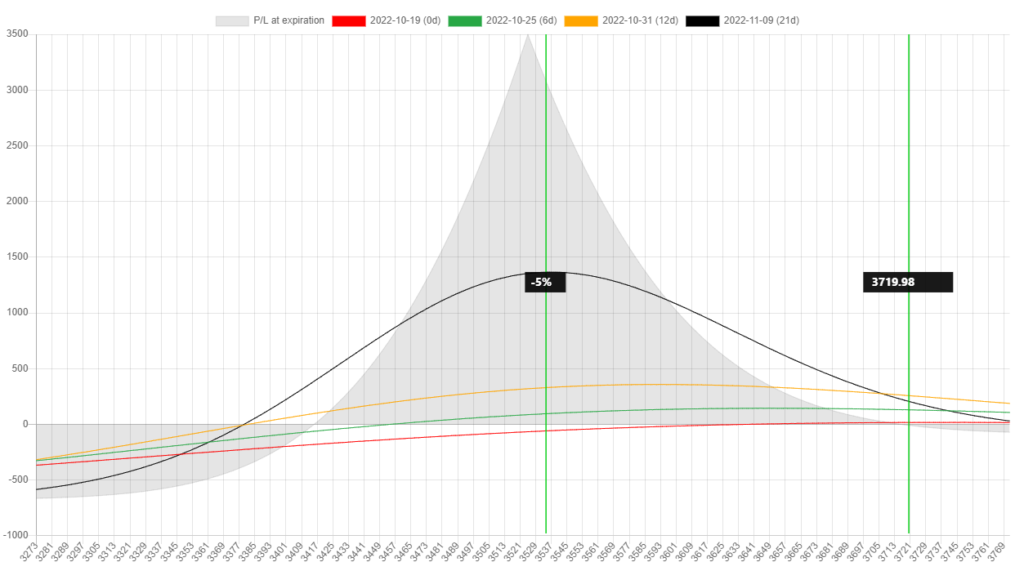

Risk graph of the position

Here is the risk graph of that one diagonal above.

You can tell from the risk graph that this configuration is pretty wide and flat in terms of net delta. It makes money with time and direction. Since I love these diagonals, I have created a scan template for it and clicking on the alert button, I will get notified whenever this setup comes around during the day. This is pretty rare, so I might not get an alert every day, but in a high IV environment, it is more common.

Diagonal scanner guide

For a more detailed explanation of how to use the diagonal spread scanner please watch the following video.

Special SO offer:

If you sign up for NinjaSpread until 11.30.2022, you get 30 day free trial instead of 14 day and 20% discount. Coupon code: SO10

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.