In this article, I will show why it might be not a good idea to keep those options straddles through earnings.

As a reminder, a straddle involves buying calls and puts on the same stock with same strikes and expiration. Buying calls and puts with the different strikes is called a long strangle. Strangles usually provide better leverage in case the stock moves significantly.

Under normal conditions, a straddle/strangle trade requires a big and quick move in the underlying. If the move doesn’t happen, the negative theta will kill the trade. In case of the pre-earnings strangle, the negative theta is neutralized, at least partially, by increasing IV.

The problem is you are not the only one knowing that earnings are coming. Everyone knows that some stocks move a lot after earnings, and everyone bids those options. Following the laws of supply and demand, those options become very expensive before earnings. The IV (Implied Volatility) jumps to the roof. The next day the IV crushes to the normal levels and the options trade much cheaper.

Over time the options tend to overprice the potential move. Those options experience huge volatility drop the day after the earnings are announced. In many cases, this drop erases most of the gains, even if the stock had a substantial move. In order to profit from the trade when you hold through earnings, you need the stock not only to move, but to move more than the options "predicted". If they don't, the IV collapse will cause significant losses.

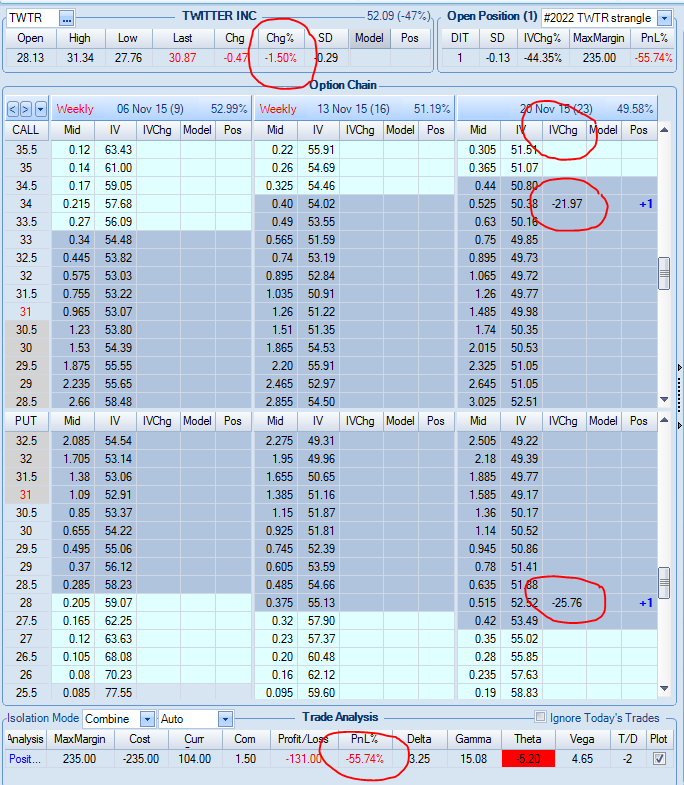

Here is a real trade that one of the options "gurus" recommended to his followers before TWTR earnings:

Buy 10 TWTR Nov15 34 Call

Buy 10 TWTR Nov15 28 Put

The rationale of the trade:

Last quarter, the stock had the following price movement after reporting earnings:

Jul 29, 2015 32.59 33.24 31.06 31.24 92,475,800 31.24

Jul 28, 2015 34.70 36.67 34.14 36.54 42,042,100 36.54

I am expecting a similar price move this quarter, if not more. With the new CEO for TWTR having the first earnings report, the conference call and comments will most likely move the stock more than the actual numbers. I will be suing a Strangle strategy. 9/10.

Fast forward to the next day after earnings:

As you can see, the stock moved only 1.5%, the IV collapsed 20%+, and the trade was down 55%.

Of course there are always exceptions. Stocks like NFLX, AMZN, GOOG tend on average to move more than the options imply before earnings. But it doesn't happen every cycle. Last cycle for example NFLX options implied 13% move while the stock moved "only" 8%. A straddle held through earnings would lose 32%. A strangle would lose even more.

It is easy to get excited after a few trades like NFLX, GMCR or AMZN that moved a lot in some cycles. However, chances are this is not going to happen every cycle. There is no reliable way to predict those events. The big question is the long term expectancy of the strategy. It is very important to understand that for the strategy to make money it is not enough for the stock to move. It has to move more than the markets expect. In some cases, even a 15-20% move might not be enough to generate a profit.

Jeff Augen, a successful options trader and author of six options trading books, agrees:

“There are many examples of extraordinary large earnings-related price spikes that are not reflected in pre-announcement prices. Unfortunately, there is no reliable method for predicting such an event. The opposite case is much more common – pre-earnings option prices tend to exaggerate the risk by anticipating the largest possible spike.”

Related Articles:

- How We Trade Straddle Option Strategy

- Buying Premium Prior to Earnings

- Can We Profit From Volatility Expansion into Earnings

- Long Straddle: A Guaranteed Win?

We invite you to join us and learn how we trade our options strategies in a less risky way.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now