.thumb.jpg.84786c5b2d946aaa69a1e2a9a8ddd9a5.jpg)

While this is true, this ignores the ability to layer on options exposure in a margin account in a well thought out disciplined manner.

TLT is a popular ETF for options traders because US Treasuries are a widely followed market resulting in options contracts with high volume and liquidity. Even long term investors could benefit from trading TLT options, and I have a couple ideas of how. First, an investor with an equity ETF portfolio that is passively managed could write TLT puts as an overlay to increase expected returns and add diversification. This would be the more conservative approach. The second way would be to simulate a synthetic long TLT position by purchasing a longer dated ATM call and selling an ATM put. Some people refer to this position as a synthetic, a combo, or a risk reversal.

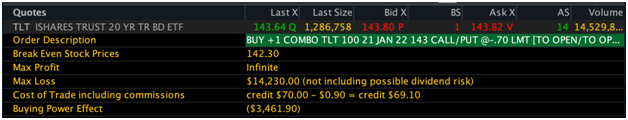

A trade example looking at today’s closing prices would be the following:

- Buy 1 TLT January 21, 2022 143 call

- Sell 1 TLT January 21, 2022 143 put

For a credit of $0.70

The confirm and send page for ThinkOrSwim shows the following details:

This position is very similar to owning 100 shares of TLT, which would currently cost more than $14,000. As a synthetic long position, the options trade is actually done at a small credit and would have positive carry evidenced by the break even stock price of $142.30. If an investor had a portfolio of $100,000 fully invested in a basket of equity ETF’s, similar to our ETF BuyWrite strategy available at no additional cost to Steady PutWrite subscribers, he or shemight also buy 2 or 3 TLT combos and effectively have a portfolio 100% invested in equities and 28-42% US Treasuries.

The TLT option combo will have a very similar return when held until maturity as owning TLT directly. There would likely be a small lag relative to TLT with the option combo because borrowing costs roughly equal to the risk free rate are embedded into the price of the contracts. If this were not true, you could go long TLT and short the options combo and earn the TLT yield without any price risk since it would be offset by the option positions.

Overall, this trade idea is a way to efficiently create low cost leverage. Since leverage magnifies both risk and return, it should be done carefully and only if you have a good understanding of the potential outcomes. My crystal ball is always cloudy so I can’t say if now is a good time or not to add this type of trade to your portfolio, but TLT was down more than 20% and currently is down about 14% since last August. Since US Treasuries tend to be a less volatile asset class than equities, this level of drawdown doesn’t happen often. Looking at monthly data going back to 1935 I find that this current drawdown would rank among the 5 largest in history. Buying proven asset classes like stocks and US treasury bonds with lots of long term evidence when they are going through large drawdowns usually turns out to be a good investment.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University.

Related articles

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now