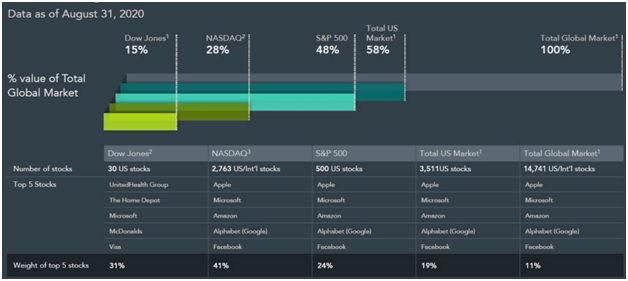

Most investors are surprised to learn the Dow Jones is made up of only 30 stocks, which is less than 10% of all the publicly traded stocks in the US and only 15% of the market capitalization of the total global stock market. The Nasdaq covers 28% of the value of the global market but has a massive 41% weighting in the top 5 stocks. The S&P 500 gets you to 48% of the value of the global market, but concentration is still an issue with almost a quarter of the index in the top 5 stocks.

Diversification is important at many levels including number and weighting of securities, and by country. Going from the Dow Jones to the total global market is a significant increase in diversification that has no expected long-term disadvantage. Since US and Foreign stocks have similar risk, they are expected to have similar returns. Concentrating a portfolio in a single country like the US can result in long periods of poor performance.

Using the popular S&P 500 index as an example, we only have to look back to the turn of the century to see a period of 13 years when the index produced no risk premium relative to US Treasury Bills. Specifically, from 2000-2012 the S&P 500 returned only 1.66% per year while US Treasury Bills returned 2.15% per year. The tech heavy Nasdaq performed even worse, losing-2.1% per year.

What’s a better alternative? Using the Dimensional Equity Balanced Strategy Index as a global market proxy as it’s made up of more than 14,000 large and small cap US, Foreign, and Emerging Market stocks, a global investor would have earned a very respectable 8.18% annualized return over this 2000-2012 period. Earning an equity premium is more reliable historically with globally diversified equity portfolios.

Summary

When we think about “the market”, we should look beyond popular US equity indexes. The S&P Global BMI and MSCI All Country World Indexes are more representative, but it’s unlikely financial media will change their practices anytime soon. Since it’s impossible to predict future returns, the safe strategy is to diversify broadly by using the global market as a starting point for portfolio construction. Going from the S&P 500 index to the S&P Global BMI index adds roughly 12,000 additional stocks to a portfolio from more than 40 additional countries. Owning only US stocks is like fishing in half the lake when there are opportunities everywhere. Recently, we’ve seen US stocks, and in particular US large technology sector stocks outperform. But history tells us this is not only the case, and over the long-term US and Foreign stocks have similar expected returns.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now