Consider selling strategies when options are being traded at high implied volatility levels.

Consider buying strategies when options are being traded at low implied volatility levels.

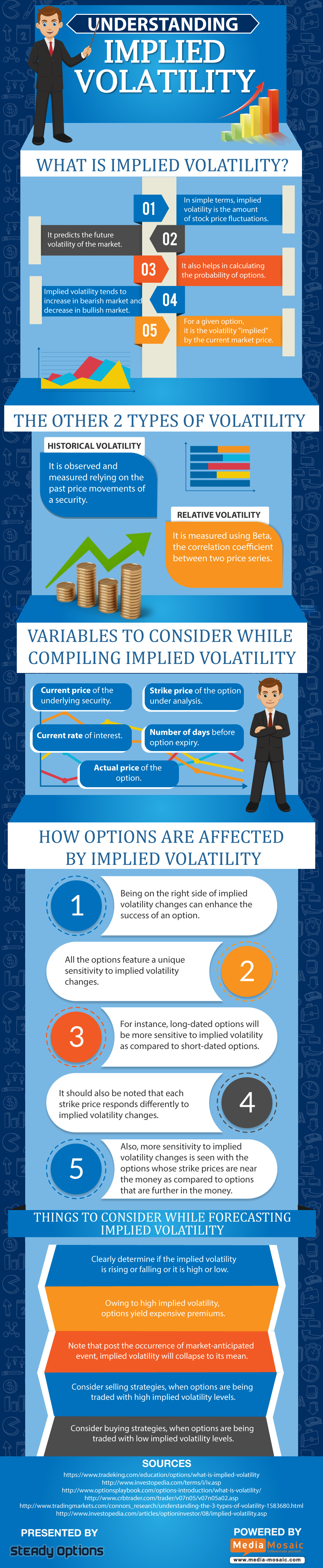

The following infographic explains some of the aspects of the Implied Volatility:

1. What is Implied Volatility?

2. 2 types of volatility.

3. How options are affected by Implied Volatility?

And more.

We invite you to join us and learn how we trade our options strategies.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now