So what do you do when your most successful strategies suddenly become much riskier?

The answer: you are looking for new opportunities.

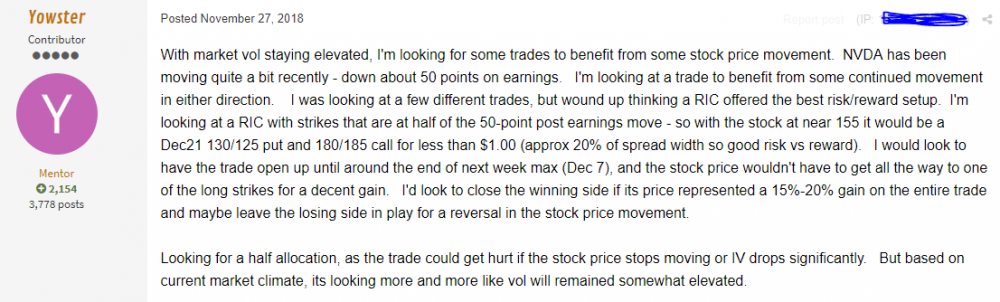

Our long time contributor @Yowstercame with the following idea:

For those of you not familiar with RIC (Reverse Iron Condor) - it is a limited risk, limited profit trading strategy that is designed to earn a profit when the underlying stock price makes a sharp move in either direction. The RIC Spread is where you buy an Iron Condor Spread from someone who is betting on the underlying stock staying stagnant.

This is not a new strategy for us - we have traded it successfully back in 2012, but the current version is slightly different and more suited for the current environment.

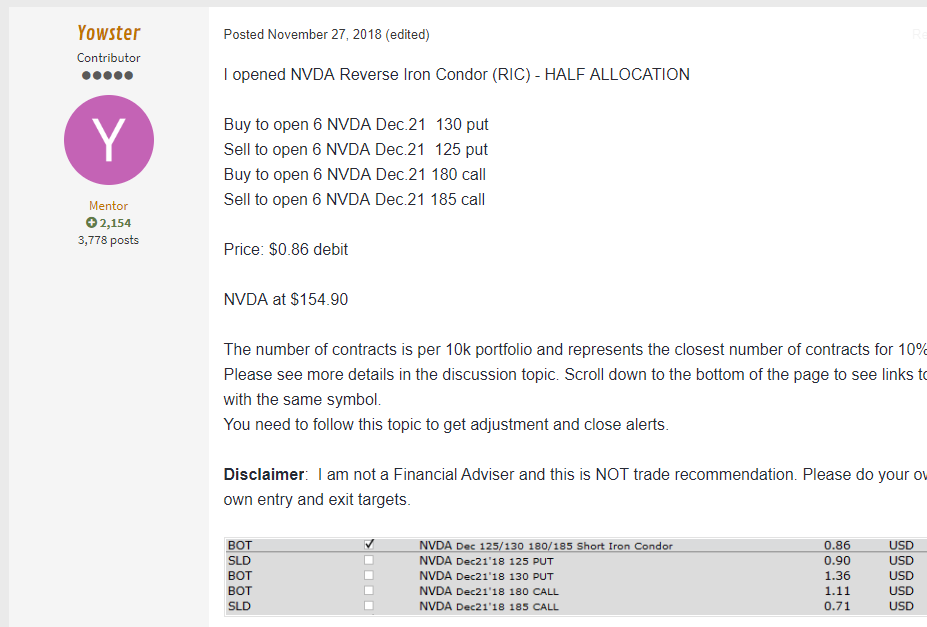

Our first RIC was opened on November 27, 2018:

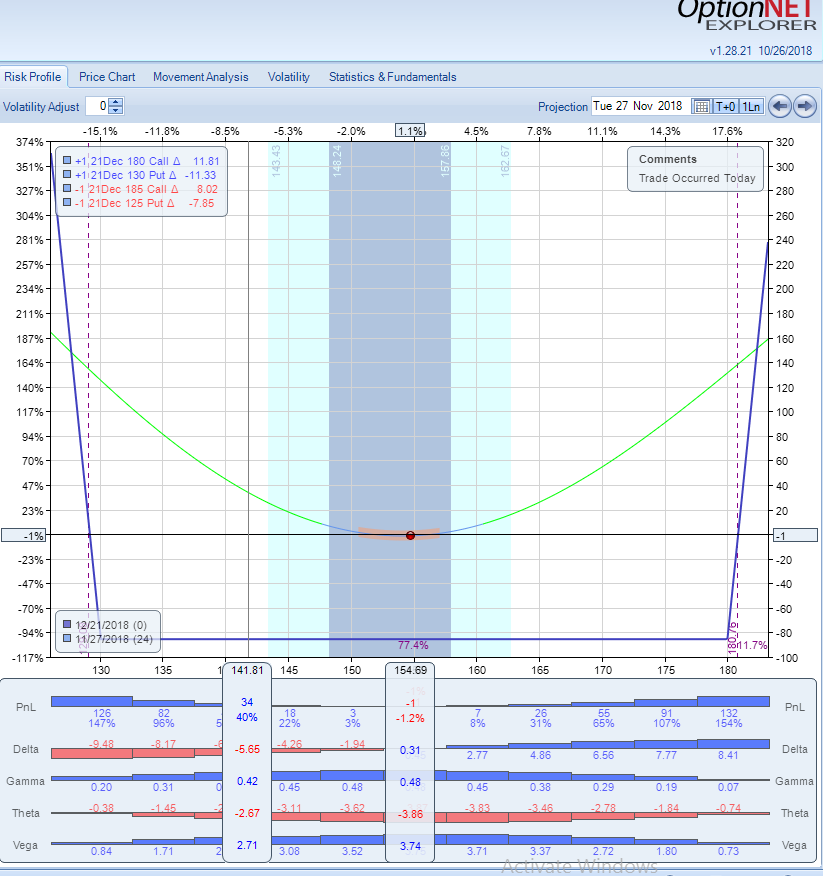

This is how P/L chart looked like:

Fast forward to Dec.4 - NVDA moved to $170+, and the trade has been closed for 81.4% gain.

It is worth to mention that such high gain is not typical for this strategy. Normally, we aim for 15-20% gains. But sometimes stocks gap in the right direction, and you can get much higher gains.

As @Yowstermentioned in the strategy description on the forum:

Reverse Iron Condor (RIC) trades can be used during periods of elevated market volatility to take advantage of stock price movement that is more common during these timeframes. A RIC trade is buying OTM put and call debit spreads. RICs are vega positive trades, meaning they are helped by rising IV and hurt by falling IV. However, the degree by which IV changes affect the RIC are much less compared to hedged/unhedged straddles – this is simply because they have equal number of long and short legs using the same expiration and the strikes are relatively close to one another. Therefore, using RICs instead of straddles during elevated market volatility has 2 main advantages:

-

Better handle the scenario of IV significantly falling back down closer to normal levels – Straddle RV can decline 10% or more in one day that has the VIX drop significantly, and 30% or more during a multi-day significant VIX decline. It will take a lot of gamma gains due to stock price movement to overcome that drop, and if it’s a hedged straddle its more likely that short strangle losses will exceed long straddles gain when this happens. RICs can still get hurt by IV decline (especially if the stock price winds up being near the midpoint) but if you get some stock price movement away from the midpoint the RIC will be in better shape.

- Easier to make good gains despite IV decline – if the significant IV decline comes with a larger stock price move (fairly common when IV spikes downward) then the RIC can still have a very nice profit if the stock price movement takes the stock price near one of the wings.

The biggest negative of RICs compared to hedged straddles is that you’ll need the stock price to move to make a profit. Hedged straddles can make gains due to short strangle credits when the stock price doesn’t move, and this is why hedged straddles are great trades to initiate during low volatility times because its less likely that any market wide volatility decline will significantly hurt the trade (and any IV rise will help it).

Since starting trading RIC strategy in late November 2018, we closed 12 winners out of 12 trades:

BABA +20.3%

FB +20.0%

GS +15.4%

AXP +10.2%

GS +5.7%

GS +19.9%

MSFT +19.7%

FB +20.5%

MSFT +15.9%

GS +17.9%

NVDA +38.4%

NVDA +81.4%

Of course, the strategy is not without risks - you need the stock to move in order to make a gain. However, in the current environment, if you select the stocks that have tendency to move, you improve the probabilities significantly.

When the market conditions change, you need to be flexible and trade what is working. And this is exactly what we do at SteadyOptions.

Related articles:

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now