How short volatility products work?

If you’re long volatility then you make money when the VIX index or the volatility index goes up. The opposite happens if you’re short volatility. When you’re short volatility, you make money when the VIX index goes down, and you lose money when the VIX index goes up.

Vance Harwood provided a good explanation how XIV works here:

-

XIV trades like a stock. It can be bought, sold, or sold short anytime the market is open, including pre-market and after-market time periods. With an average daily volume of 29 million shares, its liquidity is excellent and the bid/ask spreads are a penny.

-

Unfortunately, XIV does not have options available for it. However, its Exchange Traded Fund (ETF) equivalent, ProShare’s SVXY does, with five weeks’ worth of Weeklys with strikes in 50 cent increments.

-

Unlike stocks, owning XIV does not give you a share of a corporation. There are no sales, no quarterly reports, no profit/loss, no PE ratio, and no prospect of ever getting dividends. Forget about doing fundamental style analysis on XIV. While you’re at it forget about technical style analysis too, the price of XIV is not driven by its supply and demand—it is a small tail on the medium-sized VIX futures dog, which itself is dominated by SPX options (notional value > $100 billion).

-

The value of XIV is set by the market, but it’s tied to the inverse of an index (S&P VIX Short-Term Futurestm) that manages a hypothetical portfolio of the two nearest to expiration VIX futures contracts. Every day the index specifies a new mix of VIX futures in that portfolio. This post has more information on how the index itself works.

- XIV makes lemonade out of lemons. The lemon in this case is an index S&P VIX Short-Term Futurestm that attempts to track the CBOE’s VIX® index—the market’s de facto volatility indicator. Unfortunately, it’s not possible to directly invest in the VIX, so the next best solution is to invest in VIX futures. This “next best” solution turns out to be truly horrible—with average losses of 5% per month. For more on the cause of these losses see “The Cost of Contango”.

This situation sounds like a short sellers dream, but VIX futures occasionally go on a tear, turning the short sellers’ world into something Dante would appreciate.

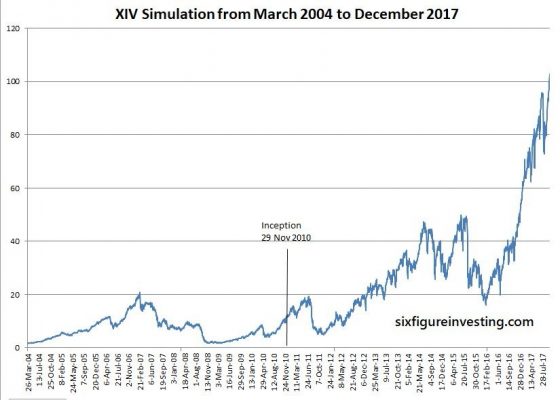

Most of the time (75% to 80%) XIV is a real money maker, and the rest of the time it is giving up much of its value in a few weeks—drawdowns of 80% are not unheard of. The chart below shows XIV from 2004 using simulated values.

Understand that XIV does not implement a true short of its tracking index. Instead, it attempts to track the -1X inverse of the index on a daily basis and then rebalances investments at the end of each day. For a detailed example of what this rebalancing looks like see “How do Leveraged and Inverse ETFs Work?”

There are some very good reasons for this rebalancing, for example, a true short can only produce at most a 100% gain and the leverage of a true short is rarely -1X (for more on this see “Ten Questions About Short Selling”. XIV, on the other hand, is up almost 200% since its inception and it faithfully delivers a daily move very close to -1X of its index.

What happened on February 5?

The Astonishing Story Behind XIV Collapse by Ophir Gottlieb provided a fascinating description of events leading to XIV collapse. The collapse was caused by huge increase in VIX index and forced liquidations caused by margin calls. Those liquidations triggered the Acceleration event, as outlined in the Prospectus:

QuoteAs discussed in more detail under “Specific Terms of the ETNs—Acceleration at Our Option or Upon an Acceleration Event” in this pricing supplement, an Acceleration Event includes any event that adversely affects our ability to hedge or our rights in connection with the ETNs, including, but not limited to, if the Intraday Indicative Value is equal to or less than 20% of the prior day’s Closing Indicative Value.

License to Print Money?

XIV and SVXY were not bad products. The problem is not the product. The problem is how you use it.

There is nothing wrong to maintain constant long exposure to XIV or SVXY. Over the long term, it is a winning strategy.

Nowhere was the pain more palpable than on Reddit’s “Trade XIV” group, which counts more than 1,800 members. One of them goes by the cyber-handle Lilkanna, and to say he’s had a rough stretch would be a huge understatement.

“I’ve lost $4 million, 3 years worth of work, and other people’s money,” he wrote in a post that’s garnering lots of attention. “Should I kill myself?”

“I started with 50k from my time in the army and a small inheritance, grew it to 4 mill in 3 years of which 1.5 mill was capital I raised from investors who believed in me,” Lilkanna explained, adding that those “investors” were friends and family.

“The amount of money I was making was ludicrous, could take out my folks and even extended family to nice dinners and stuff,” he wrote. “Was planning to get a nice apartment and car or take my parents on a holiday, but now that’s all gone.”

The Problem? Leverage, Leverage, Leverage!

When people make those kind of returns, it is pretty clear they are taking too much risk.

Too much risk == too much leverage == position sizing too big.

Imagine you make 10 trades. The first 8 trades make 40% each, and the last 2 trades lose 90% each.

if you allocate 10% for each trade, your account is still up 14%. But if you allocated 50% of your account (not to mention 70-80%), your account is toast.

This is what happened to those poor XIV traders.

The problem is not limited to retail traders. We all remember the Karen Supertrader story. Those who are not familiar with the story:

- Karen The Supertrader: Myth Or Reality?

- Karen Supertrader: Too Good To Be True?

- How To Blow Up Your Account

Here is another example.

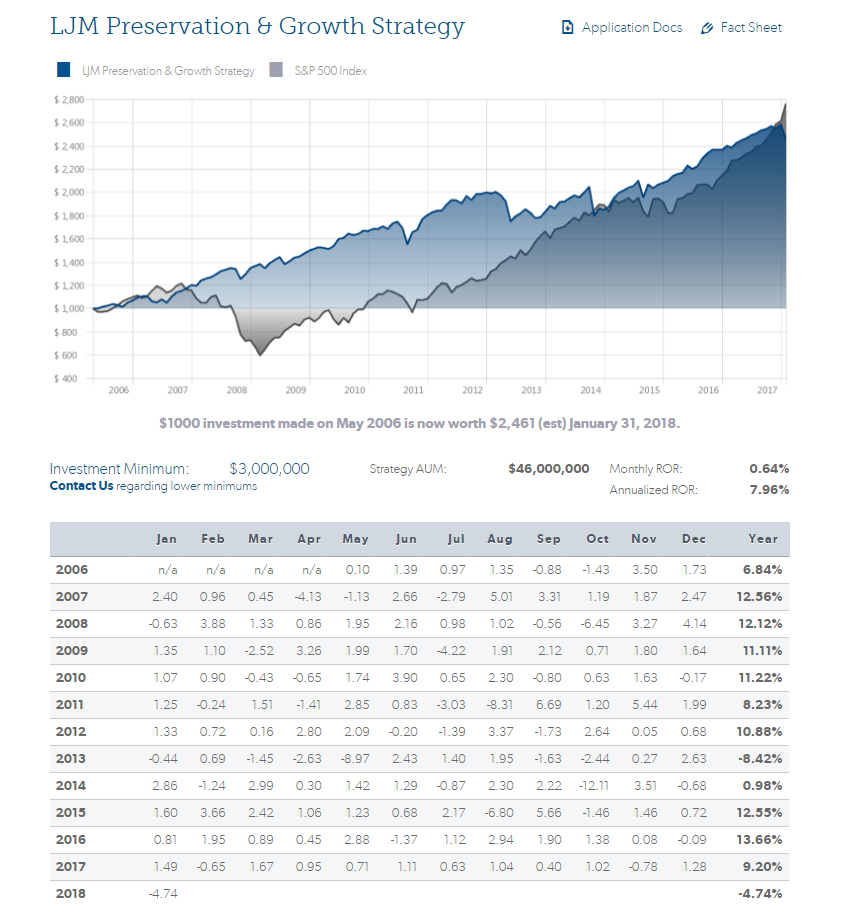

Mutual fund LJMIX, ran by Chicago based firm LJM Partners. They sell strangles on the S&P futures.

This is their track record before this move:

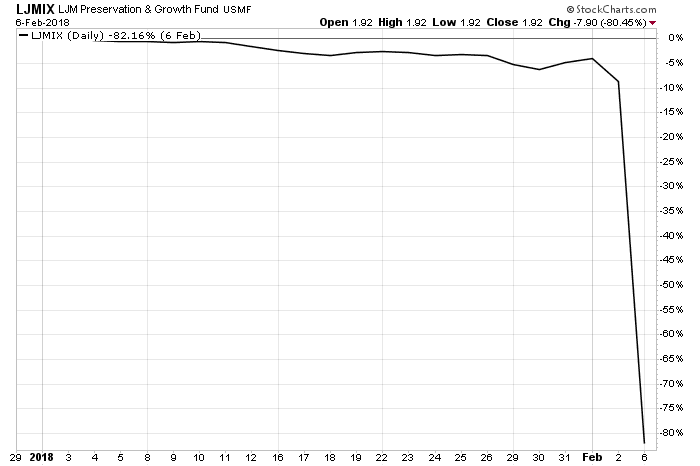

Excellent track record, but look what happened on Monday:

And yesterday:

Once again: The biggest problem is not the strategy. It is leverage. It is sad that even billion dollar hedge funds fall into the trap.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.