I’ll also continue to assume a 32% tax rate for short term gains and 15% for long term gains.

Writing puts on 1256 option contracts makes 60% of the gains Long Term Capital Gains, but those gains are fully taxable every year. This makes an 8% pre-tax return a 6.26% after-tax return. With an ETF BuyWrite strategy, most of the yearly profits will be unrealized in the form of share price appreciation. On an annual basis, I’m assuming the 8% return would be composed of:

- ETF dividend yield: 1.5%

- Short call option realized gains: 0.5%

- Unrealized share price apperception: 6%

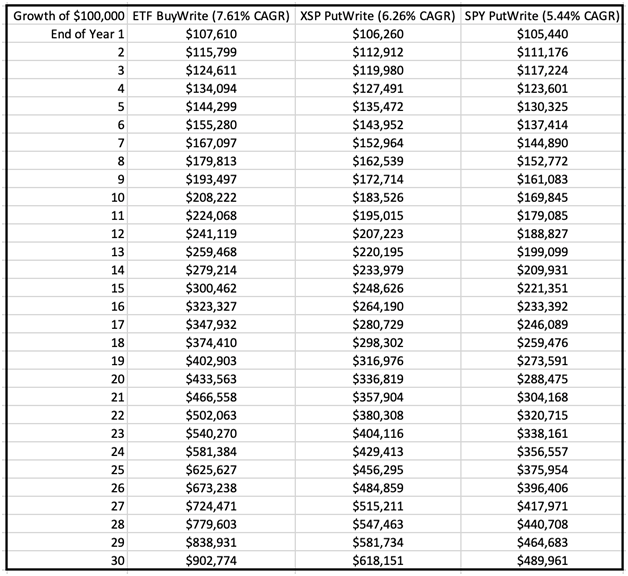

If we assume 80% of the dividend yield is qualified dividends, and the call option gains are 1256 contracts, the annual after-tax return falls from 8% to 7.61%. Updating the chart from the Part I article comparing all three strategies, we see the following differences in long term after-tax performance:

Summary

This illustration shows how taxes are a very important long-term consideration in a taxable brokerage account. While the results of all three strategies would be the same in a retirement account, they are very different in a taxable account. An ETF BuyWrite strategy has the advantage of deferring taxes on share price appreciation until shares are sold, which the investor has full control over. An investor can also tax loss harvest shares when unrealized losses exist by swapping from one ETF into another that is similar but not identical, booking a capital loss deduction.

After 30 days have passed, the investor is free to switch back to the preferred ETF. Investors who make charitable donations can gift highly appreciated shares instead of cash, then using the available cash to repurchase donated shares. The net result is an increased average price per share and lower future capital gains liabilities when shares need to be sold to meet financial obligations.

In retirement an investor could use dividends, gains from calls, and sales of shares to meet their spending needs. Even if the investor were to fully liquidate the portfolio at the end of year 30 the after-tax amount would still be $831,622, well in excess of either PutWrite strategy. Since ETF’s can be used as collateral for a margin loan, an investor could also take tax free margin loans instead of selling shares to continue deferring unrealized capital gains. Under current US tax law, unrealized capital gains would effectively be erased at death due to receiving a step up in cost basis.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University.

Related articles:

- Tax Efficient Trading Part I: The 1256 Contracts

- The Magic of Compounding, and the Tyranny of Taxes

- Traditional or Roth Retirement Account?

- Investment Ideas for Conservative Investors

- What’s Wrong With Your 401(k)? (If anything)

- First Time Trader? Here Are 3 Tax Tips You Should Know

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.