.thumb.jpg.423c1b7a9324babf04f010dd69030e10.jpg)

This options investment strategy involves buying "Deep In The Money" (DITM) options to limit downside risk while retaining the full benefits of the stock. The options are purchased at a lower cost than the actual stock but still receive close to a $1 increase for every favorable $1 move in the underlying security which increases the percentage return for the same dollar move.

Advantages of stock replacement strategy:

- Keeps all benefits associated with trading the stock.

- Reduces costs associated with owning the stock.

- Offers more leverage by increasing the potential percentage return.

- Offers lower downside risk.

Disadvantages of a stock replacement strategy:

- Needs good trading experience and skills to master the strategy.

- The strategy may fail, when the stock stays on (almost) the same price or moves sidewise.

- Leverage works both way - If the stock falls, the percentage loss is larger as well.

Let's check how you could use this options investment strategy to reduce your cost of owning Apple. The stock closed at $174 yesterday.

Experienced options traders are usually well aware of this strategy and make good use of it.

Strategy No. 1: Buy 100 shares of the stock

Buying 100 shares will cost you $17,400. Not cheap. If the stock rallies to $185, you have made $1,100 or 6%. Let's see how it compares with the stock replacement strategy.

Strategy No. 2: Buy DITM call

As an alternative to buying the stock, we can buy the AAPL July 20 2018 130 call at $45.47. The cost will be $4,547 which is about 26% of the cost of the 100 shares. The P/L graph looks like this:

If the stock rallies to $185, you have made $1,030. This is slightly less than buying the stock, but percentage wise, it is a 23% gain, compared to the 6% gain when owning the stock. Of course the opposite is true as well - if the stock goes down, your percentage loss is much higher.

This is called leverage. It works both ways - you increase the reward if the stock rises and increase the risk if the stock falls.

However, if the stock falls, the volatility should increase which actually helps our option price because increased volatility can cause option prices to increase or not fall as fast. So basically even though we will gain $1 for every $1 the stock increases we will lose slightly less than $1 for every $1 the stock drops.

You might noticed that we gained only 93 cents for every $1 movement in the stock. This is due to the fact that the delta of the 130 call is 0.93. We could choose a call which is deeper in the money - it would have a higher delta and have a better replication of the stock movement. However, it would also be more expensive and provide less leverage. 0.90-0.95 delta provides a good compromise between 1:1 movement and a reasonable price.

Now let's see if we can do better.

Strategy No. 3: Buy DITM call and sell OTM call against it every month

Here is how it works:

- Buy AAPL July 20 2018 130 call at $45.47

- Sell AAPL Feb 16 2018 185 call at $1.55

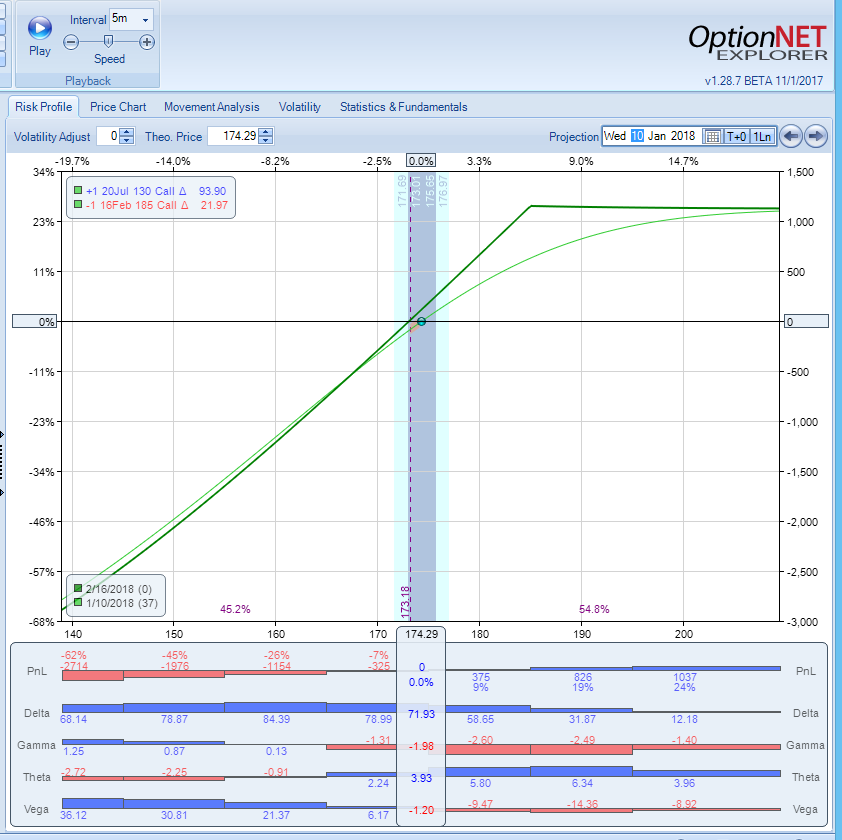

We reduce the cost of our trade by $155 to $4,392, but we also limited our gains. The P/L graph looks like this:

As we can see, we increased the maximum gain to $1,147. This gain is not only larger than the dollar gain from owning the 100 shares of the stock, but also translates to a cool 26% in one month. If the stock is below $185 by February expiration, we can repeat the process with the March options. If it is higher, you just close the trade for a gain and can roll to higher strikes.

Of course if you believe that AAPL will be higher than $185 by Feb expiration, you will be better by just buying the DITM calls.

Strategy No. 4: Buy DITM call, sell OTM call and buy OTM put

Here is how it works:

- Buy AAPL July 20 2018 130 call at $45.47

- Sell AAPL Feb 16 2018 185 call at $1.55

- Buy AAPL Feb 16 2018 165 put at $2.07

Our cost now is $4,599, still significantly lower than owning the stock. The P/L graph looks like this:

Our gain is now limited to "only" $900 (20%), BUT we also limited our loss to ~13% in case AAPL goes down after earnings. And if the stock really crashes, the position can actually produce some gains because at some point the long put will more than offset the losses from the long call.

This is a variation of collar, where we replace the long shares with DITM call.

And this is the beauty of options. You have almost endless possibilities to structure your trade, based on your outlook and risk tolerance.

Before investing any money, please make sure you understand what you are doing. Good luck.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.