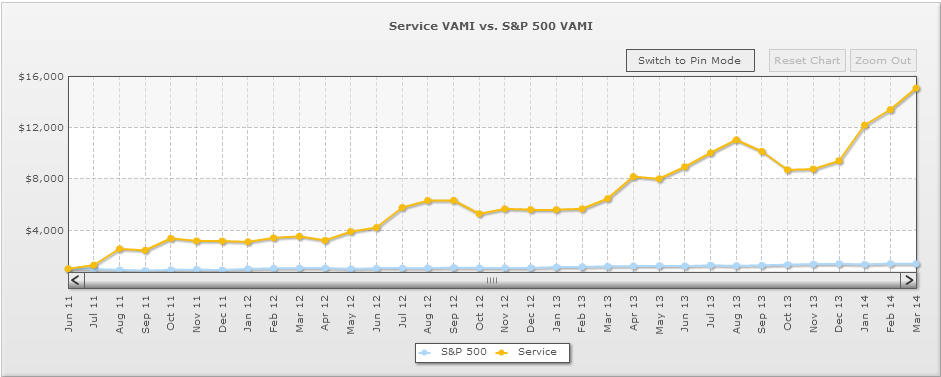

Q1 2014 was our best quarter since inception. Our key to success is a high winning ratio and keeping the losers small. Our biggest loser was 31.8%, and we had only four trades losing more than 20%. Our biggest winner was CF calendar with 62% gain and we booked few nice 30-50% winners. Here are some of our Q1 highlights:

-

TIF calendar +31%

-

AAPL calendar +21%

-

RUT calendars +21% and 22%

-

BIDU calendar +25%

-

TSLA calendar +26%

-

GMCR calendar +33%

-

CF calendar +62%

-

YUM straddle +18%

-

GOOG calendar +50%

-

AMZN calendar +48%

-

CMG calendar +25%

-

V calendar +18%

-

MA straddle +15%

-

FFIV calendar +20%

-

NFLX calendar +30%

-

SPY calendar +21%

Many services are using deceptive performance reporting to push up their numbers. It might include reporting based on "maximum profit potential", calculating gains based on cash and not on margin etc. You can read my article Performance Reporting - The Myths And The Reality for full details.

We provide a full disclosure and list all our trades on the performance page. Unlike some other newsletter services, we will never omit a trade from our track record because some members couldn't open the trade or make the adjustments. This rule applies to all trades, good and bad - you will always get a full picture and will never have to guess how we calculate our numbers.

There are few things that make SteadyOptions unique.

-

Performance reporting is based on real fills.

-

Every trade is discussed on the forum before it is executed.

-

Our community includes some very smart and experienced traders.

-

High quality education, including basic concepts, risk management, the Greeks, etc.

-

A complete portfolio approach, including capital allocation guidelines.

We don't just send few trade alerts every month and let members to blindly follow them. We maintain a fully balanced portfolio all the time, so any sharp move won't cause a big damage to the portfolio.

We continue expanding our strategies and adapting to ever changing market conditions. When we realized that low volatility is here to stay (at least for now), we switched our focus from earnings straddles (which don't perform as well in low IV environment) to earnings calendars. We will continue looking for new opportunities and continuously improving the service.

We invite you to join one of the most successful options trading services. When you join SteadyOptions, we will share with you all we know about options. We will never try to sell you any additional "proprietary systems", training, webinars etc. All our "secrets" are included in your monthly fee.

The earnings season is just around the corner. Now is an excellent time to join our service.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.