It's official now: Steady Condors has completely erased last year's losses and drawdown. Risk management, as always, is what made the difference.

Even though last year was difficult with Steady Condors, risk management still made a difference and kept you in the game to trade another day. To be sure, "managing risk" in the market has not paid off in 2014 and 2015 as each and every dip has been followed by a spirited "V bottom." This is why we have been whipsawed several times, which caused a few tough months. However, we need to follow our discipline. And since one never knows in advance when this pattern will change, staying disciplined and limiting the losses is the most important part of our trading plan.

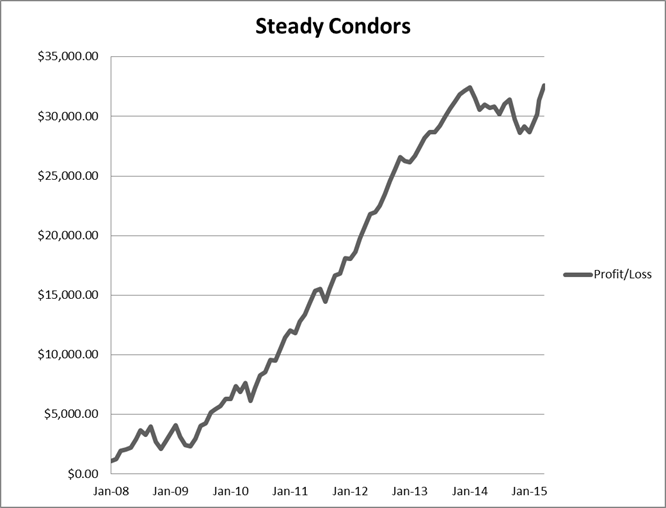

Here is a year by year performance and the P/L chart for 2008-2015 (live trading began in late 2012 as shown on the performance page):

2008: 13.50%

2009: 18.00%

2010: 25.70%

2011: 33.40%

2012: 40.80%

2013: 29.40%

2014: -14.90%

2015: 17.00%

AVG: 20.36%

The chart presents non-compounded P/L on 20k account.

Some competing condor services that had multi-year track records appearing to be low risk with high returns took devastating losses last year because of inadequate risk management. Option selling strategies, especially those that roll from month to month to hide losses in their track record, often have hidden risk. Selling options without risk management is not a profitable venture over the long term, but in the short term it can be very easy to get fooled by randomness as you can easily go months or years without taking losses. It’s why you see very few option selling strategies with a lengthy track record.

What risk management does is lower your win rate in order to maintain positive expectancy. It often sounds counter intuitive to new traders to learn they need to win less in order to make more money (or make any money at all) over the long term. We urge you to be very cautious about any service that only promotes a high win rate. Win rate alone tells you absolutely nothing. How many times do you get emails about a "options strategy with 99% winners" and "make $xxxx dollars per month". Unfortunately, humans desperately want to believe there is a way to make money with virtually no risk. That’s why Bernie Madoff existed, and it will never change.

It is also important to remember that Steady Condors reports returns on the whole portfolio including commissions. Our 20k unit will have two trades each month (the RUT MIC and the SPX MIC). With 20% cash, we will allocate ~$8,000 per trade. If both trade made 5%, that means $400 per trade or $800 total for the two trades. In our track record, you will see 800/20,000=4%. Other services will report it as 5% (average of the two trades). In addition, our returns will always include commissions. If you see 5% return in the track record, that means that $100,000 account grew to $105,000. Plain and simple. If we were to report returns on margin as most other services do, our returns would be about 30-35% higher. For example, 2015 YTD return would be 23.1%% and not 17.00%

As a reminder, Steady Condors is a strategy that maximizes returns in a sideways market and can therefore add diversification to more traditional portfolios. Selling options and iron condors can add value to your portfolio. They aren't the holy grail. Just like everything else. Both our Anchor and 15M strategies (available on the LC Diversified forum as part of any membership) have had negative correlation of monthly returns to Steady Condors and therefore have blended together nicely for a diversified and relatively low maintenance portfolio.

Click here to read how Steady Condors is different from "traditional" Iron Condors.

Related Articles:

Why Iron Condors are NOT an ATM machine

How to Calculate ROI in Options Trading

Why You Should Not Ignore Negative Gamma

Can you double your account every six months?

Can you really make 10% per month with Iron Condors?

Want to join our winning team?

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.