As you noticed, we closed our December trades two weeks before expiration, to reduce the negative gamma risk. We recommend reading the Why You Should Not Ignore Negative Gamma article to understand the gamma risk.

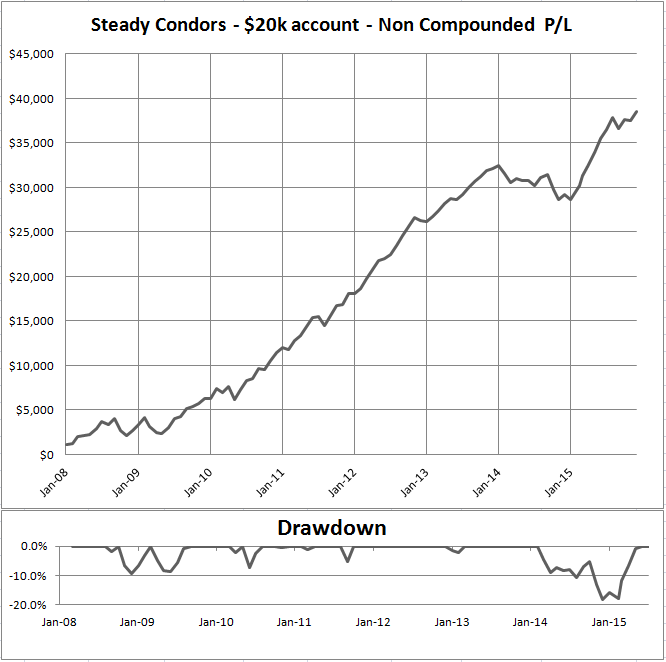

This is another thing we do differently from many other services. We open our trades early and close them early. We would typically open the trades 6-8 weeks before expiration and close them 2-3 weeks before expiration. Here is the P/L chart for 2008-2015 (live trading began in late 2012 as shown on the performance page):

The chart presents non-compounded P/L on 20k account, including commissions. Total P/L since Jan. 2008 is $38,502 or 192.5%.

Anyone who has traded more than a handful of non-directional iron condors knows they can be extremely challenging in a trending market potentially causing a lot of stress, large drawdowns, and significant losses. They aren't the Holy Grail (no single strategy is). It’s normally relatively easy to make money with high probability condors 9 or 10 months per year when the markets are range bound…But many condor traders give back most or all of their profits during the usual 2 or 3 losing months each year when the markets do make large moves because they lack a detailed plan for risk management.

“I would have had a great year if it wasn’t for one or two months”. If you trade condors without a detailed risk management plan you will eventually experience large losses. Since our trading strategies naturally have a high expected monthly win rate our risk management objective is to avoid giving back much more than one month’s average earnings during our losing months.

This is why we introduced the Steady Condors. We tweaked the traditional Iron Condor strategy to address the issues and make the P/L curve much smoother.

As we always say, you can't control returns, only manage risk. I really dislike when people make trading sound like if you are really good at it you somehow have control over your returns. The only thing you can do is build a winning strategy (better yet, multiple winning strategies with low correlation) and then manage your risk and position size so that you stay in the game long enough to let your edge work out over the long term.

What risk management does is lower your win rate in order to maintain positive expectancy. It often sounds counter intuitive to new traders to learn they need to win less in order to make more money (or make any money at all) over the long term. We urge you to be very cautious about any service that only promotes a high win rate. Win rate alone tells you absolutely nothing. How many times do you get emails about a "options strategy with 99% winners" and "make $xxxx dollars per month". Unfortunately, humans desperately want to believe there is a way to make money with virtually no risk. That’s why Bernie Madoff existed, and it will never change.

It is also important to remember that Steady Condors reports returns on the whole portfolio including commissions. Our 20k unit will have two trades each month (the RUT MIC and the SPX MIC). With 20% cash, we will allocate ~$8,000 per trade. If both trade made 10%, that means $800 per trade or $1,600 total for the two trades. In our track record, you will see 1,600/20,000=8%. Other services will report it as 10% (average of the two trades). In addition, our returns will always include commissions. If you see 5% return in the track record, that means that $100,000 account grew to $105,000. Plain and simple. If we were to report returns on margin as most other services do, our returns would be about 50-60% higher. For example, 2015 return would be 80.8%% and not 46.7%.

Another point worth mentioning is rolling. If you look at some services, you might see few last months of data missing. That would usually mean that the trades were losing money and have been rolled for few months, to hide losses. In some cases, the unrealized losses can reach 25-50%. Rolling might work for some time - till it doesn't, and unrealized losses become realized. By then it's usually too late. It is very important to know how returns are reported, in order to make a real comparison. Always make sure to compare apples to apples.

As a reminder, Steady Condors is a strategy that maximizes returns in a sideways market and can therefore add diversification to more traditional portfolios. Selling options and iron condors can add value to your portfolio. They aren't the holy grail. Just like everything else. Both our Anchor and 15M strategies (available on the LC Diversified forum as part of any membership) have had negative correlation of monthly returns to Steady Condors and therefore have blended together nicely for a diversified and relatively low maintenance portfolio.

Click here to read how Steady Condors is different from "traditional" Iron Condors.

Related Articles:

Why Iron Condors are NOT an ATM machine

How to Calculate ROI in Options Trading

Why You Should Not Ignore Negative Gamma

Can you double your account every six months?

Can you really make 10% per month with Iron Condors?

Want to join our winning team?

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now