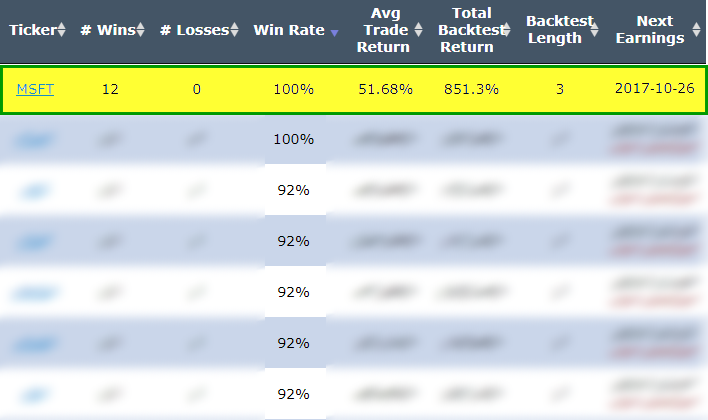

But, this pre-earnings momentum back-test is unlike any other in that it is the only one, out of more than 4,000 scans, that has never lost over the last three-years. (This does not mean it deserves extra risk capital or that it is somehow infallible, but, we are sharing a fact.) Here we go.

PREFACE

There is a bullish momentum trading pattern in Microsoft Corporation (NASDAQ:MSFT) stock 7 calendar days before earnings,

and we can capture that phenomenon explicitly by looking at returns in the option market. The strategy won't work forever, but for now it is a momentum play that has not only returned 851.3%, but has also shown a win-rate of 100% over the last three-years.

LOGIC

The logic behind the test is easy to understand -- in a bull market there can be a stock rise ahead of earnings on optimism, or upward momentum, that sets in the one-week before an earnings date. Now we can see it in Microsoft Corporation.

The Bullish Option Trade Before Earnings in Microsoft Corporation

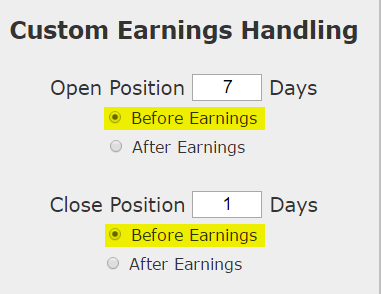

We will examine the outcome of getting long a weekly call option in Microsoft Corporation 7-days before earnings (using calendar days) and selling the call before the earnings announcement.

Here's the set-up in great clarity; again, note that the trade closes before earnings, so this trade does not make a bet on the earnings result.

RISK MANAGEMENT

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

Discovery

We found this pattern by using the TradeMachine™ Pro scanner, searching for stocks that show bullish momentum 7-days before earnings. Here are the top results in the entire market over the last 3-years:

RESULTS

Here are the results over the last three-years in Microsoft Corporation:

| MSFT: Long 40 Delta Call | |||

| % Wins: | 100% | ||

| Wins: 12 | Losses: 0 | ||

| % Return: | 851.3% | ||

Tap Here to See the Back-test

We see a 851.3% return, testing this over the last 12 earnings dates in Microsoft Corporation. That's a total of just 72 days (6-days for each earnings date, over 12 earnings dates). This has been the results of following the trend of bullish sentiment into earnings while avoiding the actual earnings result.

This is not a magic bullet, even though it looks so good, there are no guarantees in the market. This is simply a bullish strategy. In the short-term it hasn't seen any losses, but more importantly, whether or not it loses on any given earnings run-up, the 851.3% return in less than three-full months of trading is predicated on an idea of consistent momentum.

The trade will lose sometimes, but over the most recent trading history, this momentum and optimism options trade has won ahead of earnings.

Setting Expectations

While this strategy had an overall return of 851.3%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 51.68% over each six-day period.

Back-testing More Time Periods in Microsoft Corporation

Now we can look at just the last year as well:

| MSFT: Long 40 Delta Call | |||

| % Wins: | 100% | ||

| Wins: 4 | Losses: 0 | ||

| % Return: | 230.1% | ||

Tap Here to See the Back-test

We're now looking at 230.1% returns, on 4 winning trades and 0 losing trades. It's worth noting again that we are only talking about one-week of trading for each earnings release, so this is 230.1% in just 4-weeks of total trading.

➡ The average percent return over the last year per trade was 53.93% over six-days, remarkably similar to the 51.68% average return over the last three-years.

WHAT HAPPENED

Bull markets tend to create optimism, whether it's deserved or not. To see how to test this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.