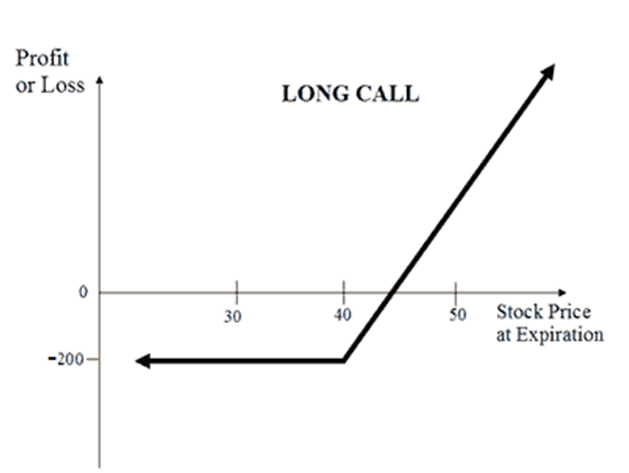

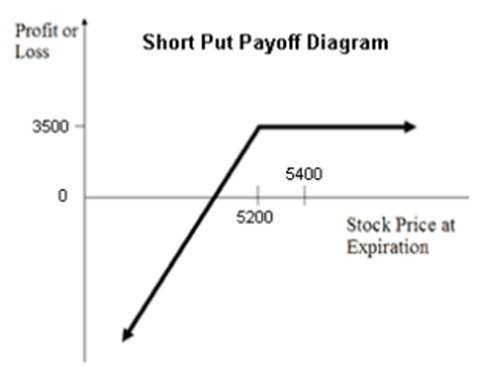

The most obvious way to demonstrate this is showing you a payoff profile (the possible path of your P&L for the trade at different underlying prices):

Long Call:

Short Put:

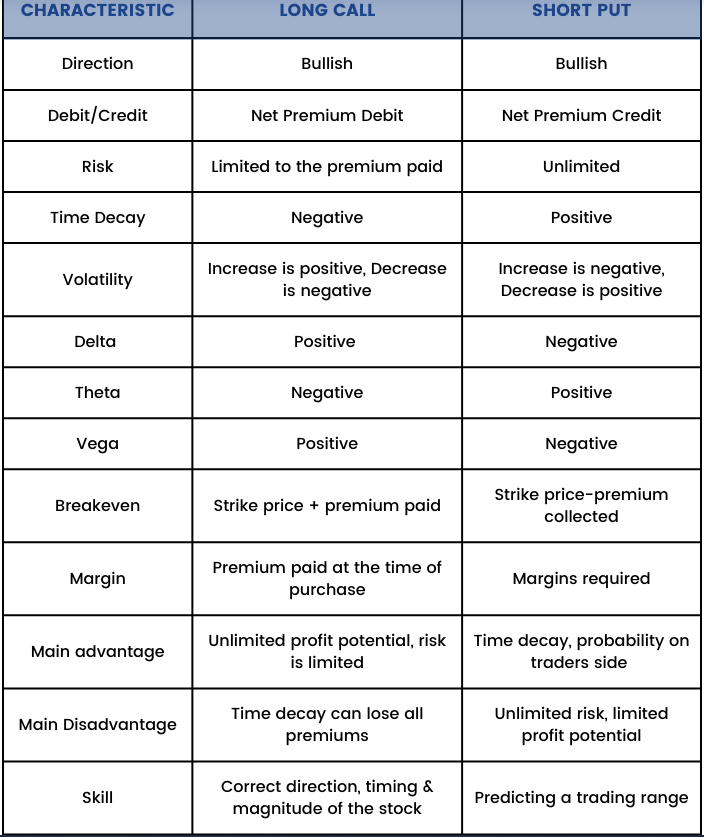

There are immediate differences.

You buy a long call when you think the market will go up a lot. You're optimistic and willing to risk some cash in the hopes of making a multiple of that.

You sell a put when you think the market won't go down a lot. You're confident that the market won't go down. By selling a put to another trader, you're almost acting as a bookie, taking a fee to allow another trader to make a big bet. If he's wrong, you get to keep his bet. For him to be right, the market has to move enough to neutralize the cash value of his bet.

When To Use a Long Call

Reason #1: You Have Reason to Believe the Market Will Go Up. A Lot.

If you're bullish on a stock, there's a lot of things you can do to express that view.

● You can buy the stock

● You can buy calls on the stock

● You can buy the stock and sell covered calls against it

● You can buy the sector ETF or a basket of related stocks for a sympathy play

● You can sell puts against the stock

● You can enter any number of directionally bullish options spreads

All bullish outlooks, but very different P&L paths.

Buying a long call makes the most sense.

Reason #2: Other Traders Disagree With You (Low Volatility)

Professional options traders are fond of saying that anytime you trade options, you're making a bet on volatility, whether you intend to or not.

This is because option prices are inherently tied to the expected future price movement of the underlying asset. In other words, buying options is expensive when people think the market will move a lot, and vice versa. Hence, buying puts or calls on a stock like Tesla is much more expensive (as a percentage of the stock price) than a more tame stock like Johnson & Johnson. Tesla makes wild price moves all the time, while Johnson & Johnson remains stable most of the time.

In the options world, this idea of the market's expectations about future price fluctuations is called volatility. When options traders say a stock is "high volatility," they mean that traders expect the stock price to fluctuate a lot in the future and options on that stock are expensive.

Imagine Tesla is announcing earnings tomorrow, in the first quarter after the Tesla Semi is on sale. If the results are bad, the stock will tank. If results are good, it will skyrocket. All traders know this and hence buying puts and calls is expensive to account for the big move. There's no free lunch.

But while Tesla's baseline volatility is high compared to the average stock it has it's own ebb and flow cycle. Volatility is relative. You can't say Johnson & Johnson's volatility (i.e. option prices) are cheap because it's cheaper than stocks like Tesla. Both of them are priced the way they are for good reason.

Instead, volatility is relative to itself. So you should compare Tesla's volatility to the stock's own historical volatility. Is volatility cheap, average, or expensive today compared to recent history?

One way to do this is using a measure like implied volatility rank, or IV Rank. It measures how expensive a stock's options are as a percentile compared to the past 12 months.

When To Use a Short Put

Reason #1: To Capitalize on Expensive Option Prices

As we discussed, every option trade is an implicit volatility. Buying an option outright is taking the view that volatility (or the market's estimate of how much the market will move until expiration) is underpriced, and vice versa.

If you spend time in professional trading circles, you'll find that successful option traders tend to sell volatility far more often than they buy it. This is due to the "volatility risk premium."

This idea of a volatility risk premium comes out of academia. Scholars have essentially found that traders that sell volatility when it's high tend to make excess returns. And there's a good reason for that. High volatility indicates a high level of market stress.

And when investors are stressed, the first thing they want to do is protect what they have. Everyone doing this at once pushes up the price of protection temporarily until the market calms down.

When a stock declines quickly, investors will rush to buy puts and they'll become expensive--opening an opportunity to sell potentially overpriced options.

But it's not as simple as selling expensive options. Selling a put is a directionally bullish strategy--in other words, you need a compelling reason to be bullish on the underlying stock.

Reason #2: You're Moderately Bullish on a Stock

There are times when you're more sure that a stock won't fall than you are that it will rise.

There are plenty of situations like these.

A stock stuck in a long-term trading range with no evident catalysts.

Or perhaps a stalwart stock within a bull market. While Apple (AAPL) isn't the highest flying stock, it's rare to see its shares plummet in a stable bull market.

Some traders will even sell puts against takeover targets, surmising that there's a "floor" to their stock price due to the takeover interest.

Buying calls and playing for the home run isn't the right move for stocks like these. But you still have a market view you're confident in and want to profit from. Selling a put allows you to generate income as long as the stock doesn't decline a lot, which comes in handy in stable bull markets.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.