Who Was Karen the Supertrader?

Karen Bruton, known better as Karen the Supertrader, is a former hedge fund manager who became famous after multiple appearances on the Tastytrade live show.

Bruton started as a novice retail trader who knew virtually nothing about trading and became a multimillionaire in a handful of years. Specifically, she turned $110,000 into $41 million between 2008 and 2011 using basic option selling strategies.

Following her massive personal trading success, Karen started a hedge fund called Hope Advisors.

Nowadays, Karen the Supertrader is infamous because she was barred from managing outside money by the SEC. According to the SEC’s complaint, Bruton was continually rolling losing positions forward to avoid realizing a loss and thus, in the eyes of the SEC, misleading investors.

Because selling options results in immediate income, it’s been the weapon of choice for traders who are hiding large losses. Nick Leeson, a rogue trader who famously brought down Barings Bank, also hid his losses by selling naked options.

What Was Karen the Supertrader’s Strategy?

Karen the Supertrader’s trading strategy, sometimes referred to as the “KST method,” was based on the concept of theta decay. Her approach involved short selling options with the expectations that they would become worthless upon expiration.

By focusing on options that were highly likely to expire out-of-the-money, Karen leveraged the gradual erosion of their time value to her advantage.

Karen focused primarily on equity index options on the S&P 500, Nasdaq 100, and Russell 2000. Focusing on a small number of highly liquid symbols allowed her to form a consistent strategy.

Her strategy involved selling options that were two standard deviations out-of-the-money with expiration dates ranging between 30 and 56 days to expiration. In other words, these options were roughly 95% likely to expire worthless.

As far as systematically selling options goes, Karen’s strategy is par for the course. Most traders who use a similar strategy tend to sell deep out-of-the-money (OTM) options, as they will expire worthless most of the time. The strategy tends to rack up several consecutive winning trades that are relatively small in size with a rare losing trade that will be significantly larger.

Karen the Supertrader Trading Rules

Let’s take a more granular look at the specific trading rules that Karen the Supertrader has publicly reported using.

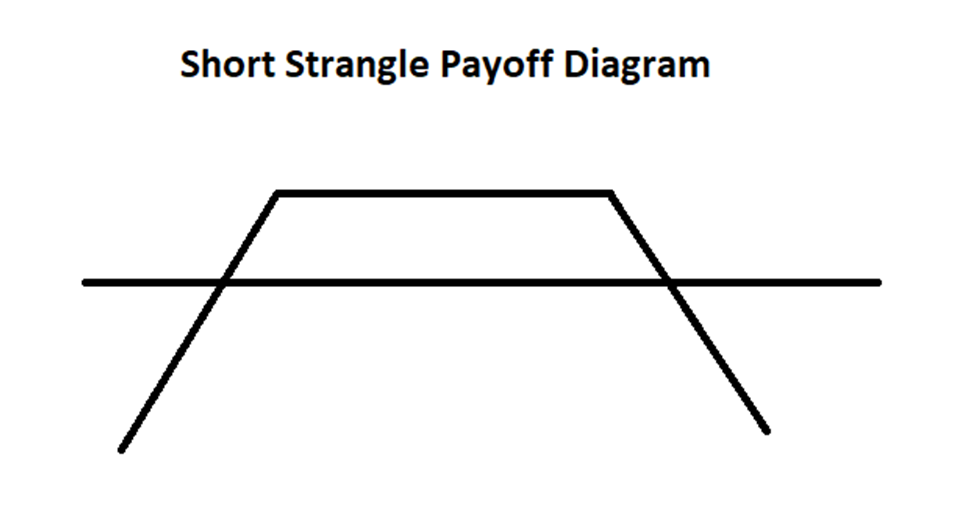

Firstly, she preferred a short strangle trade structure. This gave her a market neutral market outlook, taking no position on which direction the market will move next. Her only goal with the trade was for the market to remain inside her chosen strikes until expiration or until she closed the trade.

Here’s an example of what a short strangle looks like:

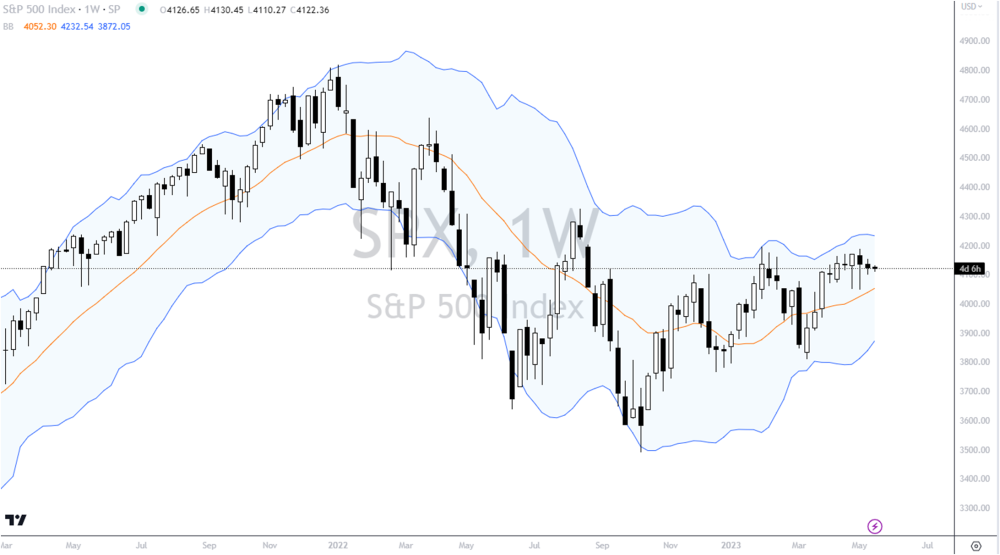

When it comes to short strangle strike selection, Karen the Supertrader used Bollinger Bands to select her strikes. Bollinger Bands are a technical indicator that plots trading bands two standard deviations away from a moving average.

See the chart below for an example:

She primarily traded in expiration dates ranging from 25 days to 56 days at the latest.

To round up all of these rules, let’s create a rough example of an SPX short strangle trade that Karen the Supertrader might take, based on the rules she’s reported publicly in her Tastytrade interviews:

● Trade type: short strangle

● Put strike: 3875

● Call strike: 4230

● Expiration date: June 23 (39 days to expiration)

Karen would typically take profits on winning trades, and roll out losing trades to a later expiration.

Today she manages 190 million dollars, after making nearly 105 million in profits.

Before we start analyzing Karen the Supertrader's strategy, lets be clear: she did NOT make 105 million in profits as TastyTrade claims. That number includes money from new investors. This headline is misleading at best, deception at worst.

How much did she really make? We don't really know, but lets try to "guess".

With SPX currently at 2075, she would sell May 1825 puts and 2280 calls. This is how the P/L chart would look:

So she would get around $700 credit on ~21k in margin. If she holds till expiration and both options expire worthless, the trade produces 3.5% gain in 59 days. That's 21% annualized gain on 50% capital, or ~11% gain on the whole account.

This assumes that both options expire worthless and no adjustment is needed. This also assumes regular margin. With her capital, she obviously gets portfolio margin, so her margin requirements are significantly less. But if she wants to take advantage of portfolio margin, she has to sell more contracts, taking much more risk. For the sake of her investors, I hope she is using 50% of the regular margin, not portfolio margin.

In any case, I have hard time to see how she can make more than 25-30%/year with this strategy. Don't get me wrong, this is an excellent return - however, by selling naked options, she also takes a LOT of risk. To make 25-30%/year with this strategy, she must use a lot of portfolio margin - which means a lot of leverage. Karen the Supertrader’s strategy is also short gamma and short vega, which means as the market moves against her, the positions become worse at a greater rate. If volatility spikes like it did in 2008, her account will be gone in matter of days.

Here are some questions/comments taken from public discussions about Karen SuperTrader:

- I really have no idea how that is possible. In the TOS platform, if I sell a naked Put, the usual margin required is very large. We’re talking that my short Put usually would yield between 1.5% – 2.5% of the margin required. -

- I think there is more than a fair chance she may be a fraud and possibly even an invention of TastyTrade. Any manager worth her salt would be happy to provide audited returns, especially if only managing 150 million.

- She is probably generating around 30% a year while taking a lot of risk. I don’t know if that makes sense in the long run.

- Another thing that’s strange is the fact there’s not even one chart or table of her performance. I hear a lot of big numbers but just give the facts black on white.

- This strategy will only work for a period of time. When it stops, the results will be catastrophic.

- If she was that good as she claims she is, after 7 years of such spectacular returns she would have few billion under management, not 190 million.

- It’s Finance 101 isn’t it? The higher the return, the higher the risk you have to take. If she is generating 30% or greater per year, she is taking on a lot of risk. Hopefully her investors realize that.

Here are some articles about Karen SuperTrader:

http://www.optionstradingiq.com/karen-the-supertrader/

http://smoothprofit.blogspot.ca/2012/11/a-glimpse-of-option-strategies-of-karen.html

So: IS Karen SuperTrader myth or reality? You decide.

June 2016 update:

Karen is now being investigated by the SEC for fraud. Don't say we didn't warn you.

Read my latest article: Karen Supertrader: Too Good To Be True?

Here are the links to the SEC claim and the verdict:

https://www.sec.gov/news/pressrelease/2016-98.html

https://www.sec.gov/alj/aljdec/2019/id1386cff.pdf

I suspect that investors will not learn the lesson from this case. Humans desperately want to believe there is a way to make money with no or little risk. That’s why Bernie Madoff existed, and it will never change.

TastyTrade removed all articles and videos related to Karen the Supertrader from their website and YouTube right after the SEC investigation started, but returned them few days afterwards.

Karen the Supertrader: Where Is She In 2023?

The SEC sued Karen the Supertrader’s hedge fund, Hope Advisors, leading to the hedge fund paying a hefty fine, disgorging of profits, and Karen Bruton’s ban from managing outside money.

However, Karen still appears in interviews, like she did with Michael Sartain in 2022. She maintains that the SEC unfairly targeted her firm seeking an easy prosecution. Both Karen and Michael Sartain, the host of the podcast, claim that the SEC’s complaint took issue with the fact that Karen’s hedge fund rolled losing positions forward, a common practice among systematic premium sellers.

Her point of view is that the SEC interpreted the fund rolling its losing positions forward as the act of a rogue trader, rather than the routine actions of an options trader who sells premium.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.