This year's sideways market has been very kind to calendar spread trades.We booked few very nice winners with SPX and RUT calendar spreads. When we opened another SPX calendar spread on August 5, I expected another nice winner. But the market had very different plans.

The strike was 2100, which was right in the middle of the range for the big part of the year.

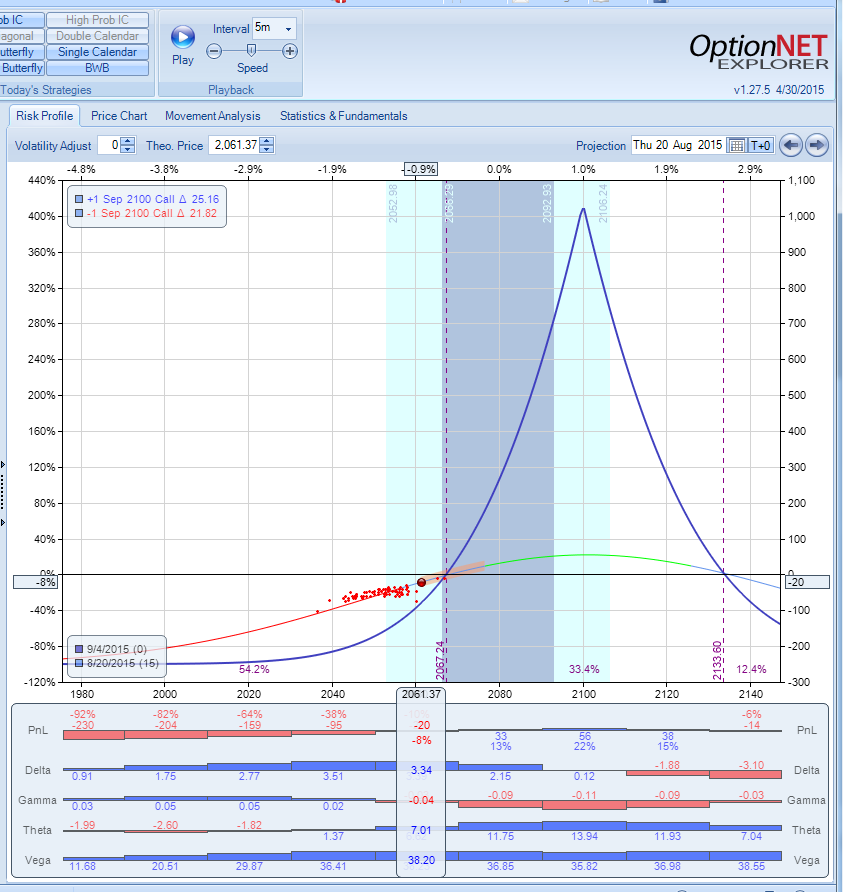

Last Thursday, August 20 SPX was at 2061, and the trade was still in decent shape, down only 8%:

However, as the selloff accelerated towards the end of the day, the trade was down around 20-25%.

At this point I considered different adjustment options but didn't find an efficient and inexpensive hedge. So my plan was just to close the trade around 30% loss. I tested different adjustments and didn't find them too efficient, so considering the fact that we also had a butterfly trade that was expected to offset the loss, it was an acceptable result to me.

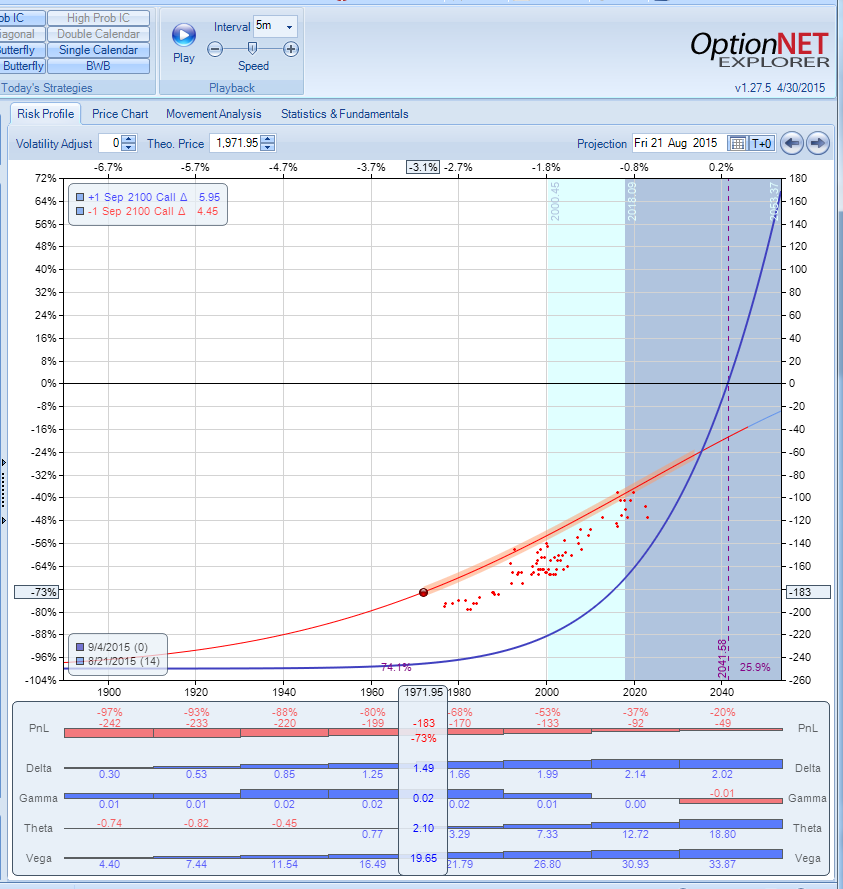

However, SPX really collapsed at the last hour on Thursday, and the trade went through the stop loss in matter of minutes. I assume that most members wouldn't have time to act on the alert sent 5-10 minutes before the close. Spreads also became very wide, and I doubt we could close it anywhere near the mid. On Friday SPX gaped down another 20 points and the trade was down over 50%. By the end of the day the loss was 70%+.

We used yesterday's rally to reduce the loss and closed the trade for 60% loss.

To put things in perspective, SPX went down 130 points in 3 trading days. Last time it happened was 2011.

So what could we do differently?

In the wise words of one of our mentors, Dan Sheridan, "just buy a stinking put!" Dan survived on the floor of the CBOE trading options for over two decades, so he's experienced it.

Lets see how things would be different with the put.

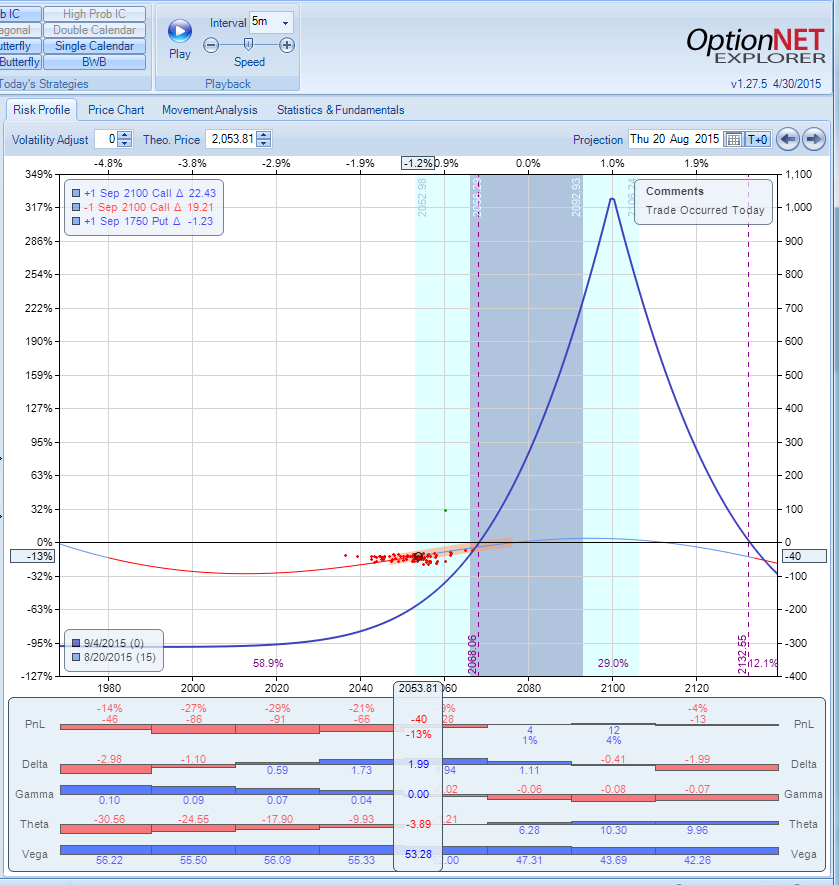

When SPX went through our adjustment point, we could buy the 1750 put for just 0.75. This is how the P/L chart would look like with the put:

As we can see, the chart looks much "smoother". But even more important, it significantly increases the vega, which helps in case SPX continues down and volatility increases.

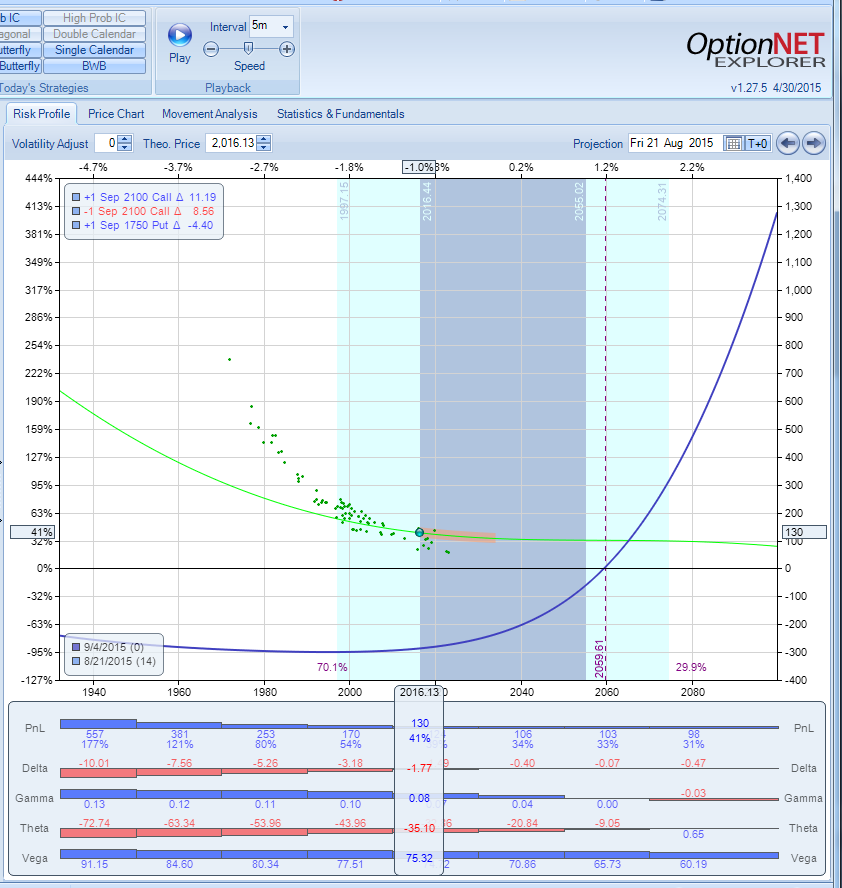

Fast forward to Friday morning:

That's right. Instead of being down 50%+, we would be actually UP 41%.

So what can we learn from this trade?

The most important thing is "don't assume anything". Gaps happen and should be taken into consideration. If the market went down 60 points and became oversold, it doesn't mean it cannot go lower. Don't let your opinions impact your risk management. When in doubt, cut the loss or "just buy a stinking put!"

This trade emphasizes once again the importance of position sizing. In our model portfolio, we recommend allocating 10% per trade. Which means that this trade had a 6% negative impact on the overall portfolio. Not pleasant but not catastrophic and allows us to leave another day. After closing 9 consecutive winners in August, we are still having a great month, while most major indexes are significantly down.

Related posts:

How We Made 23% on $QIHU Straddle in 4 Hours

How Position Sizing Impacts Your Returns

How we trade calendar spreads

We invite you to join us and see how we manage our portfolio of non-directional strategies.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.