After all, if you want to buy an option for $50 and you have $100 in your trading account, why shouldn’t you buy it? You have the money to afford it, right?

The answer isn’t that simple. Perhaps your market view is wrong and your option expires worthless.You’ve just lost 50% of your trading capital. One more $50 option loss and you’re out of the game.

Obviously, risking 50% of your capital on one trade is unsustainable, and to be an options trader, and not someone who uses options to gamble, a far more modest risk per trade is due.

Although everyone’s answer to how much they need to trade options will be different based on risk tolerance, strategy, available capital, etc., the answer basically comes down to bet sizing in relation to win rate. We’ll get into this in a moment.

But beyond strategic and probabilistic concerns about how much you can/should risk on a trade, there are certain regulations from brokers, exchanges, and governments as to how much you need to trade certain options strategies.

So, as always and perhaps annoyingly, the answer to how much capital you need to trade options is “it depends.”

The Basic Requirements

Before we start evaluating your bet sizing, win-rate, risk tolerance, and so on, let’s get a few basic statistics straight.

In order to make option trades that require margin, you need to have at least $2,000 in your trading account.

Most options strategies require margin, so here’s a list of the strategies you can employ without the use of margin:

-

Buying outright puts and calls

-

Selling covered calls

- Selling cash-secured puts (you need the value of the underlying should you get assigned)

In order to trade option spreads or sell uncovered options, you need a margin account.

That’s your first hurdle. If your strategy involves option spreads or selling options at all, you will need the $2,000 required for margin trading in the United States.

With less than $2,000, you’re basically stuck buying puts or calls, as an account that small is unlikely to be able to sell covered calls or cash-secured puts.

You’ll find that of the full-time options traders you ask, few of them simply buy options as their bread-and-butter trade. It’s difficult to be consistently correct about the both the direction of the market, the magnitude of the move, and the timing of the price move to make it a full-time income.

However, when that’s your only option and you’re committed to becoming an options trader and building your account, it’s a legitimate way to grow your account.

With a small trading account, this might mean that your universe of tradeable assets is constrained. You can’t trade high-priced, or possibly even moderately-priced stocks.

However, you’ll probably find the universe of possible stocks to be large enough. This FinViz screen shows that there’s over 400 stocks trading between $1 and $10 that trade over a million shares a day and have listed options. Cutting the range down to $1 to $5 still leaves over 200 stocks.

Just as an example, perhaps you found a call you want to buy for $30 and you have a $1,000 trading account. You’re risking 3% of your account per trade, which is relatively aggressive, but acceptable when your account size is so small.

It's important to focus on low-priced stocks to keep your bet sizing small in proportion to the size of account, and I’ll show you why…

Your Risk Tolerance: How Much Should You Bet?

As said, the capital required to have a shot at trading options in a consistently profitable manner relates to your bet sizing. In other words, what percentage of your total trading capital are you risking on the average trade?

While there’s no concrete correct answer here, there are blatantly wrong answers that you can arrive at through common sense. You shouldn’t risk half of your trading capital on one trade. Unless you’ve found some insane arbitrage or you’re breaking the law somehow, trading edges almost never justify that level of bet sizing.

Using the Kelly Criterion, we can arrive at more wrong answers, which will nudge us in the direction of our correct answer.

Let’s start with a simple example. We’re looking at a trade opportunity and we’re evaluating if we want to take the trade, and if so, how much we should bet.

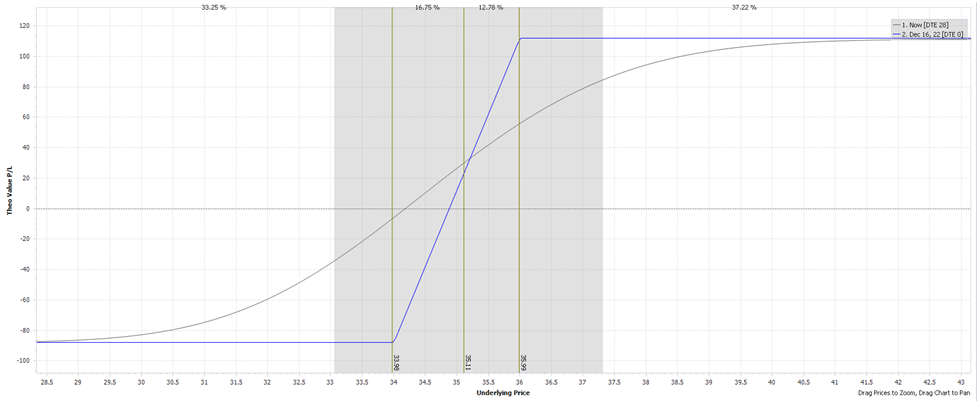

The trade is a bull call spread.

-

Max loss is $88

-

Max profit is $112

-

28 days to expiration

- Implied volatility is 25%

Here’s the payoff diagram so you can get an idea:

Perhaps we think there’s a 45% shot that we’ll exit the trade with our max profit, and a 55% chance that we’ll get the max loss on this trade.

We can simply enter those numbers into a Kelly Criterion calculator like this one and find that a Kelly bet here would be roughly 2% of your trading capital. That sounds pretty reasonable, after all, this edge is pretty small.

But let’s see what happens when we make the numbers more dramatic. Using the same trade example, let’s change our assumptions and guess that we have a 75% chance of hitting the max profit.

With these assumptions, the Kelly Criterion says you should bet 55% of your trading capital.

Hopefully you can see how dramatically getting your assumptions wrong can hurt you. Because you can never know your true odds in the market, its imperative that you discount them relative to your level of uncertainty.

A veteran options trader with a database of 2,000 trades he’s taken in a specific strategy can trust his assumptions far more than someone who is just beginning to trade and is mostly guessing at their odds.

Hint: a veteran trader’s history will basically never tell him to bet even close to half of his account on a trade.

It’s for this reason that most traders who utilize a bet sizing formula like the Kelly Criterion will never use “full Kelly,” and instead use half, a quarter, or even a tenth of full Kelly, depending on their aggression and confidence in their edge.

As you can see, bet sizing in trading can complicated, as it’s one of the most essential things to get right, or at least not get wrong. It’s always better to err on the side of caution and bet less than your numbers tell you to.

A novice or even lower-intermediate options trader is likely to have a lot of trouble guessing at what they think their edge is. They don’t fully know it yet, and they might even question if their edge is concrete enough to put into numbers. That’s okay, basically all traders exist on a spectrum of knowing their edge is real, and nobody truly knows, you just get more confident.

In this situation, it’s best to keep your bet sizing small to stay in the game. Risking one percent of your capital per trade is typically the number suggested by respected trading authors and mentors. If you’re unsure, stick to risking one percent or less per trade.

What is Your Strategy?

You can craft nearly any market view using options. Beyond the price of a stock going up or down, options introduce the elements of time and volatility, allowing you to finely craft your position to your exact view.

If you’re bearish on the next two weeks of price action, but bullish for the following month, you can use a calendar spread. And if you think volatility is expensive right now, you can make the net-short volatility by buying a put with around 10 days to expiration to express your short-term bearish view and selling a put to express your intermediate-term bullish view.

The point is, options are an instrument with infinite strategies and possibilities. The capital required varies depending on the strategy you’re implementing.

The most basic distinction is whether you’re trading spreads with a defined max risk or not.

Options trades with an undefined max risk level make it difficult for you to plot the worst case scenario. If you don’t know that, it’s hard for you to pick a correct size for your bets. And sometimes, you can size your bets correctly and still blow up your account with undefined risk trades. Consider the case of OptionSeller.com.

Furthermore, many undefined risk strategies are the analogical equivalent to selling hurricane insurance. Keep collecting small premiums until the hurricane hits. Did you collect enough premium to cover your claims? This is a very difficult question to answer.

Tips for Undercapitalized Option Traders

-

Undefined-risk strategies are not only capital intensive for a small account, but they’re too risky for a novice to intermediate trader to risk blowing up their account with.

-

Try to stick to lower-priced assets. If you really want to trade SPY, see if you can find another large cap equity ETF with a lower price instead. This will let you keep your bet sizing small, or more surgically manage the number of contracts you trade.

-

In general, with a small account, the “sweet spot” is sizing your bets high enough to grow your account aggressively, but not so high that you dramatically increase your risk of ruin.

- To learn to trade, you need to trade. Educational material and reflection are vital, but not without real experiences to drive you. Otherwise, it’s all theoretical. This is another reason to keep your bet sizing small, it allows you to stay in the game longer and continue to learn.

Summary

In short, with more than $2,000, you should be able to use most defined-risk strategies on lower-to-moderately priced stocks while still keeping your average bet size reasonable.

With less than $2,000, you’re pretty much limited to buying outright options, although you can make bets on volatility by buying a long straddle, which just involves buying a call and put at the same price. As said earlier, it’s imperative to focus on finding trade ideas in lower-priced stocks.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.