Thousands and thousands of pages

Each of these methods have an incredibly wide-array of literature on the web. Personally, I tried to understand the Gann concept at the beginning of my career, that took me about 1.5 years. I have read about 5000 pages of Gann documents, and to be honest, I did not get much out of them for my trading. However, I learned a lot of interesting things about how the world works and the numerological rules hidden in the Egyptian pyramids ![]() .

.

It was a dead end

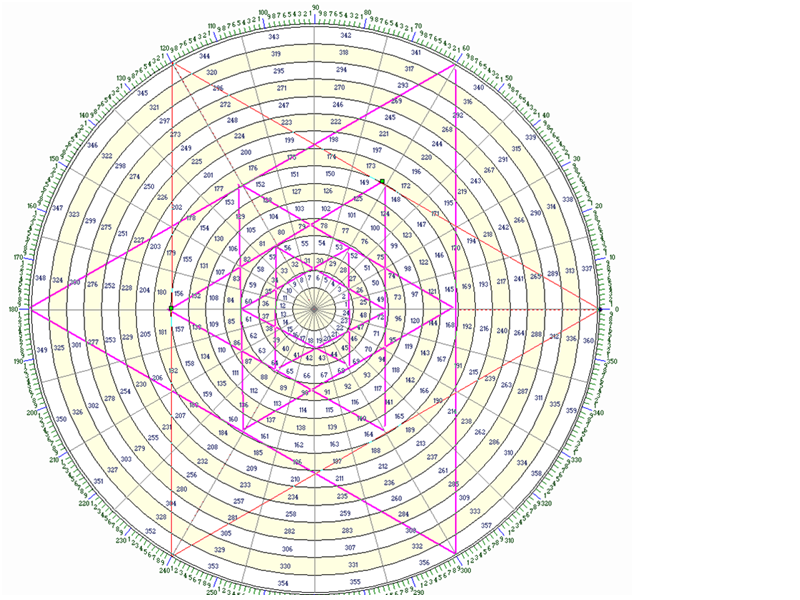

Here's a really "sick" example of what I drew on the basis of the charts following the Gann principles.

Instead of trading the market, I was looking for the nuts, but in vain. There are no nuts, but I was looking for them at the beginning ![]()

Gann has a book titled ”Tunnel Through the Air”. Basically, it is a trading guide embedded into a romantic novel, but it stipulates at the beginning that you will not understand anything in it at first and you have to read it at least 3 times. Well, I think what he wants to tell in this opus is not clear even after that. Gann is considered by many as a mighty genius, and he claimed to know the gospel truth, but only those "who are at the appropriate awareness level" will understand his works. This shows that I was not there: D.

Man and Nature

I agree that nature has well-defined laws and rules. But I'm almost sure that these cannot be put one-to-one onto the market. Many people have written that mass psychosis and its "ups and downs" follow the laws of nature, but I think this is not true. Markets might have followed some kind of law at the beginning of the 1900's (when Gann lived), but I am sure that they do not do so today.

Today, mostly people manipulate the market. Internet presents the news within seconds, anywhere in the world. Announcements, news, data can move heaven and earth on the markets. In the past, these spread in days. Today, supporters of laws of nature try to find the nuts between HFT and the news. I'm skeptical.

There were quite a few examples in the past showing what happened when people interfered with the laws of nature. The market is the same. It does not work by itself, it never went by itself.

Today, Brazilian soap operas - like the US debt ceiling crisis, QE1, QE2, QE3, interest rate increase or decrease, oil production cut or release and so on - provide good examples of that. Decisions of large market players keep prices moving and volatility increasing. This is not a natural wave …

Afterwards ...

Of course, afterwards you can pull the matching fibonacci, angles or waves on anything. But I have not encountered any method that would have predicted the movement in prices simply on the basis of charts. Mainly because there are always many processes taking place in the background, that are not indicated by any chart formations.

If, for example, the weather in America is much colder than they thought, because the polar vortex comes from Canada again, the price of natural gas will increase, as they need to heat more. This is not Fibonacci, not Elliott and not Gann.

We simply feel cold ![]()

By Gery Nagy, optionsrules.com

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.