Which is also the same day that Apple and Amazon report. Two trading days before 2-1-2018 would be Tuesday, January 30th.

IDEA

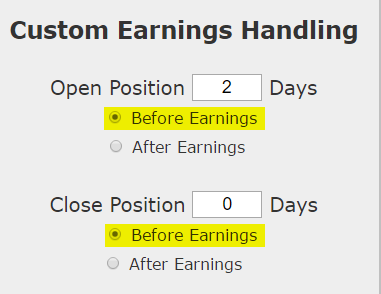

The idea is quite simple -- trying to take advantage of a pattern in short-term bullishness just before earnings, and then getting out of the way so no actual earnings risk is taken, looking at just the 2 trading days before earnings.

The Short-term Option Swing Trade Ahead of Earnings in Alphabet Inc

We will examine the outcome of going long a weekly out of the money call option in Alphabet Inc just two trading days before earnings and selling the call the day of the actual news. But, since Alphabet reports earnings after the market closes, this back-test does not take a position on the earnings result -- it closes before the report.

Oftentimes we look at option set-ups that are longer-term, and take no directional bet -- this is not one of those times. This is a no holds barred short-term bullish swing trade with options and that's it. It's a bullish bet, so must be conscious of the delta risk.

RISK MANAGEMENT

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

RESULTS

Below we present the back-test stats over the last two-years in Alphabet Inc:

| GOOGL: Long 40 Delta Call | |||

| % Wins: | 87.5% | ||

| Wins: 7 | Losses: 1 | ||

| % Return: | 136% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

We see a 136% return, testing this over the last 8 earnings dates in Alphabet Inc. That's a total of just 16 days (2-day holding period for each earnings date, over 8 earnings dates).

Setting Expectations

While this strategy has an overall return of 136%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 21% over two-days.

➡ The average percent return per winning trade was 28.4% over two-days.

➡ The percent return for the losing trade was -31% over two-days.

Looking at More Recent History

We did a multi-year back-test above, now we can look at just the last year:

| GOOGL: Long 40 Delta Call | |||

| % Wins: | 100% | ||

| Wins: 4 | Losses: 0 | ||

| % Return: | 102% | ||

Tap Here to See the Back-test

We're now looking at102% returns, on 4 winning trades and 0 losing trades.

➡ The average percent return over the last year per trade was 22%.

WHAT HAPPENED

Bull markets tend to create optimism, whether it's deserved or not. To see how to find the best performing historical momentum, technical analysis or non-directional trades for any stock using empirical results rather than guesses, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.