SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Search the Community

Showing results for tags 'tos'.

-

Just wondering if anyone has ever had success negotiating with TOS to reduce/remove the $19.95 fee that TOS charges for assignment and exercise. If so, what kind of arguments worked best? I agree with Kim that we shouldn’t have to negotiate to get the best rates. However, I greatly prefer TOS’s platform to anything else out there. I’ve been using tastyworks for a while now too, and their platform is only ok, but it’s still a work in progress, and they still charge $5 for assignment/exercise. The reason I’m asking - and not considering IB’s $0 assignments- is because I’m evaluating a couple of candidates for wheel trades (sell puts, get assigned, sell covered calls, get assigned, rinse/repeat). Since the cycle involves two assignments, the $40-ish total fees at TOS is cost prohibitive. And I refuse to use IB because of their auto-liquidation algorithm - I don’t want to have my account blown up if I get assigned on a couple of different positions one night and don’t have a chance to close things out within 10 minutes of the market opening. So if I could get TOS to come down or eliminate their assignment fee, that would be great. Otherwise I’m stuck with TW - I suppose I’ll get more used to their platform over time, but everything about their apps makes me feel like I’m playing an arcade game from the 80s. And not in a good way.... Any input is greatly appreciated!

- 3 replies

-

- tos

- assignment

-

(and 1 more)

Tagged with:

-

I am wondering if anyone ever used or still uses the spread hacker in Thinkorswim. When they say this particular vertical spread or calendar has 70% chance of winning for example, how accurate is that and can I trust it?

- 1 reply

-

- tda

- tdameritrade

-

(and 2 more)

Tagged with:

-

Hello. I have a few questions/comments about backtesting in TOS. 1. If you select that you entered a trade in TOS using the thinkback tool, is the price you enter supposed to be based on the opening price for legs in the options spread for that day? 2. When you close the trade does thinkback assume you are getting the mid of closing price for the legs in the options spread that date? 3. Is it the closing price for the underlying that day? I always assumed it was based on closing prices, but I just wanted to check. Also, I see this as a major issue with backtesting in TOS, you can only base it on whatever open/close condition it uses. Thank you! Richard

- 17 replies

-

- backtesting

- thinkorswim

-

(and 1 more)

Tagged with:

-

Options Trading is a business. As in any business, there are costs. One of the major costs is commissions that we pay to our broker (other costs are slippage, market data etc.) While commissions is a cost of doing business, we have to do everything we can to minimize that cost. This is especially true if you are an active trader. The impact of commissions on your results can be astonishing. This excellent article by Business Insider is asking the right questions (and also answering some of them): Click here to view the article

- 4 replies

-

- brokers

- commissions

-

(and 2 more)

Tagged with:

-

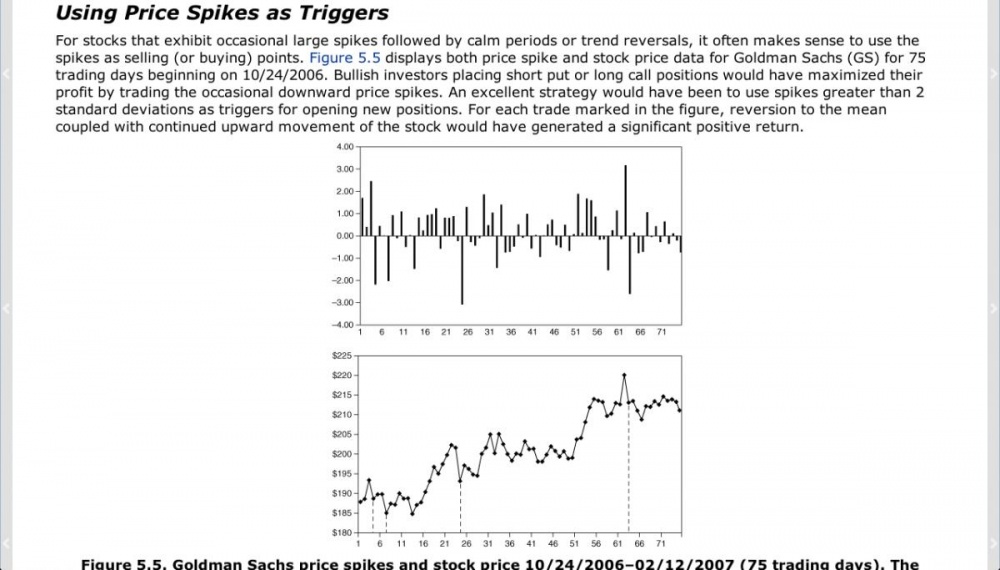

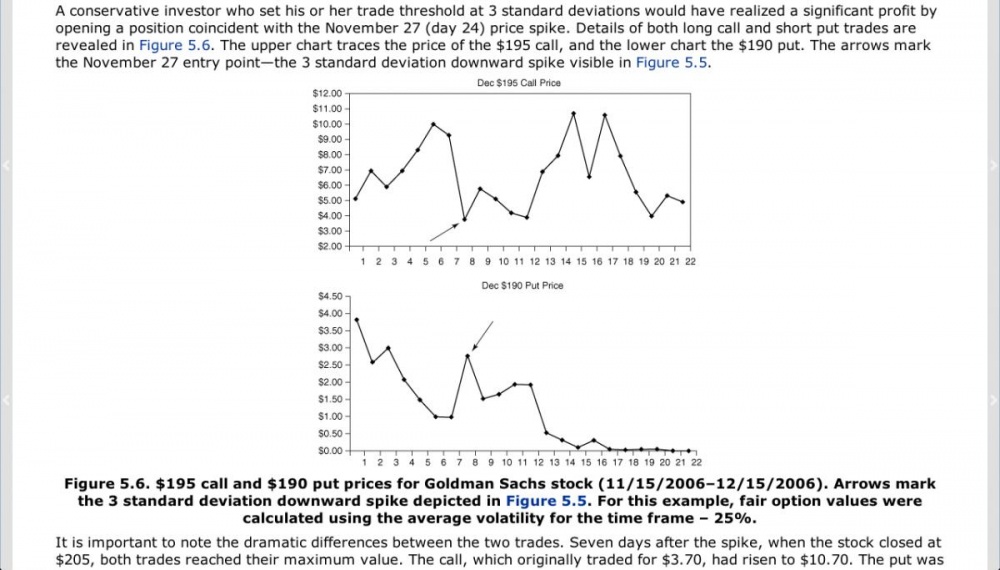

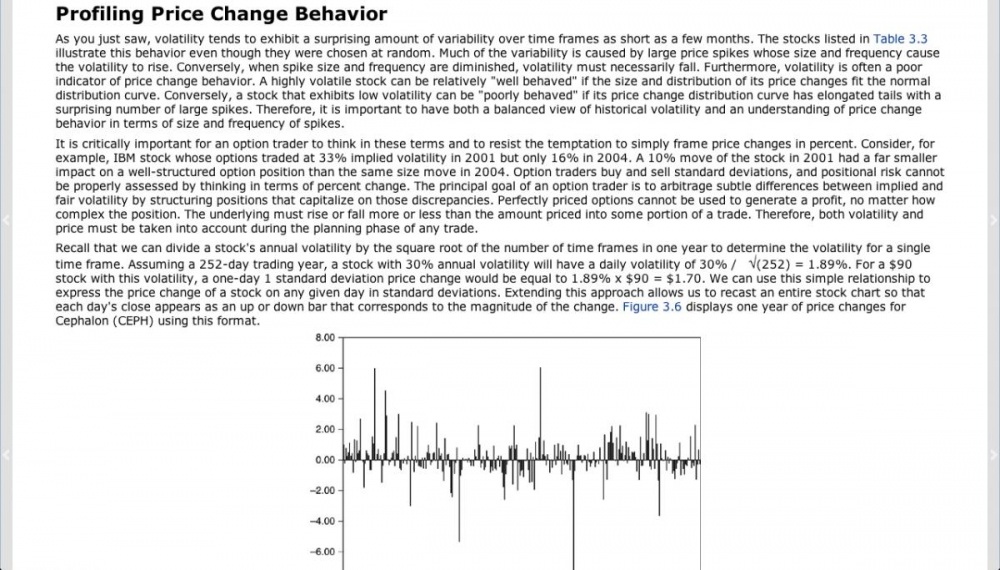

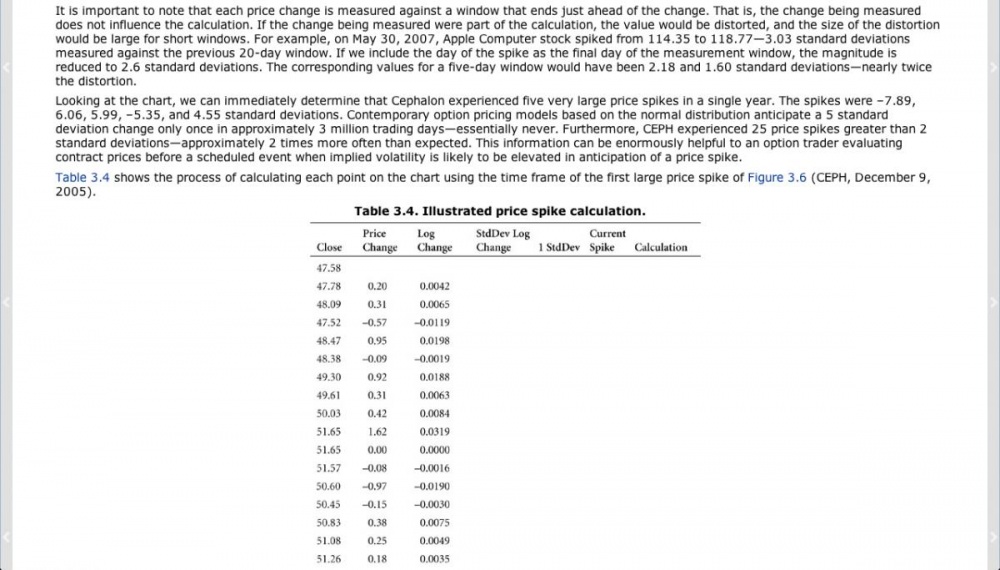

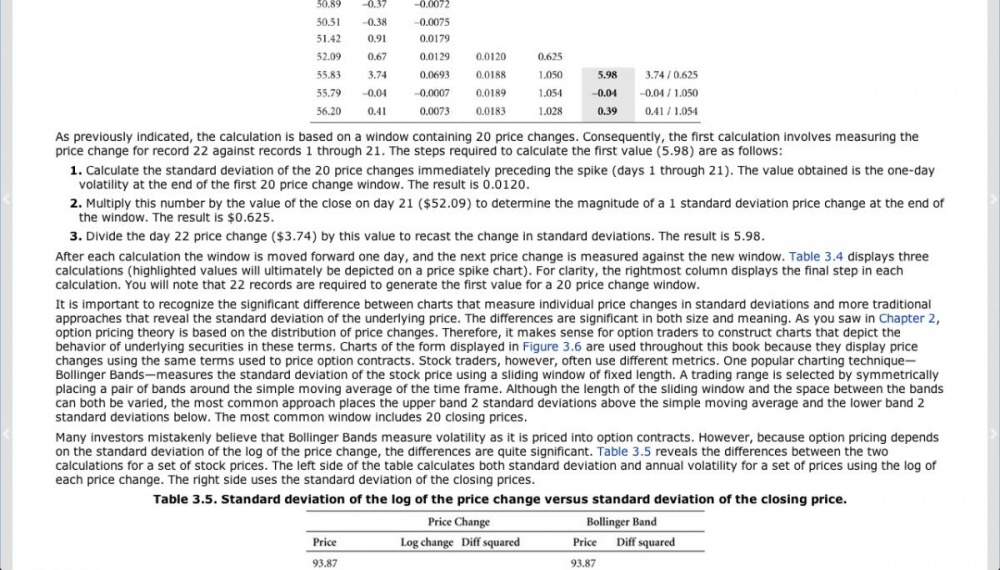

Background In Jeff Augen's Volatility edge, he often used a standard deviation plot to look for spikes. He also discussed it in managing basic option positions and using price spikes as triggers to enter. (it starts on page 113 of the actual book if you are interested in reading it). I post a brief synopsis below (straight from his book, because i have the eBook version). The Mechanics of the Std Dev Study The following is directly from the book, to give a better idea on how he came up with the idea of this study. The ToS Script To turn on this study you have to go to ToS program > Charts > Studies > Edit Studies > New > thinkscript editor and paste the following code in. Then just save it as whatever you want to call it and add it to studies on lower subgraph. Credit to this guy who wrote the script: http://www.thinkscripter.com/indicator/standard-deviation-price-change # Tom Utley 3-17-2009 # Thanks to Jeff Augen # Price Spikes in Standard Deviations declare lower; input length = 20; def closeLog = Log(close[1] / close[2]); def SDev = stdev(closeLog, length)* Sqrt(length / (length – 1)); def m= SDev * close[1]; plot spike = (close[0] – close[1]) / m; spike.setPaintingStrategy(PaintingStrategy.HISTOGRAM); spike.AssignValueColor(if close > close[1] then Color.UPTICK else if close < close[1] then Color.DOWNTICK else GetColor(1)); This is how it looks like in ToS live Example with AAPL Aug monthly 470 Call Possible Entry on greater than 2 STD downspike Possible Exit on spike 25 minutes later (or set your own p/l% with a limit order)

-

Hello all, I just spent few hours chatting with Kenny Griffin, Manager of the Trade Desk at TOS, trying to get a discounted rate for SO members. He offered us an initial rate of 1.50 per contract, with an option to negotiate lower on customer by customer basis. I realize that this might not do any good for many members who are already paying less. However, I believe that some members are still paying more and this deal might be attractive to them. Remember: this is an initial rate, you can always try to negotiate less, and your starting point is still better than the general public. I personally still believe that unless you can get 1.00 or lower, IB presents better value, but some people just cannot stand IB, and for them TOS is probably the best option. Thanks to Jesse for his help, if any of you will take advantage of this offer, please mention him. To get this rate, contact the Trade Desk and ask to talk to Kenny Griffin or email him at kenny.griffin@tdameritrade.com March 2013 Update: Had another session with Kenny. He offered further discount for those on "standard" commissions structure: instead of 9.99+0.75, it is $8.00 ticket + $0.75 per contract for SO members. In addition, TOS will conduct a one on one platform demo for every new customer who is SteadyOptions subscriber. The demo is done by an experienced trade desk rep and typically last about 30 minutes. Please note that Anchor Trades members who select to auto-trade those products enjoy 0.75/contract with TDAmeritrade Institutional platform.

-

I keep thinking I am missing something but I think TOS thinkback may have some major defects. Take a look at ABT (Abbott Labs) "Last" price on 7/10/2012: 65.67 Then TOS thinkback says for 7/11/12 "Last" 65.18, Net Chng, +.02 This VERY wrong. 65.67 to 65.18 represents a decrease in price NOT a +.02. Am I missing something? Thanks!