We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

cwerdna

Mem_C-

Posts

412 -

Joined

-

Last visited

-

Days Won

5

Content Type

Profiles

SteadyOptions Trading Blog

Forums

Everything posted by cwerdna

-

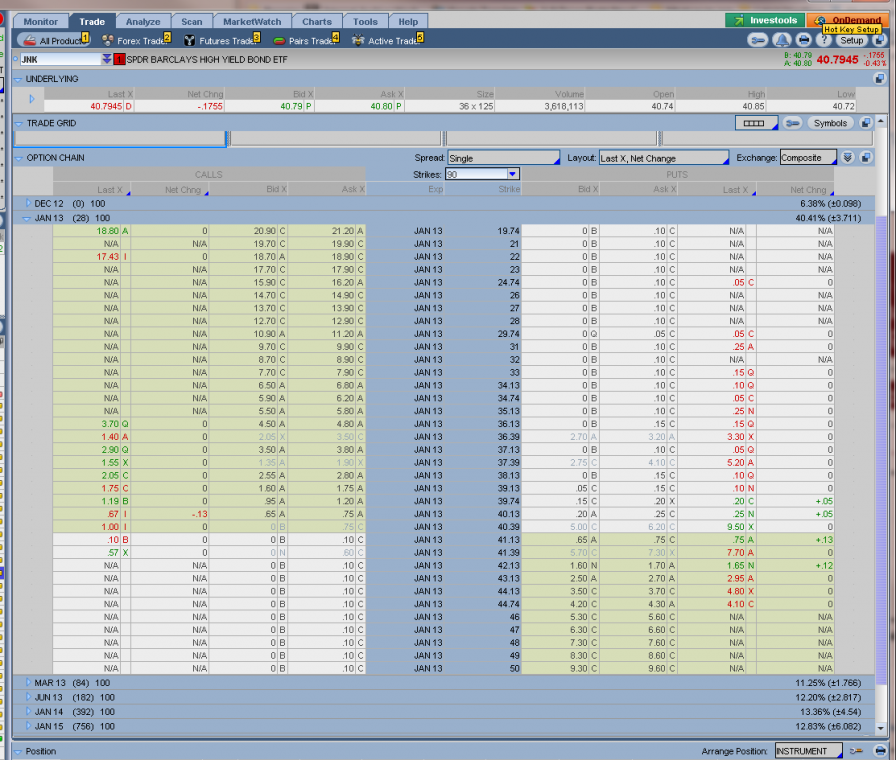

Has anyone seen weird option pricing like these? Take a look at the Jan '13 puts (right side) at the $36.39, 37.39 and 40.39 level. Has anyone seen this weirdness before and/or know of the reason why? Notice the IV of the Jan '13 options is real high (40.41%) probably as a result of this? This is what it looked like earlier today and it still looks similar to that after the close.

-

Red Option "newsletter" (part of Thinkorswim/TD Ameritrade)

cwerdna replied to cwerdna's topic in General Board

No worries. This has been an interesting discussion. Maybe RobertB is right... it doesn't seem like Red Option's strategies of using these theoretical probabilities (at least at they levels they choose) is a very good idea given their not so hot returns.- 27 replies

-

- red option

- newsletter

- (and 6 more)

-

Red Option "newsletter" (part of Thinkorswim/TD Ameritrade)

cwerdna replied to cwerdna's topic in General Board

Yes, I am a total amateur compared to Kim and some of the other folks here. :/ I'm embarrassed to say I did not (long story). I did request it earlier today and you're right on those. It is not pretty at all. I've discontinued autotrade on all my subscribed strategies for now and well let the remainders get closed per their recommendations. It's rather dismaying and am surprised (or maybe I shouldn't be?) that they're continuing to offer all these strats. They calculated collars differently than I did but I see where they're coming from. The way they calculated is a little odd (to me). I also got their 2011 track record. Double double last year made money but was only 3.49% gain, which is less than what it's gotten so for YTD. That strat seems somewhat commission heavy as well due to the # of legs. Weeklys last year lost 17.62% (vs. making money this year). The only strat that made $ both years was covered calls. At least they seem to be decent stock pickers. My only reservations about it are that it ties up a lot of capital for potentially a long time and something very bad could happen to a stock where the premium from the call isn't anywhere near sufficient to make up for the loss. Thanks guys. This has been a useful and interesting discussion. I think I'm going to go w/covered call and drop all the rest once the positions are closed. FYI, if anyone wants to subscribe or at least wants to try covered call, the coupon codes MARKETBLOG (I used this before and it's in their emails) and TICKER (just found it on the net) should still work for 2 strats free for 2 months. SMACKDOWN was another code I'd received (in marketing email) which I did use. I'm not sure if that still works. You don't have to autotrade.- 27 replies

-

- red option

- newsletter

- (and 6 more)

-

Red Option "newsletter" (part of Thinkorswim/TD Ameritrade)

cwerdna replied to cwerdna's topic in General Board

On your first point, that had also crossed my mind and more so as I've been examining how commissions heavy the trades tend to be. I agree that it is possibly a vehicle for them to generate commissions. I figure that if the service sucks (results in net losses), that they won't be able to have a sustainable business and will lose subscribers. However, if there enough incoming new people to replace them... But yes, the subscription fee per strat is tiny compared to the commissions. I wonder how other newsletters handle auto-trades across multiple brokerages? Maybe I should start another thread for that? To me, there'd be the same issue that we have here, where a trade alert goes out, adjustment, roll, closure, etc. goes out, they could automatically place a limit order but there's no guarantee it'll be filled. And, how far away should the limit be set? With Red Option's use of a house account and divvying up afterward, at least everyone w/autotrade on gets a fill at the price mentioned in the alert.- 27 replies

-

- 1

-

-

- red option

- newsletter

- (and 6 more)

-

Has anyone recently negotiated w/TOS to go below $1.25/contract? That's what I'm at but I find that w/Red Option ("newsletter") auto-trades, they tend to trade quite a few contracts. In some cases, their normally ripoff to me pricing (https://www.tdameritrade.com/pricing.page#Options) of $9.99 + 0.75/contract is better than my $1.25/contract, but not always. I'm almost thinking of having some of the strategies switched over to my other account (which is a TD AM account) that has the ripoff pricing. Unfortunately, autotrading for Red Option is only available on TD AM/TOS. I'd otherwise have it done on IB, if I could.

-

Red Option "newsletter" (part of Thinkorswim/TD Ameritrade)

cwerdna replied to cwerdna's topic in General Board

I see... at the risk of getting into trouble (?), I'll post the entire email (minus the boilerplate stuff at the bottom about risks, who to call for support.) (Sorry about highlighting I'm too lazy to remove it all while retaining the rest of the formatting.) I have to head out right now but I'll comment more later. I've observed that they do seem to be pretty good about making adjustments and taking profits (sometimes by closing 1/2 the position) and reducing amount of risk left. But hey, I'm just an options amateur. I picked this example because it was one I quickly dug up that had a % probability listed.- 27 replies

-

- 1

-

-

- red option

- newsletter

- (and 6 more)

-

Red Option "newsletter" (part of Thinkorswim/TD Ameritrade)

cwerdna replied to cwerdna's topic in General Board

Interesting. Well, given their history I see at https://www.redoption.com/redop/about and the analysis tools that the Thinkorswim platform provides, I'm not surprised by their methodology. I have been thru some of the Investools training that well (although, admittedly, I need to go back through some of it again, in more detail). What I see in their emails/advisories seems more/less inline what's taught in Investools training and what you can get out of the Analyze tab. The sample trades at https://www.redoptio...edop/strategies are similar to the stuff they currently send out. Here's excerpt of an email for an IWM trade they opened earlier this month: I guess we will see. It looks like today I'll have a loss on one of their plays, a SPY double calendar. There was an opening debit of $1.22, $0.56 credit on a roll, $0.15 credit to close a call calendar w/a remaining risk of $0.51. That remaining risk was some December (week 2) 133 puts that expired worthless today. When you tried out their trial, did you turn on autotrade? Which strategies did you choose? Did you make money?- 27 replies

-

- red option

- newsletter

- (and 6 more)

-

Red Option "newsletter" (part of Thinkorswim/TD Ameritrade)

cwerdna replied to cwerdna's topic in General Board

I went thru compiling my P/L so far w/the closed trades. I'm not 100% sure this is complete so I'll have to go back and double check my emails vs. TOS. They seem to have done pretty well for me, so far w/o a single loss yet. In some notification emails of trades that don't involve me (opened before I joined), I have seen some losses. Here's what my profit so far (after commissions) by trades. I joined on Nov 6th. (weekly strat:) SPY calendar: 36.3% gain CRM dbl calendar: 13.6% gain (index calendar strat:) DIA calendar: 25.1% gain (vertical strat:) SPY vertical: 65.3% gain RIMM vertical: 24.8% gain (they opened this on 11/26 and closed it on 11/27) (collar strat): DD collar: 1.0% gain (Iron condor strat:) RUT IC: 6.7% gain Obviously, this is not a long track record, but so far, paying for the collar strat doesn't seem worth it as each strat is $20/month (once my trial is over). The profit was only $44 on that DD collar (on an investment of $4252, including commissions) which they opened on 11/15/12 and closed on 12/10/12. On the SPY calendar 36.3% winner, I had a debit of $2025.98, credit of $1546.92 from a roll and $1215 credit to close, making for a $735.94 profit. All of this stuff was autotraded for me. Crossing my fingers that they can keep it up with lots of winners and few losers (hopefully small ones). .- 27 replies

-

- red option

- newsletter

- (and 6 more)

-

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

I have some US tax related questions related to IB. I use Turbotax. First off, I may be closing my account w/them soon. Do they still let you download tax info after you've closed your account? From http://www.interacti...youraccount.htm, it looks like it but it's unclear what the limited time is. Does IB provide free Gainskeeper calculations/access or something equivalent? I don't know how things are different now with 2011+ tax year changes (http://www.irs.gov/Tax-Professionals/Cost-Basis-Reporting-Overview-and-FAQs) where brokers have to report basis for securities acquired on/after 1/1/11. I didn't have an IB account for the 2011 tax year. Basically, what I'm looking for is like what I have on TD Ameritrade/TOS. They had a 2 step (IIRC) process where you had to download the 1099 info for part of the info (1099-INT and DIV?) then there was another step where you could use free Gainskeeper and I think import what it produces into Turbotax (for stocks and options). So, there was very little work. (My memory on this is a little foggy since it's been than 8 months since I last worked on that.) Does IB have something like this? I noticed they have the ability to generate Gainskeeper data files, but that seems to imply I need to pay for my own Gainskeeper subscription. http://www.prnewswire.com/news-releases/interactive-brokers-selects-gainskeeper-for-tax-lot-accounting-services-54323812.html isn't real helpful. I'll probably send a message to their "wonderful" support tonight to ask as well. -

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

Did something happen to/change with IB's combo charting? It seems recently it completely changed and it looks wonky compared how to used to look. See attached. I hit the same thing the other day when the market was open and I think it "fixed" itself once the market closed. Is there some option/default I need to change or is this a bug? -

Out of 6 trades I made in the past week, only 1 was filled on PSE.

-

Anyone here subscribe to www.redoption.com? I only heard about them recently via a marketing email since I have TD AM/TOS accounts. I think they've pitched the service to me before when I wasn't paying attention and knew nothing options. My email had a deal where I could get 2 strategies free for 60 days. I later got an update email that had another code for 2 more strats free for 60 days. They're normally $20/month per strat. I'm only paying for 1 strat right now...but will be paying for all the ones I still want when my trial's over. I'm currently subscribed to iron condor, index calendar, vertical spread, collar and weeklies and seeing how they are. One great thing about them is that they to have autotrade but only in TD AM/TOS accounts. You just set how much you want to allocate per trade. They sound out emails discussing the trade, risk, rationale, etc. They seem to be pretty active in taking profits, reducing risk, etc. by making adjustments/closing part of the position. That could suck if you're having them do small trades and on TD AM's ripoff default commissions ($9.99 + $0.75/contract) but I'm not . I asked them how it's done since I once didn't get a fill on an advisory that went out. Turns out I had insufficient buying power at the time and they don't want to take people into margin call. As they explained "These orders fill at the same time the advisory is sent. All contracts are filled under a house account then allocated to individual accounts shortly after. " That sorta explains why it's TD AM/TOS only for autotrade. That also explains how they can get the pricing on fills for everyone. Too bad they can't autotrade on IB. So far, they seem ok but I haven't been on them for long. IIRC, I haven't hit any losses yet and have had some small to decent gainers. Some positions have been partly closed (to take some gains). For others they've been rolling. I did see one notification go out about a loss but I didn't have any position in that. The trade began before I subscribed.

- 27 replies

-

- red option

- newsletter

- (and 6 more)

-

Heh. That was me. I haven't had time to read and comment on this entire thread yet (will do so later) but I've been focusing mainly on the earnings trades. That was my only reason for joining. The other non-earnings plays are sometimes difficult for me to grok (the reasoning, where things stand, etc.) as an options amateur. And, executing them requires being real careful w/TOS (I don't want to do it w/IB). As I've mentioned a bunch of times before, I tend to set multiple GTC limit sell prices after I've entered a position, at varying gain levels (e.g. 20%, 25%, 10%, 15%, etc.) Sometimes at market open, option prices get wonky and I might luckily get a fill one of those, esp. the higher values. I've also now tended to (right or wrong) avoid SO plays that involve massive theta decay. I prefer if they don't involve weeklies (or anything very close to expiration). I avoid it or use a monthly option instead. I'm leery of the IV not rising enough to make up for the theta decay. I honestly am contemplating leaving (sorry Kim, no offense intended) given that I haven't been net profitable even when excluding the anomalies due to Sandy and user error on my part. I think at this point, I might only enter SO earnings trades if I'm able get a much lower entry price than Kim. I tallied up my results, tossing the anomalies and user error, and for me, the problem was, I had losers outnumber winners in # and $ amount. I couldn't get into many of the plays. Also, this trading ends up taking a fair amount of my time to babysit and causes me sleep disruption (& repercussions after that), mainly on days where I need to close positions. My position sizing also ends up being a bit uneven because of multiple limit buys at various prices (some at Kim's entry price, some lower and some no higher than 1% above) and how "lucky" I am to get in a few, none, many or all. If I'm unlucky where I got a BIG position and it's a loser, that sucks. I'd been doing some other plays that tie up a lot of my buying power but at least mostly win and disrupt my sleep a lot less.

-

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

For those considering IB, they have reduced their cancel/modify fees further. I got this email on 11/20. -

See http://steadyoptions...ns/page__st__0. Yes, $10/trade at TD AM is a rip. I opened an account w/ TOS at $2.95/contract and was grandfathered into that when the TD AM and TOS integration was complete. I got feedback from Kim and others that it's too high. I negotiated them down to $1.25/contract, but I was doing >$700/month in commissions w/TOS at the time I was paying $2.95/contract. Well, for me, TOS can be daunting as there's so much functionality and so much that one can learn (some you have to learn via Investools training, someone showing you, Swimlessons, videos, etc.) But, if you think TOS is bad, IMHO, IB is even worse in terms of UI. IB's commissions are lower, but they suck for trading non-spreads due to cancel/modify fees on singled-legged options trades. At least they finally recently reduced them. IB also doesn't let you close out short option positions of a nickel or less for free. IB has a few pros for SO trades. It is very convenient to be able to easily see, act on and monitor multiple spreads at a time. I don't know of a way to do that on TOS. Also, I don't think you can graph spread prices on TOS, unlike IB. Also, on IB, their treatment/terminology of certain types of trades and having to use NEGATIVE limit prices for those can be real confusing. I and others got bit by this: http://steadyoptions...entry5750.��TOS is usually pretty clear about debit and credit and there are only a few cases on TOS where you have confusing negative price values. (See post 59, my link got mangled. Seems to happen here a lot.) IB also has annoying commission monthly minimums, otherwise you might have to pay for difference and/or for data feeds. In the cases where IB's terminology is confusing and usage of negative prices are required, I usually just use TOS for that, to avoid confusion. Also, back to TOS vs. IB, for some of Kim's non-earnings trades, since I'm not real familiar w/IB, I find making adjustments to be extra confusing on IB. It's easier on TOS, but then again, I've been using TOS way longer.

-

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

I replied w/my result after downgrading to Java 6 and their response was: This isn't the most satisfying response to me... I did notice that the bulid number is now Build 933.5, Nov 26, 2012 2:44:55 PM. This might explain why the sudden (?) change and lack of mention of the .5 build at http://www.interactivebrokers.com/en/p.php?f=tws&p=n&ib_entity=llc... -

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

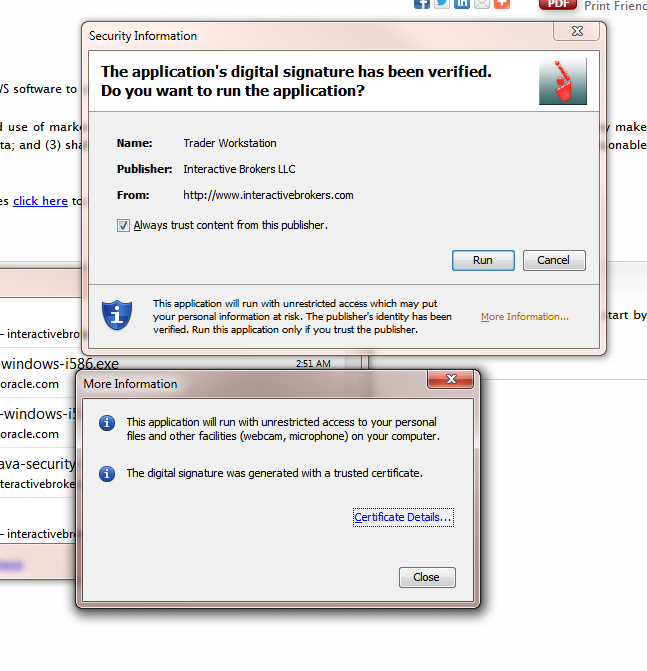

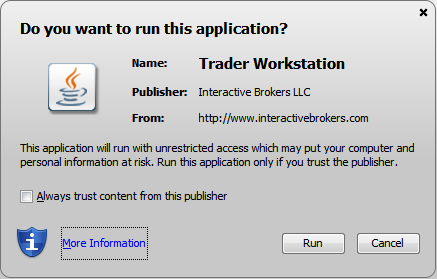

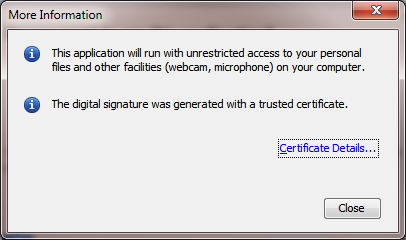

Ok... I downgraded from Java 7 update 9 to Java 6 update 37. The UI is a bit different, but essentially, the same text is there but presented differently. I've never had Java 6 on this machine before (at least not while I've been an IB user). The way Java 6 presents it, it's a lot easier to ignore/miss. So, with the dialog I put up earlier in post 177... was it something new (appeared in the last few days or last week or so) or has it always been there and I just noticed it today? To me, the problem remains w/Java 6. BTW, after seeing how my dad shot himself in the foot w/all that malware and spyware, I've observed he's very susceptible to falling prey to phishing emails and/or clicking on random links in emails from unknown senders. Side note: The reason why so many places use two-factor identification such as the security code card IB forces you to use (http://www.interactivebrokers.com/en/p.php?f=ibgStrength&p=log-default) is I'm guessing that financial institutions practically need to assume that a % of their customers have malware/spyware and keyloggers on their machines so their accounts (username and password) are compromised and the info's being sent to some nefarious party. One of my banks issues me http://www.emc.com/security/rsa-securid/rsa-securid-hardware-authenticators.htm#!offerings (model 700). So, even if your password got captured, it's useless because it's constantly changing. Another bank forces you to click your PIN on the screen and there's no way to type it (to get around the keylogger problem). -

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

Yeah... perhaps less paranoid. I have had to cleanup messes on my parents' computers after my dad's "shot himself in the foot" and installed all sorts of malware and spyware on his machine (e.g. iLivid, Funmoodz, random crap from Cyprus, Malta, etc. that even altered their browser search providers to point to questionable searche engines), that also disabled their anti-virus app. Had to run multiple legit anti-malware apps (e.g. Spybot Search and Destroy, AdAware, Super Antispyware (looks spammy, but it's legit), Malwarebytes, etc.) Was a HUGE waste of my time (took me over a day, including overnight due to scans taking forever besides them having a slow machine). Long ago, he also infected the OS of another machine. And... I receive a phishing mails (end up in my spam folder) which come from groups which are looking for financial gain. Brokerages seems like a good target for that (besides banks). I came to realize how bad the problem was once I read http://www.computerw...s_moment.��They have to basically run their attachments on a virtual machine to look for suspicious behavior. A college classmates works at http://www.fireeye.com/ and described to me at a high level a similar such system that they sell... Watching the video featured at http://www.symantec....meware-toolkits (from 2009 (!)) might be interesting/insightful. You may want to click on the gear, switch to 720p and then watch in full screen. -

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

My original concern (and still is to some degree) is the possibility of a malicious version of TWS being placed on my machine (possibly not by IB itself but by a 3rd party, possibly unauthorized) and it concerns me due to the elevated permissions it's requesting. The app does appear to be properly signed by IB though... I just wanted to see if others were getting that dialog.... At least I know it's not just me now. By unauthorized, it could be my machine being infected by something or someone have altered content on IB's side, for instance. It is curious as to why their app needs unrestricted access. If this dialog is in fact new, then it seems this release of TWS is asking for more permission than before (may not be... might be some goofy change in the Java VM) or it maybe a bug (and inadvertent on the part of IB). A change the VM seems unlikely since I'm on Java 7 update 9 (made typo) that was release in mid-October 2012 (https://blogs.oracle..._7_update_9_and) and I'm pretty sure that it wasn't auto-updated recently. It looks like I installed it ~Oct 18th. -

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

I initiated a chat w/IB and after a bunch of back and forth he advised me to downgrade from Java 7 (I'm on Java 7 update 7) to Java 6 and pointed me to http://ibkb.interact...s.com/node/1976 which is a crap article because I have no idea which security flaw they're referring to and it doesn't even have a date. Below's an excerpt of my chat... I think I'm going open a support ticket anyway and see if CSR/tech support rep roulette yields a better answer... I need to take a care of a ton of stuff before I go to sleep and might not have time to muck w/Java and rebooting. -

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

Has anyone noticed what seems like a new dialog when running IB's TWS. It looks like it just started in the last day or two. I don't remember seeing this before and am a little apprehensive. It's a "Do you want to run this application?..." dialog with "This application will run with unrestricted access which may put your computer and personal information at risk..." If I Cancel, I of course can't continue. I'm puzzled at it looks like the last new release was on 11/8/12 and I don't remember seeing this dialog until today. Is my memory faulty? It looks like it's properly signed by IB. The same behavior occurs on my other machine (which I don't use much w/IB). And the same thing if I try using the previous version (I'm going to http://www.interacti...com/en/main.php and selecting Login > Trader Workstation or Trader Workstation Previous). -

Trading and getting fills with Interactive Brokers

cwerdna replied to cwerdna's topic in General Board

Is there a good way to get the overall p/l (profit and loss) for a symbol? Trade Log and selecting all days only goes back a week. I've poked around a few of the reporting functions before and couldn't find anything, but I didnt look that hard. Not sure if this has been asked before, but is there a good discussion forum for IB how-to's and UI? Side note: For people not on IB because they hate the cancel/modify fees, we got notified recently of this: -

Thanks Kim, for sending out those two mails that everyone should've gotten. For me, I do find it valuable when people post their fill prices, both in and out, even if they're dupes of others. It gives me a sense of whether I got a "good" price vs. everyone else and whether anyone got in. Sometimes when I see nobody posting an "in", I wonder if anyone got in. Given how many registered users there are, I've been wondering how active others actually are in doing the official plays/trades. Is everyone else just quietly lurking, not even looking or not playing? Perhaps they don't wish to post are don't have the time or can't easily do it (e.g. trading using smartphones only). I also look for guidance from some of the more experience folks here for exiting, esp. if my original profit targets of 10-20% weren't hit or if the straddle/strangle is tanking,

-

On the front page of the CBOE, I noticed a link to this odd memo: http://communities.c...tices/ba-p/4153 Of course, it looks like it was issued after the markets would've been closed on a regular day. Could this have possibly helped on our SO plays, like BIDU where we're probably going to get screwed? I thought about it and didn't think so given that we don't own the underlying stock and on straddles, the strike prices are equal. Maybe it could've helped if BIDU jumped (in other markets) big time and we exercised the call (if we have enough buying power) then turned around and sold the stock and the put?

-

Oddly enough, the notice that I quoted has gone away. Right now at http://www.cboe.com/...us/default.aspx it says: However http://communities.cboe.com/t5/What-s-On-Our-Minds/CBOE-ANNOUNCES-EXCHANGE-CLOSURES-FOR-MONDAY-OCTOBER-29/ba-p/4141 still remains: