SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation since 04/17/12 in all areas

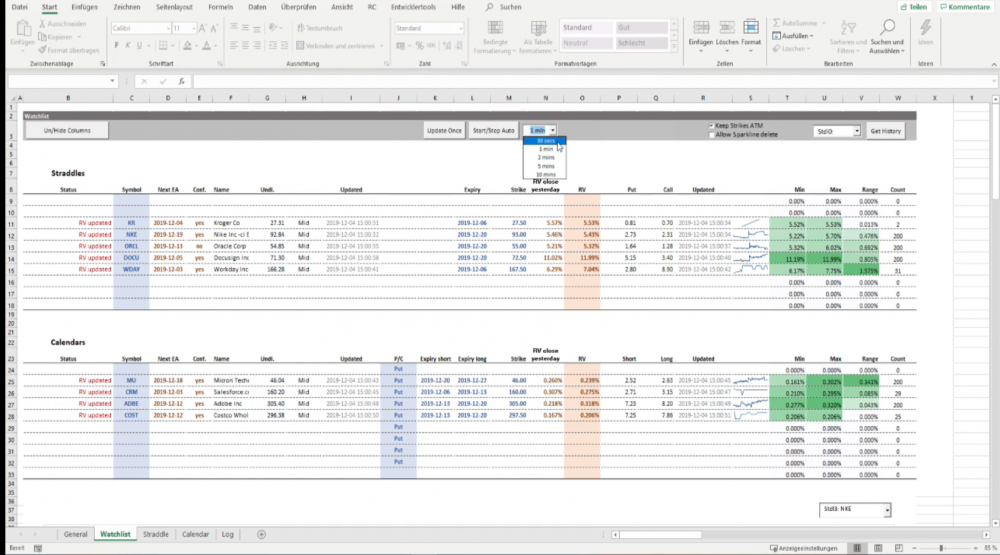

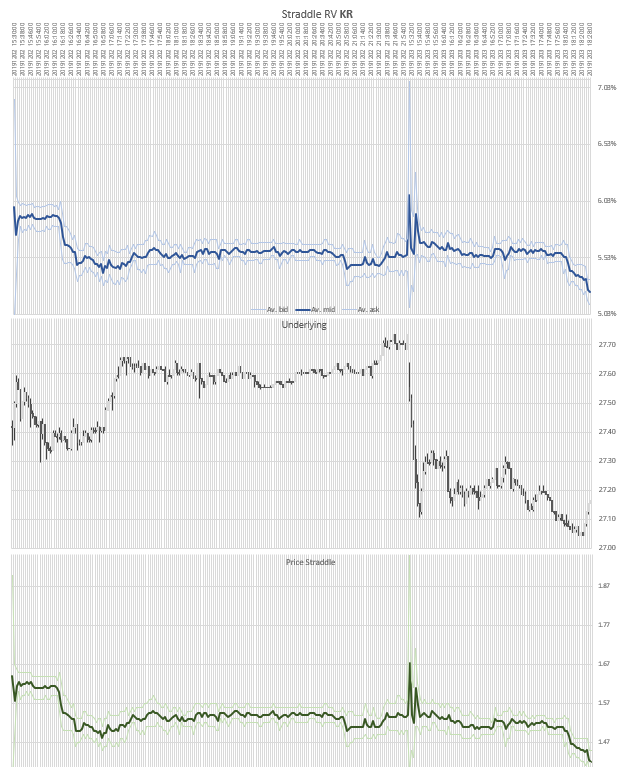

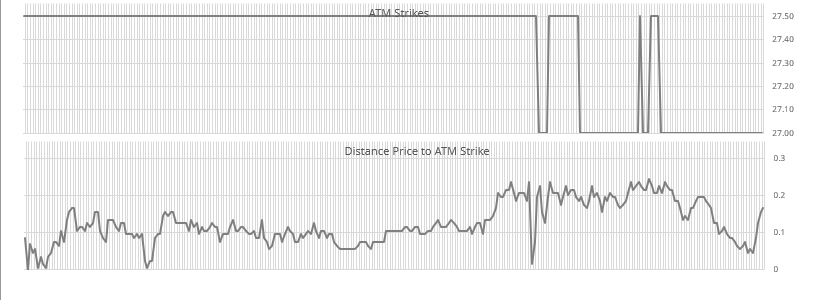

-

Like many other new members, I went through a frustrating time on Steady Options. I almost gave up on it very early on, but luckily, I hung around. Having been here a while now, I’ve seen other newbies come full of enthusiasm and leave full of disappointment, walking the same frustration-filled path that I left behind. I’ve examined my own journey, and can break it down into various stages. So, here they are. Other peoples’ journey may be very different, but I hope that my pathway may shed some light, or give some hope to others who find themselves shouting at the cat for no reason, like I once did. 1) Initial Enthusiasm I joined full of hope and excitement, lured by the mouth-watering annual returns, thinking “If I can make even half of those returns, then I’ll be a happy-chappy”. Motivation Level : 10/10 2) Frustration with Fills Okay, I’ve been a member for a few weeks, and have tried to enter a few trades, but each time, I cannot even get close to the official entry price. I give up on many trades and enter others at the wrong price, resulting in more losers than winners. Motivation Level : 7/10 3) Frustration turns to Fury (well almost) It’s now many trades later and the fills are not getting any easier. It’s getting annoying seeing others open trade after trade and close it two days later at a profit, whilst my GTC order to buy is sitting idle on some exchange gathering dust. I’m a mild-manner guy, who wishes no ill-will on anyone, and thought I didn’t have a dark side, but the ugly monster of jealousy is tapping me on the shoulder and saying “Damn, there’s another guy who’s just closed the GOOG calendar for 30% ….AND….he’s gone in and out twice already this cycle, whilst you can’t even get in once?”. I'm anything BUT a happy-chappy. Motivation Level : 3/10 4) “I’ve had enough” Months have rolled on, my SO portfolio is not showing any gains whilst the official portfolio is showing a healthy number. I don’t even bother trying to enter any SO trades now, and hardly logon to the forums. I’m bitter and just waiting for my membership to expire. Motivation Level : 1/10 5) The last Attempt Over a year has gone by, and the anger and frustration has turned to “Let me give this lousy service one last chance, before my membership expires”. I register with one of the two charting services (ChartAffair/VolatiltyHQ), and spend the whole weekend reading up on old trades, and asking myself “Why did Kim enter this calendar at this price? How does he know that it should be a 1-week or a 3-week calendar?” I look at the RV charts and start to see that the official trades are entered at very low RV’s and every time I over-pay, I’m reducing my chances of profitability. I’m seeing patterns in the calendar RV charts – a ramp up as we get to earnings, a zig-zag pattern that allows others (who I envied) to go in-and-out of trades multiple times. Same for the RV charts for straddles. I’m starting to see why Yowster thinks something is a good buy or not. My head is filled with little “ah-ha” moments and learnings, and the next few days I watch live prices and then I do the un-thinkable – I open my own calendar trade on PANW for 0.89. The very next day, Kim opens the same Put calendar for 1.05 – Bingo! I feel a sense of un-controllable excitement, not just cos I received validation that my trade was correct, but that I actually got a better price than the official. (https://steadyoptions.com/forums/forum/topic/4106-trades-panw-november-2017-calendar/?tab=comments#comment-87397) Motivation Level : 7/10 6) Creating my own Trades I spend Nov and Dec ’17 coming up with tons of my own trades – calendars and straddles. I'm not really too sure of what I'm doing, so some are winners and many are losers. I’ve started doing something else – I’m now keeping a proper journal. Every trade is logged together with the rationale behind it. If it goes wrong, I try to understand why. I’m trading full-time and this has become all-consuming, but I am enjoying it. My knowledge and skill level is rapidly increasing. For the first time, I make a profit for the month (12.9% for Nov ’17). I’m on a high. I still try to enter official trades, but don’t get upset if I miss many. I do this for a few months, averaging around 6% monthly profit overall. I also increase my portfolio size. Motivation Level : 8/10 7) Consistency at Last Two years later, and I have traded several earnings cycles, done literally hundreds of my own trades, and I rarely take the official SO trades. Fills are not a problem, as I’m normally in the trade already, and I’m also trading stocks which are not on the SO list. Profits are decent, but I get some big losses, and the occasional losing month. I don’t like those, so I ramp-up the commitment. I decide to REALLY focus on this from 01-Jan-20. And then a dark-cloud-with-a-silver-lining comes along – COVID lockdowns. They suit me just fine: 7-8 hours a day – just me, the PC screen, charts, Excel sheets, Word documents detailing my ups/downs, cups of Earl Grey tea…..trade after trade. Total immersion. I love it. The wife has become a trading-widow. The cat is happy to be around me, cos I am no longer shouting. My profits rise to new levels, the March crash comes and goes without a dent to the bottom line. As we head towards the end of the year, I can finally say to myself that I have matured into a proficient SO trader – my risk management has improved enormously, my position sizing is as it should be, and my ability to distinguish between good/not-so-good trades has improved. I still screw up, but I keep a list of the mistakes I’ve made each month, and it’s satisfying to watch that list become smaller as the months roll on. I have finally found consistency – I’ve made a profit every single month this year. And my SO portfolio is far more profitable than my other ones. But the learning never stops – every week I read some post on the forum and think “Oh, wow, I didn’t think of that.” I’m no longer a SO member for the trades, but for the ideas and the discussions on the forum. They are gold. And I’ve learnt skills that I’ve been lacking for a long time – patience (no more “FOMO”), discipline (sticking to the rules, no doubling-down etc), no emotional trading (no revenge trades, not getting upset when a trade loses etc) The next stages are to get to grips with different trade types, like ratios. Motivation Level : 10/10 I’ve written this not with the view of “Hey, look at me”, but in the spirit of “If a dunce like me can become a competent trader, then anyone can”. If you’re a frustrated newbie, then rest assured that many of us have been there, many others are still in that place, but with determination and dedication, it’s possible to come out of the pain barrier, and see the sunshine on the other side. Happy trading.68 points

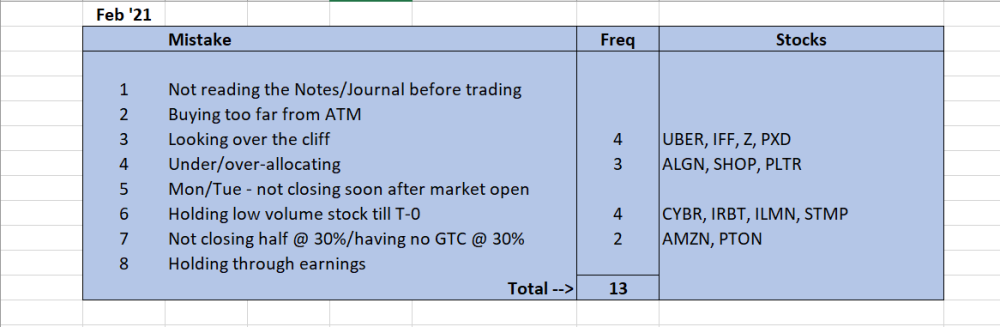

-

thought I share come of the web pages I use regularly. Maybe others can do the same. Options and volatility Option Strategy finder, all sorts of combos listed/explained http://www.theoptionsguide.com/option-trading-strategies.aspx Option Strategies and their greeks explained, interactive analysis http://www.888optionsnet.com/investigator_2/wi_strategyExplorer.asp?disclaimerread=true number of tools and data around (historical) IV http://www.ivolatility.com/home.j historical IV data http://www.optionistics.com/ probability calculator (I actually use that to quickly look up HV for a name) http://www.ivolatility.com/custom/pbc/ VIX Term Structure and historical VIX data http://vixcentral.com/ Options Screener (most active, higest Ivol and other) http://www.marketwatch.com/optionscenter/screener?screen=1&displaynum=100 VIX and more (blog, very educational if you want to learn more about VIX and VIX related ETN's (VXX etc) home page http://vixandmore.blogspot.co.uk 'best of' articles http://vixandmore.blogspot.co.uk/search/label/educational http://vixandmore.blogspot.co.uk/search/label/hall%20of%20fame http://vixandmore.blogspot.co.uk/2010/12/top-posts-of-2010.html earnings data and dates earnings data (earnings dates and historical moves) http://www.optionslam.com/ earnings calendars http://www.morningstar.com/earnings/earnings-calendar.aspx Market commentary and economic calendars Market commentary and free "Flash headline" alerts and paid for (directional) trading trading alerts (trend following) - I use the former http://www.stateofthemarkets.com/ economic data calendar (U.S.) http://www.marketwatch.com/economy-politics/calendars/economic economic data calendar (U.S. and international) http://global.econoday.com/byweek.asp?cust=global-premium FED Meeting calendars, statements, and minutes (2007-2013) http://www.federalreserve.gov/monetarypolicy/fomccalendars.htm charts and stock screeners Stock screener with ability to filter for loads of different fundamentals and other criteria http://www.finviz.com/screener.ashx stock charts pages http://stockcharts.com/ http://ycharts.com - can chart economic data (like jobless claims) and things like total return prices (incl. divs) for stocks and indices Tools/ Excel Addins Hoadley options Addin/tools, great Excel AddIn (windows only) with option pricer, Strategy evaluator and much more (good set of free tool, good value 'professional version') http://www.hoadley.net/options/options.htm Excel AddIn (I think also Windows only) to import all sorts of data (live and historical) from Yahoo Finance (free, you need to join Yahoo group though) http://finance.groups.yahoo.com/group/smf_addin/25 points

-

As many of you know, it has been a difficult period for me and my family. My wife had a second stroke last month and had to do a brain surgery last week to remove a brain stem cavernoma. I'm glad to report that the surgery went well, and she is now recovering in rehab. It is still a long process, but the most difficult and risky part is behind us. I would like to thank everyone for your support and good wishes! I'm very fortunate to have such great community, both on professional and personal level. The number of emails and messages was really overwhelming. Special thanks to our dedicated team of mentors (@Yowster @SBatch and others) for covering during my absence. I expect to be back in full force shortly and to continue providing the same level of support and service you are all used to. Happy Thanksgiving and happy trading during those challenging times!24 points

-

As I’ve done the past few years, I’ve broken down the Steady Options 2018 trade performance by trade type. Numbers were taken directly from the data in the Performance screen. Here’s are this year’s stats along with some comments from my perspective. Where applicable, I added totals from prior years for comparison... Pre-Earnings Calendars 40 Trades – 31 win, 9 loss (78% win) – Average Gain +9.61% 2017: 31 trades (84% win) – Average Gain +13.81% 2016: 44 trades (80% win) - Average Gain +15.07% 2015: 51 trades (80% win) – Average Gain +12.67% 2014: 48 trades (71% win) – Average Gain +13.80% 2013: 24 trades (88% win) – Average Gain +20.60% Comments: Average gain% down from prior years, largely because of 2 really big losers caused by large stock price movement away from calendar strike. Not really surprising given the bigger market swings this year. Without those big losers the average gain was right in line with prior years (we avoided big losers in prior years). Win rate comparable to prior years,. and very high. Pre-Earnings Straddles/Strangles 72 Trades - 60 win, 12 loss (83% win) – Average Gain +5.40% Breaking down further by hedged and non-hedged: Hedged – 49 win, 10 loss (83% win), average gain +4.66% Non-Hedged – 11 win, 2 loss (85% win), average gain +8.76% 2017: 77 trades (79% win) – Average Gain +5.02% 2016: 18 trades (72% win) – Average Gain +5.19% 2015: 44 trades (68% win) – Average Gain +2.61% 2014: 74 trades (62% win) – Average Gain +2.54% 2013: 104 trades (57% win) – Average Gain +1.35% Comments: Highest average gain percentage ever. Highest percentage of winning trades ever. Very low risk trades as it takes RV levels going much lower than prior cycles for these trades to be significant losers (only 4 of 72 trades had losses over -10%). Trade count down slightly from last year due to periods of elevated market volatility. These are riskier trades to open when IV is very high, as the risk for significant straddle price decline due to falling IV can really hurt trades. Index trades (RUT, SPX, TLT) 22 Trades – 19 win, 3 loss (86% win) – Average Gain +15.35%. 2017: 9 Trades (89% win) – Average Gain +19.72% 2016: 27 Trades (67% win) – Average Gain +3.01% Comments: RUT Broken Wing Condor: 3 win, 0 loss, average gain +10.00% SPX Butterfly: 7 win, 2 loss, average gain +17.08% TLT Butterfly: 9 win, 1 loss, average gain +15.41% Typically longer duration trades, can be open for 30+ days. Gain percentage down slightly from last year, due to 2 large losses. As with the calendars, this is not surprising given some of the bigger market swings. VIX-based trades 15 trades – 6 win, 9 loss (40% win) – Average Loss -10.89% 2017: 16 trades (75% win) – Average Gain +9.25% 2016: 16 trades (56% win) – Average Gain +1.34% Comments: Typical trade was for VIX to decline after spikes, but with larger and more sustained spikes this year there were many losing trades. Two 100% losses really hurt the overall average. Reverse Iron Condor (RIC) trades 7 trades – 7 win, 0 loss (100% win) – Average Gain +30.96% Comments: Started using the RIC trade later in the year during times when VIX was high (20+). Trades were designed to take advantage of larger price swings for stocks that was somewhat common during these elevated VIX times. When the stock prices moved, we saw some great gains. Going forward into January/February earnings cycles, will look to use RICs as alternative to straddles if VIX is still high – because although RICs hurt to IV decline, they are hurt by a lesser degree than straddles. However, downside of RICs compared to hedged straddles is that you need the stock price to move to make a profit. Other Trades 5 other trades than had an average loss of -5.35%. Nothing significant to note regarding them. Summary 2018 was unlike prior years for significant chunks of time. Prior years had low volatility and any VIX spike above 20 quickly reverted back down. 2018 had VIX near 20 for about 5 months of the year (7 months were much like prior years). Despite the increase in volatility, 78% of all SO trades were winners with an average gain of 7.07%. The biggest take away from this year is that certain trade types are better for certain market volatility conditions – hedged straddles and calendars are great to put on when volatility is low but they are riskier when volatility is elevated. When volatility is elevated, other trades like RICs and butterfly are less risky to put on during these times. SO is a great community, where members share ideas that benefit all of us and we all continue to learn more and more. Looking forward to continued success in 2019.22 points

-

Please welcome two new mentors @krisbeeand @rasar I'm sure most our members know those two members very well. They helped hundreds of members, are well respected in our community - we just making their status "official".21 points

-

As I’ve done the past few years, I’ve broken down the Steady Options 2017 trade performance by trade type. Here’s are this year’s stats along with some comments from my perspective. Where applicable, I added totals from prior years for comparison... Pre-Earnings Calendars 2017: 31 Trades – 26 win, 5 loss (84% win) – Average Gain +13.81% 2016: 44 trades (80% win) - Average Gain +15.07% 2015: 51 trades (80% win) – Average Gain +12.67% 2014: 48 trades (71% win) – Average Gain +13.80% 2013: 24 trades (88% win) – Average Gain +20.60% Comments: Again one of our best performing trade types, as it has been for multiple years. Number of trades down a bit from last year, seemed a bit tougher to find good entry prices overall this year. Win rate comparable to prior years, and very high. Pre-Earnings Straddles/Strangles 2017: 77 Trades - 61 win, 16 loss (79% win) – Average Gain +5.02% Breaking down further by hedged and non-hedged: Hedged – 28 win, 6 loss (82% win), average gain +6.01% Non-Hedged – 33 win, 10 loss (77% win), average gain +4.24% 2016: 18 trades (72% win) – Average Gain +5.19% 2015: 44 trades (68% win) – Average Gain +2.61% 2014: 74 trades (62% win) – Average Gain +2.54% 2013: 104 trades (57% win) – Average Gain +1.35% Comments: Trade count spiked up significantly this year as hedged straddle trades (beginning in 2nd half of year) gave a lot more trade opportunities. Highest percentage of winning trades ever. Very low risk trades as it takes RV levels going much lower than prior cycles for these trades to be significant losers (only 4 of 77 trades has losses over -10%). No reason to limit the number of these trades that you have on at the same time as big market upturns/downturns will help these trades but they can also be winners during normal market times. Initially, there was some fear that the short hedges may hurt overall performance but thankfully this was not the case as the win% and average gain were both higher than the non-hedged trades. Index trades (RUT, SPY, SPX, TLT) 9 Trades – 8 win, 1 loss (89% win) – Average Gain +19.72%. 2016: 27 Trades (67% win) – Average Gain +3.01% Comments: RUT Broken Wing Condor: 3 win, 1 loss, average gain +6.10% TLT Iron Butterflies: 5 win, 0 loss, average gain +30.62%. Great trade idea on this one. Kudos to @SBatch on this idea, I believe. Longer duration trades, typically open for 30-60 days. VIX-based trades 16 trades – 12 win, 4 loss (75% win) – Average Gain +9.25% Breaking down further by trades for contango and those playing for VIX spikes: Contango (VXX/SVXY) – 10 win, 0 loss (100% win), average gain +29.70% VIX spike – 2 win, 4 loss (33% win), average loss -24.83% 2016: 16 trades (56% win) – Average Gain +1.34% Comments: Those trades playing for the continued low volatility were some our best performing trades with 100% wins and average gain near +30%. Those trades playing for VIX spikes were our worst performers – low win% and average loss of near -25%. I view these trades primarily as portfolio hedges, so in that respect the losses are kind of acceptable to me. Other may not view these trades as hedges – but after multiple years of a flat/declining VIX will a small number of upward spikes (and spikes to VIX levels still below 20) saying we are due for a larger VIX spike and opening trades for it sounds foolish to me. I’m sure such a spike will happen at some point in time, but many people have lost a lot of money over the past few years playing for such a large and prolonged spike. Other Trades A few post-earnings Iron Condors on FB were both successful at around +30% gains. These trades played for stock price to stay relatively stable after earnings. I’d like to see more of these trades in the future as there appear to be quite a few stocks that have a tendency to stay calm after earnings. The one caveat being that we can’t go overboard and have too many of these open at the same time because large overall market moves can really hurt these trades (unlike straddle trades where such overall market moves will help).21 points

-

As has become my year-end tradition, I’ve broken down the Steady Options 2021 trade performance by trade type. Numbers were taken directly from the data in the Performance screen. Here’s are this year’s stats along with some comments from my perspective. Where applicable, I added totals from prior years for comparison. I should highlight up-front that 2021 saw SO’s highest ever yearly Compounded Annual Growth Rate (CAGR) of ~201%. It was a start to a return to a more “normal” market behavior – although VIX did have a few spikes into the 20’s and 30’s, it spent a large portion of the year below 20 which means we were able to do many of the SO standard bread and butter trades like calendars and straddles. Pre-Earnings Calendars 110 Trades – 87 win, 23 loss (79% win) – Average Gain +12.82% 2020: 33 trades (85% win) – Average Gain +21.97% 2019: 54 trades (65% win) – Average Gain +9.27% 2018: 40 trades (78% win) – Average Gain +9.61% 2017: 31 trades (84% win) – Average Gain +13.81% 2016: 44 trades (80% win) - Average Gain +15.07% 2015: 51 trades (80% win) – Average Gain +12.67% 2014: 48 trades (71% win) – Average Gain +13.80% 2013: 24 trades (88% win) – Average Gain +20.60% Comments: Highest ever number of calendar trades by a large margin at roughly twice the highest total of prior years. I attribute a large part of this increase to the RV analysis tools we now use all the time. Despite the higher number of trades, both win percentage and average gain per trade were on par with prior years - which means the calendars portion of the overall SO profit was very high this year. Straddles/Strangles (earnings and non-earnings) 129 Trades - 87 win, 40 loss, 2 break-even (68% win) – Average Gain +3.27% Breaking down further by hedged and non-hedged: Hedged – 27 win, 11 loss (71% win), average gain +2.11% Non-Hedged – 60 win, 29 loss, 2 break-even (67% win), average gain +3.75% 2020: 118 trades (67% win) – Average Gain +2.80% 2019: 106 trades (68% win) – Average Gain +3.58% 2018: 72 trades (83% win) – Average Gain +5.40% 2017: 77 trades (79% win) – Average Gain +5.02% 2016: 18 trades (72% win) – Average Gain +5.19% 2015: 44 trades (68% win) – Average Gain +2.61% 2014: 74 trades (62% win) – Average Gain +2.54% 2013: 104 trades (57% win) – Average Gain +1.35% Comments: Note that this data contains both earnings straddles and non-earnings hedged straddle (NEHS) trades. Highest ever number of straddle/strangle trades, up slightly from the number of trades during the last few years. Like calendars, RV analysis tools have helped identify more trades than before these tools were available. The straddle/strangle contribution to the overall SO profit was a yearly high. This is calculated as the number of trades multiplied by the average gain per trade. Hedged straddle average gain was hurt by several larger losses. Digging into these trades showed that they were all trades where we held the long straddles beyond the last short expiration and into earnings week, had the trades been closed on the day of the last short expiration losses would have been much lower. This will be a take-away for me going into 2022, when we have a losing trade as of the last short expiration, if I do hold the trade into earnings weeks I will add shorts to help protect against further RV decline. Very low risk trades as it takes RV levels going much lower than prior cycles for these trades to be significant losers Flys and Verticals 21 trades – 15 win, 6 loss (71% win) – Average Gain +4.81% Comments: New trade type, so no prior year comparisons. Directional, delta positive trades playing for stock price increase. Most trades were hedged. Used to replace call verticals as they handle falling RV better. Ratio Trades 9 trades – 3 win, 6 loss (33% win) – Average Loss -7.96% 2020: 10 trades (70% win) – Average Gain +2.50% 2019: 28 trades (64% win) – Average Gain +2.01% Comments: Poor performance caused by not having enough stock price rise scenarios, or having the gains on the rise offset by RV decline. For delta positive directional trades like this, we switched to unbalanced flys and call verticals, as they handle the scenario of stock price rising coupled with RV falling much better than the call ratios. Index trades (TLT, EEM, SPY, USO, EEM) No index trades this year: 2020: 19 trades (63% win) – Average Gain 9.54% 2019: 20 trades (60% win) – Average Loss -7.71% 2018: 22 trades (86% win) – Average Gain +15.35% 2017: 9 Trades (89% win) – Average Gain +19.72% 2016: 27 Trades (67% win) – Average Gain +3.01% Comments: We didn’t do index trades this year. Not sure if that’s a good thing or a bad thing. Other Trades Only one “other” trade this year. Summary 2021 Steady Options model portfolio gain is around +201% for the year, and as stated earlier it’s the highest yearly return we’ve ever had. While not everyone will be able to match this performance, the key takeaway is that the SO-style trades work – which means learning these trades and “making them your own” is well worth the effort. Again this year, I’d like to highlight and thank the SO community. We really have a bunch of very smart people who share their ideas and knowledge – this is what makes SO great. This year saw many new members make positive contributions to the community. Looking forward keeping things rolling in 2022! 2020 Year End Performance by Trade Type 2019 Year End Performance by Trade Type 2018 Year End Performance by trade type. 2017 Year End Performance by Trade Type 2016 Year End Performance by Trade Type 2015 Year End Performance by Trade Type20 points

-

Here is @cwelsh shares his experience of trading big volume in a fund: Open interest and volume, almost completely, are completely irrelevant. This has been the single biggest surprise. I have traded hundreds of contracts where I was the ONLY volume with zero issues. The bigger deal is the spread. If there is a two cent spread, I typically can get my order easily filled. If there's a $4.00 spread (e.g. PCLN), I get creamed. The PCLN trade took HOURS to get filled, and was filled 1-2 contracts at a time, sometimes as many as 5. Getting out was a nightmare and I had to leg out individually at bad prices. By and large now I'm planning on avoiding the big spreads. That's unfortunate because those spreads allow smaller traders (5 contracts or less) to snipe away and get great fills; Option pricing systems are NOT efficient or fair. There is no "queue." In other words if I put an order in for 100 contracts of the $50 straddle on stock ABC at $1.00 and five minutes later you do the same thing at $1.00 you might get filled first. There is no FIFO or LIFO system. This means its also possible that I have an order for $1.00 and you do for $0.99 and the price moves and you get a fill but I don't -- even though I offered more. This happens on HIGH volume options because there essentially is just a screen the market makers look at, and if my order is buried, they can miss it. I have seen this happen when I had multiple orders in trying to push the price down. E.g. I wanted a $1.00 fill for 900 contracts, so I put in orders at $1.00 at $0.99 and $0.98 -- for 900 contracts each (with a cancel order in for as soon as I get 100 contracts filled). My theory was to drive the price down, or make it look like there was demand to push the price down so I could get the strike I wanted. Imagine my surprise when the $0.99 got filled, but not the $1.00. This also means it makes sense on higher volume stocks to "refresh" your order by resubmitting it. There have been dozens of times I've had an order sitting for an hour, I cancel and replace and its instantly filled at the same price. "Smart" routing is sometimes not that smart too. This is because when I submit my $1.00 order, it might be routed to the CBOE because CBOE has the best price at $1.03 currently. But over the next five minutes another exchange might become the best priced one -- my order won't necessarily be moved to the better exchange because it's already on one. Another reason to resubmit. Lastly, Smart routing, DESPITE what you've been told, does not cross exchange map. In other words, if you have an order for $1.00 on a straddle and there is one exchange that has the put for $0.50 and the call for $0.51 and a separate exchange that has the put for $0.51 and the call for $0.50, the software will NOT split your order between the two exchanges so as to pick off the better priced option off each. This is another reason you can have a straddle priced at the natural price, but not get a fill -- the natural price is not from one exchange, rather multiples.19 points

-

So.. it's the end of the month, time for a decision. Since this is our first award, we have to take into account contribution of the last few months, not only one month. And this time it will be not one member but three.. surprise surprise.. The award goes to The Three Musketeers ( @gf58, @TrustyJules, @FrankTheTank) Thank you for your contributions, we all appreciate it very much!!18 points

-

As I’ve done the past few years, I’ve broken down the Steady Options 2019 trade performance by trade type. Numbers were taken directly from the data in the Performance screen. Here’s are this year’s stats along with some comments from my perspective. Where applicable, I added totals from prior years for comparison... Pre-Earnings Calendars 54 Trades – 35 win, 19 loss (65% win) – Average Gain +9.27% 2018: 40 trades (78% win) – Average Gain +9.61% 2017: 31 trades (84% win) – Average Gain +13.81% 2016: 44 trades (80% win) - Average Gain +15.07% 2015: 51 trades (80% win) – Average Gain +12.67% 2014: 48 trades (71% win) – Average Gain +13.80% 2013: 24 trades (88% win) – Average Gain +20.60% Comments: We had both our largest number of calendar trades and the lowest percentage of winning trades, but still good as we had right around 2 winners for every 1 loser. Market had quite a few VIX spikes with corresponding larger stock price movements. This led to our overall win/loss percentage to be lower as there were a number of trades where the stock price moved too much. Contribution was very positive on overall portfolio performance. Pre-Earnings Straddles/Strangles 106 Trades - 72 win, 34 loss (68% win) – Average Gain +3.58% Breaking down further by hedged and non-hedged: Hedged – 37 win, 15 loss (71% win), average gain +4.41% Non-Hedged – 35 win, 19 loss (65% win), average gain +2.78% 2018: 72 trades (83% win) – Average Gain +5.40% 2017: 77 trades (79% win) – Average Gain +5.02% 2016: 18 trades (72% win) – Average Gain +5.19% 2015: 44 trades (68% win) – Average Gain +2.61% 2014: 74 trades (62% win) – Average Gain +2.54% 2013: 104 trades (57% win) – Average Gain +1.35% Comments: Its a little apples vs oranges when we compare the non-hedged straddles. This year we did a lot of short-term straddle trades over the last few days prior to earnings (tools such as VolatilityHQ and ChartAffair have made the analysis of this type of trade much easier). So, the lower average gain percentage is ok given that most of the short-term straddle were only open for 1-3 days. Hedged straddle winning percentage and average gain were down a bit from prior couple of years. I believe this was caused by middling VIX levels during the year, time periods where the VIX was neither too high to avoid entering trades nor too low to have minimal risk of larger than normal RV decline due to VIX dropping for hedged straddles held open for multiple weeks. Very low risk trades as it takes RV levels going much lower than prior cycles for these trades to be significant losers. I am not surprised that the average gain for all straddles (hedged and non-hedged) is lower, as this is a result of short-term straddle trades held open for only a few days. The positive aspect of this is we were able to open more trades, so when you multiply the average gain x number of trades the positive contribution to the overall portfolio performance was good and in line with prior years. Index trades (SPX, TLT, EEM, XLV) 20 Trades – 12 win, 8 loss (60% win) – Average Loss -7.71%. 2018: 22 trades (86% win) – Average Gain +15.35% 2017: 9 Trades (89% win) – Average Gain +19.72% 2016: 27 Trades (67% win) – Average Gain +3.01% Comments: 4 big losing trades SPX (-100%, -100%, -72.9%) and TLT (-100%) killed the performance of these trades this year. Typically longer duration trades, can be open for 30+ days. Most of these trades were half-allocations, but even at that level the large losing trades have a big impact on the overall portfolio performance. VIX-based trades 3 trades – 0 win, 3 loss (0% win) – Average Loss –66.43% 2018: 14 trades (40% win) – Average Loss -10.89% 2017: 16 trades (75% win) – Average Gain +9.25% 2016: 16 trades (56% win) – Average Gain +1.34% Comments: 3 losing trades which play for VIX to fall from highs, or looking for movement in either direction all failed. Going forward, we will not be using VIX-based trades as these types of trades are in the PureVolatility portfolio. Reverse Iron Condor (RIC) trades 13 trades – 8 win, 5 loss (62% win) – Average Loss -4.39% 2018: 7 trades (100% win) – Average Gain +30.96% Comments: RICs did great in late 2018 when VIX stayed above 20. We used them in the early part of 2019, but as VIX fell back below 20 we had some outsized losses which resulted in an overall small loss per trade despite having more winnings trades than losing trades. RICs are trades that we may use in the future when the VIX gets very high, but we are unlikely to use them in other timeframes. Ratio Trades 28 trades – 18 win, 10 loss (64% win) – Average Gain +2.01% Comments: New trades for this year, based on TrustyJules research and trades. Similar to straddles in that straddle RV is an important aspect of trade performance, but unlike straddles in that the trade looks for stock price movement in one particular direction (almost all trades used calls to look for stock price to go up). A few mid-sized losers lowered average gain%, as larger than normal RV declines caused the trades to lose more than what was expected. Broken-wing Butterfly (BWB) Trades 8 trades – 6 win, 2 loss (75% win) – Average Loss -5.20% Comments: One big -96% losing trade exceeded the gains from all winning trades. Risk/reward is about equal with these trades, but the caveat is that to hit the really big gains you need to hold until expiration day and have the stock price in a tight zone. Conversely, bigger losses can accumulate quicker on stock movement. Given the current trade allocations, will likely avoid these trades in the future to limit risk Summary 2019 Steady Options model portfolio is likely to be around +40% for the year, which is very good for a stock or fund performance in general, but well below the typical SO level. When you dig into the above numbers you see that the overall contribution from our “bread and butter” calendars and straddle trades is on par with prior years (multiply avg gain per trade by number of trades). We had some very large losing trades, and of the top 10 losers only one was from the calendar or straddle trades (and it was at #10). Take away those 10 biggest losers and the model portfolio gain gets to almost +90%. Going forward, a goal is to avoid those bigger losses – here are a few ideas along those lines: Of the -100% losers (or close to it), we see SPX/TLT/VXX butterflies and the stock-specific MMM butterfly. These trades can have very big gains, or very big losses – and the losses can accrue fairly quickly on significant stock price moves in the wrong direction. Even at half allocation, these big losses can have a large negative impact on the overall portfolio performance. However, their potential large gains can be enticing. An idea here is to create a quarter allocation trade, where occasional outsized losses would not be a devastating – and the occasional huge gains would still have a positive impact. Closing early at loss levels is another possibility here, but a large gap in stock price movement in the wrong direction could still lead to a large percentage loss. RICs have 3 of the top 10 biggest losers, they suffered during the timeframe early in the year when market volatility was coming down from highs at the end of 2018 into early 2019. RICs offer great risk/reward setup where 100%+ gains are very possible, but so are big losers. RICs would also be best served by a quarter allocation trade size. In summary, our bread and butter calendar and straddle trades have been consistent performers over the years, and this year too. We have lots of experience with them and tools available to quickly analyze trades (longer term SO members remember back a few years where analysis for these trades was not nearly as easy). So, stick with what has consistently worked. We should be more careful with some of the other trade types, particularly those where bigger percentage gains and losses are possible. As always SO is a great community, where members sharing their ideas and experiences allow us all to learn. Looking forward to a successful 2020. 2018 Year End Performance by trade type. 2017 Year End Performance by Trade Type 2016 Year End Performance by Trade Type 2015 Year End Performance by Trade Type18 points

-

As I do at the end of each year, I’ve broken down the Steady Options 2025 trade performance by trade type. Numbers were taken directly from the data in the Performance screen (plus some recently closed trades). Here’s are this year’s stats along with some comments from my perspective. Where applicable, I added totals from prior years for comparison. Unfortunately, 2025 was Steady Options worst performing year. I’ll try to present what I believe to be the main reasons for this as they apply to each type of trade. From an overall perspective, here are some key points that I believe factored into the performance: Most SO trades are Vega positive trades leading up to earnings events, so volatility plays a key role in the outcome of our trades. Volatility rising helps trades and volatility declining hurts trades. 2025 saw 4 VIX spikes that occurred rather quickly (not a gradual rise), most spikes were relatively short in duration with declines starting shortly after the spikes. When you look at the year in total, the vast majority of the time we were in time periods where volatility was falling. Trades that were in place prior to the spike performed well, but other trades that did not encompass a spike commonly dealt with falling volatility and RV declines bigger than prior earnings cycles. This meant that trade that would have been small to moderate gains in prior years turned into small to moderate losses this year. Losses above 10% were also more common. There were some things that worked very well this year, although they were in some of the portfolios outside of SO. Steady Yields (SY) and Simple Spreads (SS) performed very well as many of their trades were helped by the same things that hurt the SO trades. Most trades in SY and SS tended to be Vega negative, meaning that they were helped by declining IV – so both time decay and declining IV helped these trades. Pre-Earnings Calendars 24 Trades – 21 win, 3 loss (88% win) – Average Gain +8.77% 2024: 65 trades (81% win) – Average Gain +12.13% 2023: 65 trades (85% win) – Average Gain +9.56% 2022: 11 trades (64% win) – Average Loss -9.55% 2021: 110 trades (79% win) – Average Gain +12.82% 2020: 33 trades (85% win) – Average Gain +21.97% 2019: 54 trades (65% win) – Average Gain +9.27% 2018: 40 trades (78% win) – Average Gain +9.61% 2017: 31 trades (84% win) – Average Gain +13.81% 2016: 44 trades (80% win) - Average Gain +15.07% 2015: 51 trades (80% win) – Average Gain +12.67% 2014: 48 trades (71% win) – Average Gain +13.80% 2013: 24 trades (88% win) – Average Gain +20.60% Comments: Overall winning percentage was at the high end compared to prior years, but average gain per trade was at the lower end. This year lacked some larger gains that we got in prior years (likely due to volatility declines). Number of trades was much lower than most prior years as this year saw the calendars for many stocks having their calendar RV significantly higher than prior cycles, and therefore trades were not opened in these cases. There was a learning here to take forward into next year. For calendar trades entry we look to enter at lower RV levels and/or on stocks that show a pattern of rising calendar RV heading into T-0. Many stocks show a tendency for calendar RV to rise regardless of current levels, but we didn’t open trades on these stocks if the current RV was elevated. While we wouldn’t want to enter if calendar RV was sky high, hindsight showed that opening trades when RV was slightly to moderately elevated wound up being winners. Earnings calendars continue to be a core SO strategy. Straddles/Strangles 42 Trades - 21 win, 20 loss, 1 break-even (51% win) – Average Loss -0.56% Breaking down further by hedged and non-hedged: Non-Hedged – 21 win, 17 loss, 1 break-even (55% win), average gain +0.24% Hedged – 0 win, 3 loss (0% win), average loss -10.97% 2024: 57 trades (73% win) – Average Gain +4.72% 2023: 166 trades (64% win) – Average Gain +1.65% 2022: 148 trades (71% win) – Average Gain +4.89% 2021: 129 trades (68% win) – Average Gain +3.27% 2020: 118 trades (67% win) – Average Gain +2.80% 2019: 106 trades (68% win) – Average Gain +3.58% 2018: 72 trades (83% win) – Average Gain +5.40% 2017: 77 trades (79% win) – Average Gain +5.02% 2016: 18 trades (72% win) – Average Gain +5.19% 2015: 44 trades (68% win) – Average Gain +2.61% 2014: 74 trades (62% win) – Average Gain +2.54% 2013: 104 trades (57% win) – Average Gain +1.35% Comments: Lower number of straddle/strangle trades compared to prior years, due primarily to double diagonal (DD) trades which have similar gain targets to straddles and strangles but can be kept open longer. Overall winning percentage and average gain per trade were at lows. This is primarily due to the decline volatility which saw straddle RV dropping by larger percentage compared to cycles in prior years. When the stock price did moves, gains were often muted when factoring in the larger RV declines. From a downside risk perspective, we saw more losses above 10% compared to prior years with 7 of the 20 losing trades having a loss greater than 10%. 12% of trades hit 10% gain target, which is lower compared to prior years. These trades remain low risk trades as it takes RV dropping much more than their prior cycle tendencies to be significant losers – unfortunately we saw more cases of the outsized RV drops this year. Double Diagonals DD trades have the goal of having performance similar to straddles/strangles – but have the ability for the trades to be open for much longer periods of time (up to 3 weeks prior to earnings) giving the stock more time to move but still have minimal downside risk. 48 Trades - 28 win, 19 loss (60% win) – Average Gain +0.79% 2024: 52 trades (73% win) – Average Gain +4.86% Comments: Winning percentage was down from last year and average gain per trade was only slightly positive. Again, a result of RV declines more than prior years. What were small winners last year because small losers this year. Last year, all losing trades were under 10% losses (majority of losses were under 5%). This year we saw 6 losses above 10%, but all losses were under 20%. The DD trade is a low risk trade type with minimal downside risk, but this year has shown that when RV declines are more than expected then losses in the 10%-15% range can occur if the stock price doesn’t move. 25% of trades hit 10% gain target (compared to 35% last year). This is not a huge difference, it means that when the stock price moves you can hit that 10% gain target regardless of what happens with RV. Pre-earnings Iron Condors In the 4th quarter we introduced the pre-earnings Iron Condor (IC) trade as a way to get a Vega negative trade type into the SO mix of trades. We targeted stocks that have a consistent and large straddle RV decline heading into earnings whose historical straddle performance show mostly losing trades (meaning the stock price doesn’t tend to move a lot prior to earnings). 10 Trades - 7 win, 3 loss (60% win) – Average Gain +0.07% Comments: Large percentage of winning trades, but one of the three losing trades was an oversized loss when stock price made a big move corresponding to a larger market downturn. Will continue with these trades in the future, trying to limit those bigger losing trades by keeping risk vs reward near equal and by selecting stocks whose straddle RV decline is both large/consistent and happens in a relatively short period of time. Other Trades Non-Earnings RICs: 2 win, 1 loss (67% win) – Average Gain +0.00%. These non-earnings trades have higher downside risk if stock price doesn’t move. In this case the 1 loss equaled the 2 wins. Hedged ratios and BWBs: 2 win, 3 loss (40% win) – Average Loss -10.90%. These were hedged directional trades, the losses were larger when the stock price didn’t move in the right direction. S&P500 addition date trade: 1 win, 2 loss (33% win) – Average Loss -14.50%. These trades play for stock price decline (or at least staying flat) after the S&P500 addition. The pattern of prior year additions was broken this year. Several of the additions this year had much less lead time compared to prior years, so this might be a factor. Summary 2025 was a very challenging year for the Steady Options model portfolio. We used the same types of trade setups and analysis that has worked for us year after year. However, the market behavior this year yielded underperforming trade results. Going forward, we will continue to try to optimize trades and limit losses – but one underperforming year does not mean we need to re-think every type of trade as they have performed consistently well in prior years As always, I’d like to highlight and thank the SO community. We continue to have a group of very smart people that seems to grow each year who share their ideas and knowledge – this is what makes SO great. Looking forward to a better 2026.17 points

-

As has become my end of year tradition, I’ve broken down the Steady Options 2022 trade performance by trade type. Numbers were taken directly from the data in the Performance screen. Here’s are this year’s stats along with some comments from my perspective. Where applicable, I added totals from prior years for comparison. While 2021 appeared to be the start of a return to a more normal market behavior, volatility was back again in 2022 with the VIX staying above 20 for almost the entire year. This meant RV’s for both calendars and straddles were elevated, so the year was dominated by shorter-term straddle trades as a way to keep downside risk lower, very few calendars and a new combo trade using indexes such as SPY and QQQ. Pre-Earnings Calendars 11 Trades – 7 win, 4 loss (64% win) – Average Loss -9.55% 2021: 110 trades (79% win) – Average Gain +12.82% 2020: 33 trades (85% win) – Average Gain +21.97% 2019: 54 trades (65% win) – Average Gain +9.27% 2018: 40 trades (78% win) – Average Gain +9.61% 2017: 31 trades (84% win) – Average Gain +13.81% 2016: 44 trades (80% win) - Average Gain +15.07% 2015: 51 trades (80% win) – Average Gain +12.67% 2014: 48 trades (71% win) – Average Gain +13.80% 2013: 24 trades (88% win) – Average Gain +20.60% Comments: Lowest number of calendar trades we’ve had since we started using the strategy. This is due to much higher RV levels and stocks moving more with the higher market volatility. Although there were more winning trades than losing trades, several outsized losses caused the combined return to be negative. This is still a core SO strategy, and we’ll do more of them once market volatility returns to more normal levels. Straddles/Strangles 148 Trades - 103 win, 40 loss, 5 break-even (71% win) – Average Gain +4.89% Breaking down further by hedged and non-hedged: Non-Hedged – 97 win, 36 loss, 5 break-even (72% win), average gain +5.24% Hedged – 6 win, 4 loss (60% win), average gain +0.14% 2021: 129 trades (68% win) – Average Gain +3.27% 2020: 118 trades (67% win) – Average Gain +2.80% 2019: 106 trades (68% win) – Average Gain +3.58% 2018: 72 trades (83% win) – Average Gain +5.40% 2017: 77 trades (79% win) – Average Gain +5.02% 2016: 18 trades (72% win) – Average Gain +5.19% 2015: 44 trades (68% win) – Average Gain +2.61% 2014: 74 trades (62% win) – Average Gain +2.54% 2013: 104 trades (57% win) – Average Gain +1.35% Comments: Highest ever number of straddle/strangle trades. The vast majority of these trades were short-term, one or two day straddles or tight strangles using stocks identified by RV charting tools as being good candidates. The short-term trades were used with the goal of keeping downside risk lower – and this is exactly what happened as only 8 of the 148 trades had losses above 10% (and none more than 15%). On the winning side, 50 trades had gains above 10%. Both the win rate and average gain per trade were very good given the short durations of most trades. Only a few hedged straddles were used this year. Since RV was higher, we wanted to avoid giving trades more time for RV to decline. Very low risk trades as it takes RV dropping much more than their prior cycle tendencies to be significant losers. Index trades (SPY, QQQ, IWM) 50 Trades - 37 win, 13 loss (74% win) – Average Gain +2.07% Breaking down further: Combo New (Friday/NextFriday) – 9 win, 1 loss (90% win), Avg gain +5.24% Combo Old (Friday/Monday) – 24 win, 9 loss (73% win), Avg gain +2.07% Friday Flys – 4 win, 3 loss (57% win), Avg Loss -3.19% 2021: None 2020: 19 trades (63% win) – Average Gain 9.54% 2019: 20 trades (60% win) – Average Loss -7.71% 2018: 22 trades (86% win) – Average Gain +15.35% 2017: 9 Trades (89% win) – Average Gain +19.72% 2016: 27 Trades (67% win) – Average Gain +3.01% Comments: We started using a combo trade on indexes, initially a 5-leg trade held for 3-5 days using Friday/Monday expirations. Trade initially performed well, but when market volatility started dropping we saw losses above 10% becoming too common. So, we then began to use a new combo setup, a 4-leg trade held for 3-5 using Friday/NextFriday expirations. The goal was to keep losses smaller because having the long expiration a week after the shorts would allow it to retain more of its value. To date, it has played out that way with only 1 smaller losing trade out of 10 (compared to 6 losses above 10% of the 33 trades using the Friday/Monday expiration). We plan on continuing to use the Friday/NextFriday combo going forward. The Friday Flys were designed to be opened and closed on the same day. They back-tested very well, but turned out to be volatile to manage so we stopped using them. Other Trades A handful of some miscellaneous trades, most of which turned out to be losing trades. Summary 2022 Steady Options model portfolio was up around +90% for the year. This result was below some years, but note that we didn’t use calendar trades this year due to the volatile market climate – and calendars have historically always been our highest average gain per trade. Going with mostly lower risk, short-term straddles and tight strangles kept us away from trades with bigger losses, but also kept us away from trades with larger gains – so that 90% yearly gain is good based on the more conservative trades we primarily used this year. As always, I’d like to highlight and thank the SO community. We continue to have a group of very smart people that seems to grow each year who share their ideas and knowledge – this is what makes SO great. Looking forward to 2023. 2021 Year End Performance by Trade Type 2020 Year End Performance by Trade Type 2019 Year End Performance by Trade Type 2018 Year End Performance by trade type. 2017 Year End Performance by Trade Type 2016 Year End Performance by Trade Type 2015 Year End Performance by Trade Type17 points

-

As I’ve done the past few years, I’ve broken down the Steady Options 2020 trade performance by trade type. Numbers were taken directly from the data in the Performance screen. Here’s are this year’s stats along with some comments from my perspective. Where applicable, I added totals from prior years for comparison... A note on prior year comparisons. 2020 was a year unlike any other in recent history so any comparison to other years will certainly have an apples vs oranges aspect to it – prior to 2020 we went through 8 years where the VIX barely got above 20, and when it did it only stayed there for a few days at most, this year we’ve had VIX above 20 for ~10 months straight with some historic highs as well. Pre-Earnings Calendars 33 Trades – 28 win, 5 loss (85% win) – Average Gain +21.97% 2019: 54 trades (65% win) – Average Gain +9.27% 2018: 40 trades (78% win) – Average Gain +9.61% 2017: 31 trades (84% win) – Average Gain +13.81% 2016: 44 trades (80% win) - Average Gain +15.07% 2015: 51 trades (80% win) – Average Gain +12.67% 2014: 48 trades (71% win) – Average Gain +13.80% 2013: 24 trades (88% win) – Average Gain +20.60% Comments: Lower number of trades this year, as high market volatility made finding good entry levels difficult (25 of 33 trades were made in the first 2 months of the year before Covid hit). The trades we did make had a very high win/loss percentage and the highest average gain we’ve had since we started using these trades. Contribution was very positive on overall portfolio performance. Straddles/Strangles (earnings and non-earnings) 118 Trades - 76 win, 42 loss (64% win) – Average Gain +2.80% Breaking down further by hedged and non-hedged: Hedged – 48 win, 24 loss (67% win), average gain +2.68% Non-Hedged – 28 win, 18 loss (61% win), average gain +2.99% 2019: 106 trades (68% win) – Average Gain +3.58% 2018: 72 trades (83% win) – Average Gain +5.40% 2017: 77 trades (79% win) – Average Gain +5.02% 2016: 18 trades (72% win) – Average Gain +5.19% 2015: 44 trades (68% win) – Average Gain +2.61% 2014: 74 trades (62% win) – Average Gain +2.54% 2013: 104 trades (57% win) – Average Gain +1.35% Comments: We did a lot of non-earnings hedged straddle (NEHS) trades this year during periods of elevated volatility, but to separate those will require a deeper dive into the data. So, for now, this data has all straddle trades grouped together, both earnings and non-earnings. It's safe to say that the NEHS trades had both bigger winners and bigger losers. Hedged straddle winning percentage was a tiny bit lower than prior years, but average gain per trade was down a bit more. Given the large volatility swings this year, I think we had some larger than normal losing trades when volatility dropped more than anticipated – part of trading in a year like this. Very low risk trades as it takes RV levels going much lower than prior cycles for these trades to be significant losers – although we did see a few of those this year. I am not surprised that the average gain for all straddles (hedged and non-hedged) is lower, as this is a result of short-term straddle trades held open for only a few days. The positive aspect of this is we were able to open more trades, so when you multiply the average gain x number of trades the positive contribution to the overall portfolio performance was good and in line with prior years. Index trades (TLT, EEM, SPY, UNG, USO, EEM) 19 Trades – 12 win, 7 loss (63% win) – Average Gain 9.54%. 2019: 20 trades (60% win) – Average Loss -7.71% 2018: 22 trades (86% win) – Average Gain +15.35% 2017: 9 Trades (89% win) – Average Gain +19.72% 2016: 27 Trades (67% win) – Average Gain +3.01% Comments: Longer duration trade with many big winners and big losers, many more big winners than big losers so average gain was very good. Reverse Iron Condor (RIC) trades 6 trades – 4 win, 2 loss (67% win) – Average Loss -5.17% 2019: 13 trades (62% win) – Average Loss -4.39% 2018: 7 trades (100% win) – Average Gain +30.96% Comments: One big loser offset the winners. Switched to NEHS setups instead of RIC trades, as downside risk is lower with NEHS setup. Ratio Trades 10 trades – 7 win, 3 loss (70% win) – Average Gain +2.50% 2019: 28 trades (64% win) – Average Gain +2.01% Comments: Trade count was lower, due to not finding good entry levels with elevated volatility for much of the year. We’d like to do more of these in 2021, especially for stocks who have stock rising tendencies into earnings. We’ve learned a lot about different hedging scenarios as we’ve done more of these trade. Other Trades 7 other trades than had an average loss of -8.46%. Nothing significant to note regarding them. Summary 2020 Steady Options model portfolio is likely to be around +120% for the year, so a very good return. Key to this was avoiding any big losing months, which was a significant accomplishment given the huge market swings this year. This year was one when our traditional bread & butter trades were not possible for a larger percentage of the year due to the very high market volatility. We adapted the best we could and avoided entering trades just for the sake of entering them. We had some bigger winners and bigger losers compared to prior years – but that is to be expected given the volatility. I hope 2021 returns to more normal market behavior where we can get back to our standard trades. I’d like to highlight and thank the SO community. We really have a bunch of very smart people who share their ideas and knowledge – this is what makes SO great. This year saw the development and enhancement of many different trade analysis tools put together by members and shared with the community. These things really do have a big impact on making trade analysis easier. Looking forward to a great, and hopefully more normal, 2021 2019 Year End Performance by Trade Type 2018 Year End Performance by trade type. 2017 Year End Performance by Trade Type 2016 Year End Performance by Trade Type 2015 Year End Performance by Trade Type16 points

-

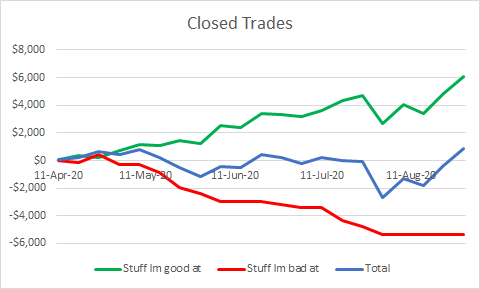

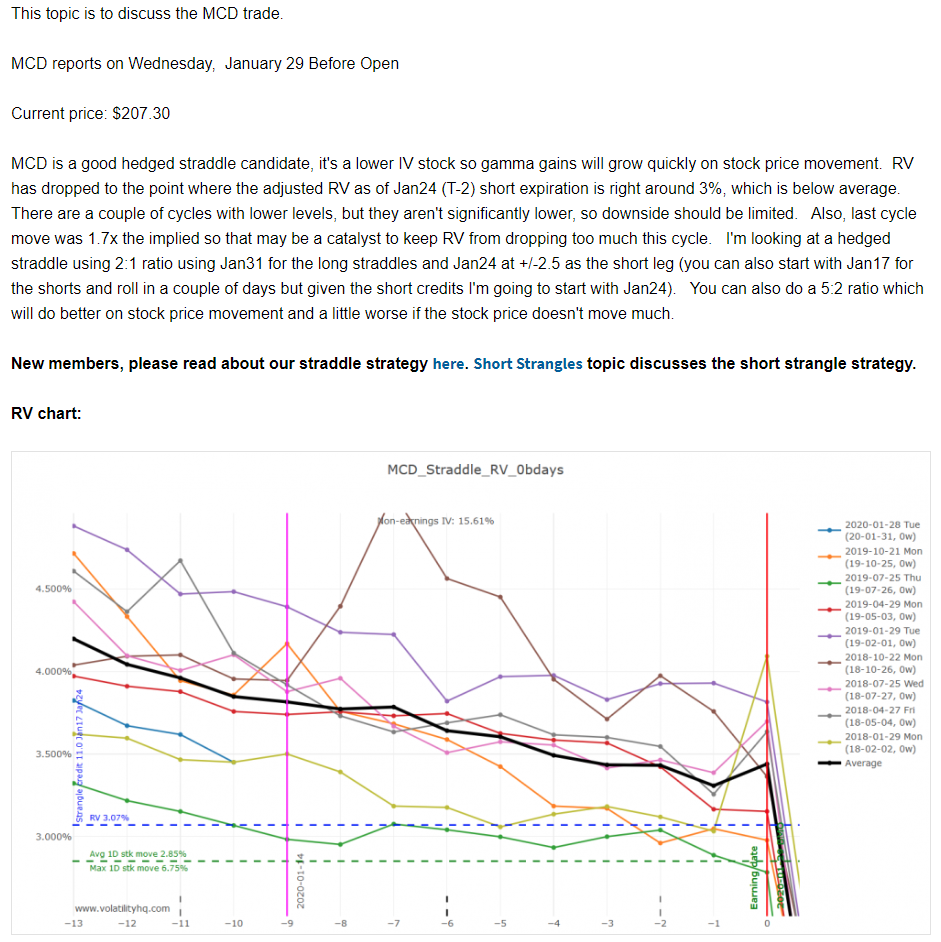

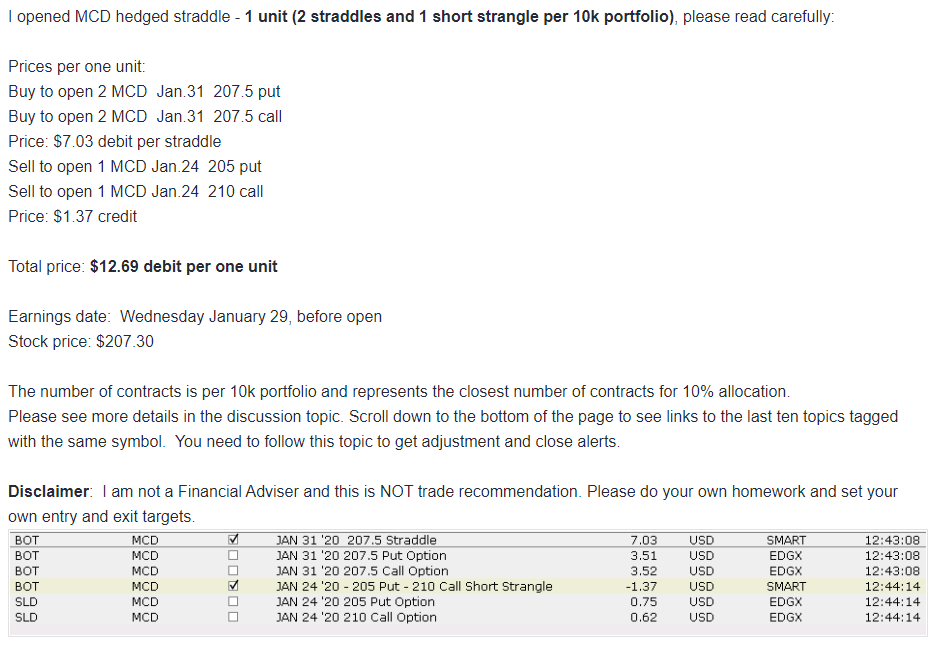

With the month virtually over I thought I'd give an update of my results since I stopped doing the stuff Im bad at (8 Aug to today): 7.8% return on capital including commissions 27 trades with 77.8% win rate Worst loss of 27.3% and best return of 30.2% with an average of 6.8% My trades consisted of most of the official trades along with a number of unofficial trades/strategies that I've learnt directly from the SO forum/members. The official trades that I missed were usually good ones (like BILI) and I whiffed a number of otherwise good ones (BBY was a 1.2% return after I hit BUY rather than sell and had to quickly unwind that mess). Id put the total result down to a combination of focus and luck. Focus in that I used my results to tell me what I seemed to do well and what I wasnt getting the hang of...then eliminating what wasnt working and focusing single mindedly on getting good at the one or two strategies I continued to trade. I cant emphasise strongly enough the benefits I got from just focusing on one thing at a time and relentlessly focusing on improving at it. Luck in that the outcome of each trade is random..so its kind of illogical to think that one or two trades is going to be consistently profitable...but applying the law of large numbers to a strategy with an established edge -ie do it a lot- and the numbers work out in your favour. Its been mentioned that an important step in the learning is putting on your own trades. Through having to identify my own potential stocks, identify my entry points, plan and execute my own exits countless times....well....the learning multiplies. One other thought: trading is the most honest task Ive ever experienced. There is no room for delusion, bias, negativity, optimism, excuses or blame. It demands total honesty of the self. Ive worked in jobs where the majority of the role involved wearing a suit, being likable and appearing to know what was going on...actually generating money for shareholders was an optional extra and could be frowned upon if done in a way that made others feel inadequate...ie most of the job was playing 'dress ups' as a busy business men in business. Trading couldnt be further from it. If you make a profit; thats on you. If you make a loss; thats on you. If you waste time not focusing on how to make a profit; thats on you. So without being provocative -and with the non-existant authority of someone who had a couple of lucky weeks in a row and still has too much to learn- if you're not making money then it stands to reason that its your fault. Putting aside the emotion this statement would conjure up in any human with a pulse, the correct response is to ask yourself what can I do to improve. I dont know if the discussion has moved on or not but I unfollowed the thread when there was a lot of finger pointing about commissions and impossible fills...it was bumming me out and screwing with my mental. The only thing that matters is how each of us can improve; blame is a waste of time. My biggest loss this month was on a low open interest CIEN ratio where the MMs immediately jacked the IV after I entered; the previous me would have bitched and moaned about how it was rigged or unfair. The me that's developed during my time with SO instinctively thought that sucked...how do I reduce the risk of it happening again in future. So I pulled some data, identified some micro structure behaviour, got a sense of where the punji traps were and adjusted my approach. Im still nervous as hell about it happening again and Ive by no means gotten to the bottom of it but the adjustments in my approach allowed me to close out a position today for a overnight gain of 16% all off the back of RV change in a low liquidity/wide spread market. I wouldnt have been able to do that had I not been punched in the face a week earlier and resolve to minimise its future frequency. Iago said whats done is done and John Galt said what is, is but a less esoteric boss once told me that its not how many times you get knocked down that counts, its how many times you get back up. As this last point is becoming a bit abstract but I'll try to bring it down to earth by summarising that a critical part of trading seems to be having an appropriate mentality; specifically one of complete honesty, resilience and self ownership of all outcomes good or bad. If you feel the urge to blame then youre probably on the wrong track. If you feel the urge to find a way to avoid that happening again then youre on a more profitable course. What that one improvement is going to be different for everyone but look at your trading log -you have been keeping one havent you?-, pick only one thing that will make a difference and ignore everything else until you've improved it.15 points

-

Thank you @Yowster for the excellent summary! To put things in perspective, we had 215 trades in 2022, lower than our long term average, and average holding period was just 3 days, due to higher IV and higher risk. It means that we utilized only around 20-30% of the portfolio on average, with the rest in cash. 90% return that we reported was on the whole portfolio - if we reported return on invested capital (like other services do), we would be reporting over 300% return. Thank you again to everyone for their support, and of course special thanks to our contributors @Yowster @krisbee @cwelsh @Jesse and @SBatch We would like to wish everyone Happy Holidays, Happy New Year and healthy and prosperous 2023!13 points

-

Well thank you all for the kind words - I shall do my best to be helpful. I see @craigsmith posted some of his background. First of all I am Dutch, I live in Belgium, I have a French education and grew up in Brazil and in my professional life not a small part of my clients are American. I have been investing since very early days as my parents encouraged me to manage the small portfolio of stocks I inherited as far back as when I was 15. For those unaware of this bit of history the first options exchange in Europe was opened in Amsterdam under the then name European Options Exchange shamelessly copying much of the good work of the CBOE. I got quite interested in this and my first trade involved the purchase of a LEAP on the Amsterdam index and writing short options against it. LEAPS were (and are) undervalued compared to shorter term options and the thought was to recover the full purchase price and then some over the course of the process. This was in 1980ies in a bull period and I found rather sooner than later that the cash lay-out required to buy-back the short option and sell a higher option eliminated my liquidity rather more quickly than I expected. Selling deep ITM shorter options would not give the necessary return so my first trade was a (modest fortunately!) bust. I read more on options - but frankly for a long while I found all the so called strategies to be unsatisfactory as they were to my mind all variants of a long (or short/neutral) punt. Nothing wrong with those but to my mind it didnt make use of what options offered in terms of mechanism. Certainly I wasnt doing this full time and with the usual job, wife, children, house obligations I lacked resources for trading anyhow. In the meanwhile I managed a family trust but that did not lend itself to options trading. I came back to serious options trading when I had more capital and time to devote to it. Like most on here I looked a long time in both books and OL resources finding absolutely nothing that told me something new - its all very well to know about butterflies or condors - what you need is something where as the small guy you can make use of things that larger parties cannot adequately make use of. A few years ago I came across Jeff Augen's books which were quite an eye opener - for the first time it gelled in my mind how to use that odd derived value volatility for something more interesting than just option (mis) pricing. Looking into volatility traders turned out to be an (initial) disappointment - they certainly talked very complicated language but I got the distinct impression that most were types that claim to have a winning strategy to play Baccarat, just gamblers with a big mouth. Through SeekingAlpha and another site I came across SO and was immediately interested - however i had been disappointed before so for a long while I watched from afar and read the many publicly available articles on SO. Then there was a rather nasty public spat in which Kim got drawn in by a disagreeable fellow on the other site - Kim's responses impressed me by their cool and reasonable manner. This gave a whole new credibility to the 'claims' on the SO site and I decided to join, so whilst its true that I have been here less than a year - I lurked for a long while before. What I picked up on SO has really helped me and i am now trading very frequently and much more structurally successful - the CA part of the offering was new to me but after paper trading in a first stage, I have been diligently following on here ever since. SO made me trade better and hopefully I can assist some of you to get better too.13 points

-

I'm asked many times how I choose between Straddle, strangle or RIC for my pre-earnings plays. It's always a balance between risk/reward. As we know, those trades are supposed to be sold before earnings. They benefit from IV jump and/or price movement. The biggest (and basically the only) enemy is the negative theta. When buying a strangle, we are buying calls and puts with different strikes. The strangle will have the largest negative theta (as percentage of the trade value, not absolute dollars). Further you go OTM, the bigger the negative theta. If the stock moves, the strangle will benefit the most. If it doesn't it will lose the most. I found that if I have enough time before expiration, deltas in the 25-30 range for both puts and calls provide a reasonable compromise. For lower priced stocks, I would prefer a ATM (At The Money) straddle (buying the same strikes). For example, strangle on a $20 stock might be very commissions consuming, plus the negative theta might be too big. Please note that when I'm talking about the theta being larger or smaller, I'm always referring to percentages, not dollar amounts. In absolute dollars, the theta is always be the largest for ATM options. However, since those options are also more expensive in dollar terms, percentage wise the theta will be the smallest. For higher priced stocks (over $100) I will usually do RIC. Since you sell a further OTM strangle against the purchased strangle, this reduces the theta of the overall position. It might be the least risky position and still benefit from IV jump like AMZN trade. I prefer to have spreads of $5 for RIC. Since I don't know what will happen with the stock I play, I prefer to have a mix of all three. In case of a big move, strangles will provide the best returns. When IV is low, RIC will provide some protection against the theta while still having nice gains from time to time. Remember: those are not homerun trades. You might have a series of breakevens or small losers, but one down day can compensate for the whole month. This is why I want to be prepared when it happens. In August I had 4 doubles in two days (but I played mostly strangles). Generally speaking, RIC is the most conservative trade due to lower negative theta (the sold strikes reduce the negative theta). But if the stock moves sharply, strangle will produce the highest gains. It also might lose the most if the stock doesn't move and IV increase is not enough to offset the theta. Let me know if you have any questions. This post has been promoted to an article13 points

-