SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 11/04/22 in all areas

-

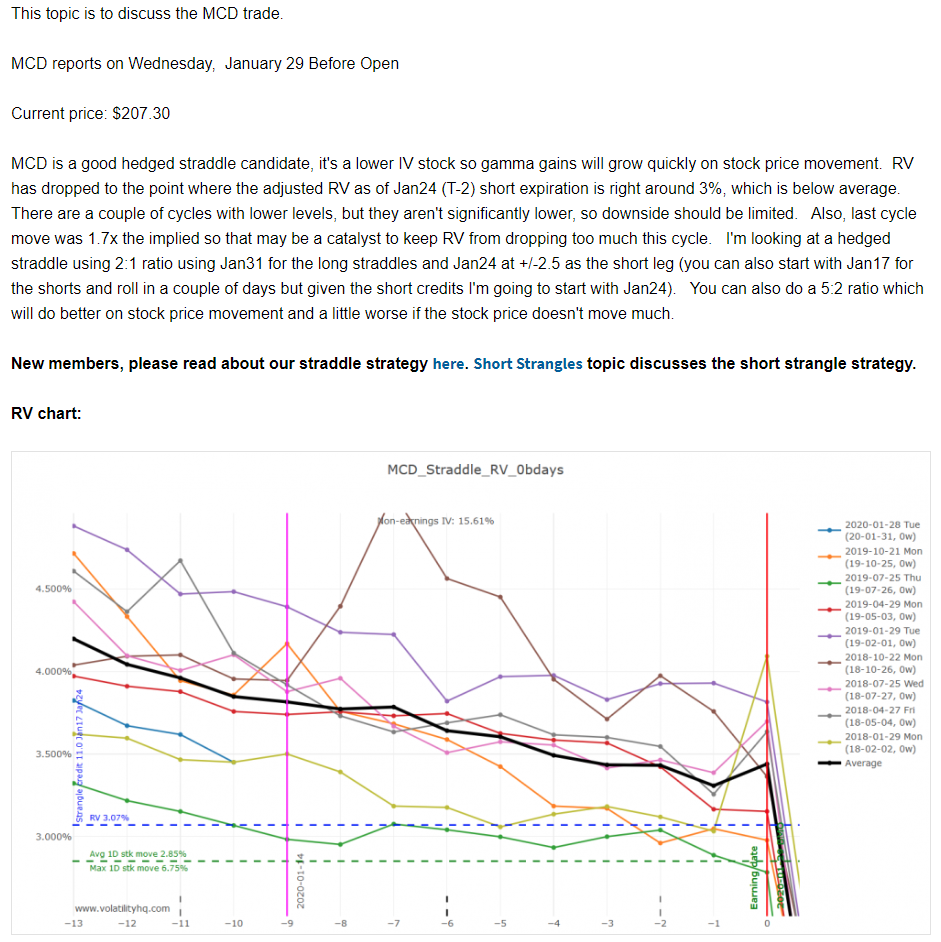

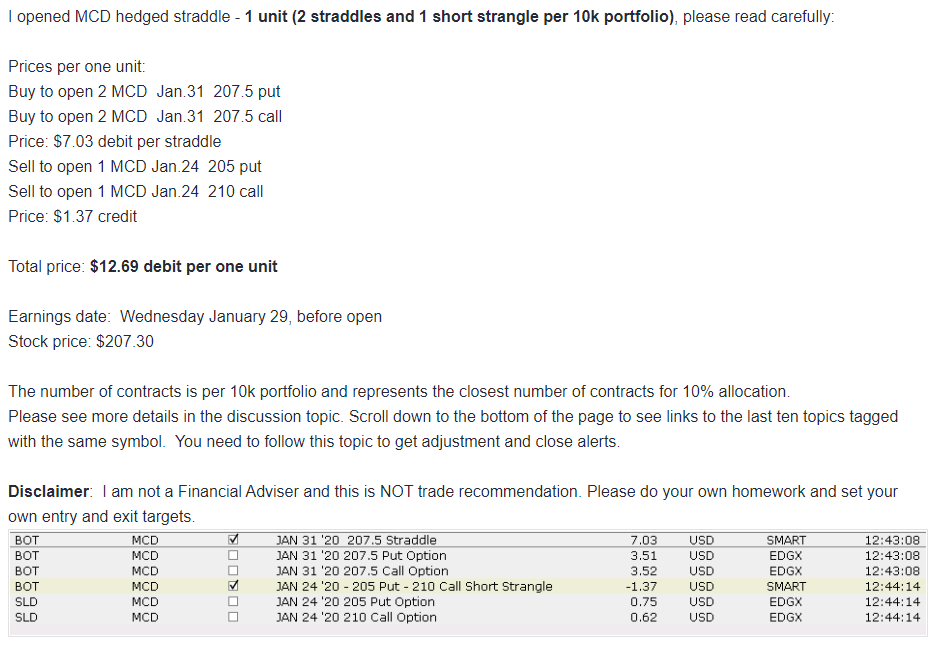

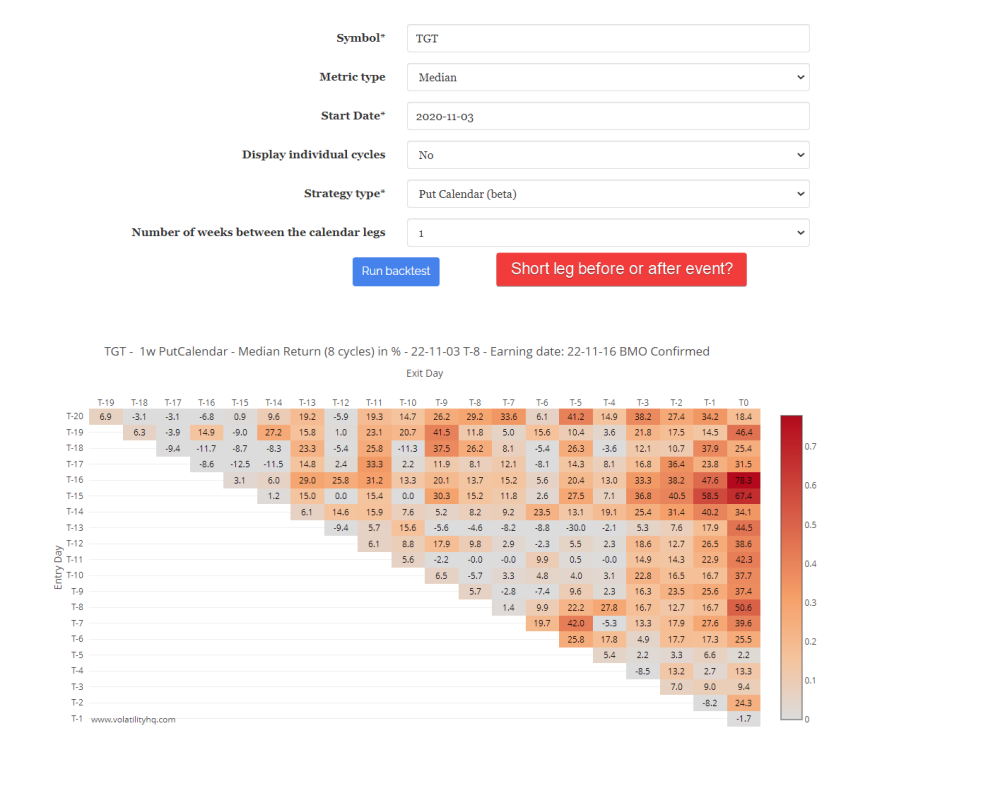

Welcome to Steady Options! Please spend few minutes to read this post, the Frequently Asked Questions and the Useful Links. It will be time well spent. SteadyOptions is a premium options trading advisory service. We offer a combination of a high quality education and actionable trade ideas. Our forums and the trading community are the heart of the service. The focus of the service is on non-directional strategies like Long Straddles/Strangles, Calendars, Butterflies, Iron Condors etc. We always trade defined-risk strategies, never naked options. You need to create a forum account to get access to the service. We are sharing our trades with full explanation of the Greeks, the risk/reward, the best time to entry/exit, price targets etc. Full follow-up is provided, including entry, adjustments and exit. You might expect 10-15 trade ideas per month. We will usually have about 4-6 trades open, some are short term (2-6 days), some medium term (3-5 weeks). We use portfolio approach and will have trades balancing each other in terms of theta/vega/gamma. Please note that suggested portfolio size for SO trades is $10,000-$100,000. We do NOT recommend trading accounts larger than $100,000 due to potential liquidity issues. We recommend using one of our other services for larger portfolios. We will also provide options education. I encourage you to ask questions about options trading. Please note that we don't provide auto-trading. SteadyOptions is an educational resource. I want my members to be in a full control of their trading. In addition, SEC considers newsletters that engage in auto-trading to be investment advisers, and I am not licensed to be an investment adviser. So most newsletter that engage in auto-trading are breaking the law and are exposed to lawsuits like this one. You can read more details here. The SteadyOptions forum has several sub-forums (access to members only): SteadyOptions Trades - this is where the official trades are posted. Any trade posted on this forum by any of the contributors @Kim @Yowster @krisbee or @TrustyJules is considered an official trade. SteadyOptions Discussions - This is where we discuss our trades. Unofficial Trade Ideas - This is where we discuss our unofficial trade ideas. In addition, SteadyOptions members have access to all Members forums where we discuss general issues, strategies etc. You can start topics and post on each subforum except “Trades Discussions” and “SteadyOptions trades”. You can reply on “Trades Discussions” forum. Each trade has a separate topic in “Trades Discussions” and “SteadyOptions trades”. The SteadyOptions Trades forum is used for posting our trades. To get notifications about my trades, you will need to follow that forum (by clicking "Follow this forum" button). Each trade has a separate topic, with our entry price, exit price and some comments. We will start a topic for each trade in the “Trades Discussions” subforum and you will be able to post your replies. You will need to specifically follow each forum you want to get updates from. When you follow the forum, you will get an email about every new topic in that forum. If you are interested getting emails about new posts in that topic, you will need to follow that topic. We recommend to follow all forums to get notified when new trade or trade discussion is posted. You can also follow specific members to get notified every time they post. SteadyOptions model portfolio is based on 10% allocation per trade (some trades are 5% and considered half allocation). Average of 5-6 trades is open at any given time. Performance returns are based on the entire portfolio, not just what was at risk. Please note that we usually don't hold our trades through earnings, unless specifically indicated. More details: Why We Sell Our Straddles Before Earnings Why We Sell Our Calendars Before Earnings Our goal is to share our experience and to help you to become a better trader. The trading notifications are based on our real trades that we are sharing with subscribers in real time. SteadyOptions is not a recommendation letter and I am not a financial adviser. However, let me give you few general tips: We encourage you to do your own homework before following any of our trades. If you are new to options or to those strategies, start with paper trading, then start small and increase your allocation as you gain more experience and confidence. Try to understand what we are doing. Ask questions. This is why we have the forum, and we welcome questions and discussions, no matter how basic they are. Don't wait for our notification if you like the trade. Enter if you like it. Exit based on your own profit targets. Our advice to members: learn the strategies and make them your own. Do NOT blindly follow the trade notifications. You need to understand what we are doing in order to adjust your entries and exists to changing market conditions and be proactive. SteadyOptions is a trading ideas generator rather than an alert service. If you are using it as a pure alert service, you are not taking advantage of all the wealth of knowledge and learning we offer. If you expect a pure alert service where trading alerts are just delivered to you without any effort and time commitment, this service is not for you. You will be expected to invest time and effort, please do NOT sign up if you are not willing to do it. I recommend reading My Seven Stages of being an SO Member to get a better understanding of how veteran members are using the service. My commitment to you: I want to make money with you, not from you. All I ask from you is to give me a fair chance. If you decide that you like the style, give it some time to work. Don't give up after a couple of bad trades. We are here for the long run. Don't concentrate on short term performance. Concentrate on your education. Concentrate on managing risk. If you do that, the profits will come. How to make the best use of SteadyOptions For the benefit of the new members, here is how SteadyOptions works and how to make the best use of your subscription. We use a limited number of non-directional strategies, described in the following topics (access to members only): SteadyOptions strategies How we trade straddles and strangles How we trade pre-earnings calendars How we trade Iron Condors How we trade Calendar Spreads How we trade butterfly spreads Full list of "Must Read Topics" is displayed on the right side on the main forum page. Please make sure to read it. You will need a margin account to trade most of those strategies. Here is how we trade the earnings trades: Every week we post post a list of trading candidates for the next week in Earnings Trades Discussions forum. We have some general discussion about the candidates. We will post a separate topic for each candidate I think it suitable, with analysis of the suggested prices, average move, previous cycle etc. The topic will always include a link to one of the relevant strategy topics above. This allows members to do their homework and to see if they like the potential trade. If you agree with the analysis, you can go ahead and make the trade. We will try to get the trade at the best possible price. When we do, we post it under the Trades forum. You should follow this forum to get email notification about the trade. We recommend that you try to get the trade as close as possible to the alert price. We don't recommend chasing trades. We cannot tell you what is the maximum price you should pay. It is your decision. Sometimes you will be able to get the trade the next day cheaper. Sometimes you will miss the trade. We make about 10-15 trades each month in our model portfolio plus similar number of "unofficial" trades. Don't feel obligated to take all of them. After entering the trade, please set reasonable price target. We usually start with fairly aggressive target and lower it as we get closer to earnings. Please look at liquidity, especially if you trade large amount of contracts. For our earnings trades, it is very important to close them before earnings to avoid significant loss. Here is an example of a discussion topic: And a following trade notification: In addition to earnings trades, we also trade different non-directional strategies not related to earnings. There are also many unofficial trades in a dedicated Unofficial Trade Ideas forum. Those trades are not tracked but they are integral part of the service. They are usually posted by me or one of our Mentors and are based on the same strategies as official trades. They don't make it to the "official" model portfolio for various reasons, such as: model portfolio full, size of the trade too big to fit the $10k model portfolio etc. We set different profit targets and stop losses for different strategies, and we also recommend that members set their own price targets. The best way to use SteadyOptions is to learn the strategies and make them your own. If you do that, you will be able to take full advantage of our service. You will be able to make your own decisions, based on our discussions. Getting good fills is part of the learning process. Over time when members gain more experience, they learn how to get better fills. Many members started as complete novices and now they take the trades even before I do and get better results in some cases. But those things take time. I highly recommend following the discussion topics to see how other members utilize the service. I also recommend following our Mentors for valuable tips and insights (more about our Mentoring Program). If you cannot get a fill on the exact trade, there are many ways to trade the same strategy (using different strikes, different expirations etc.) If you understand how our strategies work, you will be able to do it and see what other members do. I see the community as the most valuable part of the service. New members, please spend some time getting familiar with the forum and the strategies before jumping into live trades. Why SteadyOptions is different There are many services that trade exclusively one strategy, like credit spreads. While they might make decent returns 9-10 months per year, 1-3 bad months when the markets make sharp moves can wipe out months of returns. At SteadyOptions, we offer a complete portfolio approach. We use a diversified approach by trading a mix of non-directional market neutral strategies and balancing the portfolio Greeks. In order to hedge our theta positive gamma negative trades (like Condors and Calendars), we will always have gamma positive trades like straddles or strangles. We will discuss the following key elements for our earnings trades: Which strategy is appropriate for the specific stock. When is the best time to enter. What is the optimal entry price. Backtesting of previous cycles. What is the appropriate adjustment. What is the profit target. How Theta, Vega and Gamma impact those trades. Please make sure to read Frequently Asked Questions for more details. Finally, a quote of one of our members: I see SO as an educational course with live trades examples and the ability to discuss them with a like minded community. I don't expect or frankly care to perform as well or the same as the official returns, for the most part I don't even enter official trades unless it fits with my own strategy. Or the sectors/symbols that I like investing in and a myriad of other factors. So far, I learned a great deal directly and indirectly from SO and see a good ROI from both trades and knowledge accumulation. The truth is that about 90% of options traders will either breakeven or lose money. The same applies to any competitive sport or business, 90% will give up and stop playing, 9% will be considered average or good players and the top 1% the pro athletes will thrive. The copy and paste approach doesn't work for options... there are no shortcuts. Don't expect to look or learn how a marathon runner is running and expect to be able to run the marathon faster or even at the same pace. A person search for a one solution fix all or the "holy grail" is futile, there is no such a thing. The only thing that works is hard work, dedication and continuous learning. Every athlete will tell you the same.1 point

-

Like many other new members, I went through a frustrating time on Steady Options. I almost gave up on it very early on, but luckily, I hung around. Having been here a while now, I’ve seen other newbies come full of enthusiasm and leave full of disappointment, walking the same frustration-filled path that I left behind. I’ve examined my own journey, and can break it down into various stages. So, here they are. Other peoples’ journey may be very different, but I hope that my pathway may shed some light, or give some hope to others who find themselves shouting at the cat for no reason, like I once did. 1) Initial Enthusiasm I joined full of hope and excitement, lured by the mouth-watering annual returns, thinking “If I can make even half of those returns, then I’ll be a happy-chappy”. Motivation Level : 10/10 2) Frustration with Fills Okay, I’ve been a member for a few weeks, and have tried to enter a few trades, but each time, I cannot even get close to the official entry price. I give up on many trades and enter others at the wrong price, resulting in more losers than winners. Motivation Level : 7/10 3) Frustration turns to Fury (well almost) It’s now many trades later and the fills are not getting any easier. It’s getting annoying seeing others open trade after trade and close it two days later at a profit, whilst my GTC order to buy is sitting idle on some exchange gathering dust. I’m a mild-manner guy, who wishes no ill-will on anyone, and thought I didn’t have a dark side, but the ugly monster of jealousy is tapping me on the shoulder and saying “Damn, there’s another guy who’s just closed the GOOG calendar for 30% ….AND….he’s gone in and out twice already this cycle, whilst you can’t even get in once?”. I'm anything BUT a happy-chappy. Motivation Level : 3/10 4) “I’ve had enough” Months have rolled on, my SO portfolio is not showing any gains whilst the official portfolio is showing a healthy number. I don’t even bother trying to enter any SO trades now, and hardly logon to the forums. I’m bitter and just waiting for my membership to expire. Motivation Level : 1/10 5) The last Attempt Over a year has gone by, and the anger and frustration has turned to “Let me give this lousy service one last chance, before my membership expires”. I register with one of the two charting services (ChartAffair/VolatiltyHQ), and spend the whole weekend reading up on old trades, and asking myself “Why did Kim enter this calendar at this price? How does he know that it should be a 1-week or a 3-week calendar?” I look at the RV charts and start to see that the official trades are entered at very low RV’s and every time I over-pay, I’m reducing my chances of profitability. I’m seeing patterns in the calendar RV charts – a ramp up as we get to earnings, a zig-zag pattern that allows others (who I envied) to go in-and-out of trades multiple times. Same for the RV charts for straddles. I’m starting to see why Yowster thinks something is a good buy or not. My head is filled with little “ah-ha” moments and learnings, and the next few days I watch live prices and then I do the un-thinkable – I open my own calendar trade on PANW for 0.89. The very next day, Kim opens the same Put calendar for 1.05 – Bingo! I feel a sense of un-controllable excitement, not just cos I received validation that my trade was correct, but that I actually got a better price than the official. (https://steadyoptions.com/forums/forum/topic/4106-trades-panw-november-2017-calendar/?tab=comments#comment-87397) Motivation Level : 7/10 6) Creating my own Trades I spend Nov and Dec ’17 coming up with tons of my own trades – calendars and straddles. I'm not really too sure of what I'm doing, so some are winners and many are losers. I’ve started doing something else – I’m now keeping a proper journal. Every trade is logged together with the rationale behind it. If it goes wrong, I try to understand why. I’m trading full-time and this has become all-consuming, but I am enjoying it. My knowledge and skill level is rapidly increasing. For the first time, I make a profit for the month (12.9% for Nov ’17). I’m on a high. I still try to enter official trades, but don’t get upset if I miss many. I do this for a few months, averaging around 6% monthly profit overall. I also increase my portfolio size. Motivation Level : 8/10 7) Consistency at Last Two years later, and I have traded several earnings cycles, done literally hundreds of my own trades, and I rarely take the official SO trades. Fills are not a problem, as I’m normally in the trade already, and I’m also trading stocks which are not on the SO list. Profits are decent, but I get some big losses, and the occasional losing month. I don’t like those, so I ramp-up the commitment. I decide to REALLY focus on this from 01-Jan-20. And then a dark-cloud-with-a-silver-lining comes along – COVID lockdowns. They suit me just fine: 7-8 hours a day – just me, the PC screen, charts, Excel sheets, Word documents detailing my ups/downs, cups of Earl Grey tea…..trade after trade. Total immersion. I love it. The wife has become a trading-widow. The cat is happy to be around me, cos I am no longer shouting. My profits rise to new levels, the March crash comes and goes without a dent to the bottom line. As we head towards the end of the year, I can finally say to myself that I have matured into a proficient SO trader – my risk management has improved enormously, my position sizing is as it should be, and my ability to distinguish between good/not-so-good trades has improved. I still screw up, but I keep a list of the mistakes I’ve made each month, and it’s satisfying to watch that list become smaller as the months roll on. I have finally found consistency – I’ve made a profit every single month this year. And my SO portfolio is far more profitable than my other ones. But the learning never stops – every week I read some post on the forum and think “Oh, wow, I didn’t think of that.” I’m no longer a SO member for the trades, but for the ideas and the discussions on the forum. They are gold. And I’ve learnt skills that I’ve been lacking for a long time – patience (no more “FOMO”), discipline (sticking to the rules, no doubling-down etc), no emotional trading (no revenge trades, not getting upset when a trade loses etc) The next stages are to get to grips with different trade types, like ratios. Motivation Level : 10/10 I’ve written this not with the view of “Hey, look at me”, but in the spirit of “If a dunce like me can become a competent trader, then anyone can”. If you’re a frustrated newbie, then rest assured that many of us have been there, many others are still in that place, but with determination and dedication, it’s possible to come out of the pain barrier, and see the sunshine on the other side. Happy trading.1 point

-

Fyi, as part of the fixes needed to be made to properly support the FB -> META symbol change properly, I need to rebuild some of the caches from scratch, so the website is going to be slow starting now. It should complete during the weekend, will let you know when I see it back to normal. Sorry about that, but I underestimated the complexity to support the feature.1 point

-

1 point

This leaderboard is set to New York/GMT-05:00