SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 08/24/20 in all areas

-

I don't mean to sound indifferent as I remember feeling like this too. I remember getting so excited about the official SO performance and I was day dreaming about all that money I was going to make. Each time I saw Yowster and other make profits when I was losing money felt like a knife being jammed into my heart. It sucked. I get it. Based on my own journey - the sooner you stop trying to duplicate the official trades and admit to yourself that you cannot duplicate them the better. Unsubscribe from the SO alerts and just follow the unofficial trades and the trade discussion group to see what people are looking at (many times you find these trades before the official ones giving you a chance to get in early). Are Kim and Yowster trying to pull a fast one on us? No - but you also cannot replicate their trades exactly because some of these trades have low liquidity. As soon as any market maker sees 100s of orders coming in at the same strike they are going to raise the price of the options. This means you will always get filled on the losing trades and maybe get filled on some % of the winning trades. This can easily flip a strategy that makes 50% a year to one that makes 0% per year. So - once you admit that to yourself you have two options: 1) Give up. Move onto the next guru who claims they can make you a millionaire. 2) Figure out how you can make this strategy work. Whenever you miss a trade you can complain which won't change anything or instead ask Yowster what exactly he was looking for when he entered. Learn from him so you can spot your own trades and maybe get in before everyone else. I went from complaining about SO and quitting here to just closing out several calendar trades for 30% each. None of them were official trades or even mentioned on the board here. Just used the information Yowster teaches us and VOLHQ to find my own setups.5 points

-

The point's been made before, but even very high liquidity options can have their prices (and especially spread prices) temporarily disrupted when a sudden influx of orders hits. This is the algos trying to predictively front run the order flow. So I second @FrankTheTank's remarks. But also, I say again, there is no such thing as an options advisory service that doesn't suffer from this problem, especially ones that trade spreads or multilegged strategies. Also, maybe it's been mentioned, but I want to give Kim some kudos for allowing this discussion on a non-member board. Any prospective SO subscriber can see this. If this whole thing were a ruse or whatever, you'd think he'd prevent threads like this from being publicly visible on his own site. (You'd also think he wouldn't allow monthly memberships that can be canceled any time.)4 points

-

I agree with you. It's good to see different opinions and different perspectives, although it can be pretty upsetting to be accused of misleading marketing, when in fact we do zero marketing and zero advertising. All the necessary information is in the service description. It describe exactly what SO is what it isn't. All you need to do is reading the service description before subscribing to set the right expectations. But I guess people see what they want to see. Members who feel misled are free to look elsewhere and compare what other services offer. To add to @Yowster last post, at this point he is posting 70-75% of the trades, so for his trades, I'm in the same boat as the rest of the members. And I do exactly what I recommend other members to do: being patient, scaling in and out, setting my own profit targets, using slightly different strikes and expirations etc. Yes, I miss some trades here and there, and I also take some unofficial trades, there are plenty of them. My personal account performance is very close to the official performance, and I'm trading few times the official model portfolio size and keep higher percentage of the account in cash. So it's completely doable, even for larger accounts, and it's not just few members that learned to do it successfully, it's much more. But yes, you need a lot of effort and practice to do it. Show me how to make 100% a year with no effort, and I will close the service immediately..2 points

-

I wanted to start this thread to discuss what and if I am doing something wrong and maybe even suggest some positive improvements that can be made. I will first start this with declaring I am not making any money using Steady Options so far. As a matter of face I am down around 10-15% of my funds since I started. This is absolutely not intended to criticize this service. The intention is to get to the root of the problem and understand what could be going on. That said, I am going to list the following observations and would love your thoughts about the same: 1) So we all understand this is not an alert service and should not be used that way. I would like to confirm this again since when used as an alert service, it's very unlikely to make money from it. My P&L confirms this. My understanding is that when you are following official trades....you are not getting the same fills as the official trades. In order to get a fill, you end up giving away more money so you end up never matching the performance of official trades. If/when you choose not to offer more money to get the fills, you will more often not get filled at all. I have raised this concern few times but I have been told there is enough liquidy for the underlying that we should be able to get filled at official prices or better.....but it evens out. I personally do not believe this. I have attempted to take every single official trades within reasonable time of it being announced and either do not get filled at all at official price or I just end up spending more to get filled. This happens for over 70% of official trades (my best guess) I am just emphasizing the importance of setting up expectations that Steady Options just cannot be used as a "Alert Service" It will not make you any money. Most likely you will lose money. 2) Ongoing Cost: I find it quite frustrating to have an ongoing cost of closer to $300 a month for the service itself and bare minimum tools required to understand the trades and the dynamics of those trades. That spend would be justified if you could even create returns close to it by investing/risking 10K. But I have not been able to even create ROI for a 10K account even to be able to break even with the cost involved. 3) Learning: I sure have learnt a lot in last 3 months of being on this. I have spent countless hours going through hundreds of articles and thousands of posts here but honestly I still don't find myself having an edge to create a positive returns for my capital. I sure do understand a lot of things better about Options trading before I had joined. But I believe I still can't convert this acquired knowledge into money even with decent funds to invest. 4) Continuing the last point....is it really so difficult to make money Options trading? I mean with 100s of members here with all the great knowledge, why am I not able to still make money? Is it just me? I am really curious how many members here are able to make decent returns. What are they doing differently? I don't claim to be the smartest person....but I do have basic sense to judge what I am capable of and what my weaknesses are. Why do I still not make money here? @Kim Again I would like to clarify that this post is not intended as a complain but an attempt to understand what I could be doing wrong and how I can improve on it. I still believe that by making some changes somewhere (I don't know) any and all members here can achieve same or even better performance than the official trades. I would like to achieve that but I am still not able to figure out how.1 point

-

I'm curious how do you know that? Even I don't have that information. What I do know is that many members reported that they make well north of $50k/year using SO strategies. Pretty good ROI on $1k investment. Many people in the US (not to mention many developing countries) don't make that kind of income in their full time job. But it took those members much longer than few months to get there. Thank you @Ticc I still remember your post: "for me it is big satisfaction that I have made this trade before you did. (same strike, same price) The reason was as same as you had. I have spend lot of time with learning last few months from you and now it pays off. Thank you." And for me it is a big satisfaction that many members are still using what they learned here even after cancelling.1 point

-

Let me give some perspective from my own personal experience. When I first joined SO in 2013, I was just a regular member just like everyone else. I had experience with directional options trades but wanted to learn about the non-directional trading. When I entred official trades, I didn't always get at or below the entry price but I tried to enter near the official price and sometimes waiting a day or more to enter. I tried to not pay more than 1% or 2% more for straddles as they have lower gain targets, I'd pay a little more at times for calendars since they have higher gain targets. I'd set my own exit targets, not waiting for the official trade notifications. But, from the very beginning, I tried to adapt the trades to other stocks for my own trades. And back then, it was more difficult because we didn't have the RV charting tools to make the analysis quicker and easier. Once I'd mastered the in's and out's of the trade setups and how IV changes played such a huge role, I began to come up with tweaks to the trades - that's how the entire hedged straddle setup originated right around the timeframe when weeklies became available for some stocks (I knew that in the vast majority of trades we didn't get huge stock price moves so the shorts would add to smaller gains and make small losers break-evens or small gains). Even now, although Kim and I discuss some trade ideas, we react to each other's trade posts like everyone else when we try to enter. I apply my same logic for entering Kim's trades that I did back in 2013, and I'm sure Kim does similar when I post new trades. @yalgaar - regarding your suggestions around opening trades, I mean no disrespect but I feel these ideas come from your goal of trying to match official trade performance, where the SO goal is to educate as to why the trade setups look good when we enter them. I spend a ton of time explaining setups and answering member's questions - happily doing so knowing that they ask because they want to learn. I need to spend my time looking for new trades and answering the questions, so I don't want to add extra rules and restrictions as to when I enter a trade. Since I've been at SO, in general, the disgruntled members usually are the ones that only follow the official trades and the happier members are the ones who try to use the knowledge to create their own trades. I realize that a lot of people don't have as much time to devote to trading, so its more difficult for some people to adapt SO trades to their own stocks. If you can only play the official trades, then don't go in and expect the same returns, but if an official trade has a 10% gain and your same trade winds up a loser then it's probably you who missed an opportunity to exit. I always use the analogy of when a analyst issues a stock upgrade/downgrade - does everyone get to buy/sell the stock at the same price as when the recommendation came out? Of course not and I don't think any investor would think so, so it always perplexed me as to why there is so much discussion about entering SO trades at exacly the same prices as the official (I never had that assumption when I tried to folllow and enter an official trade). Based on the discussions and unofficial trades forums, many people are actively working on applying SO techniques to their own trades - and that is ideal and makes me happy that the time I devote to answering setup/strategy questions is helping people with their own trades. For the official trade strategies, I'd encourage people to learn the stratagies and research their own setups because there are 2 main reasons that a good setup doesn't turn into an official trade: For the higher priced stocks, the allocation size is simple too big. I know that when we were doing a lot of the NEHS trades, people were using stocks like AMZN and got good results but the allocation size was orders or magnitude higher than an official trade. Same thing applies to some earnings hedged straddles for some higher priced stocks. Also trades like call ratios on AAPL and TSLA over the last month or so. Some stocks don't have enough volume/OI to work as an official trade, but for an individual investor can work well. I do these kind of trades a lot in my own personal trades (I don't mention them in unofficial trades because I know if I do then they can turn into a psuedo offical trade). If you are unsure about something, post your setup and question in the unoffical trades forum (or send personal messages) and many members try to answer your questions.1 point

-

I made a little tally of the SO trade results so far in 2020 (Results were compiled based on the data available in the Performance section of the SO Website for 2020) . I will let you judged the results by yourself but I have to admit that I am impressed by the states especially by the fact that only 15 trades (10.3% of the trades) had a -10% yield or worst and that 71 trades ( 49% of the trades) had a +10% yield or better. That's a very good risk management... I thought It might be interesting to share.1 point

-

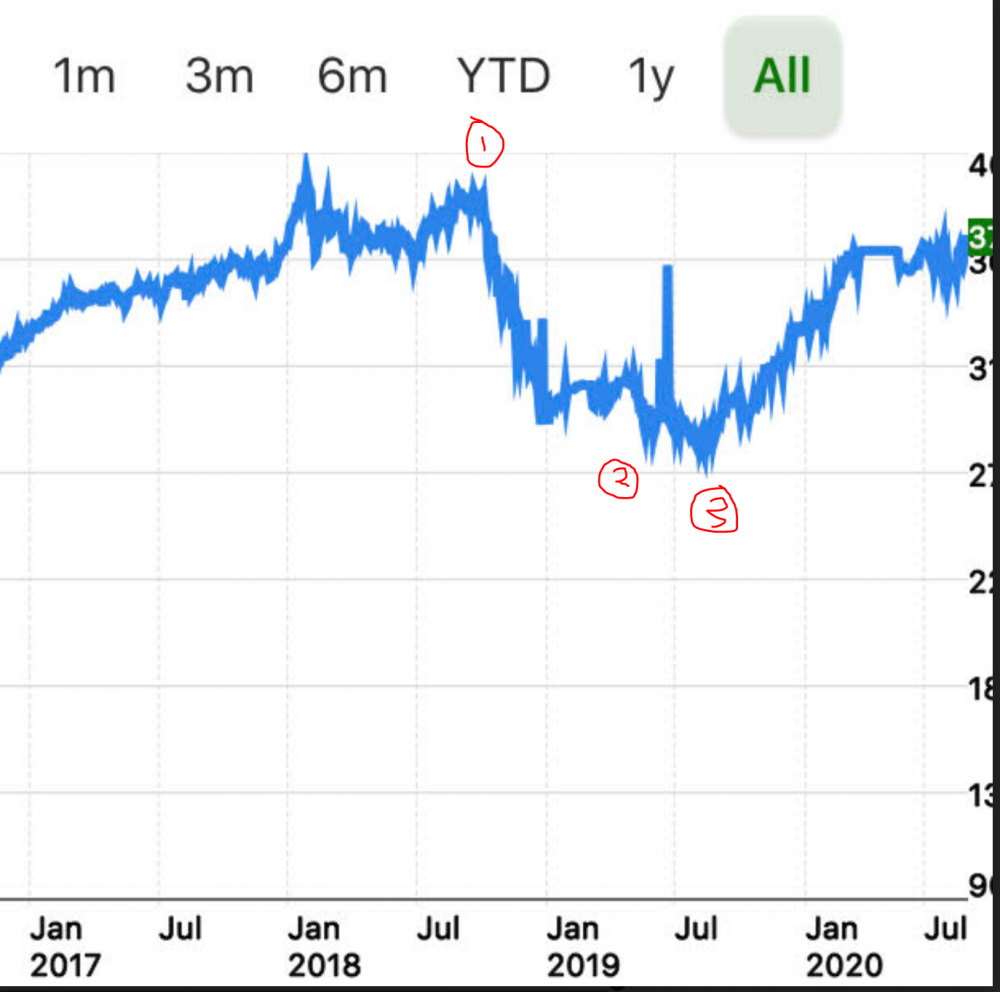

I dont think I should be listed with those guys but I am glad to be pinged on this topic because I have something I wanted to share that is relevant here. I finally figured out how to find an equity curve in my TD Ameritrade Account (can only do it on mobile for some reason). @yalgaar this should be interesting for you because I was in your shoes about 18 months ago and saying the same thing (but just quietly to myself). With reference to the equity chart below (this is mostly earnings and SO trades, I also have an account at RH and two other TD Ameritrade accounts but this one is a good example of my journey) Point (1) I joined SO in the summer of 2018 and had a string of really bad trades (many were my fault, chasing losing trades, over trading, etc.). I just could not make it work. We also had some big 100% losses, HD and GS come to mind, plus a few others where I had on large positions. If I remember correctly this was a rough patch for SO and I joined at the peak and gave up near the bottom. Point (2) I quit SO for the first time somewhere around there, convinced myself it did not work. Between point (2) and (3) I tried a bunch of other options services and continued to lose money. I started to take it more seriously. I turned off my computer, read a bunch of options books, academic papers, and started to really think deeply about options, the greeks, what works, what doesnt work, and tried to figure out why. I kept coming back to SO and earnings trades. It was like an itch I could not quite scratch or figure out in my brain. In my opinion the IV rise before earnings is a consistent edge that we can take advantage of as retail traders. I know the results Kim and Yowster got were real (we can see their trade logs) so I started thinking really hard about that and how to exploit it. I found some of Kim's old articles on Seeking Alpha which laid it all out very clearly about getting your straddles for "nearly free" or something like that and it started to click for me and the light bulbs started going off. Point (3) I started gathering data and doing my own research, largely based on the past work here at SO. I started making my own spreadsheets to track RV (Excel linked to TOS with RTD). I paid for a subscription to ONE and started backtesting as many earnings trades as I could and visualizing how rising IV can push around your T+X lines. I started trading long straddles and calendars on my own. After the first earnings season doing this on my own I had about a 30% return on my account during that earnings period with very little risk/drawdown. Then 2020 hit and I missed out on an entire earnings season and made some bad VXX and VIX type trades. I had a bit of a rough patch the past few 6 weeks or so (took a lot of large losses on some of my own NEHS trades and other speculative plays). But, here is the interesting thing, almost all of my earnings trades have been profitable. Although the equity curve looks jumpy the past few weeks its because I have a lot of non-liquid calendars open where the pnl jumps around a lot at close. My guess is that my equity curve will be close to a new all time high within the next week or two as some of my calendars are starting to turn profitable and RV is moving in my favor. If I did not do any of those NEHS trades and VXX trades it would probably be back at the highs based on earnings trades. So this is not "easy" by any means and I am not even sure if I have this figured out but I can tell you the underlying concepts and principles taught here work and make sense. Blindly following the alerts is not great in my opinion and I wish there was a way to split the group out for those of us that dont even want to follow the alerts (I would bet most of the successful people here do not follow every alert and are in the trades before Yowster even posts them). So if you want an alert service that is "set and forget" I would just quit now and I don't know of any such alert service. If you want to collaborate and learn with a group of really good traders and smart people I think this place is worth the money. Edit/Update - I did not mean to scare people with that equity curve above. If you compare my results back in 2019 to the SO trades you will see I was not following the rules or official trades very closely. Some of my biggest trades were HD and GS calendars which were both assigned to me and 100% losses which was very rare for these type of trades and SO no longer trades calendars that way with the shorts expiring before earnings. Here is my 1 year equity curve which is mostly earnings trades plus some bad VXX and VIX trades I made recently. Even with those losses I am up close to 36% year to date and we still have one more earnings quarter left. I am not posting this to brag as I suspect people here have returns that are double or triple this, rather, to show that earnings trades can work.1 point

-

We had quite a few topics discussing similar issues. Here are couple topics I recommend reading: Best Practices/Tools Last 2 months Performance (your topic actually where you got some very advice). To address your points: 1) We recently started tracking trades where members could get a [BETTER PRICING] than the official trade, on entry, exit or both. Please take a look at this list - this is from the last few weeks alone and not a full list. 2) As I mentioned on several occasions, I believe that looking at SO subscription cost (or the cost of any tool or course) as percentage of your account is a mistake. You invest in your trading education. You invest in your future. You expect that what you learn will help you to improve your trading and your profitability going forward. In the same way as people who pay $5-10k for educational course or mentoring program don't expect an immediate return on their investment. 3) This is related to 2) I'm sure nobody expects to become proficient in any area in life in 4 months (engineering takes 4 years to study). It's a process that takes years not months. In no way I'm comparing SO to what is offered at University, I'm just comparing the time it takes to become proficient in any area. 4) Yes, it is difficult and it takes time. If it wasn't, millions of people would become very rich very quickly. But again, why would it be different from any other area in life? To answer your question more specifically: I don't think you doing anything wrong. Just give it more time, and don't forget that those are very challenging and uncertain times, and even much more experienced traders struggle (just to remind you that July was our first losing month since last June). Add some inevitable mistakes you will make trading new strategies (this is why we recommend starting with paper trading) - and here is your answer1 point

This leaderboard is set to New York/GMT-05:00