SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 08/21/20 in all areas

-

It can be a smart way to invest, if the service's strategy is one that lends itself well to picks and truly generates alpha or risk-adjusted return, not just extra returns by taking extra risk. But that's a huge if. The overwhelming majority of successful "picks" from a typical service rely on beta or other risk factors to generate the return. Anyone can do that without needing to pay a fee. Heck, these days you can do it through low-cost ETFs that will literally do the work of isolating to particular risk factors for you (e.g., beta). SO is a rare outlier in this respect. This strategy generates very attractive risk-adjusted returns, which is the only thing that matters. I have no idea what service you're referring to, obviously, but your skepticism seems very well warranted given the information you've presented. It is not difficult to be up 45% in an equity account since April, considering how equities have rallied since then. To my earlier point, all it would require is buying a few higher beta stocks. Same thing with a directional options service since April. Return is return, but if you're paying someone for a service, you should be getting skill, alpha, and risk-adjusted returns. If not, you could easily replicate it yourself with very little time invested, and without paying a fee.2 points

-

When using any directional service, please pay attention not only to overall returns, but also to volatility. The below losing streak is not uncommon for directional services, and while they might present the performance based on 10% allocation per trade, with such volatility I would never allocate more than 2-3% per trade for directional speculative trades (which of course would completely change the overall returns).2 points

-

For those interested, a little followup with an extra breakdown of the outcome of each trade by strategy so far in 2020 (NB : Results were compiled based on the data available in the Performance section of the SO Website for as per 20200818) . Here are the best three "major" strategy by category so far this year No 1 : Calendars with a ratio of 89.7% Winners No 2 : Strangle with a ratio of 80% Winners No 3: Hedged Straddle with a ratio of 72.4% of Winners2 points

-

Here is a statement I'll get blasted for but I'm primarily here for the trades not the education. I like and want to learn but the way I evaluated the process in the begining was to let the experts make the trades, I place the trades and would be happy to have returns that are say 75% of the official return. While this is going on for a couple years I keep learning and eventually start putting on my own trades. 5 years from now I actually consider myself a well versed options trader. Unfortunately that doesn't seem like a doable plan. I am not interested in devoting the time to paper trade and can't sustain ongoing losses plus fees. I think that is a very doable plan. Following the trades might not match the SO returns but 75% is a very reasonable goal. You might have to make a few adjustments in the mechanics of building the trades. Perhaps I'm reading it wrong but if you have 5 out of 5 winners you shouldn't be losing money. Tighten up your parameters. With straddles and such if you are 2% off on entry and 2% off on exit plus some commission it will be a tough go for sure. Let them go and focus on the trades that don't have to be so exact for now. The market for our historical strategies is slowly coming back to normal and there will be many more trades that won't need as high a level of exactness entering. And nothing wrong with letting the experts make the trades as Kim and Yowster are certainly experts and work diligently to come up with trades to make us money. For example, I am certainly no expert on 30 year or 10 year bonds and don't have any inclination to be but I make sure I get in on every TLT trade that comes up. I focus my time on the stuff I am good at and less on the the trades I'm not really interested in gathering a book of knowledge on. In Canada we aren't allowed spread trades in retirement funds (RRSP) so I also have a cheap but profitable alert service I use for directional trades. That is another area I am not inclined to do the T/A on and pay it very little attention. Like you my goal was to get something going to add to the retirement years. On the west coast the market is over at 1 oclock so lot's of time for a round of golf. This has turned into a lot of fun, my mornings are busy like most retirees, I'm just happier making money than woodworking ha! Everyone has there own goals, good luck.2 points

-

To everyone else I meant to say in my OP I had 5 winners AND 5 losers for -6.2%. That was in May. Wish we could edit. I don't have a PC just using my Android. I don't feel it proper for me to advertise or even mention by name another service on this forum. Even though the proprietor can be abrasive and rude I still won't stand in his "store" and tell out about the competitors. Kim responds to any form of criticism no matter how diplomatic and polite it is in a way I find to be overkill and harsh. Certainly if someone is being a jerk and making stupid comments they deserve it. But...you tend attack in relentless fashion even to polite comments that aren't attacking SO as much s just expressing what they've experienced. That's why I decided to not be as diplomatic in this response. That was probably me that got that wrong. Thought you said you lost money on 5 winners. No biggie. The same holds. Not sure where you are going with this, I don't usually say much but you should relax and focus on filling the coffers. No matter what you made or didn't make in May, June or July doesn't change anything. I'm sure a lot of people did better than me and I did OK. A number of people on this site are going out of their way to help others, listen to what they offer and go from there. And I am pretty sure Kim couldn't care less about whatever other service was mentioned here, no reason he should care. His record speaks for itself. I was referencing a specific situation in regards to Canadian retirement funds. Good Luck.1 point

-

I very quickly realized paper trading means nothing at all. It is completely useless and waste of time. There might be some value of paper trading to only someone who is complete beginner and still trying to learn very basics of trade, the platform and how Options trading overall works. Getting proper fills for the trades enter is everything. I can completely relate. I am glad there is at least 1 more person with similar experience. Like I have mentioned in my posts, I have concluded following trades will not make you money. Most likely you will lose money. I know many members do not agree with me but I don't conclude things without thorough testing. Just like you my expectations were also to just follow the official trades and make at least 50% of returns of official trades while I learn and gradually make 100% of better of the official trades. But I realized we cannot make the same returns as official trades by following it. These were my expectations as well. I wanted to just execute the trades make money from it while gradually learning and get even better at it. But that really didn't happen for me. About learning the techniques of the SO trades and make it our own. What still impresses me about SO is Kim's integrity and honesty. He is a very smart guy and have amazing business sense and he is doing a great work with this service and the most important thing is he is honest......While reporting each and every trade honestly with real fills and still generating the kind of returns is amazing! Even though I am not able to generate the same performance, not even close....who is stopping me from doing that!!! I will it's just me....Kim and Yowster and so many members here are willing to and happy to share every logic in detail about why a certain trade is taken....why it's closed! It may all be difficult but who is stopping us from learning that? They are willing to teach and are very happy to....why not put in our time and effort to learn it.1 point

-

@Kim. No doubt that you are right about the fact that winning ratio does not mean much. By the way I had already read that post ...(worth reading no doubt) Winning Ratio by itself doesn't mean much and that's precisely why I did my other table first. Lets say that the second one (with % of winning trades) was an addition to the first one not a standalone table... Anyway. lets say that I am just doing my personal homework to try to get the maximum out of what you have to offer... Since Its available just wanted to share it for what its worth! @Kim and @Yowster, thanks for all the info.. Very good info... worth every penny!1 point

-

As a new member (less than a month) I can already tell other "newbies" that some hard work is require to succeed. We need to do our homework and especially don't chase the trades. I am still learning the SO methods but to help me target what strategy could have the best outcome (NB: Sample size is limited and market conditions vary and stats have to be taken into that context) took a couple of hours to compile and make a bit of analysis of SO trade stats for 2020 (% of Winners by category)... See my other post. It certainly can be of some help. https://steadyoptions.com/forums/forum/topic/6584-steady-options-2020-stats/ With the % of winning trades, the average return as well as the low average drawdown on losers, I have to admit that If I cannot start to make money on a regular basis here at SO within the 6 months (maybe a year...) I will have to reverify what is wrong with the way I trade because there is certainly a way to make consistent money with what is being teach here with what the stats are telling me. In any case good luck and good trading!1 point

-

@shipdriver I won't repeat everything that others mentioned earlier. I will just say that evaluating a service based on 2 months of experience is really not fair and not representative, especially for a service like SO. Especially considering the fact that those 2 months had returns significantly below historical our historical averages. And honestly, I now understand why many services have only yearly terms. Maybe this is what we need to do as well. Also, I'm sorry to say that, but those who "can't sustain ongoing losses" probably should not be in this business, and fees have nothing to do with the returns. You can pay hundreds of dollars per months for different tools (like ONE, cmlviz etc) and still lose money. As for your comparison to directional strategies (stocks or options), this is really not apples to apples comparison. I hear those comparisons all the time, but they always come after big market rallies, never after big market declines.. Most major indexes are up 35-40% since April, so it's not surprising that your long equity portfolio is up 45% since April. How this portfolio performs during market meltdowns is a more relevant question? How does it perform during periods of sideways markets? Like 2015 when the markets were flat and our model portfolio produced 200% return? Looking at returns alone is meaningless without considering the risk. P.S. This is taken from one of the options trading mentoring programs website: Plan on at least six to twelve months of paper trading and live trading to get to break even. Once you are not losing money, you can slowly start scaling your trading size up. Your doctor, attorney or pilot all started by hitting the books and then getting instruction from a current and qualified professional to teach them their trade. It is no different with option trading. It's a complicated skill set that needs a good amount of understanding before you start trading live. I guess I'm not the only one advocating this approach. btw, most mentoring programs are priced around $5-6k (5 years worth of SO membership). Usually people don't expect to get back their fee during their first year with the program, but for some reason they expect to get their SO fee back during their first few months..1 point

-

I didn't notice any issues with IB. IB has a different set of problems (terrible customer service, buggy algorithm, very unfriendly handling of margin calls etc.) but I never experienced any issues with platform stability or fills. In fact, I still remember that IB was probably the only platform that was fully functional during the flash crash in 2011.1 point

-

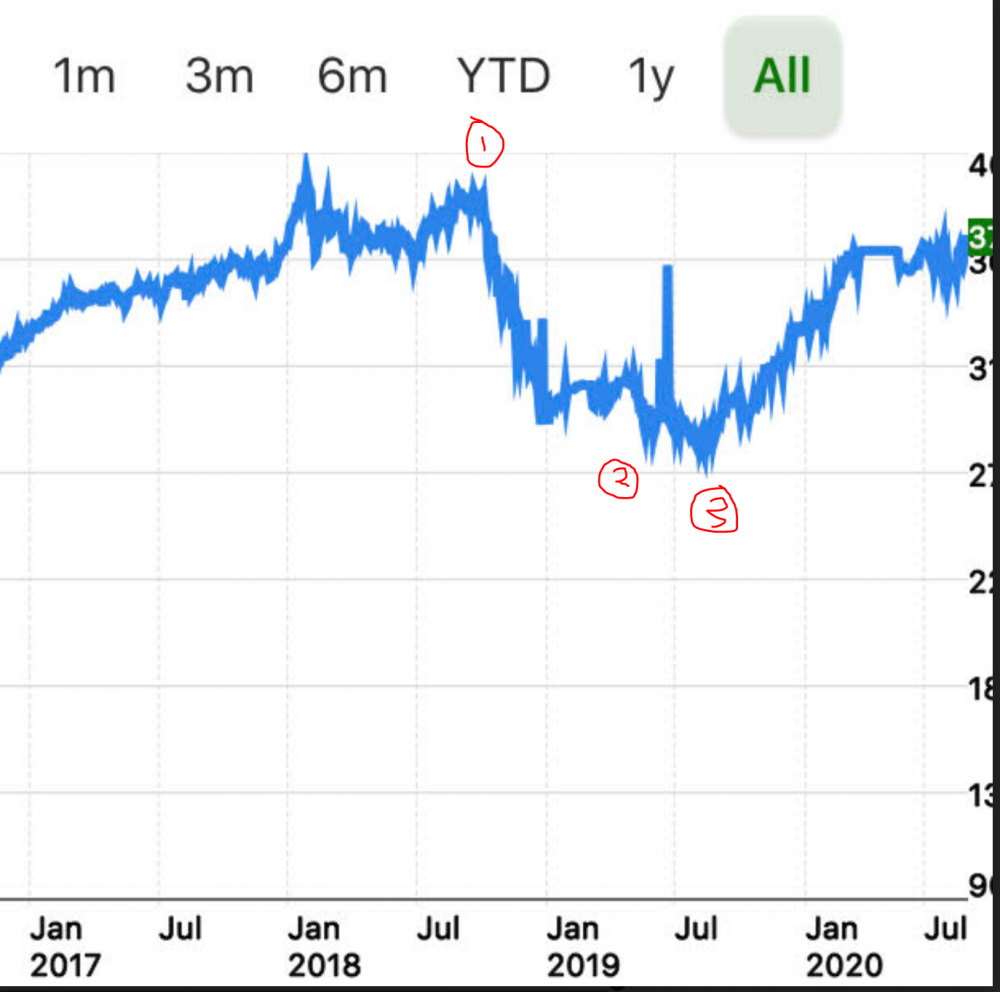

I dont think I should be listed with those guys but I am glad to be pinged on this topic because I have something I wanted to share that is relevant here. I finally figured out how to find an equity curve in my TD Ameritrade Account (can only do it on mobile for some reason). @yalgaar this should be interesting for you because I was in your shoes about 18 months ago and saying the same thing (but just quietly to myself). With reference to the equity chart below (this is mostly earnings and SO trades, I also have an account at RH and two other TD Ameritrade accounts but this one is a good example of my journey) Point (1) I joined SO in the summer of 2018 and had a string of really bad trades (many were my fault, chasing losing trades, over trading, etc.). I just could not make it work. We also had some big 100% losses, HD and GS come to mind, plus a few others where I had on large positions. If I remember correctly this was a rough patch for SO and I joined at the peak and gave up near the bottom. Point (2) I quit SO for the first time somewhere around there, convinced myself it did not work. Between point (2) and (3) I tried a bunch of other options services and continued to lose money. I started to take it more seriously. I turned off my computer, read a bunch of options books, academic papers, and started to really think deeply about options, the greeks, what works, what doesnt work, and tried to figure out why. I kept coming back to SO and earnings trades. It was like an itch I could not quite scratch or figure out in my brain. In my opinion the IV rise before earnings is a consistent edge that we can take advantage of as retail traders. I know the results Kim and Yowster got were real (we can see their trade logs) so I started thinking really hard about that and how to exploit it. I found some of Kim's old articles on Seeking Alpha which laid it all out very clearly about getting your straddles for "nearly free" or something like that and it started to click for me and the light bulbs started going off. Point (3) I started gathering data and doing my own research, largely based on the past work here at SO. I started making my own spreadsheets to track RV (Excel linked to TOS with RTD). I paid for a subscription to ONE and started backtesting as many earnings trades as I could and visualizing how rising IV can push around your T+X lines. I started trading long straddles and calendars on my own. After the first earnings season doing this on my own I had about a 30% return on my account during that earnings period with very little risk/drawdown. Then 2020 hit and I missed out on an entire earnings season and made some bad VXX and VIX type trades. I had a bit of a rough patch the past few 6 weeks or so (took a lot of large losses on some of my own NEHS trades and other speculative plays). But, here is the interesting thing, almost all of my earnings trades have been profitable. Although the equity curve looks jumpy the past few weeks its because I have a lot of non-liquid calendars open where the pnl jumps around a lot at close. My guess is that my equity curve will be close to a new all time high within the next week or two as some of my calendars are starting to turn profitable and RV is moving in my favor. If I did not do any of those NEHS trades and VXX trades it would probably be back at the highs based on earnings trades. So this is not "easy" by any means and I am not even sure if I have this figured out but I can tell you the underlying concepts and principles taught here work and make sense. Blindly following the alerts is not great in my opinion and I wish there was a way to split the group out for those of us that dont even want to follow the alerts (I would bet most of the successful people here do not follow every alert and are in the trades before Yowster even posts them). So if you want an alert service that is "set and forget" I would just quit now and I don't know of any such alert service. If you want to collaborate and learn with a group of really good traders and smart people I think this place is worth the money. Edit/Update - I did not mean to scare people with that equity curve above. If you compare my results back in 2019 to the SO trades you will see I was not following the rules or official trades very closely. Some of my biggest trades were HD and GS calendars which were both assigned to me and 100% losses which was very rare for these type of trades and SO no longer trades calendars that way with the shorts expiring before earnings. Here is my 1 year equity curve which is mostly earnings trades plus some bad VXX and VIX trades I made recently. Even with those losses I am up close to 36% year to date and we still have one more earnings quarter left. I am not posting this to brag as I suspect people here have returns that are double or triple this, rather, to show that earnings trades can work.1 point

-

From the Horse's mouth Best execution? Another little-known aspect of zero-commission trading pertains to the execution of a given trade. Before, when brokers charged commissions for each trade, they often were promising a best possible execution, meaning they prioritized time and therefore share price of a security. As zero commissions became industry standard, brokers now go for the cheapest option to execute a trade. Steve Sanders, Interactive Brokers’ executive vice president of marketing and product development, said its zero-commission option — known as IBKR Lite — gets lower priority than its paying IBKR Pro customers for execution. “If it’s IBKR Lite with zero commissions we do what the other brokers do, we send them off to a market maker just like everybody else and there’s payment for order flow that comes back and you may not get as good of an execution,” Sanders said. “If its IBKR Pro you’ll get better execution.”1 point

-

One option is to create a custom 4 leg position. Another (simpler) is to close the Jul31 strangle first and then open Aug07 strangle.1 point

-

My preferred broker is thinkorswim ( TD- ameritrade)has the best price/order execution both to buy and sell, IB is the worse broker i have seen, you pay less but in execution of the orders you pay much more than your saving is.-1 points

-

To everyone else I meant to say in my OP I had 5 winners AND 5 losers for -6.2%. That was in May. Wish we could edit. I don't have a PC just using my Android. I don't feel it proper for me to advertise or even mention by name another service on this forum. Even though the proprietor can be abrasive and rude I still won't stand in his "store" and tell out about the competitors. Kim responds to any form of criticism no matter how diplomatic and polite it is in a way I find to be overkill and harsh. Certainly if someone is being a jerk and making stupid comments they deserve it. But...you tend attack in relentless fashion even to polite comments that aren't attacking SO as much s just expressing what they've experienced. That's why I decided to not be as diplomatic in this response.-2 points

This leaderboard is set to New York/GMT-05:00