SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 08/19/20 in all areas

-

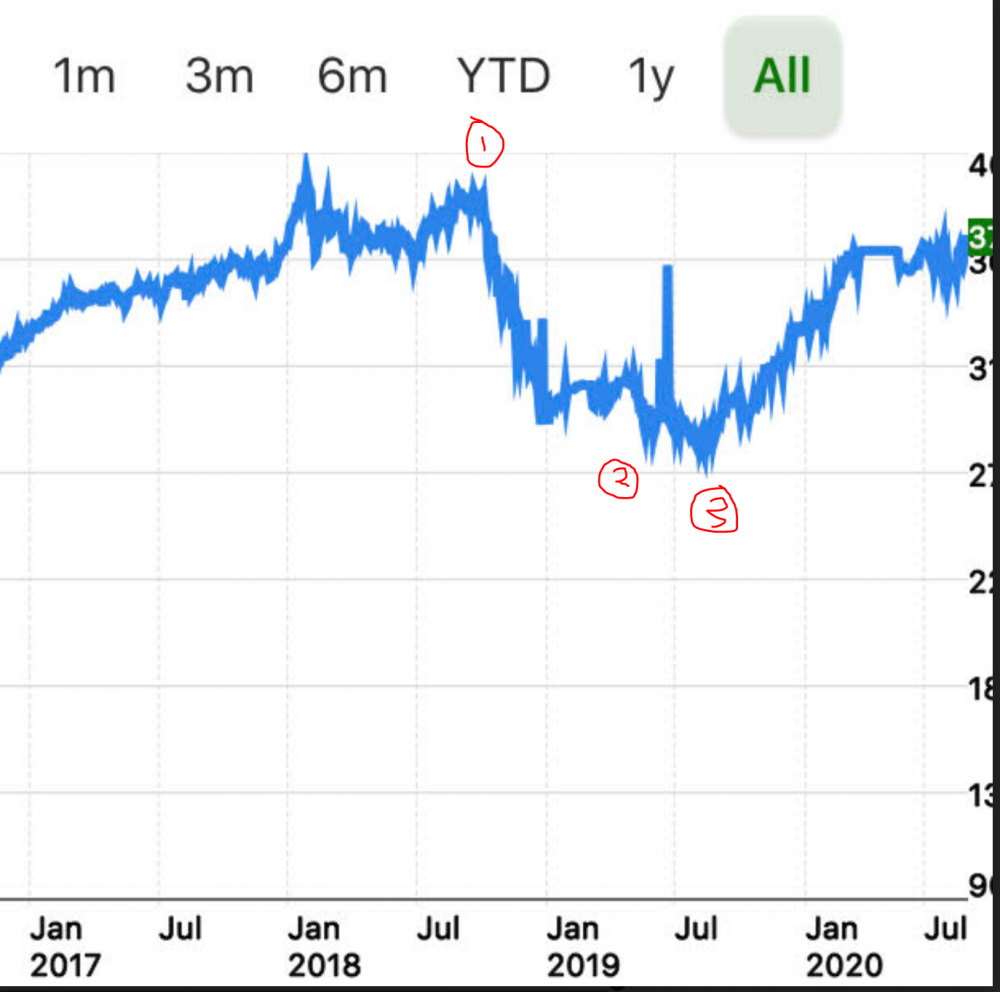

I dont think I should be listed with those guys but I am glad to be pinged on this topic because I have something I wanted to share that is relevant here. I finally figured out how to find an equity curve in my TD Ameritrade Account (can only do it on mobile for some reason). @yalgaar this should be interesting for you because I was in your shoes about 18 months ago and saying the same thing (but just quietly to myself). With reference to the equity chart below (this is mostly earnings and SO trades, I also have an account at RH and two other TD Ameritrade accounts but this one is a good example of my journey) Point (1) I joined SO in the summer of 2018 and had a string of really bad trades (many were my fault, chasing losing trades, over trading, etc.). I just could not make it work. We also had some big 100% losses, HD and GS come to mind, plus a few others where I had on large positions. If I remember correctly this was a rough patch for SO and I joined at the peak and gave up near the bottom. Point (2) I quit SO for the first time somewhere around there, convinced myself it did not work. Between point (2) and (3) I tried a bunch of other options services and continued to lose money. I started to take it more seriously. I turned off my computer, read a bunch of options books, academic papers, and started to really think deeply about options, the greeks, what works, what doesnt work, and tried to figure out why. I kept coming back to SO and earnings trades. It was like an itch I could not quite scratch or figure out in my brain. In my opinion the IV rise before earnings is a consistent edge that we can take advantage of as retail traders. I know the results Kim and Yowster got were real (we can see their trade logs) so I started thinking really hard about that and how to exploit it. I found some of Kim's old articles on Seeking Alpha which laid it all out very clearly about getting your straddles for "nearly free" or something like that and it started to click for me and the light bulbs started going off. Point (3) I started gathering data and doing my own research, largely based on the past work here at SO. I started making my own spreadsheets to track RV (Excel linked to TOS with RTD). I paid for a subscription to ONE and started backtesting as many earnings trades as I could and visualizing how rising IV can push around your T+X lines. I started trading long straddles and calendars on my own. After the first earnings season doing this on my own I had about a 30% return on my account during that earnings period with very little risk/drawdown. Then 2020 hit and I missed out on an entire earnings season and made some bad VXX and VIX type trades. I had a bit of a rough patch the past few 6 weeks or so (took a lot of large losses on some of my own NEHS trades and other speculative plays). But, here is the interesting thing, almost all of my earnings trades have been profitable. Although the equity curve looks jumpy the past few weeks its because I have a lot of non-liquid calendars open where the pnl jumps around a lot at close. My guess is that my equity curve will be close to a new all time high within the next week or two as some of my calendars are starting to turn profitable and RV is moving in my favor. If I did not do any of those NEHS trades and VXX trades it would probably be back at the highs based on earnings trades. So this is not "easy" by any means and I am not even sure if I have this figured out but I can tell you the underlying concepts and principles taught here work and make sense. Blindly following the alerts is not great in my opinion and I wish there was a way to split the group out for those of us that dont even want to follow the alerts (I would bet most of the successful people here do not follow every alert and are in the trades before Yowster even posts them). So if you want an alert service that is "set and forget" I would just quit now and I don't know of any such alert service. If you want to collaborate and learn with a group of really good traders and smart people I think this place is worth the money. Edit/Update - I did not mean to scare people with that equity curve above. If you compare my results back in 2019 to the SO trades you will see I was not following the rules or official trades very closely. Some of my biggest trades were HD and GS calendars which were both assigned to me and 100% losses which was very rare for these type of trades and SO no longer trades calendars that way with the shorts expiring before earnings. Here is my 1 year equity curve which is mostly earnings trades plus some bad VXX and VIX trades I made recently. Even with those losses I am up close to 36% year to date and we still have one more earnings quarter left. I am not posting this to brag as I suspect people here have returns that are double or triple this, rather, to show that earnings trades can work.2 points

-

I am a relative new member here and see this service for what it is, an educational course with live trades examples and the ability to discuss them with a like minded community. I don't expect or frankly care to perform as well or the same as the official returns, for the most part I don't even enter official trades unless it fits with my own strategy. Or the sectors/symbols that I like investing in and a myriad of other factors. So far, I learned a great deal directly and indirectly from SO and see a good ROI from both trades and knowledge accumulation. @Tniko the truth, is that about 90% of options traders will either breakeven or lose money. 9% will make profits within 1/2 a standard deviation from just holding long term S&P index and the top 1% will consistently beat yearly returns. The same applies to any competitive sport or business, 90% will give up and stop playing, 9% will be considered average or good players and the top 1% the pro athletes will thrive. The copy and paste approach doesn't work for options... there are no shortcuts. Don't expect to look or learn how a marathon runner is running and expect to be able to run the marathon faster or even at the same pace. A person search for a one solution fix all or the "holy grail" is futile, there is no such a thing. The only thing that works is hard work, dedication and continuous learning. Every athlete will tell you the same.2 points

-

Posted July 27, 2016 For those of you getting frustrated and a bit confused on how Steady Options operates I would suggest you reduce your size until comfortable with the mechanics, theory etc of the community, model portfolio, trade alerts etc. iIf you choose to just follow the model and alerts you will do OK, I found I averaged about 80 to 85% of the models returns due to the competition to get the exact same fills. After a few months when I started taking advantage of the advice and knowledge on the rest of this site I can happily report I consistently beat the monthly performance of Steady Options. Have patience. I posted this a bit over 4 years ago and it still holds. This isn't rocket science. I am a member of the KISS crowd. There are enough tall foreheads around here lol. Obviously you need to pay the subscription fee. A big time saver is one of the charting programs for about 50 bucks. I use nothing else. Glancing at the value of my account right now I figure I am up over 10% this past month. I consider 100% returns annually the benchmark by applying what I learn here to trades that don't make the official but I do on my own. Right now I have 26 orders in the market but have had no fills since Monday. Somebody said Dog Days of Summer ha! It's only as complicated as you want to make it. You don't have to be an expert on the greeks and volatility, you just have to have a general understanding that they affect the price of the options and wait for that price to come to you. This probably holds true whether you are with Steady Options or not.2 points

-

I made a little tally of the SO trade results so far in 2020 (Results were compiled based on the data available in the Performance section of the SO Website for 2020) . I will let you judged the results by yourself but I have to admit that I am impressed by the states especially by the fact that only 15 trades (10.3% of the trades) had a -10% yield or worst and that 71 trades ( 49% of the trades) had a +10% yield or better. That's a very good risk management... I thought It might be interesting to share.1 point

-

What a thread ! Very interesting. I just completed 1 month with SO, joined in the month of "Loosing July" . For results, I broke even ..would have been profitable without NFLX unofficial NEHS trade. And I am in the worst position from fills perspective i.e. in exactly opposite timezone so rarely I am able to execute on same day. Biggest lesson learnt, never execute NEHS at official price without looking at leg volatility and short credit percent. At times, I got the exact fill but the short credit percent was less..leading to leakage. I took only one trade on my own and closed it for NPNL. It would be great to have an experience person like @FrankTheTank guide on Calendars .I have read the site content but not feeling confident enough. Its the beginning of my second month and will try BBY straddle today. Given the amount of experience, it might be worth considering few directional trades as part of the service. Due to difficult environment and trending market, might be good to diversify SO strategies to add more directional ones. Just my 2 cents.1 point

-

Let me make one general statement about returns. The 127% CAGR excludes commissions. This is mentioned twice on the performance page (good luck to find a similar disclaimer in most other services). The actual return depends on the broker you are using. Those with Tradier who pay $10/month as part of our deal with Tradier will see a very small impact of commissions. Those who are with IB will be probably impacted by 1-2% per month - again, clearly mentioned in many places. How much members can make? It depends. Everyone is different. I get messages all the time from members who beat our performance. But it will not happen after 4 months. 4 years is more likely. But yes, it's possible, and I disagree with a general statement like "It's impossible to make returns similar to your stated performance". This is simply not true. I will go one step further and say that if you stick around for 3-4 years, you will have a very good chance to make at least half of those returns or more (again, if you account for commissions). Why 3-4 years? Because as I mentioned many times, this is how long it takes to become proficient in any area in life. And if you find it insulting comparing University to learning to trade, maybe you need to adjust your expectations. Doesn't matter if you do it alone, with SO help or with another mentoring program. Our goal is to help you in your journey which is already hard enough. If you want our help, we are here. If you prefer to do it alone, that's fine too. Just don't expect any shortcuts. Also account size matters as well. Our performance is for 10k model portfolio, it is much more difficult to achieve a similar performance in a $100k account. Again, this is a well known fact and is mentioned in many places, it should not come as a surprise. But the main point is: you should not compare your results to the official performance, and you should not care how much other members make. If you are new to options, give yourself at least one year, to see the effect of learning, and also neutralize any periods of lower returns. If after one year you still don't find the value, move on. Everyone's path to success is different. If you read My story, you will see that it took me almost 10 years to become consistently profitable. To many traders it takes much less. To some it takes more. Some don't achieve that goal even after 20 years. Please believe veteran traders who say that this is extremely hard. Please don't believe all the marketeers out there who claim that it's easy to double your account every 6 months with no time and effort. I'm trying to be as honest and transparent as possible. I know not everyone can appreciate it, but I will always tell people the truth, not what they want to hear. Here are some articles that might help: Probability Vs. Certainty Trap Are You EMOTIONALLY Ready To Lose? Are You Ready For The Learning Curve? Why Retail Investors Lose Money In The Stock Market Can you double your account every six months? Top 10 Mistakes New Option Traders Make Price Of Options Trading Education How To Become A More Profitable Trader 5 Stages Traders Go Through Learning To Win By Learning To Lose How To Avoid Emotional Mistakes In Trading 10,000 Hours Of Trading How Much Do You Need To Trade Options? 40 Steps In The Trader’s Journey Buy High, Sell Low: Why Investors Fail Performance Reporting: The Myths And The Reality Is 5% A Good Return For Options Trades? Big Drawdowns Are Part Of The Game Should You Care About The Sharpe Ratio? Do You Still Believe In Fairy Tales? How To Calculate ROI In Options Trading It Is Time To Get Real @yalgaar One last comment: the answer to "what I am missing" question is you are not missing anything. You are going through the same path that millions of traders have experienced in the past. And your path might be a bit tougher in the short term because you joined during much more challenging times. The simple truth is that (at least) 80% of traders fail, and the reason is not they are not smart enough. The reason is they quit too quickly. They think about success in trading in terms of weeks or months instead of years. And you can be insulted by my comparison to University, but my point is that success in any area in life takes years. It's a process. The fact that you are still here and did not cancel after 3 losing trades says a lot about your character and commitment.1 point

-

Instead of that, diversify. You never know - that other broker could be (probably is) worse. You just haven't learned to hate them yet 😄.1 point

-

I'm not the one you asked, but I've been a member since December. I take a relatively small percentage of the official trades, and then my own trades based on SO strategies. I average about 12 trades per month. My return since December--on a significantly bigger account than the $10,000 model portfolio, which of course makes it harder to achieve a big return--has been 24% after commissions. My max drawdown during that time is about 11%. About 62% of my trades have been winners. Related: I also have about 12 years' experience trading options in various non-SO strategies. I suspect my returns would be lower without that experience. It is extremely difficult to make money trading options. Also, my experienced helped me come in with realistic expectations. Nobody is going to make 127% per year trading this strategy. Almost no one will make even half that. But the great thing is, even a tiny fraction of that return is an excellent return. If you make, say, 20% a year with acceptably low return volatility and max drawdown, you are crushing almost every professional who trades in public securities, and you're doing extremely well.1 point

-

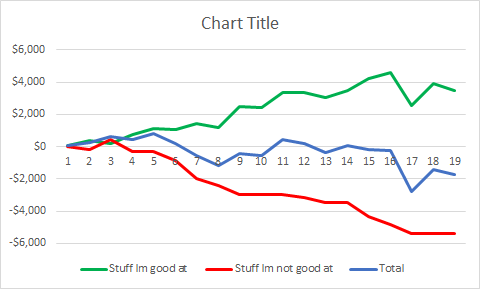

Hi @yalgaar the approach I took was to dump all of my trades out of ONE into a spreadsheet and categorise them by strategy (ie. hedged straddle, earnings calendars) and origin (SO or myself).....closed trades only. From there I looked at the weekly and cumulative P&L of each strategy+origin combination. I used this to get a sense of consistency. From there I grouped the different strategies into 'stuff im good at' and 'stuff im not good at'. I continued doing the stuff Im good at and moved to paper trading the stuff Im not good at. Taking this approach allowed me to focus my learning. I learnt that Im good at executing SO Earnings straddles but I burn money when I try to do them myself. This caused me to focus in on the differences to which I identified that my entries suck. This has lead me on a path of learning thats improved my entry skill on all trades. TLDR: You would have done a lot of stuff my now....pick through what has worked and what hasnt. Focus your energy on improving one thing that hasnt been working...then move onto the next thing.1 point

This leaderboard is set to New York/GMT-05:00