SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 08/18/20 in all areas

-

@yalgaarHello. Obviously it is your money and your time--and ultimately you decide what works best for you. I joined SO late last year. What I cannot understand is how you are not in profit since you joined. Something seems wrong to me. Are you "chasing" trades to get fills? When I started I definitely did this and took some small losses if the entry and exit points were difficult. But then I became more patient and would not take a fill 1% above the official posted price. As far as exits--I would set some profit targets and scale out of trades--this has worked well also. By being more patient many of the official trades I participate in actually get better fills as the prices do fluctuate. If the trade gets posted and runs away I skip it altogether. I would say that has happened roughly 20% of the time as I have become more disciplined. But is that not good trading anyway? If you are trading on your own you set a price you are willing to pay before you enter and if the trade is not giving you that price you walk away. In addition you do learn to do some trades on your own as you become more comfortable with the setups. You also learn to do modifications of the original official trade setups if the underlying price changes quickly. The professionals here are trying to show us how to put the odds more in our favor when we initiate the trades based on the underlying thesis and that does lead to more wins and profits. (At least it has for me) Another big factor is the Covid 19 wreaking havoc with the volatility of the market--thus the classic setups are more difficult to find currently. So my pep talk is to hang in there--stick with the thesis and strategies. Develop your own trades using the recommended tools. This will become a profitable venture for you as it has for hundreds of other subscribers.5 points

-

I'll make a general statement regarding SO strategies and a new members level of experience coming in. Understanding IV ramafications are a huge part of these trades, and if you are new to options or have only used simple strategies then jumping into many of the SO style trades are like jumping into Calculus but bypassing Algebra along the way. I can appreciate the learning curve, but knowing how IV changes affect trades and how the typical earnings IV behavior plays out makes it much easier to setup your own trades. If you make directional trades, you can more easily set things up to minimize IV effects (I think TV shows like Options Action do this on purpose with the simple directional veritcal trades where IV effects are minimized, so they don't have to get into the details of IV effects), but using trades that start out non-directional you really need to get a good knowledge of IV effects and behavior.5 points

-

Take it from an old guy that isn't accustomed to posting on a forum as a form of communication. If this group were sitting around in a room having this debate, the body language would most likely change everybody's experience to a more friendly character. A lot can be said with a smile or comic roll of the eyes to take the sting out of words that are true or not. When it is in this form, it just gets mean. I love to argue, my wife says that I would be fine arguing with myself, a mirror and a tape recorder. I don't mean ill to anybody here, if we were in person, I would be hopping up and down, shouting and smiling, and probably buying the beer. These forums are great for communication, but they aren't very good for empathy. Body language is a bigger part of our world than a lot of people think.4 points

-

Last point first - yes it is very difficult or a lot of people would be doing it. Whats even stranger is that this is one thing you can be fantastic at and still there will be moments you lose money. The psychology of options trading is possibly one of the hardest things to cope with before you start earning money. I did 20 official trades since June 1st and made 1.12% on those trades in total - so you are not alone in finding it challenging at times. If I include my own trades partially SO inspired I actually lost some money -2.05% in this period. It was a challenging time but due to work issues also had less time to devote to trades and this showed immediately in the losers - the loss is caused by a couple of big losers. The fact I also happened to trade the two big Yowster losers of the past 1.5 months is coincidence. There will be moments like these and the thing to do is to maintain discipline both in terms of risk, entering prices and sticking to your strategy. You havent really said what you have learnt - for me what I learnt and how much more refined my own trading became is what I am happy to pay SO for. This extends beyond just my own knowledge - others have selflessly given their time and effort to do stuff I can understand but not do on my own. I can however use what they made and this has helped me do trades on my own - in fact most of my trades are not official SO trades though many are inspired or variants of them. Certainly I never understood the volatility instruments and their usefuless for options trading until I came here. The cost is a consideration - I belayed joining SO until I felt my portfolio could justify such an investment. Whats more the moment I joined I realised the usefuless of Vol HQ and ONE and so wound up spending even more than just the SO fees. The key thing is that through SO I figured out that those really are KEY resources. There is a million for pay stuff on seekingalpa - I never could figure out whether any one of those services is really worth it or just someone getting paid to publish their trades. On a 10K portfolio the SO price is a pretty penny but then again - personal opinion once more - I find 10K not enough to have a real options portfolio. Better start with stocks and have some patience. For a variety of reasons I didnt have more than 10K kicking around for years and so though I traded options since the eighties there was a hiatus of more than a decade in which I didnt trade a single option at all. You simply need to have the liquidity to cover losses and adapt positions at times - like I said above - you will lose money at times sometimes weeks and weeks in a row. The fills question - if you dont like the fill change the position to one where the fill is better or wait. I find this as tough as the next guy and will usually pay a 1-2% more but really that should be the limit - SO doesnt try to hit 25% all the time so if you lose 2% on entry and 2% on exit you may wipe out any real profit of a trade. Better to wait for a good price or simply develop your own trade where you werent competing with the 100s of members trying to enter a position.3 points

-

I wanted to start this thread to discuss what and if I am doing something wrong and maybe even suggest some positive improvements that can be made. I will first start this with declaring I am not making any money using Steady Options so far. As a matter of face I am down around 10-15% of my funds since I started. This is absolutely not intended to criticize this service. The intention is to get to the root of the problem and understand what could be going on. That said, I am going to list the following observations and would love your thoughts about the same: 1) So we all understand this is not an alert service and should not be used that way. I would like to confirm this again since when used as an alert service, it's very unlikely to make money from it. My P&L confirms this. My understanding is that when you are following official trades....you are not getting the same fills as the official trades. In order to get a fill, you end up giving away more money so you end up never matching the performance of official trades. If/when you choose not to offer more money to get the fills, you will more often not get filled at all. I have raised this concern few times but I have been told there is enough liquidy for the underlying that we should be able to get filled at official prices or better.....but it evens out. I personally do not believe this. I have attempted to take every single official trades within reasonable time of it being announced and either do not get filled at all at official price or I just end up spending more to get filled. This happens for over 70% of official trades (my best guess) I am just emphasizing the importance of setting up expectations that Steady Options just cannot be used as a "Alert Service" It will not make you any money. Most likely you will lose money. 2) Ongoing Cost: I find it quite frustrating to have an ongoing cost of closer to $300 a month for the service itself and bare minimum tools required to understand the trades and the dynamics of those trades. That spend would be justified if you could even create returns close to it by investing/risking 10K. But I have not been able to even create ROI for a 10K account even to be able to break even with the cost involved. 3) Learning: I sure have learnt a lot in last 3 months of being on this. I have spent countless hours going through hundreds of articles and thousands of posts here but honestly I still don't find myself having an edge to create a positive returns for my capital. I sure do understand a lot of things better about Options trading before I had joined. But I believe I still can't convert this acquired knowledge into money even with decent funds to invest. 4) Continuing the last point....is it really so difficult to make money Options trading? I mean with 100s of members here with all the great knowledge, why am I not able to still make money? Is it just me? I am really curious how many members here are able to make decent returns. What are they doing differently? I don't claim to be the smartest person....but I do have basic sense to judge what I am capable of and what my weaknesses are. Why do I still not make money here? @Kim Again I would like to clarify that this post is not intended as a complain but an attempt to understand what I could be doing wrong and how I can improve on it. I still believe that by making some changes somewhere (I don't know) any and all members here can achieve same or even better performance than the official trades. I would like to achieve that but I am still not able to figure out how.2 points

-

I made a little tally of the SO trade results so far in 2020 (Results were compiled based on the data available in the Performance section of the SO Website for 2020) . I will let you judged the results by yourself but I have to admit that I am impressed by the states especially by the fact that only 15 trades (10.3% of the trades) had a -10% yield or worst and that 71 trades ( 49% of the trades) had a +10% yield or better. That's a very good risk management... I thought It might be interesting to share.2 points

-

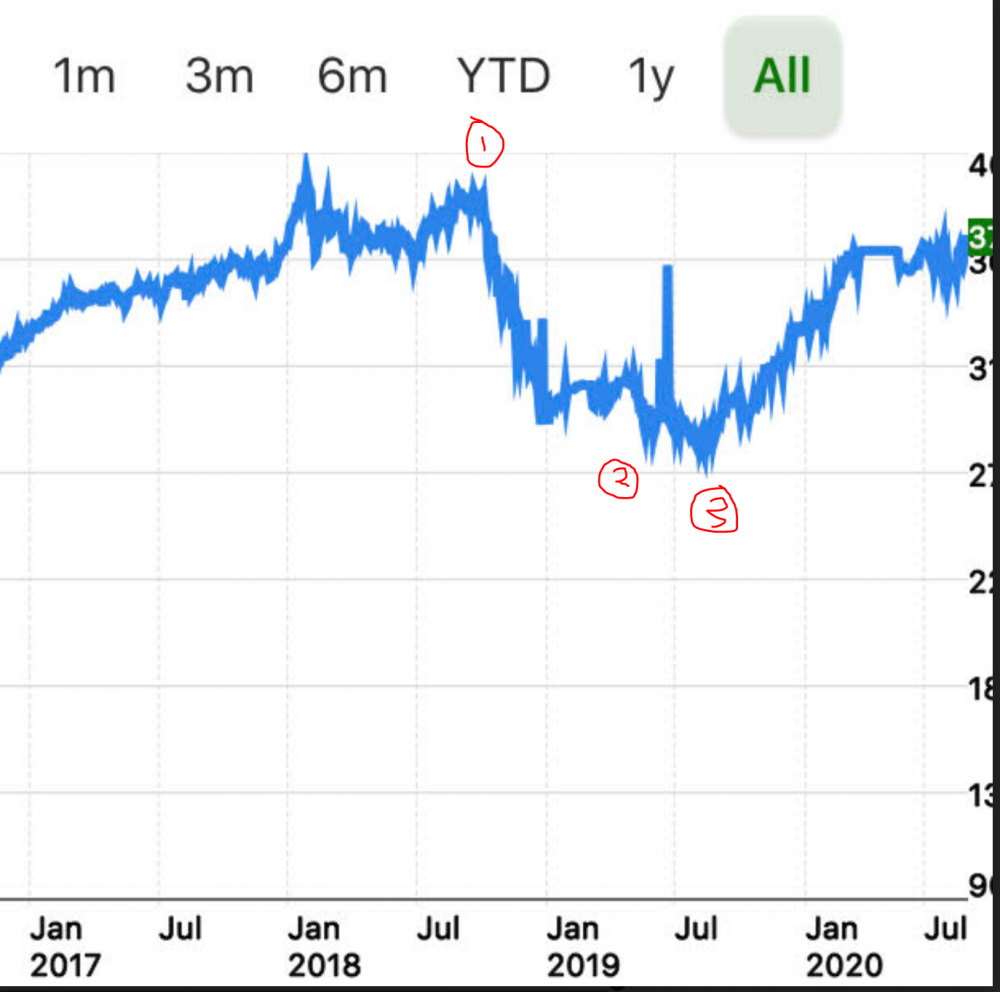

I dont think I should be listed with those guys but I am glad to be pinged on this topic because I have something I wanted to share that is relevant here. I finally figured out how to find an equity curve in my TD Ameritrade Account (can only do it on mobile for some reason). @yalgaar this should be interesting for you because I was in your shoes about 18 months ago and saying the same thing (but just quietly to myself). With reference to the equity chart below (this is mostly earnings and SO trades, I also have an account at RH and two other TD Ameritrade accounts but this one is a good example of my journey) Point (1) I joined SO in the summer of 2018 and had a string of really bad trades (many were my fault, chasing losing trades, over trading, etc.). I just could not make it work. We also had some big 100% losses, HD and GS come to mind, plus a few others where I had on large positions. If I remember correctly this was a rough patch for SO and I joined at the peak and gave up near the bottom. Point (2) I quit SO for the first time somewhere around there, convinced myself it did not work. Between point (2) and (3) I tried a bunch of other options services and continued to lose money. I started to take it more seriously. I turned off my computer, read a bunch of options books, academic papers, and started to really think deeply about options, the greeks, what works, what doesnt work, and tried to figure out why. I kept coming back to SO and earnings trades. It was like an itch I could not quite scratch or figure out in my brain. In my opinion the IV rise before earnings is a consistent edge that we can take advantage of as retail traders. I know the results Kim and Yowster got were real (we can see their trade logs) so I started thinking really hard about that and how to exploit it. I found some of Kim's old articles on Seeking Alpha which laid it all out very clearly about getting your straddles for "nearly free" or something like that and it started to click for me and the light bulbs started going off. Point (3) I started gathering data and doing my own research, largely based on the past work here at SO. I started making my own spreadsheets to track RV (Excel linked to TOS with RTD). I paid for a subscription to ONE and started backtesting as many earnings trades as I could and visualizing how rising IV can push around your T+X lines. I started trading long straddles and calendars on my own. After the first earnings season doing this on my own I had about a 30% return on my account during that earnings period with very little risk/drawdown. Then 2020 hit and I missed out on an entire earnings season and made some bad VXX and VIX type trades. I had a bit of a rough patch the past few 6 weeks or so (took a lot of large losses on some of my own NEHS trades and other speculative plays). But, here is the interesting thing, almost all of my earnings trades have been profitable. Although the equity curve looks jumpy the past few weeks its because I have a lot of non-liquid calendars open where the pnl jumps around a lot at close. My guess is that my equity curve will be close to a new all time high within the next week or two as some of my calendars are starting to turn profitable and RV is moving in my favor. If I did not do any of those NEHS trades and VXX trades it would probably be back at the highs based on earnings trades. So this is not "easy" by any means and I am not even sure if I have this figured out but I can tell you the underlying concepts and principles taught here work and make sense. Blindly following the alerts is not great in my opinion and I wish there was a way to split the group out for those of us that dont even want to follow the alerts (I would bet most of the successful people here do not follow every alert and are in the trades before Yowster even posts them). So if you want an alert service that is "set and forget" I would just quit now and I don't know of any such alert service. If you want to collaborate and learn with a group of really good traders and smart people I think this place is worth the money. Edit/Update - I did not mean to scare people with that equity curve above. If you compare my results back in 2019 to the SO trades you will see I was not following the rules or official trades very closely. Some of my biggest trades were HD and GS calendars which were both assigned to me and 100% losses which was very rare for these type of trades and SO no longer trades calendars that way with the shorts expiring before earnings. Here is my 1 year equity curve which is mostly earnings trades plus some bad VXX and VIX trades I made recently. Even with those losses I am up close to 36% year to date and we still have one more earnings quarter left. I am not posting this to brag as I suspect people here have returns that are double or triple this, rather, to show that earnings trades can work.2 points

-

I am a relative new member here and see this service for what it is, an educational course with live trades examples and the ability to discuss them with a like minded community. I don't expect or frankly care to perform as well or the same as the official returns, for the most part I don't even enter official trades unless it fits with my own strategy. Or the sectors/symbols that I like investing in and a myriad of other factors. So far, I learned a great deal directly and indirectly from SO and see a good ROI from both trades and knowledge accumulation. @Tniko the truth, is that about 90% of options traders will either breakeven or lose money. 9% will make profits within 1/2 a standard deviation from just holding long term S&P index and the top 1% will consistently beat yearly returns. The same applies to any competitive sport or business, 90% will give up and stop playing, 9% will be considered average or good players and the top 1% the pro athletes will thrive. The copy and paste approach doesn't work for options... there are no shortcuts. Don't expect to look or learn how a marathon runner is running and expect to be able to run the marathon faster or even at the same pace. A person search for a one solution fix all or the "holy grail" is futile, there is no such a thing. The only thing that works is hard work, dedication and continuous learning. Every athlete will tell you the same.2 points

-

Very well said @Ringandpinion I am sure going to grab a beer in a few! Cheers to you! 🙂 Maybe we should have zoom meeting setup and talk about these things. I am sure a lot of things that has been said the way it was said about be quite different and would beinterpretedd in a more positive way.2 points

-

@Kim I am not new to trading nor to Options trading. I just didn't find a way to consistently profit from what I have been doing all these years. I have a very long background in risk management and position sizing due to my Forex trading experience. I just feel intentionally or not the official trade performance page just suggests same/similar or better performance can be achieved by the members and still being suggested. But that is really far from truth due to many reasons. I am not criticizing you personally, I am just stating my experience here so far. I have sure learnt a lot and still intend to learn much more from here as time permit me from my super crazy schedule. All I ask is better disclaimers so no new members get a false expectations like me. I also think some improvements can be made in the current format. I will put something together as soon as I get more time. I mean I notice there are many many questions just being repeated from many members including me about why certain trade was taken in certain way. I believe this is due to the some of the pages where the original strategy is described is either outdated or needs more details. Even thought it has been described very well but due to the dynamics and complexities of each trade, it sure needs improvements.2 points

-

I certainly approve of momentum trading - being right on direction with options is the best thing. As regards finding the holy grail - good luck with that it doesnt exist. Your opinion on options is well noted - certainly you are entitled to it and thank you for sharing it. There is no single right way to go about investing, options are a tool that can be helpful it is like a pair of scissors you can use it to cut a bit of paper or slice your ear off. The instrument itself doesnt care what you do with it.2 points

-

At this point as @DubMcDub has said the conversation has become absolutely pointless. I'm neither a SO blind fan nor a detractor, results are what they are and for some are good and for some are bad as with any other thing in life I haven't seen any product or service in my life that everybody thinks is the best, there will be happy and not so happy clients what matters is that the first ones are more. Sorry @Tniko and @yalgaar to hear your experience hasn't been good.2 points

-

Let me make one general statement about returns. The 127% CAGR excludes commissions. This is mentioned twice on the performance page (good luck to find a similar disclaimer in most other services). The actual return depends on the broker you are using. Those with Tradier who pay $10/month as part of our deal with Tradier will see a very small impact of commissions. Those who are with IB will be probably impacted by 1-2% per month - again, clearly mentioned in many places. How much members can make? It depends. Everyone is different. I get messages all the time from members who beat our performance. But it will not happen after 4 months. 4 years is more likely. But yes, it's possible, and I disagree with a general statement like "It's impossible to make returns similar to your stated performance". This is simply not true. I will go one step further and say that if you stick around for 3-4 years, you will have a very good chance to make at least half of those returns or more (again, if you account for commissions). Why 3-4 years? Because as I mentioned many times, this is how long it takes to become proficient in any area in life. And if you find it insulting comparing University to learning to trade, maybe you need to adjust your expectations. Doesn't matter if you do it alone, with SO help or with another mentoring program. Our goal is to help you in your journey which is already hard enough. If you want our help, we are here. If you prefer to do it alone, that's fine too. Just don't expect any shortcuts. Also account size matters as well. Our performance is for 10k model portfolio, it is much more difficult to achieve a similar performance in a $100k account. Again, this is a well known fact and is mentioned in many places, it should not come as a surprise. But the main point is: you should not compare your results to the official performance, and you should not care how much other members make. If you are new to options, give yourself at least one year, to see the effect of learning, and also neutralize any periods of lower returns. If after one year you still don't find the value, move on. Everyone's path to success is different. If you read My story, you will see that it took me almost 10 years to become consistently profitable. To many traders it takes much less. To some it takes more. Some don't achieve that goal even after 20 years. Please believe veteran traders who say that this is extremely hard. Please don't believe all the marketeers out there who claim that it's easy to double your account every 6 months with no time and effort. I'm trying to be as honest and transparent as possible. I know not everyone can appreciate it, but I will always tell people the truth, not what they want to hear. Here are some articles that might help: Probability Vs. Certainty Trap Are You EMOTIONALLY Ready To Lose? Are You Ready For The Learning Curve? Why Retail Investors Lose Money In The Stock Market Can you double your account every six months? Top 10 Mistakes New Option Traders Make Price Of Options Trading Education How To Become A More Profitable Trader 5 Stages Traders Go Through Learning To Win By Learning To Lose How To Avoid Emotional Mistakes In Trading 10,000 Hours Of Trading How Much Do You Need To Trade Options? 40 Steps In The Trader’s Journey Buy High, Sell Low: Why Investors Fail Performance Reporting: The Myths And The Reality Is 5% A Good Return For Options Trades? Big Drawdowns Are Part Of The Game Should You Care About The Sharpe Ratio? Do You Still Believe In Fairy Tales? How To Calculate ROI In Options Trading It Is Time To Get Real @yalgaar One last comment: the answer to "what I am missing" question is you are not missing anything. You are going through the same path that millions of traders have experienced in the past. And your path might be a bit tougher in the short term because you joined during much more challenging times. The simple truth is that (at least) 80% of traders fail, and the reason is not they are not smart enough. The reason is they quit too quickly. They think about success in trading in terms of weeks or months instead of years. And you can be insulted by my comparison to University, but my point is that success in any area in life takes years. It's a process. The fact that you are still here and did not cancel after 3 losing trades says a lot about your character and commitment.2 points

-

I think this post is going in the wrong direction, the OP was looking for advice to become a better trader and it all resumes in the following: 1. Read and learn. 2. Practice (live or paper) 3. Be patient, trading is 90% having the right mental state. In the other hand I think that if you are not satisfied we the service you can always close your account and put your money for better use or find another trading system that suits you better. Also, options trading is not the only way to invest, there are people who is not suited for this. Like choosing a career not everyone could be a doctor, some people are good with their social skills etc etc. Find what you excel at.2 points

-

I like to work, I really like to learn and I really, really can't live without challenge, that is why I'm trading options. I've made good money with SO even after deducting all expenses, and I get to learn. I don't look at anybody else's numbers, I look at mine. I'm up per SO, nicely, say what you want, that's a fact, nobody can change it. If I think anything I'm looking to buy is misrepresented in any way, I'm gone, I don't spend time whining, or pointing fingers. It is useless to call an idiot "an idiot" or a crook "a crook". Shake their dust off your sandals and move on. Life is short, I'm going to get everything I can out of it, I'm not going to waste time in lamentations, so far regrets have never made my life better. There is a poem called "The Station" by Robert Hastings that about sums it up, and I normally don't have much use for poetry. What's with all these negative waves Moriarity?2 points

-

If we take your premise that you have 5% slippage you have a service that offers 6.1% per trade or 1.1% net - with an average of two trades per month you'd be making 25% a year. Generally speaking Yowster at least announces his forthcoming trades a little in advance - if you master the system you can replicate what he proposes to do and should be able to beat him to it.I guess my biggest issue with your post is that you look everywhere for excuses except at yourself - it simply isnt the walk in the park you thought it would be. Instead it turns out to be hard work.2 points

-

Hello @yalgaar First of all, this post is not to contradict you or criticize in any way, most of all is to describe my personal experience with the service. I subscribed in September last year after two years of trying to be profitable at my options trading and did not went live until late January of this year. So far I've been profitable (not by a great amount) but at least is much better than my previous two years. I've had have no trouble getting in trades at official prices but some of my exists had not been as good also, I've missed a couple of alerts that made my profits be not as good. What I am trying to say is that experience has a lot to do in the options trading business and that if you expect to be proficient in your first year, even using SO, that expectation is a little to high. Many books and people I've read suggest paper trading for at least 6 months before putting real money on this business also, read as much as you can because knowledge is your main advantage in this game. Finally, what has worked for me is: 1. Don't chase trades. 2. Set GTC orders to get out. 3. Try to make at least one trade a week on your own, If you fell that you are at a dead end and really frustrated, take a break from live trading and start from scratch on paper trading until you get used to trade the strategies. Is better to not make money because you are paper trading than loose real money out frustration at the markets. Best.2 points

-

100% agree on that. I have witnessed several of them myself. I was super skeptical about SO as well for many reasons but everything checked out fine for me. I still would like to make similar performance as official Trades. I do know I have the aptitude for it. I just need to to a better job to ask better question which I will going forward.1 point

-

We were always very transparent and open about the reasons why we are closing. As for longevity in any business, I invite you to read Performance Reporting: The Myths And The Reality article. One of the examples was a service bragging about ~42% average return per trade. A quick look on his website reveals how they calculate returns: "The highest price the option achieves is recorded as the result since this was historically what the option price reached." Is anyone really able consistently to sell at the highest price the option was trading during its lifetime, or even close? Turns out that based on real (auto-trading), not hypothetical results, not only the performance was not nowhere near 42% average return, but the service was actually not profitable. This service has been in business for 20+ years. They are proving year after year that Abraham Lincoln was wrong when he said "You can fool some of the people all of the time, and all of the people some of the time, but you can not fool all of the people all of the time." There are hundreds of services that completely and brutally mislead potential members about their performance. So you have to excuse me for getting really offended when someone says that our "marketing" is misleading.1 point

-

Since you continue spreading misinformation, I feel I have to address it. We close the service every few months in order to limit the number of members and provide the best service to existing members. I challenge you to find another service provider who is willing to sacrifice his income in order to provide a better experience for his members. We re open the service because members cancel. And they cancel for different reasons (new job, too busy, too lazy, family reasons, wrong expectations etc.), and simply because as others mentioned, there is no perfect product and there are always happy clients and not so happy clients. This is the truth. So we have to find a balance between limiting the number of members, but still allowing new people to benefit from what we provide and have a "new blood". Of course there is no way to satisfy everyone, and even when you do all you can for your members, some people still accuse you in hidden motives and "smart marketing". If you consider 1-2 updates per month "smart marketing, I suggest you use the "Unsubscribe" button at the bottom of each email.1 point

-

@rasar Schwab / StreetSmart Edge could be an ideal backup broker to ToS for you. Their desktop app is feature rich, loads quickly, it’s stable and their customer service is top notch. Also, their web app, StreetSmart Central, is arguable best in class IMHO. Both apps have been glitch free for me so far. They offer direct access smart routing and retain the among lowest amount of payment for order flow when they do route through one of their 6 wholesalers. They’ll also have a significant in house order execution advantage after completing the TDA merger in few years. From what I read, both platforms will remain for a couple to a few years. The there should be one platform with the best combined features. My favorite unique feature of theirs so far is the Walk Limit order. A great promo they’re offering is 500 free option trades up to 20 contracts each if you move over $100k. Runner up if you want a simple but innovative platform is TastyWorks. Their user interface is intuitive, their analysis features are the best I’ve seen from a broker and they have other unique features that may help make option trading a little easier. However, it’s not quite a fully mature platform yet, so occasionally they roll out features with glitches for a while. Also, they may be missing a basic feature that you use in your ToS workflow. Their fees end up above average because they add on so much for exchange fees. They don’t offer direct access order routing, but their execution is still pretty good with the 4 wholesalers they use. Also, their customer service is good. Personally though, I would revisit using them as your backup in a few years after the ToS / SSE platforms are supposed to be combined. Maybe by then they waive the exchange fees and their software will will be more mature like SSE. Runner up if you don’t mind complexity and lacking customer service is IB. Their fees are slightly higher after accounting exchange fees, minimum fees and data fees. However, their professional grade features and their direct market access smart routing may result in making more money on trades.1 point

-

Posted July 27, 2016 For those of you getting frustrated and a bit confused on how Steady Options operates I would suggest you reduce your size until comfortable with the mechanics, theory etc of the community, model portfolio, trade alerts etc. iIf you choose to just follow the model and alerts you will do OK, I found I averaged about 80 to 85% of the models returns due to the competition to get the exact same fills. After a few months when I started taking advantage of the advice and knowledge on the rest of this site I can happily report I consistently beat the monthly performance of Steady Options. Have patience. I posted this a bit over 4 years ago and it still holds. This isn't rocket science. I am a member of the KISS crowd. There are enough tall foreheads around here lol. Obviously you need to pay the subscription fee. A big time saver is one of the charting programs for about 50 bucks. I use nothing else. Glancing at the value of my account right now I figure I am up over 10% this past month. I consider 100% returns annually the benchmark by applying what I learn here to trades that don't make the official but I do on my own. Right now I have 26 orders in the market but have had no fills since Monday. Somebody said Dog Days of Summer ha! It's only as complicated as you want to make it. You don't have to be an expert on the greeks and volatility, you just have to have a general understanding that they affect the price of the options and wait for that price to come to you. This probably holds true whether you are with Steady Options or not.1 point

-

Let me PM you on this. If it's just the colors, i can change the color palette so that it's usable.1 point

-

I'm not the one you asked, but I've been a member since December. I take a relatively small percentage of the official trades, and then my own trades based on SO strategies. I average about 12 trades per month. My return since December--on a significantly bigger account than the $10,000 model portfolio, which of course makes it harder to achieve a big return--has been 24% after commissions. My max drawdown during that time is about 11%. About 62% of my trades have been winners. Related: I also have about 12 years' experience trading options in various non-SO strategies. I suspect my returns would be lower without that experience. It is extremely difficult to make money trading options. Also, my experienced helped me come in with realistic expectations. Nobody is going to make 127% per year trading this strategy. Almost no one will make even half that. But the great thing is, even a tiny fraction of that return is an excellent return. If you make, say, 20% a year with acceptably low return volatility and max drawdown, you are crushing almost every professional who trades in public securities, and you're doing extremely well.1 point

-

I have been a member since November 2018. I was up last year and am up this year. I do both SO and my own trades. SO has definitely helped me develop my trading skills and the community here is a great help. Even if my returns aren't equal to the performance posted, what is really important is that it is a very uncorrelated return to the rest of my portfolio.1 point

-

They operate on a virtual machine that distribute ToS traffic to physical machines. The issue I noticed this morning as I was able to login for about 10 minutes before it crashed is that the internal servers redirects are corrupted. Someone must have pushed an exploit code into the internal server, the timing of the forced update on Monday morning at 9:00 AM is very suspicious.1 point

-

I have the same issue, looks like TD ameritrade ToS servers are down, ping timed out. Looks like it is affecting global customers, USA, EU and Asian servers are down.1 point

-

See prior discussions on this thread. IB, Tradier and ToS seem to be the most prevalent... Also TastyWorks.1 point

-

@yalgaar I had the chance to find Steady Options just before August 1st before the door was closing for new members... I am a "newbie" here but I have traded for many years. Concerning points 2, 3 and 4... I can tell you already that I am sure that I personally have learn enough to pay for my first year of subscription in 3 weeks... In this cost I account for the money I have made and mostly what I save by "avoiding bad trades". You can lose 1000$ in the blink of a an eye with a bad trade. Steady Options is offering the chance to learn limited risk strategies (priceless), discover new trading tools, new ways to assess the edge on possible trades (RV to trade straddles for example), a deeper understanding of the greeks and the chance to read opinions and suggestions many options experienced traders with a passion. Trading can be very lonely... As for the cost of trading (Point 2) I have learn with time that "If you think Education is costly, try Ignorance!"... From what I have seen so far, I am 100% certain you more than you pay for at Steady Options but by when I did decide Steady Options membership I understood that I was the captain of my own ship... On the other end (and it is not a critic) if you spend 300$/month on a 10000$ account it means that you have to make 36% a year and then you start to be profitable... It's not an easy job if you only see the short term ... I have seen enough so far to tell you that what Steady Options has to offer is a very valuable set of tools to make me (and you) profitable. No doubt in my mind. Now we need to learn how to use the tools we are provided and make sure I don't hurt myself " by misusing the tools..." FYI I already started to make my own trades with the minimum number of contracts because I know I will make a couple of mistake. I just want to make sure that the mistakes I will do will not be too costly... paper trading never offered me the same psychological challenge as real trades. We, as trader, are almost always the weakest link in a trading system... I would add to what @vitalsign0 mentioned i.e. "Options trading is extremely difficult" by saying that trading is puzzling. As Alexander Elder mentioned in one of his book “To win in the markets, we need to master three essential components of trading: sound psychology, a logical trading system, and an effective risk management plan.” Steady Options offers, no doubt in my mind, basics for a logical trading system and an effective risk management approach. We, as trader, have the very tough job to have "a sound psychology" and it is the true challenge to be consistent. Keep in mind that I am only beginning to grasp how to trade the "Steady Options way" but I am convinced that the methods and the education offered here are worthy and I rest assured that Steady Options method has an edge. The track record don't lie.... I would suggest you to stay patient as the system here requires practice and patience. To finish with your first point, I just want to share that in the past weeks I already had the taste of what it is to be unable to have good fills. On the entry and on the exit.. I know I paid a too much at least three times to get in a trade. I also got out of a trade too early. I also kept one trade open too long... and finally I have been completely unable to get a good fill on one the trade I was trying to take... I finally never took that trade... Honestly It's frustrating but since I have been trading for years ...I see this a part of the learning process. No doubt @Kim and @Yowster know their stuff! I can only suggest to be patient and follow the "house recipe" i.e. "Understand the trades and try to make them your own.". Good luck!1 point

-

An additional insight that Id throw in is that trader 'skill' in entries/exits/ market common sense is a very underated factor amidst all the focus on strategies and set ups. In A Trade to Fade the VXX Im doing well enough but even though its my trade my returns are lower than some other others trading just simply because theyre more experienced and have a better sense of when to get out/when not to get spooked. Ive learnt a tremendous amount by flying blindly into unsafe conditions or being too conservative (and seeing how others have reacted and why).......so I 100% upvote @Patricios recommendation to do at least one trade a week off your own bat. The official trades can give you a good set up but they dont nessesarily help you build your entry/exit/market sense and I suspect that is equally if not more important than the setup/strategy.1 point

-

For what its worth, I joined the service a few weeks back after educating myself in the basics and to practice I spent the last couple of years trading simple (directional) set ups such as cash covered puts, LEAPS, synthetic longs, bear/bull spreads (And I still do). I am sure that had I joined a couple of years back I would have been hopelessly lost. I now feel I have a few handles to begin to understand some of the discussion and subject matter, but my learning curve here is indeed quite shallow, SO is challenging my mental faculties, I’ve learnt more (Tried to anyway) in a month than half a year prior. My advice to any new/aspiring members would be to make sure you’ve got the basics covered very well, ideally before joining. It’s the only way to be comfortable with entering and exiting trades ‘on your own’ which is the intent I think. Until then, and this has been emphasized in the must read sections: Learn and paper trade until you’re comfortable (or be comfortable with some losses as part of the learning experience).1 point

-

6 weeks in no trade yet. I couldn’t agree more. On CNBC this morning Mark Spitznagel was talking about his 4,000% fund increase since March. The interesting point about the interview was that even though he buys deep out of the money puts, awaiting a major event like COVID19. But the discipline in only sacrificing up to 1% of his average trade by only holding the derivatives for a day. It reminded me of how SO is disciplined in defining the risk. Thanks for all you educational post1 point

-

who said he’s losing 95% of the time in the fund? So far I’ve only seen that suggestion here on the board. His approach has a long term positive expectancy. Any strategy at all can lead to going broke unless that’s the case. I don’t have a record of every trade he’s taking. Maybe he’s buying and holding index funds. We can theorize about why it’s equivalent to buying spy puts ( with the implication being any dope can match his success) but the b*llshit filter in all of this is the fact that it’s been working for him for over 30 years and other “tail” funds haven’t seemed to produce same results. If it were that easy than we should all be worth 9 figures. Obviously people are welcome to think he’s full of shit. I’m not claiming there is “magic.” My point is that he’s a very talented trader with a long track record. I haven looked any more results with this particular fund yet . More history on talebs trading career is easy to find online for anyone interested. ill see what I can find and let you know.1 point

This leaderboard is set to New York/GMT-05:00

.thumb.png.e41473ec65d848b8bb05ec415cb90c31.png)