SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 05/02/20 in all areas

-

Sweden is so densely populated, and like others said, not a major travel hub like the US. I also see that they have a very high mortality rate. One thing to remember is that I personally think our death numbers will go up as people who are on vents will finally succumb. However, the mortality rate will actually drop as you see more widespread testing and see how many asymptomatic patients there are in the communities. We need better tracking to see who these people are and who they come in contact with and also to put them in quarantine. Our state has been hit much less than others because our governor was smart and started lockdowns relatively early. However, we have 50% of our ventilators utilized right now with Covid patients. Imagine it we started opening things up and grandma and grandpa got exposed? They are the ones who are most susceptible. And one more interesting fact, we started doing pre admission testing for elective surgeries this week. By close of business yesterday, we had 2 patients already who has tested positive but were completely asymptomatic. Who have then been in contact with? Grandma and grandpa don’t need this. One last thing to mention...you have to continue to eliminate visitors in nursing homes. They are a major breeding ground and all it takes is one to get it and you could have 60, 70 or more easily. And these are the ones who die without much chance of success.2 points

-

@yalgaar, just to add to the two wonderful responses you have already received, here's my 2-pence worth : 1) I would rate the 3% profit for March as even MORE successful than the 25% profits for Jan/Feb. If someone can make a profit in a month when there was total carnage in the markets, then that shows resilience and security in the trading strategies. It shows that even during a black swan event, the system works, and the account will not be blown. 2) As a newbie, you may be wondering - can a normal member here actually make 25% a month? From my personal experience, the answer is 'Yes'. But it requires a lot of perseverance and hard work. For me, it took a few cycles to get a handle on some of the trade types. I'm still struggling with straddles and find new ways to lose money, but it's my own mental block as opposed to the strategy. I love calendars and they are my bread and butter. Similarly, you will probably find your own niche soon enough. Good luck on the journey.2 points

-

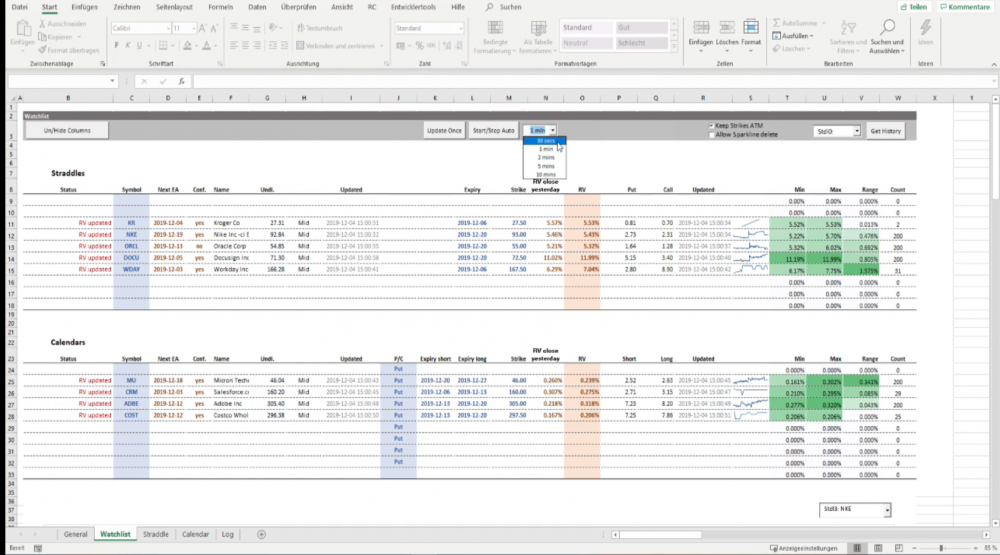

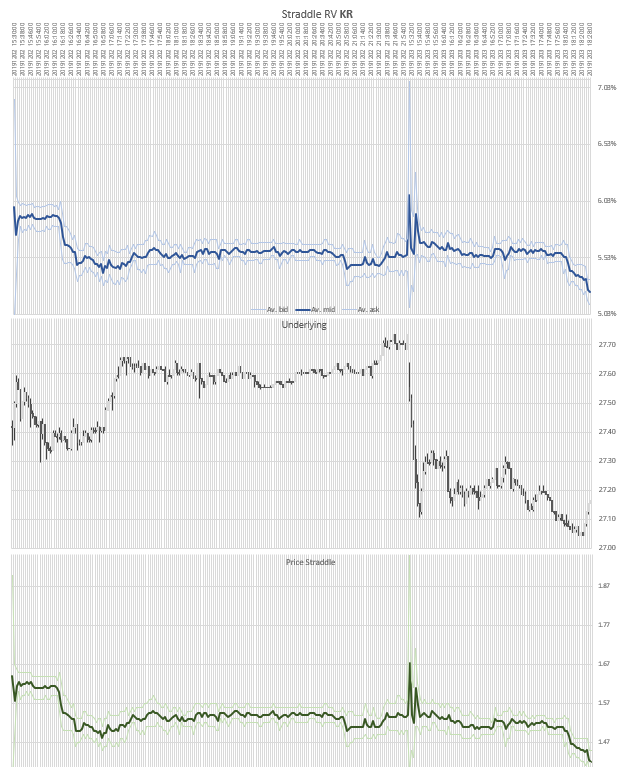

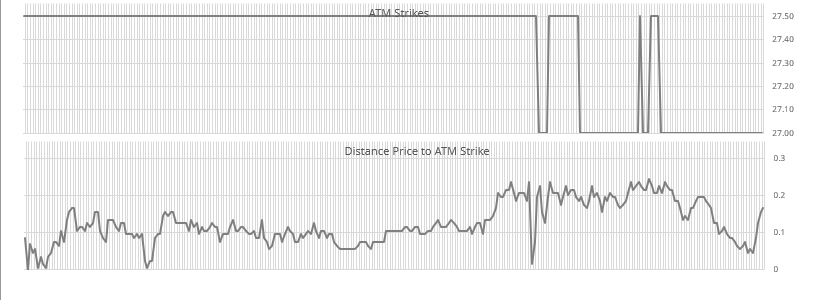

For anyone interested here is a lightweight tool for plotting real-time and historical intraday RV values. Download: bit.ly/rt-rv Short video on major features: bit.ly/rt-rv-v This tool is provided for free for your convenience. It is excel based and uses Interactive Brokers API for real-time data (follow instructions on download page). Feel free to download and use it. It works completely independent of any chartaffair subscription. However, if you happen to have a valid chartaffair premium subscription it will additionally produce up-to-date earnings data through the chartaffair API. The test key included will work for a few days from now. The VBA code inside is 100% open and accessible and anyone wanting to is invited to modify and repost it (f.e. to add more brokers).1 point

-

This question was asked of me and I’ll answer.... Would be very interested to hear your opinion. Specifically, how would you handle it? If re opening now is not the solution, then what? One of the opinions that I heard (from several sources) is that the final outcome is known: 50-70% of the population will be infected anyway. They just don't want everyone to be infected at the same time not to overwhelm the healthcare system. So there will be several re openings and re closing spread over many months in order to spread the number of cases over longer period of time. Here is my opinion, do phased reopenings. Continue to deny high population events, such as concerts, sports, church, etc. Continue to allow many who can, to work from home. You must do strict adherence to social distancing until we have slowed this to a crawl. Meaning restaurants, while I’d prefer to see stay curbside pickup, if they open, distance tables and all staff should wear masks and be tested daily when they come to work through a screening. Meaning temp, and questions about loss of sense/smell, travel, contact with any positive patient, etc. (The issue with that is will people be honest?) Most importantly, RAMP UP TESTING. We have to know who has this and test frequently. Labcorp, Qwest, and most state labs are running well behind because, guess what, the swabs that are used to do the nasopharyngeal testing are made in....yep, Italy! Expand the antibody testing ASAP. One bad thing about that is that people can become positive again, which we still don’t understand. Retrovirals may play a large part in getting us over the hump, Remdesivir may be a game changer based on the research I have seen and from talking to other doctors. Hydroxycloroquine is a major no go. Causes too many arrhythmias at the levels you need for it to be successful. Folks, this may last for years! We talk about a vaccine...well, there are seven coronavirus types, the standard 4 you see on a respiratory panel, which are all common colds, MERS, SARS and now Covid 19. Guess how many vaccines were produced for the first 6? ZERO. We may be able to come up with something resembling the flu vaccine, but depending on whether Covid 19 mutates like the flu, that would be hit and miss. We are going to have a changed world for the next few years in my opinion. Good luck to all and please stay safe!1 point

-

I have been with SO pretty much from the beginning. I can tell that 1) the performance is real 2) there are some wild fluctuations in monthly numbers 3) yes, it is possible to replicate the official numbers or come very close, but it requires a lot of work and commitment. @Kim is talking about expectations all the time, and it is very true. Some months will produce double digit returns when the environment is right, and there will be periods of lower returns.1 point

-

In the previous years, we provided around 10-12 trade ideas per month. In the recent couple years (especially since @Yowster started posting official trades) the number basically doubled to 20+ official trades per month on average. I checked unofficial trades forum and there are around 10-15 trading ideas there every month. I'm not sure how many more trading ideas we can provide. We aim to provide only the setups with the best risk/reward. That said, we will try and mention if we see a good setup that doesn't fit into 10K portfolio, but it would be unrealistic to manage several official portfolios. As a side note, while increasing the total number of trading ideas almost 3 times, the subscription fee has not increased for over 7 years. Something to consider.1 point

-

@Alan I should have been a little clearer on the point about being difficult for many trades to fit into a 1K allocation. What I was specifically referring to was the short-term hedged straddles trade that we were using over the last couple of months. We started with some successful DIS trades, but as the volatility ramped up the price of the straddles it got to the point where a 2:1 ratio hedged straddle price was ~1.7K. Other stocks priced $75+ also were too expensive as their straddle prices were trading at 2x or 3x their normal levels. MU was one we found where the price was ok, had tight bid/ask spreads with lots of volume, and the stock was moving a lot. When I looked for candidates for these short-term hedged straddles, I looked for stocks whose straddle prices could fit into 1K trade size, but equally important was good options volume and tight bid/ask spreads. Many stocks had their options trading volume well below normal levels and the bid/ask spreads were very wide, so I avoided these because slippage was a big concern.1 point

-

Thank you @Yowster excellent summary. On a high level, it's always best to focus on long term results and not short term month to month fluctuations. Not every strategy will work in all environments. When there is such an extreme change in market environment, it takes some time to adapt. It is also important to understand that performance reporting is based on trades closed in this specific month. Similar to January 2019 where some trades were carried from the previous month, creating a larger monthly loss than the real loss. @yalgaar I believe @Yowster provided a detailed analysis of the trades and the environments. My response was based on your comment "relatively very good" - if I misinterpreted it, my bad.1 point

-

I initially thought the stated performance goal of 5-7% a month was also likely in need of a reality check, until I signed up for membership and was able to start verifying all the trades and participating in the new trades in real-time and saw that it was definitely reasonable and legitimate. I only joined recently--just a little under two months ago--so my account balance for these trades has been more or less fluttering around unchanged since I joined, but even with that, the value of the knowledge I've gotten from the trade discussions and other resources on the site has been well worth the cost of admission.1 point

-

An extremely high level reason, volatility... Our core trades do well when volatility stays around current levels or rises. That was the case in January and February where volatility was flat and then rising and giving large boosts to many of our trades. Once we got the middle of March, volatility started to drop and has been doing so ever since. This created some very large percentage losers on a few trades that had an oversized negative impact on the portfolio performance. We also had less trades on, which made the impact of those larger losses bigger. There are a number of reasons for why we had less trades: Lull in earnings season, and for those stocks that did have earnings their RV was orders of magnitude above normal levels which meant our typical analysis ineffective. Options became very expensive, so it became difficult for many trade to fit into a 1K allocation. For many stocks with moderate liquidity in normal times, now had less liquidity and very wide bid/ask spreads. This made then much more dangerous to use for options trades as slippage was a very large concern.1 point

-

Our long term performance goal is 5-7% per month. I hope nobody expects to make 25% per month every month, otherwise they probably need a reality check. Most fund managers would dream to make 25% in a YEAR, not a month. It's very important to set realistic expectations. January and February were an anomaly, not a norm. It was a perfect environment for our strategies and we were able to find many good setups. When volatility exploded in March, it became more challenging to find good setups and we did not want to take more risk.1 point

This leaderboard is set to New York/GMT-05:00