SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 04/30/20 in all areas

-

@yalgaar, just to add to the two wonderful responses you have already received, here's my 2-pence worth : 1) I would rate the 3% profit for March as even MORE successful than the 25% profits for Jan/Feb. If someone can make a profit in a month when there was total carnage in the markets, then that shows resilience and security in the trading strategies. It shows that even during a black swan event, the system works, and the account will not be blown. 2) As a newbie, you may be wondering - can a normal member here actually make 25% a month? From my personal experience, the answer is 'Yes'. But it requires a lot of perseverance and hard work. For me, it took a few cycles to get a handle on some of the trade types. I'm still struggling with straddles and find new ways to lose money, but it's my own mental block as opposed to the strategy. I love calendars and they are my bread and butter. Similarly, you will probably find your own niche soon enough. Good luck on the journey.4 points

-

An extremely high level reason, volatility... Our core trades do well when volatility stays around current levels or rises. That was the case in January and February where volatility was flat and then rising and giving large boosts to many of our trades. Once we got the middle of March, volatility started to drop and has been doing so ever since. This created some very large percentage losers on a few trades that had an oversized negative impact on the portfolio performance. We also had less trades on, which made the impact of those larger losses bigger. There are a number of reasons for why we had less trades: Lull in earnings season, and for those stocks that did have earnings their RV was orders of magnitude above normal levels which meant our typical analysis ineffective. Options became very expensive, so it became difficult for many trade to fit into a 1K allocation. For many stocks with moderate liquidity in normal times, now had less liquidity and very wide bid/ask spreads. This made then much more dangerous to use for options trades as slippage was a very large concern.4 points

-

While I'm not at all confident in what the market will do over the next 6-12 months (like you, I wouldn't be surprised to see another leg down), a few observations here: A major (and IMO, underrated) difference between now and six months ago is the fall in interest rates. Six months ago, T-bills were still yielding 1.55%, and long-dated treasuries were yielding around 2.25%. The latter is certainly not a great yield historically, but it was at least enough to outpace U.S. inflation for the past 10+ years. But as of today, T-bills are yielding 0.10% (!) and the 30-year treasury yields only 1.24%. It's hard to imagine why anyone would buy the former, except maybe foreign governments who have to hold U.S. debt for various reasons. And while I won't say there's no reason to buy a 30-year bond yielding 1.24%, the reasons are relatively few. It's certainly not a good value proposition, unless you think we're headed for a long, long period of deflation. The fall in interest rates alone may justify why the equity market is at these levels, despite a much worse economic outlook. All the money in the world--and there's more every day with Fed intervention (see below)--has to go somewhere. With rates this low, bonds aren't attractive, CDs aren't attractive, savings accounts aren't very attractive, etc. So I think a lot of the resilience we're seeing in stocks is just the natural attitude of, "Well, I'm not going to get any yield on my money elsewhere, so I guess I'll buy equities, hold them, and at least earn some dividends while I wait for prices to recover." That's especially true in the sense that people with the big money--the type of money that moves markets--often either can't or aren't allowed to just put it in CDs or high-yield savings accounts. Another factor is the Fed liquidity, which is much higher than it was six months ago. The Fed isn't directly buying equities, but their aggressive purchasing of bonds adds cash to the market that historically has a positive ripple effect into equities. This isn't news to probably anyone on SO, but the market isn't pricing today's economy or even next month's economy. It's looking much further out than that. I have absolutely no idea what will happen, but factoring in the massive monetary and fiscal stimulus, it's not crazy to think that we could be roughly back to where we were in 6-9 months. Some industries surely won't be back that fast, but others may pick up the slack. The market dropped so fast and so deeply, I think there's an argument that it basically managed to price in all of the worst economic news in an incredibly short amount of time. That said, if what I just said is correct, I think it only applies to economic news. I don't think the market has any way to efficiently price in developments about the severity or mortality of the virus yet, for all the reasons Kim said. So, if it turns out that the mortality rate really is sky high, or if we see a bad second wave later this year, I absolutely think that will hit the markets hard unless we've somehow managed to nail down a really good treatment or a vaccine by then. Just my random musings here. Grain of salt, etc.4 points

-

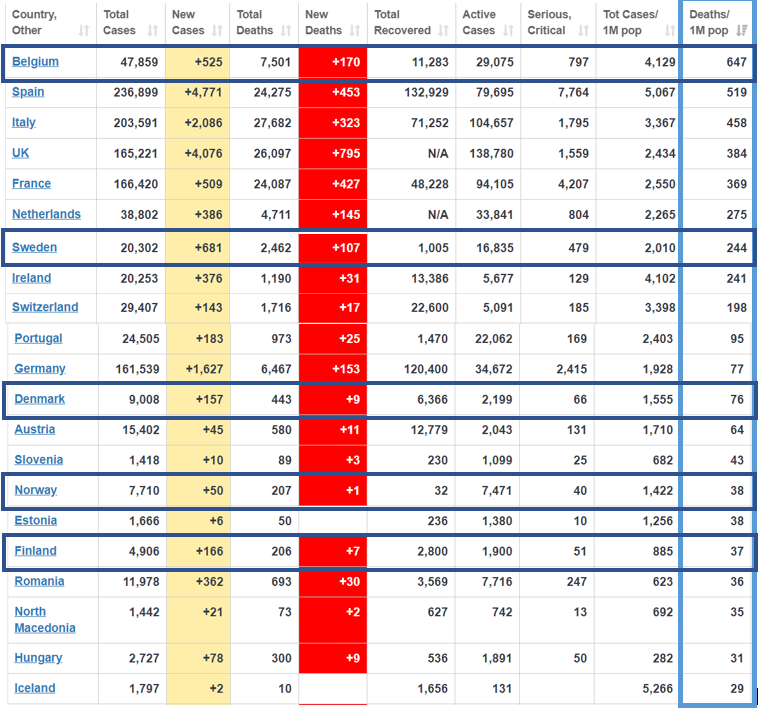

It depends what data you compare. Belgium has the highest death rate in the world apart from a number of tiny countries. I'm surprised people don't talk more about that actually. I would compare Sweden to its closest neighbors, having a similar climate, maybe quality of healthcare system and so on. Then numbers don't look that great anymore.3 points

-

I'm definitely not a medical expert and have no idea who is right. But here is my concern: each time someone comes with an opinion that is different from the "official" point of view and policy, they are condemned and declared dangerous. In my opinion, what is really dangerous is lack of respect to different opinions. What is really dangerous is an attempt to silence people. Where is the freedom of speech? Who put YouTube to be a medical expert and decide what is trustworthy and what should be removed? Do we want to end up in George Orwell's 1984 like world?3 points

-

https://seekingalpha.com/news/3566409-chesapeake-energy-preparing-bankruptcy-filing-reuters https://seekingalpha.com/news/3566116-hertz-falls-bankruptcy-cloud-hanging-over This is just the beginning.3 points

-

There is definitely a lot of controversy around the coronavirus. The more I talk to people, the more I'm convinced that at this point, we know very little about the virus, the way it spreads and the real numbers. Many experts believe that the real mortality rate is around 0.5%, way lower than the current numbers suggest. And yes, the situation in most US states and many countries is not even close to what we see in New York, Italy and Spain. But the argument used by those in favor of lockdowns is that we don't want every state or country to become New York or Italy. The argument is that since we know so little at this point, the governments simply don't want to take the risk. Because if they are wrong, the price in human lives will be too high. Going back to the markets - personally I believe that it will get worse before it gets better. But lets say I'm wrong. Lets say things are not so bad and they will become better. So here is a simple question: does anyone believe that the economy is in the same shape today as it was 6 months ago? I think even the biggest optimists would admit that we are in a much worse shape today, even if they believe things will get better soon. So how the major indexes are around the same levels today as 6 months ago? How the Nasdaq is actually 10% HIGHER today than 6 months ago? To me, it makes ZERO SENSE.2 points

-

@Yowster you hit the nail on the head, University of Miami has been doing this in S FL and is finding exactly that. I think factoring that in, it worked out to the same or slightly less than .5% mortality rate. I think this virus has been spreading a lot longer than we were aware of, I'm thinking at least 3rd quarter of last year if not longer. I am in no way a Covid denier, yes it is serious, but a lot of these numbers are not adding up. Yes we need to be careful, yes large gatherings like sports, concerts, etc should not be happening right now. But I do believe there has been a tremendous amount of number fluffing going on - I am sure some of it is just heat of the battle and will get sorted out later, but I can't help but think some of it is nefarious. You can take that to the bank. Look at NY - oh, if you died at home, clearly you couldn't get to a Dr, so it must have been Covid. No proof, no autopsy, just increase the death count by 3k or 4k or whatever it was. There is financial incentive for hospitals to mark people as covid patients, and more money if they get on a ventilator. "Follow the money". With respect to hospital workers, of course they are not furloughing the front line, but all we heard about for weeks was how every hospital would be overflowing and there would not be enough capacity, not enough medical staff, not enough ventilators, etc etc. That simply is not the case. I'm glad they were wrong, but as a Floridian who has to deal with hurricane season and the media hype that "we will most certainly die this time", I try to strip the fanatical hype from factual data. All I am saying is the data does not match the fear. I am not sure where the saying originated, but it goes something like "there's lies, damn lies, and statistics". Interesting time to be on this floating Petri dish called planet earth. Rant over and sorry for completely derailing the Uber thread, but too I agree this cannot be good for Uber LOL2 points

-

I think the real key will be once we get enough random tests performed that can be extrapolated into the general population of a state/city. The kind of tests recently performed on LA and NY. If wider testing confirms what the LA and NY tests found - that many more people have been infected without knowing it. If that happens.... It means the mortality rate is much lower than what is computed right now based on case counts and deaths, likely 0.5% or lower. We already know the elderly are the most at-risk with the average age of people dying ~80 (give or take). I live in the one of the hottest areas of Pennsylvania and that is the case here, with a large percentage of deaths being people in long term care facilities. Based on this, there will be tremendous pressures on states to open (albeit with social distancing restrictions) with the higher risk people in nursing homes and similar places remaining in tighter lockdowns. Government stimulus and payouts to citizens can't go on forever. Many people will get out an do things, many people won't at first. This is the critical period as to what happens next. Are more people getting admitted to hospitals, even those in the assumed lower-risk categories? And unfortunately, we can't ignore the political aspects of what happens in this scenario - you can be sure that the media will highlight anything negative.2 points

-

Oh look the Monday morning quarterback. Death rate of the 50-60 range is 1.3% for men its about twice as high. So that would kill 1 in 50 men in that age category. So thats 200,000 dead men in that age category in the US - not that I am taking this personally because I am 53 or anything. Even bigger problem is that these 200,000 and in fact a multiple will require hospital care. There are currently 1,000,000 staffed hospital beds in the US - not even going into the ICU beds question - do you see a problem already? Sweden has 10M people in a very sparsely populated country with nowhere near the density of population even in its couple of bigger cities. Its also out of the way of major trade and traffic lanes and isolated by sea and unpopulated land areas. The population is also applying a level of self-discipline that is quite unlikely to be found in the US.The so called herd immunity is completely based on models and not on actual testing. They believe that for every confirmed case they have 75 unconfirmed ones but there is zero proof of that. in fact a more likely factor is 15 which is the normal transmission rate without measures. But even with the 75 factor they arrive at 23% immunised population in Stockholm (not elsewhere) which is not enough to be termed real herd immunity. I agree that the numbers touted of 60% are exaggerated but 35% (one third) really is a minimum. They are still by the most optimistic predictions 50% away from that by MID MAY. In the mean time they are accepting outsized death numbers in the higher age categories starting at 50. A second wave is unavoidable but prior experience shows that with measures in place you can contain it by isolating the cases. Which is what was successful in the predecessor MERS SARS cases but which this time around slipped out of our control. https://www.theguardian.com/commentisfree/2020/apr/29/us-responses-1918-flu-pandemic-offer-stark-lessons-coronavirus-now You might want to read that as real experience of what can and cannot be done. Herd immunity is a theoretical concept that does not take into account factors as health care and systemic stress from the deaths and ill people. Already now health care workers are struggling to stay healthy AND work double shifts to deal with the emergency. I agree that we should relax the measures as soon as possible but Sweden and New Zealand's example are about as logical as comparing the Swedish and New Zealand Stock Exchange to Nasdaq and NYSE.2 points

-

From my perspective, I most care about having the best setups possible - given whatever market environment we are in. Obviously we are all in "continuously learning mode" - especially these last few months. As an example, I realized after reading a post by @Kim that I have put too much negative bias into some of my trading decisions - whether getting in or getting out of various trades. Because I believe the market has been acting irrationally as of late, I have not taken part in anywhere enough of the uptrend as I should have. This is a bad practice -- one has to trade the market we are given and not try to MAKE it what we believe it should be. Now, that is easily said and having a bias is a natural human trait - and most of us have learned to trust in our hunches, wisdom, learned experiences, etc . . .but sometime they fail us. Now back to the subject of performance and portfolio sizes. I think the goal of a 10K portfolio is great, but I also wonder how many of us "goose" up the size of our trades to work better in larger portfolios - I do this all the time. What I do think is important is that if there are some really good setups that are a bit on the expensive side - would still like to ponder them. Maybe they go into the "unofficial" bucket . . . or maybe a "Big Kahuna" bucket that is kept separate from the 10K portfolio bucket. I'm not trying to add more work to anybody's plate - more along the line if you see some good viable setups - maybe discuss them and let the SO members know that some are not being taken due to size/cost . . . but they're still valid and here is where you go to see them. Okay, enough out of me . . . seems my "negative bias" is just starting to match the market a bit more . . . I feel like some more "reality" is starting to creep into the market. We shall see!1 point

-

@Alan I should have been a little clearer on the point about being difficult for many trades to fit into a 1K allocation. What I was specifically referring to was the short-term hedged straddles trade that we were using over the last couple of months. We started with some successful DIS trades, but as the volatility ramped up the price of the straddles it got to the point where a 2:1 ratio hedged straddle price was ~1.7K. Other stocks priced $75+ also were too expensive as their straddle prices were trading at 2x or 3x their normal levels. MU was one we found where the price was ok, had tight bid/ask spreads with lots of volume, and the stock was moving a lot. When I looked for candidates for these short-term hedged straddles, I looked for stocks whose straddle prices could fit into 1K trade size, but equally important was good options volume and tight bid/ask spreads. Many stocks had their options trading volume well below normal levels and the bid/ask spreads were very wide, so I avoided these because slippage was a big concern.1 point

-

@Yowster & @Kim One of the reasons Yowster gave above was that, "Options became very expensive, so it became difficult for many trade to fit into a 1K allocation". If one were able to trade much larger allocations than 1K, are you saying that one would be able to take on more trades and potentially have even better results? If so, is there any chance that these larger allocation trades could be included more in the official discussions? I realize that we have an "Unofficial Trade Ideas" section, and occasionally these larger allocation trades are discussed there - but it is only occasionally. Therefore, is there any chance that the official 10K starting account could be increased to a larger amount to accommodate these larger trades as part of the official discussion? I, for one, would be definitely interested in seeing a larger official account.1 point

-

@zxcv64 @Kim @Yowster Thank you all. I believe I understand the reasons for around 25% returns for the month of Jan and Feb as well as around 3% returns for March April. The most important thing is these are based on real trades on live accounts with real fills. So even with 3% in these market conditions is amazing returns! I am just so excited to learn all these methods and have similar returns on my LIVE accounts....hopefully soon. I am currently only focussing on the Straddle/Strangle and the Calendar Strategies. My intention is to understand why each trade is taken and all the dynamics around it. I am still not where I want to be with respect to understanding it to the level I would feel comfortable to take trades on real money accounts. Hopefully soon....... Thanks again all of you!1 point

-

Sure, see the below. You can filter and sort at will https://www.worldometers.info/coronavirus/#countries1 point

-

Yep agree. Big miss. I guess the question is whether or not we learn anything from it. Most likely not based on past experience.1 point

-

Actually I don't think the numbers for Sweden look taht bad. Just to compare Sweden with Belgium, population wise the difference is not huge (Sweden 10M, B11.5M) but the deathtoll in Sweden is 2586 whereas the number for belgium is 7594. I'm sure there are measurement errors, but 300%? If you include The Netherlands (population 17M) in that mix, which has a lockdown, but much less stringent than Belgium, you'll find a deathtoll of 4795.1 point

-

If anyone wants to geek out on the impact of non-pharmaceutical interventions (stay at home etc) during the 1918 pandemic a working paper was recently released that seems pretty good. There are some potential problems with the analysis due to data constraints but it is pretty interesting. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3561560 They find that cities that implemented NPIs earlier and for longer bounced back better. That being said, the disease was different including who was likely to die from it and the economy was different than. Still worth reading and thinking about though.1 point

-

Thank you @Yowster excellent summary. On a high level, it's always best to focus on long term results and not short term month to month fluctuations. Not every strategy will work in all environments. When there is such an extreme change in market environment, it takes some time to adapt. It is also important to understand that performance reporting is based on trades closed in this specific month. Similar to January 2019 where some trades were carried from the previous month, creating a larger monthly loss than the real loss. @yalgaar I believe @Yowster provided a detailed analysis of the trades and the environments. My response was based on your comment "relatively very good" - if I misinterpreted it, my bad.1 point

-

I do absolutely wonder that and I am amazed at how everything is done here. The Trades taken, the discussion, the reporting etc. etc. Thanks for your suggestions. I appreciate it.1 point

-

I initially thought the stated performance goal of 5-7% a month was also likely in need of a reality check, until I signed up for membership and was able to start verifying all the trades and participating in the new trades in real-time and saw that it was definitely reasonable and legitimate. I only joined recently--just a little under two months ago--so my account balance for these trades has been more or less fluttering around unchanged since I joined, but even with that, the value of the knowledge I've gotten from the trade discussions and other resources on the site has been well worth the cost of admission.1 point

-

Our long term performance goal is 5-7% per month. I hope nobody expects to make 25% per month every month, otherwise they probably need a reality check. Most fund managers would dream to make 25% in a YEAR, not a month. It's very important to set realistic expectations. January and February were an anomaly, not a norm. It was a perfect environment for our strategies and we were able to find many good setups. When volatility exploded in March, it became more challenging to find good setups and we did not want to take more risk.1 point

-

GRUB 1.3B in opex in 2019 (on about the same in rev) for an app company....1 point

-

It will be interesting to see what happens when we see Q2 earnings. anyone I know in operations is bearish, nearly everyone with charts or on fintwit is bullish. some of the valuations of these companies are just insane. If GRUB ( for example) can’t make money when no restaurants offer sit down service, I’m not sure they ever will. Yet it still trades over 200 TTM earnings1 point

-

I'm wondering if economic issues are going to be more Regional. New York is where all the major media Outlets are so everyday those are the headlines, no one cares about the Midwest where I am. It's funny, I'm in the construction trades 10 years ago everyone I knew was out of work or short on hours. I had to hire someone to keep up I'm so busy right now. Granted these are contracts that were signed 6 to 12 months ago. I personally don't know anyone out of work other than the lady that cuts my hair.1 point

-

I may regret admitting this publicly but I have more shorts on right now than I have at any other point in recent memory.1 point

-

An interesting series of tweets from a medical professional not in NYC and the direct and indirect impact of reporting everything as if it was NYC. Link1 point

-

The county I live in has 2 deaths from the virus out of 48 confirmed cases (937 tests approx 115k residents), both at a nursing home. I was told last week from a medical professional that both patients were in hospice care, so time was short anyhow, but they got labeled a corona death. He also mentioned a woman denied care for an ailment not related to corona that and eventually died from her symptoms. Because the hospital wouldn't take her due to corona restrictions, she was labeled a corona death. My routine skin cancer screening was cancelled, the bloodwork we have done for our health insurance was cancelled. What if I have melanoma or a co worker of my wife is 3 weeks from a heart attack that could have been prevented? I fully respect the fear of maxing out hospitals, but until that starts happening, we should continue fighting the health care battles we know we can win. On a side note, it's great seeing my 4 kids being forced to be siblings again as opposed to being with friends or at activities every night. I don't think I've wiped a runny nose on our 18 month old either since mid march when the stay at home order started and schools/day care stopped.1 point

-

There’s no flat reimbursement for covid19 treatment. For patients utilizing Medicare, CMS groups Covid-19 with other respiratory illness and part of the reimbursement is calculated using what’s called DRG rates which are rates specific to a diagnosis. There will be a delta between various DRG and final reimbursement will depend on the specifics of treatment and what procedures were performed. commerial insurance would be unaffected in most cases by CMS guidelines. Approximately 70% of the population utilizes commercial insurance. Obviously the folks that don’t but have coverage ( Medicaid or Medicare) would likely be disproportionately represented on the high side among covid patients ( elderly are typically experiencing most severe cases). again, even if we want to argue deaths are being fraudulently calculated (no evidence), we would have to reconcile that belief with the fact that all cause mortality is up significantly in the US since the outbreak started and is up massively in certain other countries.1 point

-

i haven’t seen any convincing evidence anywhere that CV19 deaths are being over reported. all cause mortality is up significantly in the US and way more in most other countries that have experienced an outbreak. There is a significant lag with collecting these data in some geos so it will likely only get worse. To me, that puts a definitive end to the argument around whether people are dying “from or with” the disease. im not expressing an opinion on the response from bureaucrats, I don’t know what the perfect answer may be. But I think caution when facing something unknown like this is warranted. the response in the markets is completely crazy and illogical. Personally I don’t think we’ve seen the worst of it. I can’t see how things don’t degrade again, especially when Q2 earnings are reported. But who knows...1 point

-

Great idea. As a healthcare provider today was quite remarkable. We finally have some US study data rolling in and do not have to rely as much on data out of China. The remdesivir trial results were the first true potential "game changer" since the outbreak started--especially for critically ill patients although the mortality data did not reach statistical significance there was a clear trend toward lower mortality and further population studies with larger cohorts of patients are needed. In addition the problem literally from day one has been our lack of testing capacity. We were previously only able to "ration" testing to the population with the "sickest" profiles so the denominator was confounded by a low sample size and the most ill patients being tested increased the deaths counted in the numerator--therefore making the death rate appear much higher than it will ultimately be. As an analogy imagine if no person had ever had an influenza vaccine and a particularly virulent strain circulated in the US--the number of deaths would likely be in the hundreds of thousands, but the overall death rate in all those infected would perhaps be in the 0.2 to 0.4 percent range. This is very likely the Covid-19 scenario--time and additional studies will tell. "Herd immunity" and/or effective treatments are the key concepts to pay attention to. Thus enough penetration of a population through exposure to a pathogen followed by recovery and immunity or mass vaccination are what is needed. Ultimately we will likely have a "hybrid" of exposed and vaccinated individuals to achieve herd immunity. Interestingly there is a team at Oxford that has a true head start on the vaccine as they have been working on other coronavirus ( SARS and MERS ) vaccines for quite some time and there are already very promising results coming out of that lab which may shorten the timetable to mass vaccination to late this fall. There is another reason for increased optimism--that is antibody treatments. As we can test more individuals for antibodies ( and this is really crucial ) we can develop a global pool of antibody rich plasma to treat very ill patents with and also determine our "herd immunity" status. There is a lab in the San Fran area that has already synthesized an antibody to a Covid-19 receptor protein and this is being studied in trials as we speak. If the synthetic antibody is effective we will have millions of doses to treat patients with. So the progress in the medical war against Covid-19 is developing very rapidly. I think we all have a lot of reason for optimism at this point. As for the markets--many of you are so skilled and talented at looking at them. I am just a rookie. But from a medical standpoint it does appear the market may be pricing in a bet that some of the medical developments along with the Federal Reserve doing everything they can will hasten the recovery.1 point

-

Yeah, that makes it pretty clear that they're not furloughing frontline ICU people, which is exactly what I thought. So I'm not sure what your point is. Empty hospital wings for elective surgeries and ambulatory care (meaning outpatient care) does not mean we "flattened the curve too much." It means the hospitals reallocated resources toward ICU and patients most likely to die in the short term.1 point

This leaderboard is set to New York/GMT-05:00