SteadyOptions is an options trading forum where you can find solutions from top options traders. Join Us!

We’ve all been there… researching options strategies and unable to find the answers we’re looking for. SteadyOptions has your solution.

Leaderboard

Popular Content

Showing content with the highest reputation on 03/26/19 in all areas

-

Please welcome two new mentors @krisbeeand @rasar I'm sure most our members know those two members very well. They helped hundreds of members, are well respected in our community - we just making their status "official".6 points

-

@Anderson317 1. For spreads, Tradier treats each option leg separately for their PDT logic and calculation. If you had 2 separate calendar trades that were open and closed on the same day, that would be 2 legs on the first calendar and then 2 legs on the second calendar. So 4 "trades" in one day regardless of how your option legs were setup in spreads. So your guess as to how this happened is right on the mark. This is also what I learned from asking Tradier directly. 2. To remove the PDT status, just email them and ask them to remove it. Simple as that. You can do it once every 90 days. I know because that is what they said and exactly what I did. (I've removed it once so far) 3. To avoid PDT status, don't open and close more than 4 options in a single day. Remember to count each option leg separately in your spreads. -Note that the actual number of option contracts would not matter. (as least that is my understanding) For example, if you had a calendar position with 42 of the short leg and 42 of the long leg, and you opened and closed it on the same day, that should be 2 day "trades". For future questions, try asking Tradier directly, they're pretty quick with responses and not bad with their customer service. (Unless you're asking for opinions on steadyoptions. If so, then feel free to ask away. I'm always up for discussion.) EDIT: Regarding your message about options expiring today, you should ask Tradier directly as such a message makes no sense at all for today, a Tuesday.2 points

-

Congrats @krisbee and @rasar I've always enjoyed your posts. I haven't been posting as much but came here to do at least this much!2 points

-

2 points

-

Fantastic - this group has such talent . . . I have a long ways to go, but am putting the work in. Thanks for all the mentoring guys!2 points

-

Most members will know www.art-of.trading, an open website I run with the purpose of easy plotting RV charts. Now I have some bad news to convey. But there is some good news also. First the bad news: I will discontinue www.art-of.trading. After running it and offering its content for free for more than a year now I will not maintain the webservice longer in its current form. Daily updates will continue for now but the site will not be accessible anymore within some short period of time. Now here is the good news: There will be a replacement - a good one. Taking the essence of numerous discussions here on Steady Options and my personal take-aways and learnings from running art-of.trading I am up to offer an entirely new service for providing tools for trading the Steady Options way (in the same breath I should add a big thank you for all remarks and positive feedback I have gotten over the entire period. That is what made me take that route. On top I see that Steady Options continues to be a unique community on the web for trading options, with very good people and quality content - reason enough to stick around). I invite you to take a look at https://www.chartaffair.com Currently the site is working but open only to beta testers and not 'officially' released yet. Am still looking for some more beta testers. If you want to have early access I invite you to PM me for a free invitation code. Beta testers will get free access for some time once the site launches officially. Technically chartaffair.com is a more professional approach to running a webservice. And I have completely redesigned its code base. It uses a new data architecture, specifically targeted at handling and serving from large amounts of data. This together with fast hosting hardware and the use of new web technologies allows for two things: 1) Greatly increase available information You will find much more tables and graphs for each symbol with all information needed for trading the SO way: Historical implied move vs. actual move (as graphs and tables), credit needed for hedging straddle decay, actual performance of straddles around earnings. But also basic stuff like the next dividend ex-date or how long before the actual earnings announcement the announcement date gets confirmed (more details on specific features in later posts). Also, you will find practically any symbol now which comes at least with some traded options volume. 2) All information for a symbol aggregated on one single page Having all information in one place elminates the need to jump back and forth between different pages and websites, having to reenter the same symbol again and again (which I understood is an issue). A side bar allows for easy and fast navigation up and down on the page. All features came out of discussions and from my own experiences while trading. I believe they will be helpful. I will introduce some in greater detail in a couple of follow-up posts in this thread. On top of that there are a couple more pages to be added to this site. They are in planning and partly already in implementation. They will be added in the course of the next weeks/months. Chartaffair will be a paid service after the beta phase (it is not possible elsewise. But it will be worth it.) Now, if you found art-of.trading helpful over the course of last year, I invite you to sign up to chartaffair.com when the beta phase is completed. You will find it even more helpful.1 point

-

1 point

-

Well done Krisbee and Rasar. Well deserved. Onwards and Upwards or as we say in Ireland. May the road rise in front of you and the wind be always at your back!1 point

-

1 point

-

Great additions to the list of mentors available here at SO. It is good to see members being called out for their contributions to SO.1 point

-

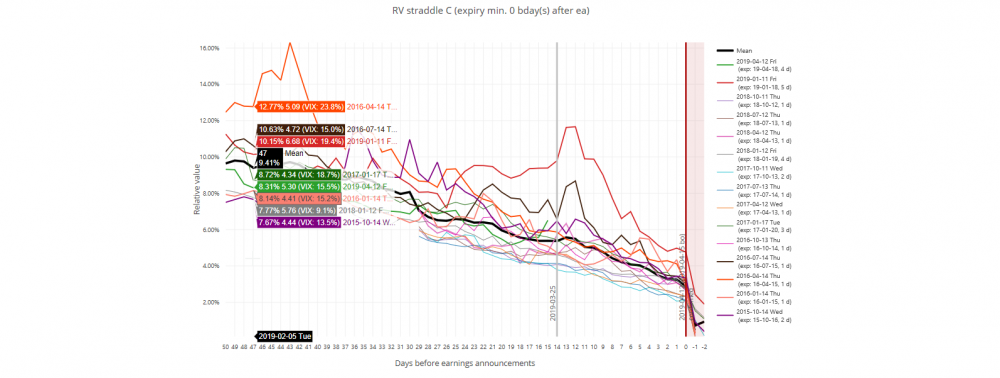

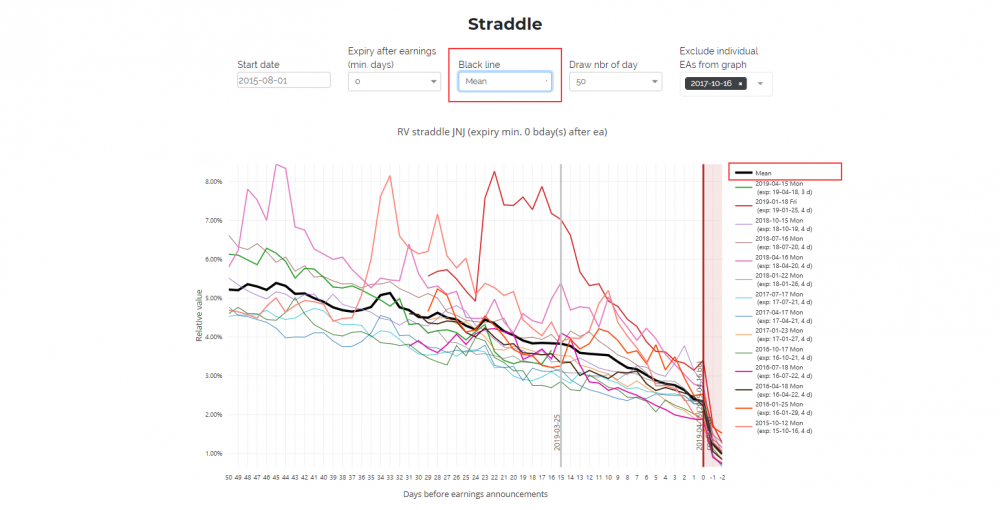

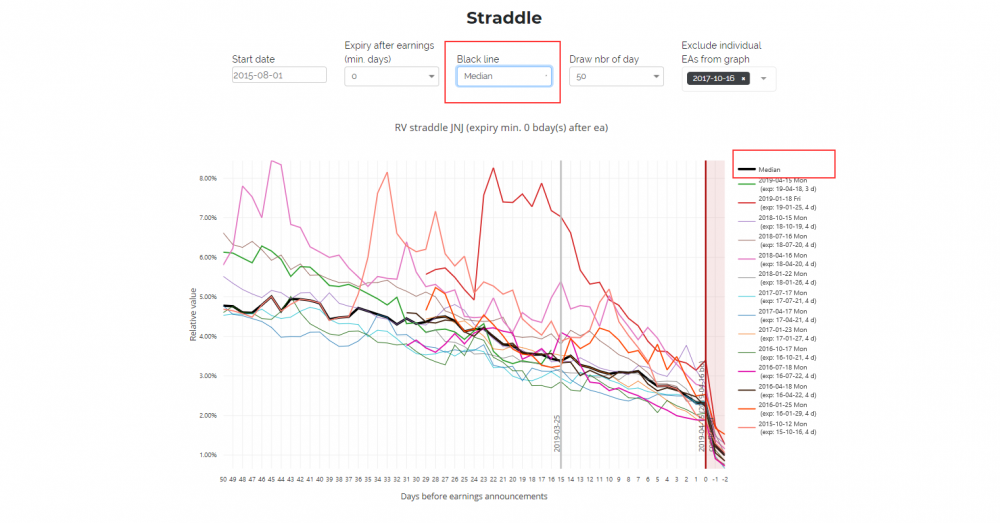

Two more things on RV charts: Line Thickness depending on Market IV To get a better feeling for the actual line with regard to the market IV regime in comparison to other cylces, the line thickness on the RV chart now corresponds to the market IV during the respective cycle (while each day's exact VIX value is contained in the hover legend): The line thickness is currently determined as follows: 0% - 14% VIX -> 1 pt. 14% - 23% VIX -> 2 pt. 23% - 30% VIX -> 3 pt. >30% -> 4pt. Possibly other values make more sense. Let me know - it can be changed easily. Line thickness can easily be overlooked if you are not aware of it (thanks @ales19 for pointing it out). Mean and Median On every RV chart it is possible now to chose between the mean (as we had it before) and the median value as the average for the black line. Both will respect the excluded cycles from the dropdown (the average will recalculate when you add or delete a cycle in the dropdown, but not when you 'only' click on it in the legend)1 point

-

I am honored to be asked to help mentor the CA PV forum. A little about my background: I started self-directed investing in stocks 25 years ago and augmented that with covered call selling and collaring about 10 years ago. I wanted to get more serious about trading options and spreads, so after a lot of research I decided upon SteadyOptions forum in 2013. It was here I really learned the importance of key principles like position size, portfolio balance, risk/reward planning, and often overlooked trade execution skills. I still trade a few pre-earnings names I follow when conditions setup and time allows. In the last few years with the air getting thin in stock market valuations I began to work on long equity portfolio hedging techniques. I focused my learning time (with the help of a mentor) to establish a background in taking advantage of market conditions to create low cost ways to add long gamma and vega positions to offset the risk with long equity exposure. I’m excited about the strategies in the CA forum and continuing to learn amongst the members there. -Tim I use (not intended to endorse any of them, just fyi): Tools: LVX, ONE, TOS, VolatilityHQ, custom Excel/Python tools for scanning, and more recently testing out TradeHawk Brokers: TDA, Tradier, IB Stock research services for fundamental analysis: Stansberry Research1 point

This leaderboard is set to New York/GMT-05:00